Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

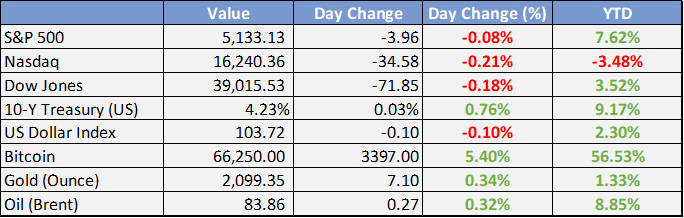

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Customs Opens 90-Day Window For Vehicle Import Duty Regularisation - Daily Trust

The Nigeria Customs Service (NCS) has announced the introduction of a 90-day window to facilitate the regularisation of import duties on specific vehicle categories. According to a statement by Abdullahi Maiwada, NCS PRO, issued on Sunday, the initiative aims to enhance compliance and simplify import processes, based on the directive of the minister of Finance and Coordinating Minister of Economy, Wale Edun.

Lagos vows to enforce monthly rental policy - Punch

The Special Adviser to Lagos State Governor on Housing, Barakat Odunuga-Bakare, has disclosed that the state’s monthly rental scheme will be enforced before the end of 2024 or early next year. She stated it during a recent press briefing of the Lagos State Real Estate Regulatory Authority in Ikeja, Lagos.

Senate summons CBN officials over N30tn loans - Punch

The Senate has said it will quiz some officials of the Central Bank of Nigeria on how the N30tn Ways and Means loan was obtained and spent by the Federal Government during the Muhammadu Buhari-led administration. The Chairman of the Senate Ad-hoc Committee Senator Isah Jibrin, who made the disclosure in an exclusive interview with The PUNCH, also revealed that the panel would commence the probe this week.

FG eyes 2.5 million barrels daily oil production - Punch

Brent, the global benchmark for crude oil, witnessed a rise in price in the past three days, crossing $84/barrel on Friday, after trading for an average of $80/barrel in the past weeks. Its price rise came at a time the Nigerian government announced a new crude oil production target of 2.5 million barrels per day, a development that would really grow the foreign exchange fortunes of the country if met.

Global

African trade less than 3% despite AfCFTA - Punch

The African share of global trade remained at less than three per cent, driven largely by merchandise trade in 2023, a report on the assessment of progress on regional integration in Africa has said. The report by the Economic Commission for Africa showed that African nations still engage in more trade with countries outside the continent than with each other.

Elon Musk sues OpenAI and CEO Sam Altman, claiming betrayal of its goal to benefit humanity - AP

Elon Musk is suing OpenAI and its CEO Sam Altman over what he says is a betrayal of the ChatGPT maker’s founding aims of benefiting humanity rather than pursuing profits. In a lawsuit filed at San Francisco Superior Court, billionaire Musk said that when he bankrolled OpenAI’s creation, he secured an agreement with Altman and Greg Brockman, the president, to keep the AI company as a nonprofit that would develop technology for the benefit of the public.

Market Commentary:

Currencies/Macro:

On Friday, the US dollar weakened against the majority of G10 currencies. The EUR/USD climbed from 1.0805 to 1.0840. The GBP/USD initially fell to 1.2600 before recovering to 1.2660. Following comments from Bank of Japan Governor Ueda that tempered hawkish market expectations, the USD/JPY decreased from 150.72 to 150.00, with the yen still underperforming for the day.

The US ISM manufacturing index dropped to 47.8 in February, below the estimated 49.5 and the previous 49.1, indicating weaker performance in employment, new orders, and prices paid than anticipated. The University of Michigan's consumer sentiment survey for February also adjusted downwards for current and future economic conditions, though inflation expectations remained stable.

Chicago Fed President Goolsbee advocated maintaining high-interest rates until inflation reliably progresses toward the 2% target, emphasizing the importance of considering employment impacts if inflation continues to decrease. Fed Governor Kugler expressed cautious optimism about inflation cooling without significant unemployment increases.

Richmond Fed President Barkin expressed hope for ongoing inflation reduction, which would support the rationale for beginning to normalize interest rates. Atlanta Fed President Bostic preferred to postpone rate cuts until there is further decline in inflation. Fed Governor Waller expressed a desire to shift the Fed's holdings away from mortgage-backed securities towards shorter-term treasuries, while Dallas Fed President Logan suggested a slower pace for balance sheet reduction as the overnight reverse repo facility balances decrease.

In the Eurozone, February's CPI was slightly above forecasts at 2.6% year-over-year, with the core rate at 3.1%, against an expected 2.9%. The unemployment rate for January was 6.4%, aligning with forecasts, although December's rate was revised to 6.5% from an initially reported 6.4%.

Interest Rates:

The US 2-year Treasury yield decreased from 4.64% to 4.53%, while the 10-year yield dropped from 4.28% before data releases to 4.18%. Market expectations for the Federal Reserve's funds rate, set at 5.375%, anticipate it remaining steady at the upcoming 20 March meeting, with an 85% probability of a rate reduction by June.

Credit indices reflected a positive trend in equity markets, with the Main index tightening by half a basis point to 54.5, and the CDX index tightening by one basis point to 51.5. US investment-grade (IG) cash positions were slightly stronger (ranging from flat to a basis point improvement) but noted wider over the week, facing pressure on recent issues. Following a record month of US IG issuance in February at USD 198 billion, contributing to a record start to the year with USD 387 billion in January and February, expectations are set for around USD 30 billion this week and USD 130 billion throughout March.

Commodities:

Crude oil markets reached their highest levels since mid-November of the previous year, driven by expectations of prolonged OPEC production cuts and evidence of tightness in the physical market. The April West Texas Intermediate (WTI) contract increased by 2.2% to $79.97, and the May Brent contract went up by 2% to $83.55. Reports on Friday from Bloomberg indicated that OPEC+ was anticipated to discuss extending production cuts in early March, a decision confirmed over the weekend as the organization agreed to prolong the 2.1 million barrels per day (mbpd) cuts until the end of June. Russia committed to an additional 471 thousand barrels per day (kbpd) reduction in April, divided between production and export cuts, with further adjustments planned for May and June. Additionally, tightening enforcement of U.S. sanctions impacted India's oil trade with Russia, prompting a shift towards alternative suppliers, including a 22% increase in imports from Saudi Arabia. Technical issues have halted operations at France's Donges refinery since February 20, exacerbating the tight supply of processed fuels in Europe.

In the metals sector, prices saw modest increases, buoyed by a positive mood in equity markets. Copper prices went up by 0.3% to $8,522, and aluminum prices grew by 0.36% to $2,236, despite a surge in global copper inventories to their highest point since September 2021 and a nearly sixfold increase in Chinese stockpiles. Attention is now turning to China's National People's Congress (NPC), set to begin on March 5, with particular focus on Premier Li's address.

Iron ore markets experienced a decline after a recent uptick, with port stockpiles growing and a significant rise in steel inventories. The April Singapore Exchange (SGX) iron ore contract decreased by $3.65 to $114.20, and the 62% Mysteel index fell by $1.60 to $115.70.

Investment Tip of The Day

Focus on building multiple streams of income, such as dividends, interest, rental income, or a side business, to enhance your financial resilience and wealth accumulation. This strategy not only diversifies your income but also provides additional funds that can be reinvested to grow your wealth further. Diversifying income sources can offer protection against the volatility of any single revenue stream.