Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

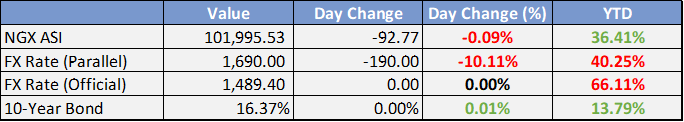

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

CBN Pegs Purchase Of Dollars In Cash At $500 - Leadership

The Central Bank of Nigeria (CBN) has pegged the payment of cash dollar purchase to a customer at $500 saying that the foreign currency (FX) exceeding this amount will be made through a transfer to their Naira bank account.

If the customer purchasing the foreign currency is a non-resident, regardless of whether they are Nigerian or not, a Bureau De Change (BDC) will issue them a prepaid Nigerian Naira (NGN) card instead of transferring money to a bank account.

Forex crisis threatens modular refineries N25bn daily crude input - Punch

Modular refineries in Nigeria are currently facing the threat of shutting down operations following their inability to access foreign exchange for the purchase of crude oil, a commodity priced in United States dollars. Nigeria has 25 licenced modular refineries with a combined capacity of producing 200,000 barrels of crude oil daily.

Govs, Elumelu, Dangote make Tinubu’s economic advisory panel - Punch

President Bola Tinubu has created an economic advisory committee comprising the federal government, sub-nationals and the private sector.

This resulted from talks between the President and key stakeholders at the State House, Abuja, on Sunday evening. The development came as the falling naira exchange rate, rising inflation and other economic headwinds have continued to worsen the cost of living crisis.

BDC operators plan mergers, fault mandatory deposit - Punch

The President of the Association of Bureau De Change of Nigeria, Aminu Gwadebe, has said that members of the association would consider mergers if the proposed guidelines for their operations go into effect. The Central Bank of Nigeria, in a draft paper titled ‘Revised Regulatory And Supervisory Guidelines For Bureau De Change Operations In Nigeria’ on Friday, proposed an increase in the share capital of Bureau De Change operators to N2bn and N500m for Tier 1 and Tier 2 licences, respectively.

Global

New Rules Will Force Buyout Firms to Flag Suspicious Investments - WSJ

After more than 20 years of debate, private-equity firms are about to be drafted into the fight against dirty money. The Treasury Department on Feb. 13 proposed extending anti-money-laundering rules to investment advisers including private-equity, venture-capital and hedge-fund managers.

Private equity fundraising plunges to 6-year low in 2023 - S&P Global

Global private equity fundraising fell 11.5% year over year by aggregate value in 2023, the lowest total since 2017, while the 1,936 funds closed was the smallest annual number since at least 2015, according to Preqin data.

Liquidity has been an issue that has disrupted the cycle of raising capital, investing and exiting, said Fraser van Rensburg, managing partner at placement agent Asante Capital.

Market Commentary:

Currencies/Macro:

The US dollar ended Friday with minimal changes against the majority of major currencies. The EUR/USD traded within a narrow range between 1.0812 and 1.0840, while the GBP/USD saw a slight increase to 1.2670. The USD/JPY showed volatility alongside Treasury yields but ultimately closed the day unchanged at 150.50.

The European Central Bank's consumer expectations survey for January indicated a slight increase in inflation expectations, with the one-year ahead forecast rising to 3.3% from 3.2%, and the three-year forecast remaining steady at 2.5%, aligning with expectations.

Germany's IFO business survey for February showed little change, with the business climate index slightly up at 85.5 from 85.2, the current assessment steady at 86.9, and the expectations index improving to 84.1 from 83.5.

Germany's GDP for the fourth quarter was confirmed at a contraction of -0.3% quarter-over-quarter, with capital expenditure (CAPEX) being revised down more significantly to -1.9% quarter-over-quarter, against expectations and a previous positive revision.

European Central Bank officials emphasized the need for patience, indicating they are awaiting further data, especially concerning wages, before considering any policy easing.

New York Fed President Williams expressed optimism about the direction of the economy, suggesting that it might become appropriate to reduce interest rates later in the year. He emphasized the importance of data-driven decisions, aiming for consistent evidence that inflation is on a downward trend towards the 2% long-term target.

Interest Rates:

The yield on the US 2-year treasury decreased from 4.74% to 4.67%, and the 10-year treasury yield dropped from 4.35% to 4.24%. Market expectations for the Federal Reserve's funds rate, currently at 5.375%, are to remain steady at the upcoming meeting on March 20, with a 70% likelihood of a rate decrease by June.

Credit indices mirrored the trends observed in regional stock markets, with the Main index improving by half a basis point to 54, while the CDX index widened by half a basis point to 51.5, marking its best weekly close year-to-date. The cash credit market was slightly weaker, and primary market activity significantly slowed, featuring only a single issuer. Last week, US investment-grade (IG) issuance totaled USD 60.3 billion, and Bloomberg forecasts suggest an additional USD 35 billion could be priced this week.

Commodities:

Crude oil prices concluded the week lower amid developments in Israel-Hamas ceasefire talks in Paris and the implementation of Navalny-related sanctions that did not impose significant restrictions on major energy sectors. The April West Texas Intermediate (WTI) contract fell by 2.7% to $76.49, and the April Brent contract decreased by 2.45% to $81.62. The US imposed sanctions on over 500 individuals and entities, including the Mir payment system and the oil shipping company Sovcomflot. National Security Advisor Sullivan expressed hope for a conclusive ceasefire agreement soon, although Israeli Prime Minister Netanyahu referred to Hamas's demands as "delusional." Bloomberg highlighted a scarcity of oil tankers, partly due to diversions caused by Red Sea attacks, with very large crude carrier deliveries expected to hit a nearly four-decade low this year. An OPEC ministerial meeting is scheduled for this week, with the majority of analysts predicting the continuation of production cuts.

In the liquefied natural gas (LNG) sector, Qatar plans to significantly expand its export capacity by 85% by the end of the decade, aiming to increase from 77 million tonnes per annum (mtpa) to 126 mtpa by 2027. This expansion is supported by a 14% increase in reserves following new discoveries in the North Field gas field.

Metals experienced a decline as initial speculation about US sanctions related to Navalny drove mid-week spikes in nickel and aluminium prices, which later subsided when the sanctions package spared metals producers. Aluminium prices retreated to mid-January levels, dropping by 0.64% to $2,184 at the week's close. Meanwhile, nickel prices sustained a 7% increase for the week, reaching highs not seen since the previous November. The global copper inventory rose to its highest level since the first quarter of 2023, following a surge in Shanghai's inventory, with copper prices dropping by 0.3% to $8,559.

Iron ore markets appeared to stabilize just above the $120 mark, buoyed by a positive shift in Chinese equity markets. The March Singapore Exchange (SGX) iron ore contract decreased by 70 cents to $120.00, while the 62% Mysteel index slightly increased by 15 cents to $120.85. Vale commented on the tight market conditions, predicting increased tightness in Asia due to the absence of new iron ore supply this year. Australian West Coast ports have reopened following the diversion of the former tropical cyclone Lincoln away from the Pilbara coast.

Investment Tip of The Day

Stay flexible in your wealth management strategy by being open to adjusting your investment approach as your financial situation, goals, or market conditions change. Flexibility allows you to capitalize on new opportunities and mitigate risks promptly, ensuring your portfolio remains aligned with your evolving objectives. This adaptability is crucial for navigating the dynamic nature of financial markets.