Money Monday-Fiscal Oversight and Corporate Recapitalisation Anchor Nigerian Equities Amid Shifting Global Risk Sentiment

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market update, where Nigeria’s equities reflect improving confidence driven by governance reforms, balance-sheet strengthening, and sustained recapitalisation activity. Key domestic themes include renewed activity in financial services and energy, alongside supportive sectoral performance across the NGX despite lingering short-term pressure in banking. Globally, markets are navigating mixed equity performance, firm commodity trends, and policy-driven shifts in energy, technology, and trade dynamics.

Nigerian News & Market Update

FirstHoldCo appoints new board members for non-bank subsidiaries:

First HoldCo Plc has appointed new board members across its non-bank subsidiaries to strengthen governance, oversight, and support sustainable growth, following regulatory approvals. - Punch

Eterna opens ₦21.5billion rights issue to drive expansion:

Eterna Plc has launched a ₦21.5billion rights issue to strengthen its balance sheet and fund strategic expansion across retail, LPG, aviation fuelling, and other downstream energy operations. - Punch

First HoldCo Lists Fresh 2.58billion Shares On Nigerian Exchange:

First HoldCo Plc has listed 2.58 billion new shares on the NGX after a private placement, boosting its share base, liquidity, and financial resilience following recent recapitalisation efforts. - Leadership

NDIC Announces ₦24.3billion Second Liquidation Dividend For Heritage Bank Depositors:

NDIC has announced a ₦24.3billion second liquidation dividend for uninsured Heritage Bank depositors, raising cumulative payouts to 14.4 kobo per ₦1 following asset recoveries after the bank’s licence was revoked. - Channels

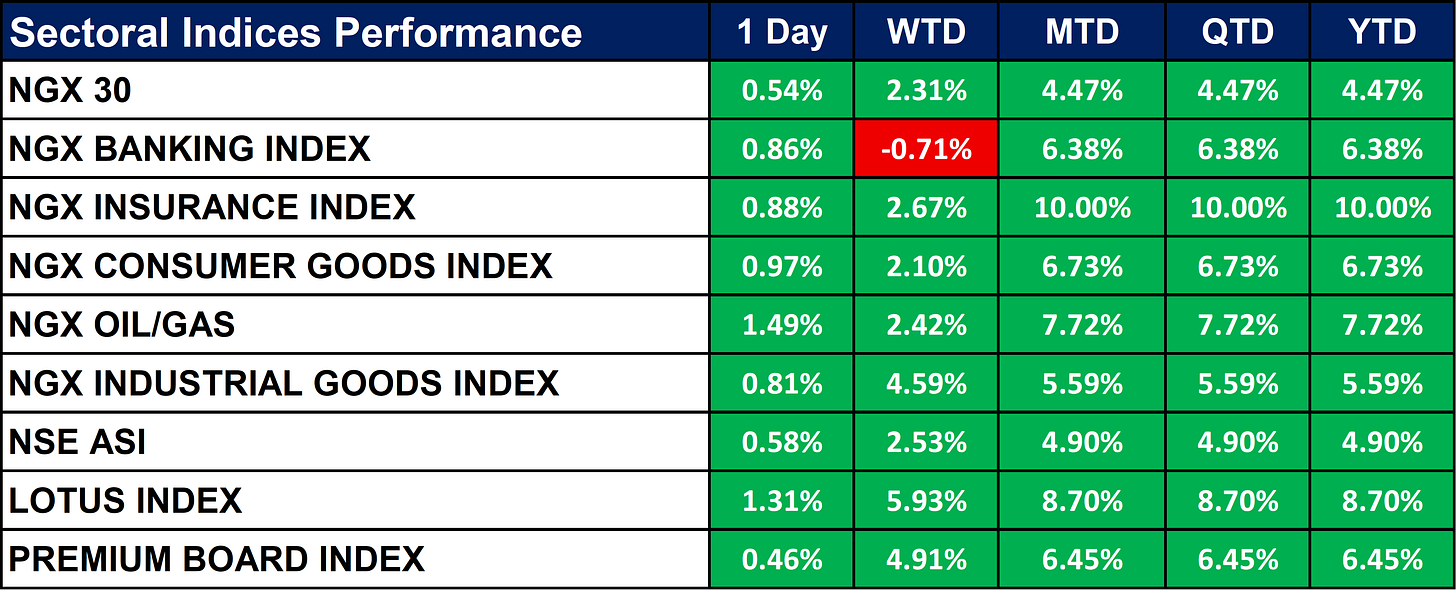

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectoral indices closed broadly positive on the day, led by Oil & Gas (+1.49%) and the Lotus Index (+1.31%), while all tracked indices recorded gains. Month-to-date performance remains strong, with Insurance (+10.00%), Lotus (+8.70%), and Oil & Gas (+7.72%) emerging as top performers, despite Banking still negative WTD (-0.71%). Overall momentum is positive across QTD and YTD measures, reflecting sustained market strength and improving investor sentiment across most sectors.

Global News & Market Update

Lithium soars as China to revoke battery export tax rebates:

Lithium prices in China jumped to multi-year highs after Beijing announced plans to cut and eventually revoke battery export tax rebates, fuelling expectations of a short-term surge in battery exports and lithium demand. - Reuters

Germany finalises deal on TenneT stake purchase, Politico reports:

Germany has finalised negotiations to acquire about a €7.6billion stake in TenneT’s German grid business, aiming to support energy transition investments and retain control over critical power infrastructure. - Reuters

Morocco targets $10 billion AI contribution to GDP by 2030:

Morocco aims to boost its GDP by $10 billion by 2030 through AI investments, job creation, and digital infrastructure expansion.- Reuters

Oil dips as investors assess Iran supply, Venezuelan export resumption:

Oil prices edged lower as easing concerns over Iran’s unrest and expectations of Venezuelan export resumption offset geopolitical risks, reinforcing forecasts of a supply-driven market surplus in 2026. - Reuters

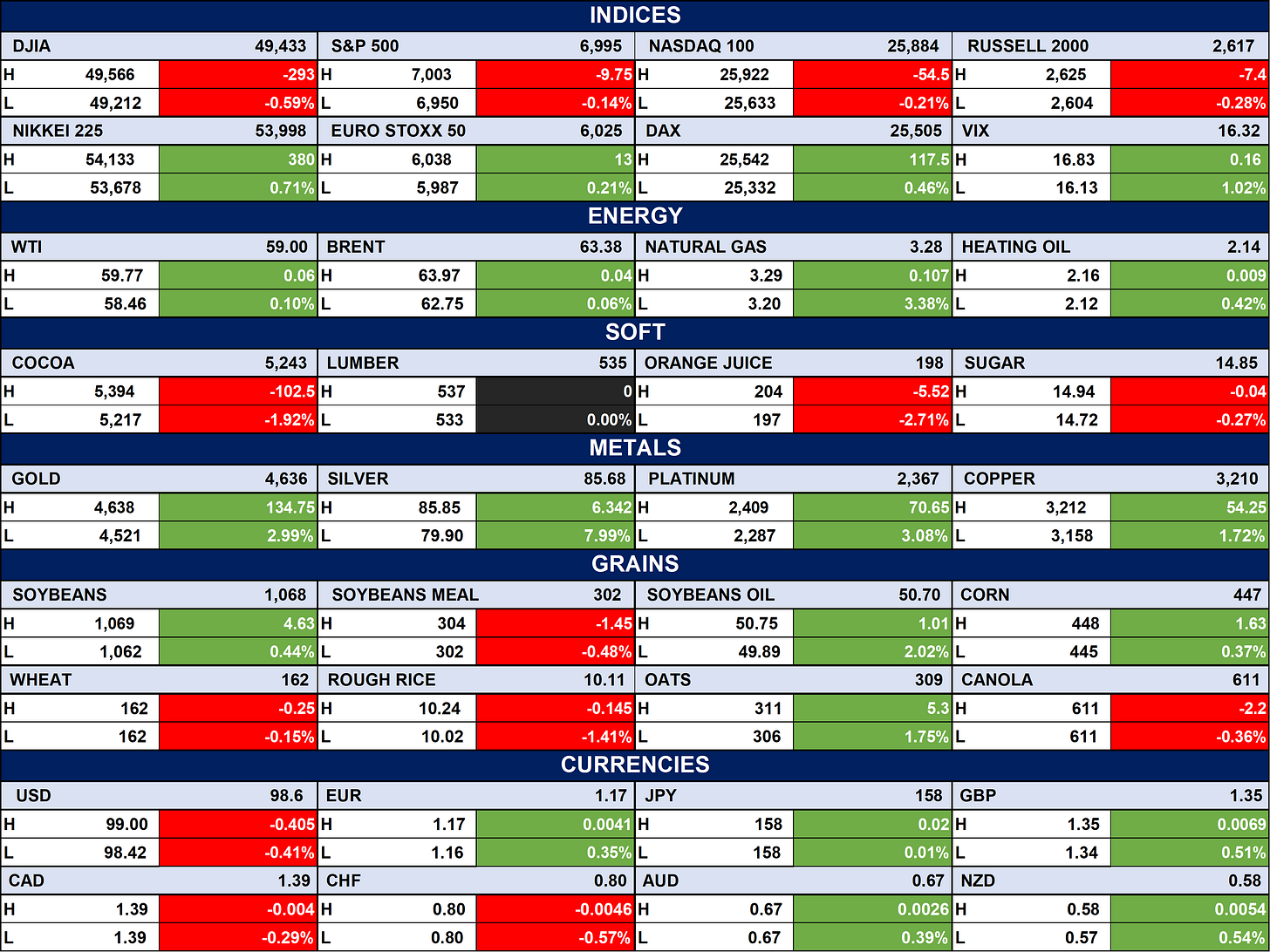

Indices, Commodities & Currencies

The table below depicts that the Global equities were mixed, with U.S. indices (DJIA, S&P 500, Nasdaq 100, Russell 2000) closing lower, while European markets (DAX, Euro Stoxx 50) and Japan’s Nikkei 225 posted gains. Energy prices edged higher across the board, metals were broadly strong led by gold, silver, and platinum, while soft commodities were mixed with losses in cocoa and orange juice offset by steady lumber. In currencies, the U.S. dollar weakened modestly against major peers, as the euro, pound, and yen recorded slight gains, signaling a mild risk-on tilt outside U.S. equities.

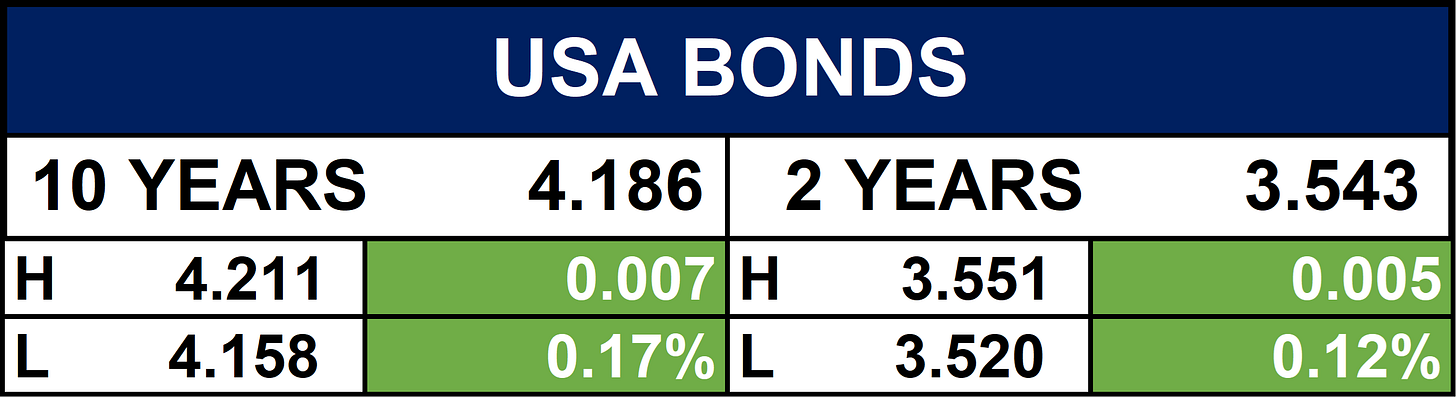

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian equities may continue to find support from structural reforms, capital inflows, and stronger corporate governance, particularly in energy, insurance, and ethical investment segments.

Globally, commodity price movements, energy supply expectations, and evolving industrial policies could drive near-term volatility across markets.

Investors should remain selective, balancing domestic growth opportunities with global macro risks as sentiment tilts cautiously risk-on outside U.S. equities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.