Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

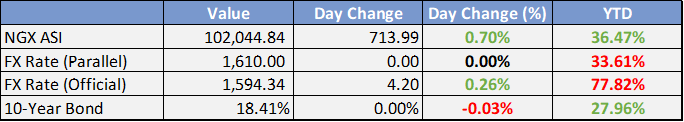

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

The US dollar exhibited mixed performance on Friday. The EUR/USD experienced volatility surrounding the release of US employment data, fluctuating between 1.0921 and 1.0981 before settling around 1.0940. The GBP/USD appreciated by 0.4% to 1.2860, while the USD/JPY decreased by 0.6% or 90 pips to 147.10, reaching a five-week low at 146.49. Reports emerged suggesting the Bank of Japan might consider policy alterations at its 19 March meeting, potentially abandoning yield curve control and terminating the negative interest rate policy on excess reserves.

The US non-farm payrolls for February outperformed expectations, recording a 275,000 increase compared to an anticipated 200,000. However, the robust figure reported for January was adjusted downward from 353,000 to 229,000, resulting in a net revision of -167,000 for the two months combined. The unemployment rate climbed to 3.9%, the highest since January 2022, and the underemployment rate increased to 7.3%, the highest since December 2021. Average hourly earnings saw a modest monthly rise of 0.1%, below the expected 0.2% and adjusted from the initially reported 0.6% to 0.5% for the previous month.

New York Fed President John Williams remarked that the post-pandemic neutral interest rate's status remains uncertain. He underscored the significance of employing economic models alongside empirical data to inform policymaking, stating that models facilitate communication and must be accurate to reflect economists' understanding.

Over the weekend, China disclosed its February Consumer Price Index (CPI), which rose to 0.7% year-over-year from -0.8% in January, with the lunar new year's varying dates affecting annual comparisons. The Producer Price Index (PPI) for February indicated a -2.7% year-over-year decline, slightly more pronounced than January's -2.5%.

Interest Rates:

The US 2-year Treasury yield fluctuated between 4.40% and 4.55% following the release of payroll data, ultimately settling around 4.47%, marking a net decrease of 3 basis points. The 10-year yield remained stable, closing unchanged at 4.07% after varying between 4.03% and 4.12%. Market expectations for the Federal Reserve's funds rate, currently at 5.375%, forecast no change for the upcoming 20 March meeting, with an 85% probability of a rate reduction by June.

Credit markets concluded a positive week, with both the Main and CDX indices tightening by half a basis point, closing at 52 and 49.5, respectively. U.S. investment-grade (IG) cash credit ended the week slightly to moderately better, signaling overall positive performance. Activity in primary markets was subdued, with only a single deal recorded in both EUR and USD sectors. The U.S. experienced an issuance of USD 52 billion in IG bonds last week, surpassing initial projections. Anticipated issuance for the upcoming week ranges between USD 35 to 40 billion, which coincides with significant data releases including the U.S. Consumer Price Index (CPI), retail sales, and Producer Price Index (PPI).

Commodities:

Crude oil prices declined as the Keystone pipeline resumed normal operations and concerns grew regarding China's shift toward lower oil demand growth. The April West Texas Intermediate (WTI) contract decreased by 1.17% to $78.01, while the May Brent contract fell by 1.06% to $82.08. The Keystone pipeline's brief suspension was a cautionary response, according to WoodMac, but normal service was quickly restored. In the meantime, Saudi Aramco reported its second-highest annual profit ever and increased its dividend to nearly $100 billion. CNPC highlighted that China's oil demand is entering a lower growth phase due to decarbonization efforts, with electric vehicles expected to replace 10% to 12% of the country's gasoline and diesel consumption this year. However, demand for crude oil is projected to rise, driven by the petrochemical sector's expansion, with China's crude imports in January and February up by 5% year-over-year. BP's Whiting refinery in Indiana may require up to two additional weeks to resume normal operations following a power outage on February 1.

In the metals market, reactions were negative following the mixed US employment data, particularly with a 4,000 decrease in manufacturing jobs in February. Copper prices fell by 0.84% to $8,568 despite briefly trading above $8,600, while aluminium dropped by 0.75% to $2,236. Chinese copper inventories reached new one-year highs, increasing almost sevenfold this year. Glencore showed interest in establishing a new copper smelter in Chile, the world's leading copper producer, aiming to reduce reliance on Asian processing. Escondida's copper production increased by 4.5% year-over-year in January, according to Cochilco. Recent transactions saw treatment and refining charges for copper concentrate from BHP's Escondida mine reach their lowest levels since 2010. The China Nonferrous Metals Industry Association has convened a meeting of major copper smelters to discuss potential collective production cuts in response to falling processing fees.

Iron ore markets softened alongside declining steel prices, influenced by growing port inventories and idle steel mills. The April Singapore Exchange (SGX) iron ore contract decreased by $1.50 to $114.25, while the 62% Mysteel index dropped by $1.90 to $116.55. Analysts believe additional stimulus may be necessary for China to achieve its 5% growth target, with the weakened construction sector pressuring steel prices to their lowest levels since October 2023. Chinese average port inventory has increased in nine out of the first ten weeks this year.

Investment Tip of The Day

Consider the impact of inflation on your investments and ensure your portfolio is structured to outpace it. Investing in assets with the potential for real returns above inflation, such as equities or real estate, can help preserve your purchasing power and grow your wealth over time. Addressing inflation is crucial for effective long-term wealth preservation and growth.