Money Monday- MSME Funding, Bank Capitalisation and Digital Payment Reforms Shape Nigeria’s Market Outlook Amid Global Rebalancing and Policy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market Kick-Off. We unpack key developments shaping Nigeria’s financial landscape from fresh MSME funding, banking sector capitalisation, to breakthroughs in digital payments alongside major global market drivers. Expect insights on market performance, commodity trends, policy moves, and what they signal for investors in the days ahead.

Nigerian News & Market Update

Nigeria seeks fresh $500million World Bank loan for MSMEs:

FG seeks a $500million World Bank loan under the Financial Inclusion for Economic Development (FINCLUDE) Project to expand MSME financing and mobilize private capital in Nigeria. - Punch

Wema Bank lists ₦49.99billion shares on NGX:

Wema Bank lists ₦49.99billion shares on NGX, boosting its capital above ₦200billion to support growth, digital transformation, and expanded lending. - Punch

National Payment Stack completes first live transaction:

Nigeria completes first live transaction on the National Payment Stack, showcasing a faster, secure, and interoperable digital payment infrastructure. - Punch

EKEDC Confirms Rekhiat Momoh As Managing Director:

Rekhiat Momoh, with nearly 30 years’ experience in Nigeria’s power sector, has been confirmed as the new MD/CEO of Eko Electricity Distribution Company (Eko Disco). - Channels

Banks hold ₦4.39trillion surplus cash as CBN debts mature:

Banks end the week with ₦4.39trillion excess liquidity despite CBN’s tightening, keeping overnight rates steady around - TheSun

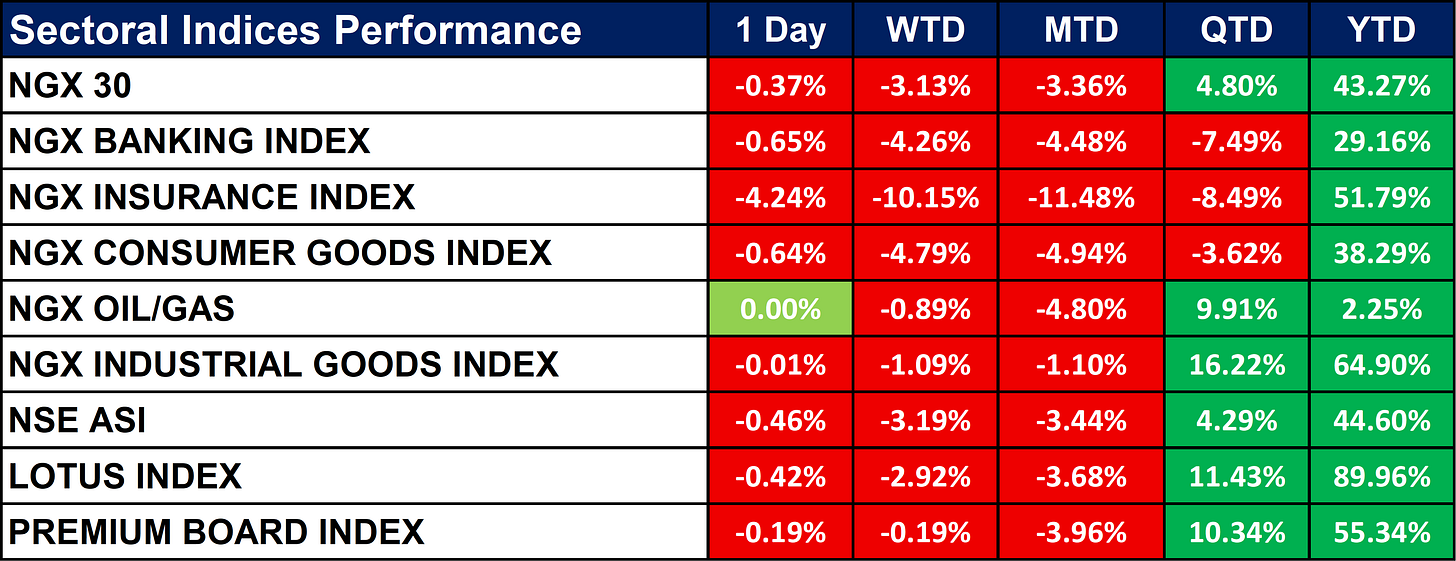

Nigeria Sectoral Indices Performance

The table below shows that market closed broadly lower, with most sectoral indices in the red across 1-Day, WTD and MTD performance. NGX Oil & Gas was flat on the day, while Industrial Goods remains the strongest performer YTD (+64.90%), followed by Lotus (+89.96%). Despite recent declines, overall market sentiment remains positive YTD, with the NSE ASI up +44.60%.

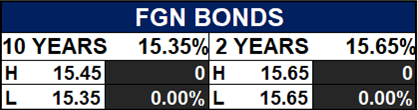

Fixed Income (FGN Bonds)

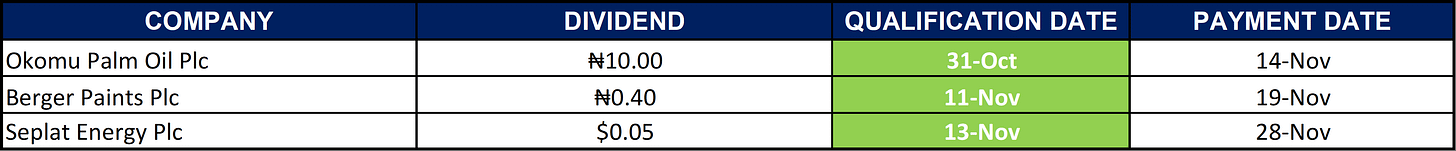

Corporate Action

Global News & Market Update

China’s major commodity imports ease, except for iron ore:

China’s October commodity imports fell for oil, gas, copper, and coal due to high prices, while iron ore remained strong as inventories were rebuilt. - Reuters

China suspends port fees on US-linked ships for a year:

China and the U.S. mutually agreed to suspend port fees and trade sanctions on each other’s shipping sectors for one year to stabilize bilateral ties. - Reuters

India plans 1.5 million ton sugar export quota on higher domestic surplus:

India plans to allow 1.5 million tons of sugar exports in 2025/26 to reduce domestic surplus and support local prices. - Reuters

India’s unemployment rate eases to 5.2% in September quarter, women’s employment rises:

India’s unemployment rate fell to 5.2% in Q3 2025, aided by higher rural employment and increased female workforce participation. - Reuters

Lukoil declares force majeure at Iraqi oilfield after US sanctions:

Iraq halts payments to Lukoil and the company declares force majeure at West Qurna-2 oilfield due to U.S. and UK sanctions, threatening a potential exit. - Reuters

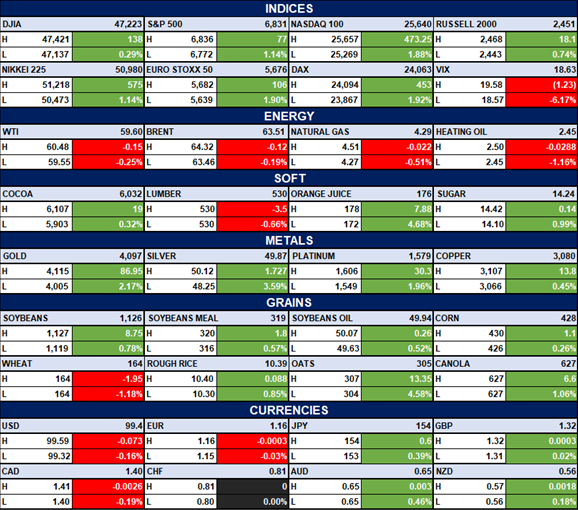

Indices, Commodities & Currencies

The table below depicts that the Global equities were broadly positive, with major indices like the S&P 500, Nasdaq 100, and Euro Stoxx 50 all posting gains. Commodities were mixed: metals and soft commodities saw notable upticks, while energy prices (Brent, WTI, Natural Gas) edged lower. The U.S. dollar weakened slightly against major currencies, while safe-haven metals like gold and silver advanced.

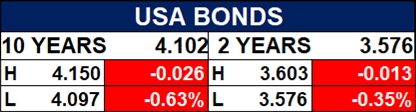

Fixed Income (USA Bonds)

Conclusion

With Nigeria’s liquidity levels remaining elevated, fresh funding pipelines opening for MSMEs, and global trade tensions easing between major economies, market sentiment may lean cautiously positive in the near term. However, mixed commodity trends, geopolitical sanctions, and global rate expectations may trigger intermittent volatility. Investors should stay selective, favour sectors with strong balance sheets and policy tailwinds, and position for opportunities in industrials, defensive plays, and quality dollar-linked assets as global conditions evolve.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.