Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

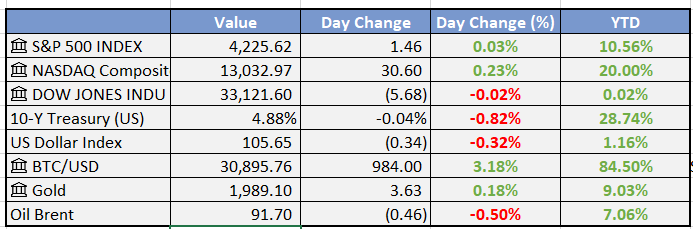

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

FG plans N26tn borrowing, N29tn for debt servicing - Punch

The Nigerian federal government has outlined a three-year economic blueprint that involves borrowing ₦26 trillion and allocating ₦29 trillion for debt servicing. This plan aims to help the nation recover from economic challenges and create sustainable growth. However, concerns are arising over the high proportion of the budget allocated to debt servicing.

Tinubu Pledges To Resolve FX Future Contracts Backlog - Leadership

Nigerian politician Bola Tinubu has pledged to address the backlog of foreign exchange (FX) future contracts to enhance economic revitalization. His commitment came during an event at the Nigerian Economic Summit Group (NESG) where discussions focused on strengthening the nation's economy.

Benue To Benefit From World Bank’s $700m Project - Leadership

Benue State, Nigeria, is set to benefit from a $700 million project initiated by the World Bank. This project aims to bolster the state's development efforts and address various challenges related to climate change, environment, and livelihoods.

Nigerian banks’ investment securities grow 76% on naira revaluation - Business Day

Nigerian banks reported a 76% growth in investment securities, driven by the revaluation of dollar assets due to naira devaluation. This revaluation positively affected their earnings, especially in terms of dollar interest income, which would be converted at a higher naira rate. The twelve banks listed on the Nigerian Exchange Group recorded investment securities worth N25.56 trillion in H1 2023, marking a significant increase from N14.51 trillion.

Global

Ten-year U.S. Treasury yield hits 5% - Reuters

10-year U.S. Treasury note surpassed 5.0%, reaching a level it last touched in July 2007. This surge in yields reflects investor expectations of robust U.S. economic growth and concerns about fiscal matters. Federal Reserve Chair Jerome Powell's recent remarks and a tight labor market contributing to the need for tighter financial conditions also pushed yields higher.

Weekly Investment Watchlist

Market Commentary:

Asia - Pacific

Asian equities experienced a sharp decline across the region on Monday, sending the MSCI Asia Pacific-ex Japan index to fresh 52-week lows. Seoul and Taipei saw more losses, while Southeast Asia was all lower, with India extending its morning losses. Japan gapped lower with no substantial recovery during the day, while Hong Kong, Thailand, and New Zealand closed for holidays.

Mainland China’s stock exchanges dropped significantly due to concerns about a Foxconn probe, issues in the property sector, and breaches of key support levels. Both the Shanghai and Shenzhen indices were at multi-year lows, with Shanghai at a one-year low and Shenzhen at a four-year low.

The Nikkei reported internal calls within the Bank of Japan (BOJ) for further Yield Curve Control (YCC) tweaks as the JGB 10-year yield approaches the effective 1% cap. While this article was published in Sunday’s morning edition, it didn’t make the front page. However, it’s essential to note that the last time there was news printed in the Nikkei about YCC, the BOJ did make adjustments. Despite this, the likelihood of significant changes in YCC occurring quickly is still uncertain. The BOJ meeting is scheduled for October 31, 2023.

In a speech, Governor Pan of the People’s Bank of China reiterated the need for prudent monetary policy that would be more precise and powerful, with counter/inter-cyclical adjustments while maintaining stable money and credit. He noted that a variety of monetary policy tools should be used comprehensively to keep growth in the money supply and social financing in line with nominal GDP growth. It’s important to mention that this speech didn’t provide a clear indication of any immediate changes, and markets have not significantly responded to this or the injection made last week.

Europe, the Middle East, and Africa

European equity markets were under pressure, following the trend of broad weakness seen in Asia.

Volkswagen cut its profit outlook in a preliminary Q3 release, citing issues with raw material hedges. This profit warning came “out of the blue,” as the company had reported no issues with consensus as recently as October 13. Hedges against commodity price fluctuations resulted in a €2.5 billion non-cash loss, and the carmaker no longer expects to compensate for it by the end of the year. Auto manufacturers in Europe continue to face challenges, with Mercedes reportedly slashing list prices by as much as 30% on some models.

Markets remained relatively quiet as the European Central Bank’s rate decision on Thursday approached. While many expect a pause, particularly after the most recent inflation reading, markets remain uncertain.

The Americas

Chevron Corp. agreed to acquire Hess Corp. for $53 billion in an all-stock transaction, aimed at increasing production growth in the US oil industry as it continues to invest in fossil fuels. Chevron will pay $171 per share for Hess, which is approximately a 10% premium over the 20-day average price. This deal is seen as beneficial for Chevron, as Hess has a strong portfolio with access to Guyana.

Aside from surging interest rates, it was relatively quiet in the US as well. The major issue currently impacting markets is the surge in rates, and it appears that the long end of the yield curve is now pricing in higher inflation levels and tighter financial conditions. To stabilize rates, it’s likely that a slowdown in the US economy, a selloff in risk assets, or a change in the Fed’s stance on rate cuts may be needed.

The Week Ahead:

Monday:

Tuesday:

Flash Manufacturing PMI (US)

Wednesday:

UK Consumer Price Index YoY is at 6.70%

Thursday:

Advance GDP (US)

Unemployment Claims (US)

Friday:

Core PCE Price Index m/m (US)

Revised UoM Consumer Sentiment

Investment Tip of The Day

Review Tax-Efficient Withdrawal Strategies: When withdrawing funds from your investment accounts, employ tax-efficient strategies. Minimizing tax implications can help preserve your wealth during retirement.