Money Monday- Markets Rally as Housing Reform Gains Traction, Oil/Gas Lags Amid Import Surge

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kickoff. This newsletter highlights that markets are kicking off the week with a mix of optimism and caution. On the home front, the Federal Government’s ₦70 billion push into the Renewed Hope Housing Programme has stirred interest in real estate and infrastructure sectors, while mixed performance in the energy space continues to spark debate. Meanwhile, the NASD(Nigerian Association of Securities Dealers) Exchange stole headlines with a 646% profit surge, and global markets ride high on growing expectations of a U.S. Fed rate cut.

Nigerian News & Market Update

FG secures ₦70billion for Renewed Hope Housing Programme:

The Federal Government has mobilized over ₦70 billion in private capital to support its Renewed Hope Housing Programme, targeting Nigeria’s housing deficit. The initiative includes state-by-state housing projects, affordable homeownership schemes, and urban renewal efforts. Housing Minister Ahmed Dangiwa emphasized collaboration with state governments and private partners to make housing more accessible and sustainable nationwide. - Punch

Fuel imports surge to 71% as marketers ditch local refineries:

In May and June 2025, over 71% of Nigeria’s petrol was imported, despite the operational Dangote Refinery. Aliko Dangote called for a ban on fuel imports to protect local refining, but oil marketers and experts opposed it, warning it could create a monopoly and raise prices. They argue importation is currently cheaper and essential for market stability. Stakeholders urge the government to focus on competition, reduce levies, and improve local refining capacity instead of enforcing a ban. - Punch

NASD Announces 646% Profit Surge, Proposes Dividend, Bonus Shares:

NASD OTC( Nigerian Association of Securities Dealers Over-the-Counter) Exchange Plc reported strong H1 2025 results, with revenue rising by 308% to ₦657 million and Profit Before Tax hitting ₦341 million, a 646% turnaround from a loss in H1 2024. Its cost-to-income ratio improved to 48% from 139%, and originating income skyrocketed by over 26,000% to ₦332 million.

Following a solid 2024, the board plans to propose a 20 kobo dividend and 1-for-5 bonus share at the upcoming AGM. NASD’s share price has appreciated 93.29% year-to-date and risen 1,898% since its 2013 listing, reflecting a 28.35% CAGR, according to CEO Eguarekhide Longe. - Thisday

Eterna Maintains Profitability, Reports ₦1.6billion Pre-tax Profit in H1:

Eterna Plc posted a ₦1.57 billion profit before tax in H1 2025, rebounding from a ₦3.57 billion loss in H1 2024. Revenue rose by 7% to ₦157.7 billion, while net profit stood at ₦574 million. The company’s improved performance was driven by better operations, cost control, and increased income. Earnings per share rose to ₦0.44, from a ₦3.71 loss last year. Eterna plans to sustain growth through efficiency, digital transformation, and expansion in the downstream energy sector. - Thisday

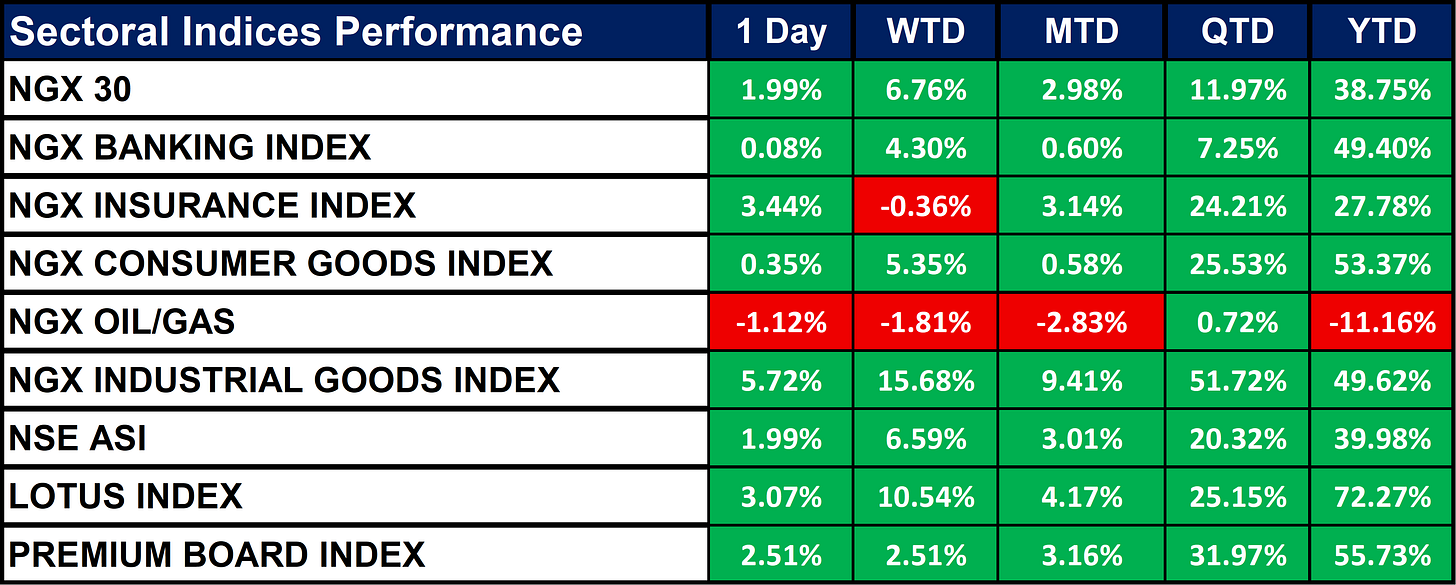

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectoral indices posted strong gains across most categories, led by the LOTUS Index (+72.27% YTD) and Premium Board Index (+55.73%). The Industrial and Consumer Goods sectors also showed solid performance. However, the Oil/Gas index was the only major laggard, down -11.16% YTD, reflecting persistent sectoral weakness. Overall, market sentiment remains broadly positive.

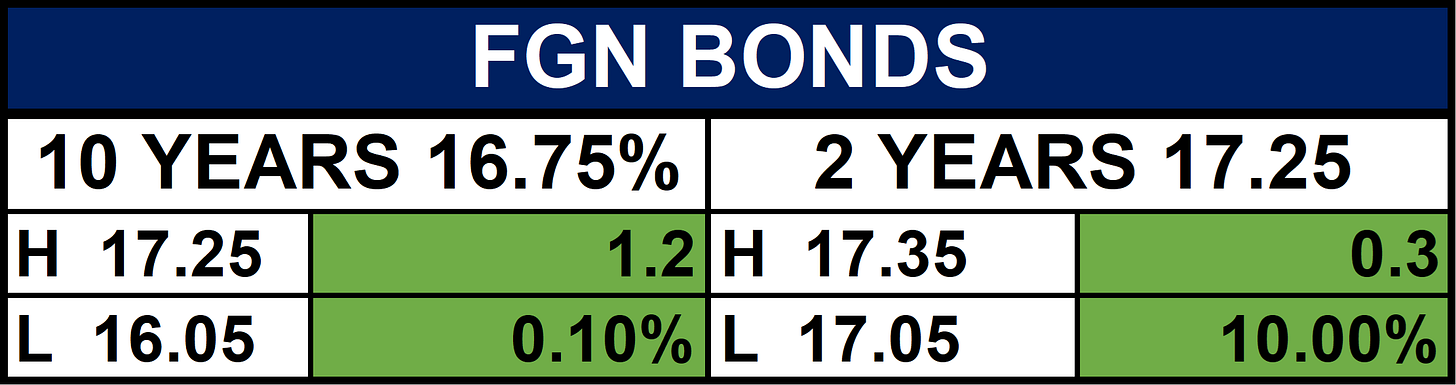

Fixed Income (FGN Bonds)

Global News & Market Update

Trump’s penalty threat puts India in a bind over Russian oil:

India is facing pressure from Donald Trump over its continued import of Russian oil, with threats of a 25% tariff and penalties. Despite this, India remains noncommittal, citing cost and supply stability. Russian oil now makes up nearly 40% of India’s imports. Indian officials argue the imports were previously encouraged by the U.S. to stabilize prices. Analysts say India faces a tough choice but may explore alternative suppliers like Iran or OPEC+ if pressure increases.- CNBC

Wall Street rebounds as Fed rate cut bets intensify on weaker payrolls:

U.S. markets surged on Monday as weak job data boosted hopes for Fed interest rate cuts, with the Dow, S&P 500, and Nasdaq all posting strong gains. Traders now expect a September rate cut, with odds at 84%. Trump added uncertainty by firing the U.S. labor stats chief and threatening Fed leadership changes. Major gainers included Tesla, Spotify, Joby Aviation, and IDEXX Laboratories. All S&P 500 sectors traded higher ahead of key earnings from Disney, Palantir, and Eli Lilly. - Reuters

Stocks rise as investors cling to hopes for US rate cuts:

Stocks rose in Europe and U.S. futures gained as weak U.S. jobs data led markets to expect more Fed rate cuts. The U.S. dollar remained flat after a sharp drop on Friday, while oil prices slipped due to increased OPEC+ production. - Reuters

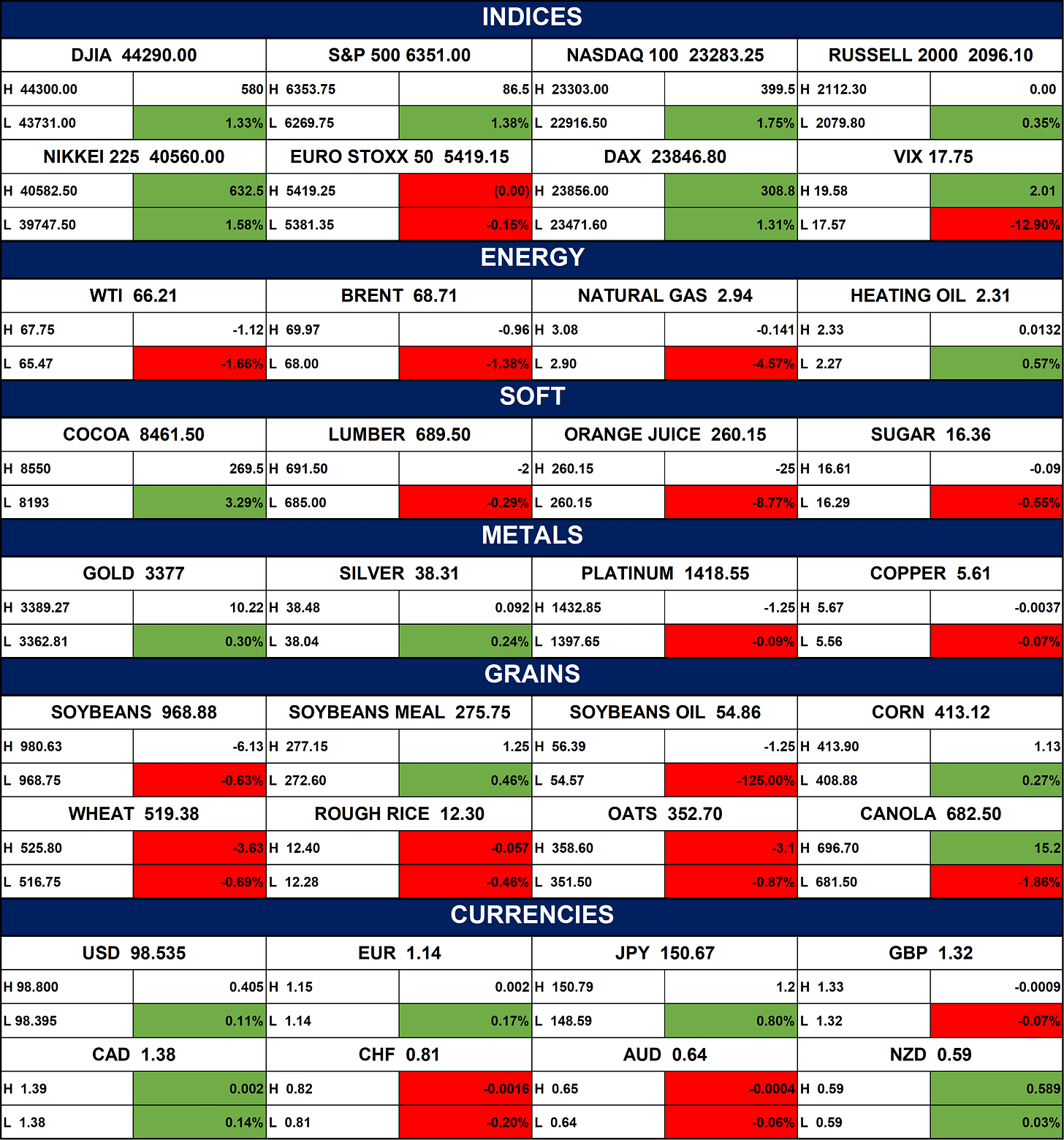

Indices, Commodities & Currencies

The table below shows that the Global markets rallied on hopes of U.S. interest rate cuts after weak jobs data. Major indices like the NASDAQ and Nikkei gained over 1.5%. Oil prices fell due to increased OPEC+ output, while natural gas dropped sharply. Commodities showed mixed performance, and the U.S. dollar remained stable.

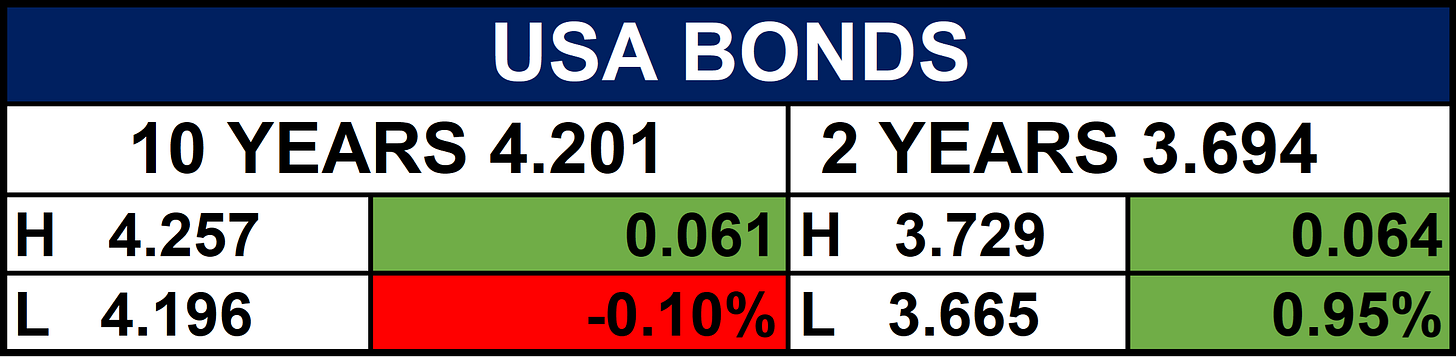

Fixed Income (USA Bonds)

Events

Conclusion

In conclusion, Investor sentiment remains strong, with broad gains in Nigerian equities led by the LOTUS, Premium Board, and Industrial Goods indices, while the Oil & Gas sector continues to lag. Globally, markets are lifted by expectations of U.S. rate cuts, though geopolitical tensions and trade risks linger. In the days ahead, investors may expect increased market activity driven by corporate earnings releases, policy signals and potential shifts in interest rate expectations.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.