Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

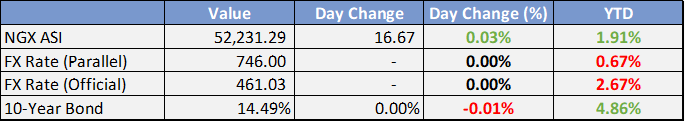

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Nigeria's Inflation Hits 22.22% As Food Prices Rise - All Africa

Nigeria's annual inflation rate rose to 22.22 per cent in April from 22.04 per cent in the previous month, the National Bureau of Statistics (NBS) said Monday. The statistics office said the April 2023 inflation rate showed an increase of 0.18 per cent points when compared to March 2023 headline inflation rate.

Nigeria loses N313bn as oil theft, shutdown rise, operators demand tough sanctions - Punch

Nigeria's oil production suffered from rising thefts and workers' strikes, causing a significant drop in earnings. Between March and April 2023, over nine million barrels were lost, resulting in a cumulative revenue loss of about N356bn.

PenCom approves commercial, non-interest banks as mortgage lenders - Punch

The National Pension Commission has listed 26 commercial banks by the Central Bank of Nigeria as its approved mortgage lenders. It also listed three non-interest banks to provide residential and commercial mortgage to workers under the Contributory Pension Scheme to access 25 per cent of the Retirement Savings Account for the purpose of mortgage.

CBN to roll out guidelines on contactless payment system – The Sun

Senate has bowed to pressure as it has approved the request of President Muhammadu Buhari for the restructuring of the sum of N23. 719 trillion Ways and Means advances that were made to ensure that the government was not shut down.

Nigeria’s borrowing from World Bank hits $14.34bn in Q1 – Punch

Nigeria’s borrowing from the World Bank has reached $14.34bn as of March 31, 2023, The PUNCH has learnt. This was an increase from the $13.93bn debt recorded by the Debt Management Office as of December 31, 2022. This means that fresh disbursements on approved loans added $410m to Nigeria’s debt from the World Bank in the first quarter of 2023.

Global

Treasury Secretary Janet Yellen says the US will have to default on “some obligation” if the debt ceiling isn’t raised.

By “some obligation”, she means Treasuries or Social Security payments.

Yellen is set to update Congress on the proximity of such a scenario within the next 2 weeks.

President Biden and House Speaker Kevin McCarthy will meet tomorrow to continue negotiations.

US consumer sentiment tumbled to its lowest in 6 months in May.

The drop was driven by concerns over the debt ceiling and its potential to trigger a recession.

Long-term inflation expectations also rose to the highest level since 2011, with consumers expecting 3.2% inflation in 5 years.

Meanwhile, deteriorating sentiment has done little to provoke a large reduction in equity exposure amongst investors.

G7 finance ministers caution against economic uncertainty - G7 Summit

The need to remain vigilant and stay agile and flexible in our macroeconomic policy amid heightened uncertainty about the global economic outlook was emphasized. This was after noting the resilience of the global economy “against multiple shocks including the COVID19 pandemic, Russia’s war of aggression against Ukraine, and associated inflationary pressures.

Investors don’t seem to be fazed by the possibility of a US default.

Even in the face of a rise in credit default swaps—which provide insurance against a default—the CBOE Volatility Index (VIX) isn’t budging.

At around 17, the VIX remains at levels consistent with complacency.

The scenario resembles that of the 2011 debt ceiling impasse which saw a similarly low VIX spike soon after the US received its first credit downgrade.

The Turkish presidential election is headed to a runoff as President Erdogan failed to secure an outright victory - FT

Moody Downgrades Kenya’s Credit Rating to B3 - Reuters

Kenya’s US$2bn 10-year Eurobond maturing in 2024 has heightened the country’s debt crisis. The country intended to issue a new Eurobond to offset the US$2bn maturity but the high-yield environment discouraged the issuance and has led to the depletion of the country’s foreign exchange reserves to US$6.43bn as of March 2023.Ghana’s official creditors pave way for IMF sign-off on $3bn loan – BNR

Ghana’s official sector creditors have formed a committee co-chaired by China and France for debt restructurings talks, the Paris Club said on Friday, paving the way for a sign-off on a $3 billion International Monetary Fund loan for the country.

Weekly Investment Watchlist

The Week Ahead:

Monday: NY Empire State manufacturing, net long-term TIC flows

Tuesday: Retail sales, industrial & manufacturing production, business inventories, NAHB housing market index

Wednesday: Building permits, housing starts

Thursday: Initial jobless claims, Philly Fed manufacturing, existing home sales, CB leading index

Friday: Powell speech

Investment Tip of The Day

Following the crowd can be tempting, but it can also lead to poor investment decisions and increased risk. Avoid herd mentality by doing your own research, setting your own investment goals, and sticking to your long-term strategy even when others are panicking.