Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

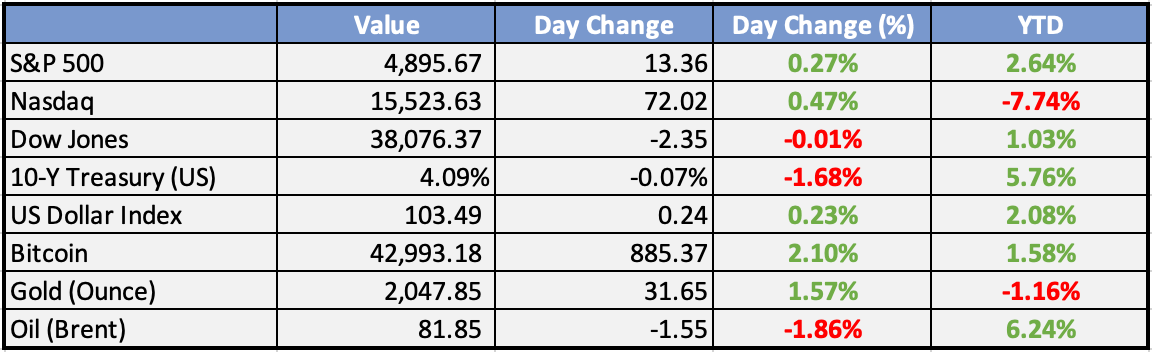

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Mali, B’ Faso, Niger yet to exit formally (ECOWAS) - Punch

Burkina Faso, Mali and Niger Republic announced, on Sunday, that they had quit their membership of the Economic Community of West African States.

FG: Indian $14bn Pledges on New Investments Already Yielding Fruit - This Day

The federal government has said Indian businesses that pledged $14 billion in new investments in Nigeria on the side-lines of the G20 Summit in India, in September 2023, have started making good their pledges.

FG mobilising MDAs to stabilise naira, says minister - Punch

The Federal Government says the President Bola Tinubu administration is mobilising its Ministries, Departments and Agencies to “bring down inflation, stabilise the foreign exchange rates and create an enabling environment for business and investment.”

Naira: Manufacturers plan general price hike - Punch

Manufacturers have predicted fresh hikes in the prices of commodities in the market to rise in response to the continued fall of the naira against the United States dollar.

PFAs Staked N13.4trn on Undervalued Stocks, Long-term FGN Securities in 2023 - This Day

Driven by gains from undervalued stocks and yield on long-term/short Federal Government securities, Pension Fund Administrators (PFAs) increased their exposure in equities and government papers to N13.4trillion in 2023 from N10.55 trillion reported in 2022.

Chinese firm to finance $27.29bn Escravos seaport project - The Sun

Hopes of deepening the blue economy project of the federal government brightened at the weekend with a Chinese firm, EDIB International Limited of Hong Kong, expressing its willingness to pool $27.29 billion to develop the Escravos Seaport Industrial Complex (ESIC) project

Global

Market Commentary:

Overview

US bond yields rose on Friday due to stronger personal spending, aiding the recovery of the US dollar. The upcoming week features key events, including Fed and Bank of England meetings, and US January non-farm payrolls.

Currencies/Macro:

The US dollar closed with mixed results on Friday, experiencing mostly modest changes.

EUR/USD initially rose to 1.0885 but retraced to 1.0855 post-US data.

GBP/USD closed little changed around 1.2700.

USD/JPY rose about 50 pips to 148.15.

AUD/USD reached a high of 0.6610 in NY trade but followed the broad USD direction to settle at 0.6580.

NZD/USD fell about 20 pips to 0.6090, leaving AUD/NZD up slightly at 1.0800.

Interest Rates:

The US 2yr treasury yield rose from 4.28% to 4.35%, and the 10yr yield rose from 4.09% to 4.14%.

Markets expect the Fed funds rate, currently 5.375%, to remain unchanged on February 1, with a 40% chance of a cut in March.

Australian 3yr government bond yields rose from 3.72% to 3.76%, and the 10yr yield rose from 4.20% to 4.26%.

Markets anticipate the RBA cash rate to be unchanged on February 6, with a 60% chance of a cut in August.

New Zealand rates markets price the OCR, currently at 5.50%, to be unchanged on February 28, with a 50% chance of a rate cut in May.

Credit spreads were little changed, with Main (in half a bp to 57.5), CDX (54.5), and US IG cash spreads remaining on their lows for the year.

Commodities:

Crude markets surged on Friday after a Houthi missile hit a tanker carrying Russian crude, and the US conducted a strike against a Houthi missile base. The March WTI contract jumped to $78.01, a high back to late November, and the March Brent contract closed at $83.55, a closing high since early November.

Geopolitical tensions, extreme cold weather in the US, large inventory draws, and China stimulus efforts contributed to a circa 8.7% rise in crude prices this month.

In gas markets, the Biden administration announced a pause in permitting for all new LNG export facilities.

Metals showed mixed performance, with copper down 0.46% to $8,529, nickel down 0.87% to $2,258, and aluminium rising 0.9% to $2,258.

The DR Congo received a $7bn financing deal for minerals-for-infrastructure with China, impacting copper and cobalt markets.

Iron ore markets closed at two-week highs, anticipating the pre-announced RRR cut ahead of the February 9th LNY holiday and expectations of further stimulus.

Day Ahead:

US

In the US, the Dallas Fed manufacturing survey is expected to remain subdued, reflecting soft manufacturing conditions across the regions.

The Week Ahead:

Monday:

Tuesday:

CB Consumer Confidence (US)

JOLTS Job Openings (US)

Wednesday:

ADP Non-Farm Employment Change (US)

Employment Cost Index q/q (US)

Federal Funds Rate (US)

Thursday:

Unemployment Claims (US)

ISM Manufacturing PMI (US)

Friday:

Average Hourly Earnings m/m (US)

Non-Farm Employment Change (US)

Unemployment Rate (US)

Revised UoM Consumer Sentiment (US)

Investment Tip of The Day

Stay Informed About Central Bank Guidance: Monitor communications and guidance from central banks. Shifts in monetary policy can impact interest rates and influence investment decisions.