Money Monday- Nigeria & Global Markets Outlook: Earnings Strength, Policy Signals, and Investor Positioning

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good morning and welcome to today’s market outlook, where Nigerian equities continue to draw strength from resilient earnings, improving balance sheets, and selective value opportunities despite a volatile macro backdrop.

Globally, investors remain focused on inflation trends, interest-rate expectations, and commodity price movements, all of which continue to shape capital flows into emerging and frontier markets like Nigeria. In this edition, we spotlight strong corporate fundamentals, liquidity conditions, and valuation signals that are increasingly driving stock-specific performance on the NGX.

Nigerian News & Market Update

PenCom accredits first pension agent for PPP enrolment:

PenCom has accredited Awabah as the first agent to enroll Nigerians in the Personal Pension Plan, aiming to expand pension coverage for informal workers despite low funding levels so far. - Punch

Fortis Global Insurance resumes trading after six-year ban:

Fortis Global Insurance shares resumed trading after a six-year suspension, surging 30% in a bullish market after the NGX lifted its ban following compliance with filing requirements. - Punch

BUA Cement kicks off POP plasterboard production at Port Harcourt plant:

BUA Cement has started producing POP gypsum plasterboards at its Port Harcourt plant, diversifying into local building materials to tap unmet demand and reduce reliance on imports. -PremiumTimes

New luxury hotel boosts NAHCO’s earnings outlook:

NAHCO boosted its earnings outlook by launching a luxury airport hotel at MMIA, reinforcing its diversification strategy as 2025 profits jumped about 40% on strong revenue growth and efficiency gains. - TheNation

BoI secures approval to operate non-interest banking:

The Bank of Industry has secured CBN approval to launch a non-interest banking window, expanding access to ethical financing for MSMEs and underserved segments of Nigeria’s economy. - DailyTrust

FMDQ Exchange Admits UAC’s ₦54.03billion 7-Year Fixed Rate Bond:

FMDQ Exchange has approved the listing of UAC of Nigeria Plc’s ₦54.03billion seven-year fixed-rate bond, strengthening the company’s funding base to support growth and strategic initiatives - ThisDay

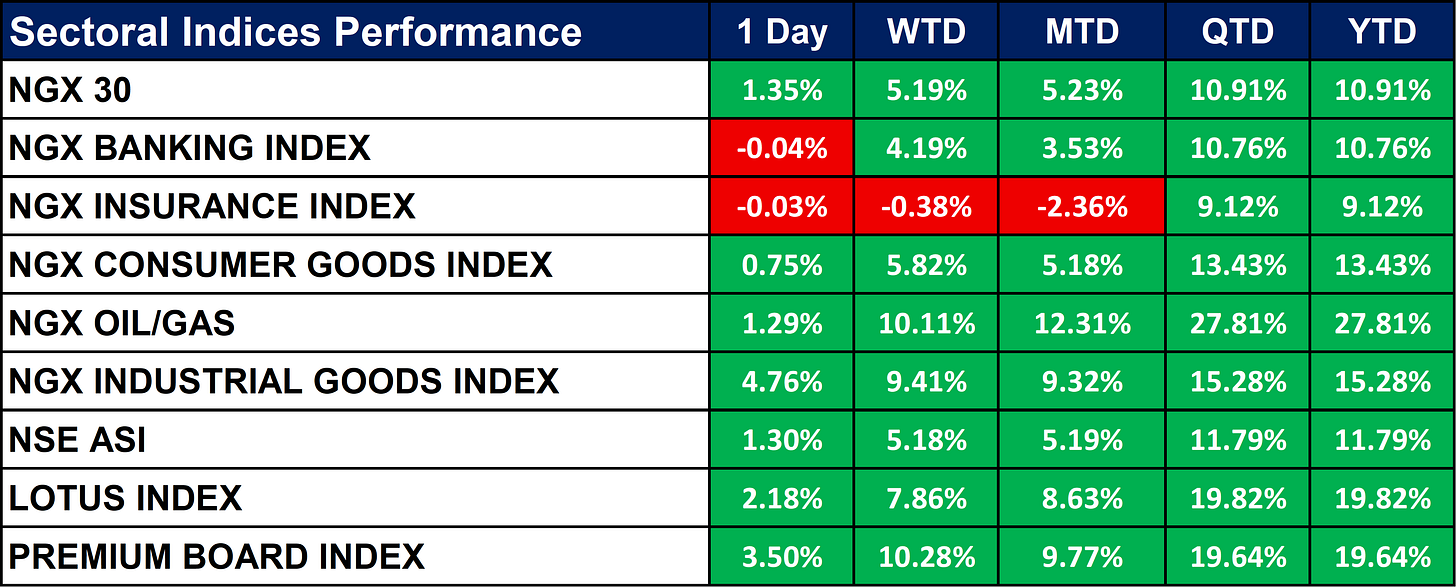

Nigeria Sectoral Indices Performance

The table below shows that market closed closed broadly positive, with the NGX ASI up 1.30% on the day and +11.79% YTD, reflecting strong overall momentum.

Industrial Goods (+4.76% 1-day) and Premium Board (+3.50%) led gains, while Oil & Gas remains the standout YTD performer at +27.81%.

Banks and Insurance lagged slightly on the day, but Consumer Goods (+13.43% YTD) and LOTUS Index (+19.82% YTD) continue to show solid medium-term strength.

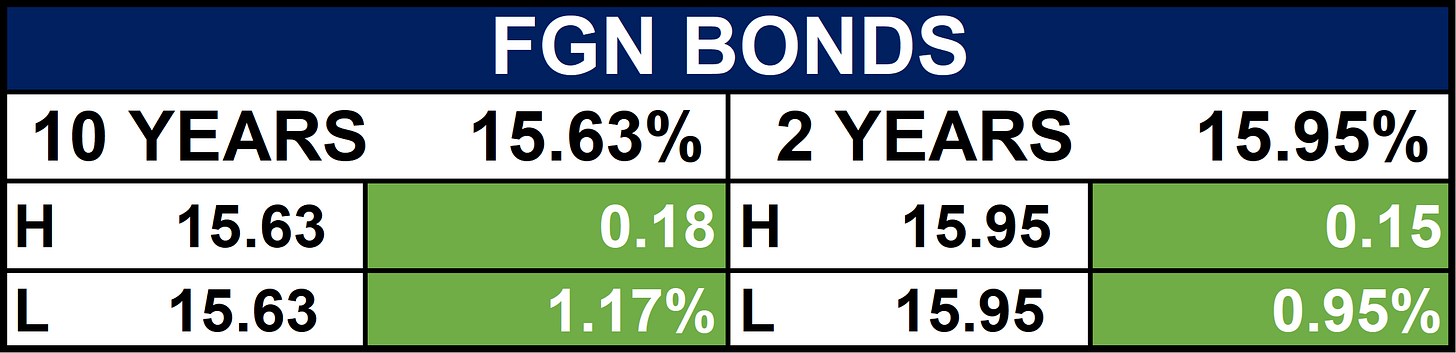

Fixed Income (FGN Bonds)

Global News & Market Update

Vietnam awards $974 million LNG power plant construction contract to PowerChina, Lilama:

Vietnam’s state utility EVN has awarded a $974million contract to PowerChina and Lilama to build a 1,612MW LNG-fired power plant, supporting energy security and its 2050 net-zero target. - Reuters

Uganda central bank holds key rate again, saying caution needed:

Uganda’s central bank held its key lending rate at 9.75% for the sixth straight meeting, citing economic uncertainty while keeping inflation on track and growth outlook strong - Reuters

Landslide election win clears path for Japan’s Takaichi to deliver tax cuts:

TotalEnergies has signed long-term deals to supply 1GW of solar power to Google’s Texas data centres, tapping surging electricity demand driven by AI growth. - Reuters

Landslide election win clears path for Japan’s Takaichi to deliver tax cuts:

Japan’s Prime Minister Sanae Takaichi’s landslide election win boosts prospects for suspending the food sales tax, though markets remain wary about how the cuts will be funded. - Reuters

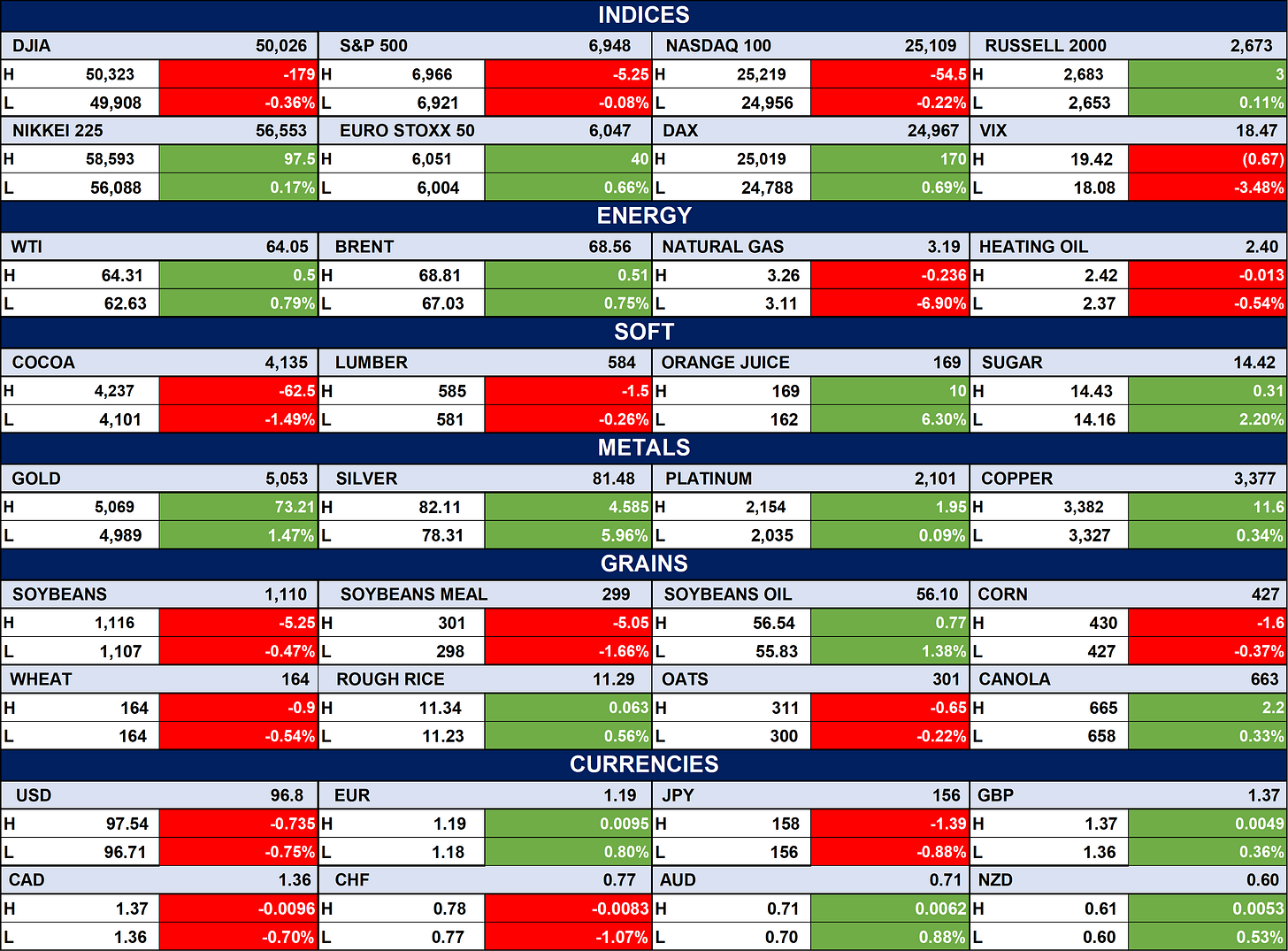

Indices, Commodities & Currencies

The table below depicts that the Global Equities were mixed, with U.S. indices mostly lower (DJIA −0.36%, S&P 500 −0.08%, Nasdaq −0.22%) while European markets advanced (Euro Stoxx 50 +0.66%, DAX +0.69%). Commodities showed divergence, as energy prices was mixed (WTI +0.79%, Natural Gas −6.90%), metals rallied (Gold +1.47%, Silver +5.96%), and softs were mixed (Sugar +2.20%, Cocoa −1.49%). Currencies reflected safe-haven flows, with USD weakening (−0.75%), EUR and GBP strengthening (+0.80% and +0.36% respectively), while JPY and CHF dipped.

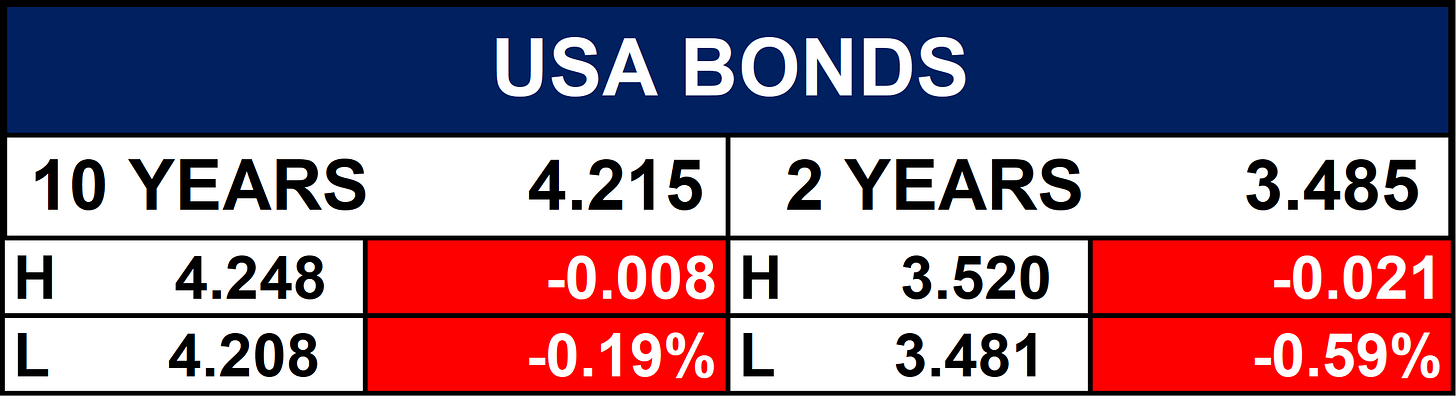

Fixed Income (USA Bonds)

Conclusion

Looking ahead, the Nigerian market may see sustained interest in fundamentally strong, cash-generative companies as investors rotate toward earnings visibility and defensive growth. Global policy cues especially from major central banks will likely influence FX sentiment, risk appetite, and short-term market volatility. Overall, disciplined stock selection and a focus on quality balance sheets could be key as markets navigate both global uncertainty and local opportunities in the sessions ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.