Money Monday- Nigeria Deepens Domestic Production and Financial Reforms as Global Markets Rally Amid Energy Shifts and Trade Realignments

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market Kick off. Nigeria’s economy saw renewed activity across sectors, from Dangote’s 310 million litres of petrol readiness and Kazfield’s 202-hectare coconut farm launch to strong pension reforms and steady capital market expansion. Globally, trade and energy developments shaped sentiment, with China halting U.S. soybean imports and the EU advancing plans to end Russian gas reliance.

Nigerian News & Market Update

Nigerian Bottling Company expands portfolio:

Nigerian Bottling Company has expanded into Nigeria’s snack market by launching Europe’s iconic Plazma Biscuit, reinforcing its long-term commitment to growth and local partnership. - Punch

Firm unveils 202-hectare coconut farm to cut $9.5million imports:

Kazfield Integrated Services launched Àdàbà Farm and Resort, a 202-hectare coconut plantation in Ogun State, to boost local production, cut imports, and position Nigeria as Africa’s leading coconut hub. - Punch

Over 310million litres of petrol ready for loading – Dangote:

Dangote Refinery affirmed its capacity to supply Nigeria’s fuel needs, urging marketers to load from its 310 million litres of petrol stock amid rising pump prices and market confusion. - Punch

Stanbic IBTC Pension Managers champions PenCom’s PPP, FCY plan:

Stanbic IBTC launched new pension plans allowing Nigerians, including those earning in foreign currency, to save and withdraw flexibly. The reforms aim to boost inclusion, infrastructure investment, and retirement accessibility nationwide. - Punch

CBN Allots ₦2.1trillion OMO Bills to Investors at Decent Rates:

The CBN allotted ₦2.1 trillion in Open Market Operations (OMO) bills to investors at stop rates of 19.40% and 19.89% to curb excess liquidity from FAAC inflows and maturing bills. - dmarketforces

FX Inflows into Nigeria’s Foreign Exchange Market Falls by 33%:

FX inflows into Nigeria’s foreign exchange market dropped 33% to $1.1 billion, driven mainly by foreign portfolio investors amid weak Foreign Direct Investment (FDI) and steady reserves. -dmarketforces

CapitalSage Holdings Names Nath Ude as Group CEO to Lead Financial Services Expansion:

CapitalSage Holdings appointed Nath Ude as Group CEO of its financial services arm to drive digital financial growth and pan-African expansion. - dmarketforces

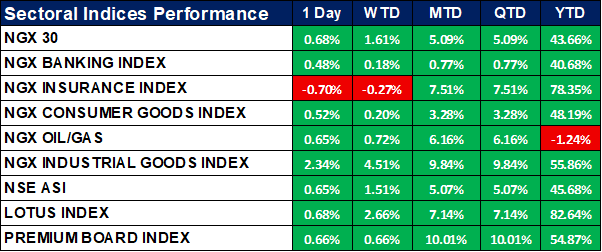

Nigeria Sectoral Indices Performance

The table below depicts that the Nigerian equities advanced broadly, with the NGX Industrial Goods Index leading gains at +2.34% for the day and +9.84% month-to-date.

Year-to-date performance remains strongest in the Lotus (+82.6%) and Insurance (+78.35%) indices, reflecting strong investor rotation into defensive and Sharia-compliant stocks. The NGX Oil & Gas Index was the lone laggard year-to-date (-1.24%), while the broader NGX ASI gained 0.65% for the day.

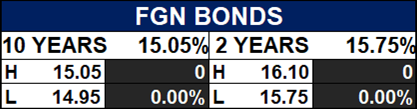

Fixed Income (FGN Bonds)

Global News & Market Update

Australia’s Albanese arrives for talks with Trump on rare earths, submarine deal:

Australian Prime Minister Anthony Albanese met U.S. President Donald Trump at the White House to seek stronger U.S. support for Australia’s critical minerals sector and reaffirm the AUKUS defence partnership. - Reuters

China imports no US soybeans in September for first time in seven years:

China’s U.S. soybean imports fell to zero in September amid trade tensions, with Brazil capturing 85% of its supply. - Reuters

Bank of England’s Greene sees no further case for quarterly rate cuts:

BoE’s Megan Greene said future rate cuts should proceed more slowly, signaling the easing cycle isn’t over but won’t follow a quarterly pace.- Reuters

EU agrees to gradually end Russian gas imports by January 1, 2028:

The European Union (EU) energy ministers approved plans to phase out Russian oil and gas imports by January 2028 to curb Moscow’s war revenues, pending final approval from the European Parliament.- Reuters

Indices, Commodities & Currencies

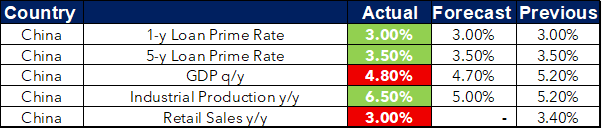

The table below depicts that the Global equities traded mostly higher with major indices like the S&P 500, Nasdaq, and Nikkei 225 gaining over 1%, while volatility (VIX) fell sharply by 6%. Energy markets were mixed WTI and Brent slipped slightly, but Natural Gas surged over 11% on strong demand.

Precious metals and agricultural commodities advanced broadly, led by gold (+3.5%), silver (+2.3%), and grains such as wheat and soybeans posting over 1% gains. USD dropped against major peers.

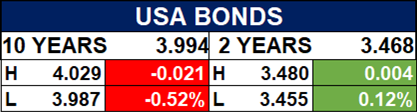

Fixed Income (USA Bonds)

Events

Conclusion

In Conclusion, Nigeria’s continued push for self-sufficiency and investment-led growth contrasts with global markets navigating shifting trade and energy alliances. Despite external headwinds, investor confidence remains firm, supported by resilient equities, proactive fiscal measures, and emerging opportunities in energy and agriculture.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.