Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

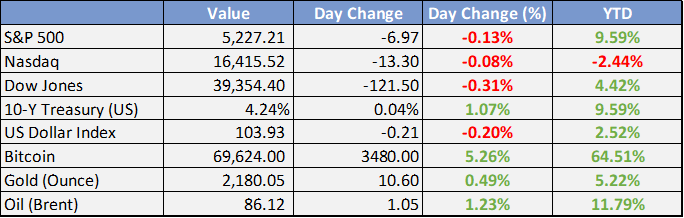

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

The US dollar gained against most key currencies, with its strength particularly noticeable in relation to the weakening Chinese yuan. The Japanese yen slightly appreciated, moving to 151.40, close to a 34-year peak. The Euro dropped from 1.0860 to just over 1.0800 against the dollar, while the British pound decreased by 55 pips, or about -0.5%, to 1.2600.

Remarks from several Federal Reserve officials, including Chair Jerome Powell, were made public, although they refrained from addressing monetary policy specifics.

In economic data, Canadian retail sales for January showed resilience, decreasing by -0.3%m/m, which was slightly better than the anticipated -0.4%m/m, with sales excluding automobiles increasing by 0.5%m/m against a forecasted decline of -0.4%m/m.

Germany's IFO business survey for March exceeded forecasts slightly, with the business climate index at 87.8, surpassing expectations of 86.0, and showing a slight improvement from the previous 85.7. The expectations index was at 87.5, higher than the predicted 84.7, and the current assessment index was at 88.1, above the forecast of 86.8.

ECB officials, including Nagel, emphasized the importance of data in determining the possibility of policy easing in June but expressed continued concern over wage inflation. ECB hawk Holzmann warned that inflation risks persist and that it may be premature to anticipate policy easing.

In the UK, retail sales for February were unexpectedly stable at 0.0%m/m, outperforming the forecasted -0.4%m/m drop, with sales excluding fuel rising by 0.2%m/m, contrary to the expected -0.1%m/m, although the figures were influenced by weather-related factors.

Interest Rates:

The US 2-year Treasury yield decreased from 4.61% to 4.59%, and the 10-year Treasury yield dropped from 4.26% to 4.20%. Market expectations suggest that the Federal Reserve's funds rate, currently at 5.375% (midpoint), will remain unchanged at the upcoming meeting on May 2, with an 80% likelihood of a rate cut by June.

Credit spreads were slightly wider on Friday, with Main expanding by 2 basis points to 55.5 and CDX widening by 1.5 points to 52.5. US investment grade cash was flat to a bit wider, yet this still marked the tightest week-ending position in 2024. Primary market activity was subdued on Friday, with Europe issuing only about EUR400 million across two deals and the US seeing no new issuances. This left US primary issuance at USD28 billion for the week, totaling USD116 billion for March, which was below the initial projections of around USD130 billion.

Commodities:

Crude oil markets experienced a conflict between the impacts of Russian refinery outages, which threaten global product supplies, and the strengthening US dollar, which makes oil more expensive globally. Ultimately, the influence of the stronger US dollar prevailed on Friday, leading to a decline in oil prices.

The May West Texas Intermediate (WTI) contract decreased by 0.54% to close at $80.63, while the May Brent contract fell by 0.41% to $85.43. Bloomberg highlighted a significant presence of Russian diesel at sea, with an unprecedented average of 6.2 million barrels floating in the ten days leading up to March 17, as reported by Kpler. This level surpasses records from both the pandemic and early 2023 when bans on Russian products were implemented.

Additionally, with all Indian refiners now avoiding Russian crude transported by Sovcomflot tankers due to US sanctions, a similar trend may begin for Russian crude. Over the weekend, it was reported that the Kuibyshev oil refinery in the Samara region was shut down following a drone attack.

Furthermore, the Financial Times disclosed that the US has cautioned Ukraine against targeting Russia's energy infrastructure, citing concerns over potential increases in global oil prices and the risk of Russian retaliation. This advice comes in light of at least nine attacks on Russian refineries this year, along with various terminals, depots, and storage facilities.

Investment Tip of The Day

Ensure liquidity in your portfolio to meet short-term financial needs without disrupting your long-term investment strategy. Having readily accessible funds allows you to cover unexpected expenses or take advantage of investment opportunities without selling off assets prematurely. This balance between liquidity and investment can protect your wealth from unnecessary losses and ensure flexibility in your financial planning.