Money Monday- Nigeria Opens Fresh Bond Window as OPEC+ Moves to Stabilise Oil Markets Amid Global Inflation Swings

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market Kick-Off, where we spotlight key economic and corporate developments shaping investment sentiment. Today, we unpack OPEC+’s move to stabilise oil prices, fresh opportunities in FGN Savings Bonds, and sector-shifting corporate and tech updates in Nigeria. We also take a quick pulse on global inflation trends and oil market dynamics that could influence capital flows and investor positioning.

Nigerian News & Market Update

Oil Prices Increase as OPEC+ Seeks to Avoid Supply Glut:

Oil prices rose as OPEC+ paused further production hikes from January to March 2026 to prevent a supply glut amid slowing demand and geopolitical tensions. - dmarketforces

DMO Opens November FGN Savings Bond Subscription:

The Debt Management Office (DMO) has opened subscriptions for the November 2025 FGN Savings Bond, offering 2-year and 3-year tenors at 13.565% and 14.565% to encourage secure retail investment. - Channels

LG expands AI adoption, partners EcoBank:

LG Nigeria launched its new AI-powered Smart TVs and partnered with Ecobank to offer flexible installment plans, making smart home technology more affordable and accessible. - Dailytrust

15% tariff: Imported petrol landing cost drops to N829/litre:

Imported petrol landing cost has fallen below local ex-depot prices as the government introduces a 15% import duty to boost local refining, with NNPCL slightly reducing pump prices amid market concerns. - Punch

PANA Holdings announces key executive appointments:

PANA Holdings has strengthened its leadership team with new executive appointments across key business units to drive growth and operational excellence. - Punch

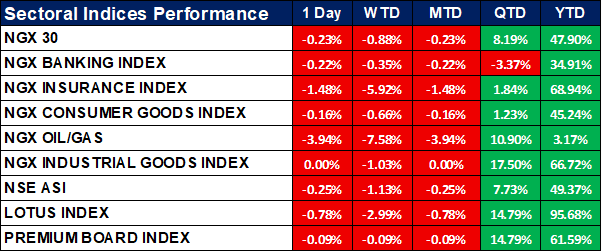

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectoral indices mostly declined over the day, led by NGX Oil/Gas (-3.94%) and NGX Insurance (-1.48%). Despite short-term losses, quarterly and yearly gains remain strong, with LOTUS (+95.68% YTD) and Industrial Goods (+66.72% YTD) outperforming.

Overall, the NSE ASI dipped 0.25% for the day but holds a solid 49.37% gain year-to-date.

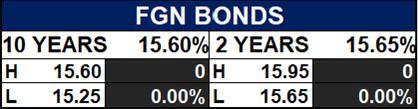

Fixed Income (FGN Bonds)

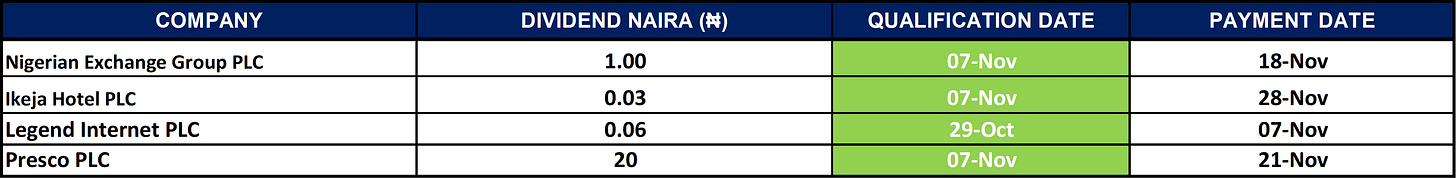

Corporate Action

Global News & Market Update

Turkey inflation dips more than expected to less than 33%:

Turkey’s inflation eased to 32.87% in October, coming in below expectations and supporting the central bank’s decision to slow rather than stop its rate-cutting cycle. - Reuters

Pakistan October inflation rises to 6.2%, highest in 12 months:

Pakistan’s inflation climbed to a 12-month high of 6.2% in October, driven by flood-related supply disruptions and border closures that pushed up food prices. - Reuters

India’s Russian oil imports rise in October:

India slightly increased its Russian oil imports in October to about 1.48million bpd, but volumes are expected to fall from late November as U.S. sanctions prompt refiners to seek alternative supplies. - Reuters

Oil prices steady despite OPEC+ plans to pause output increases:

Oil prices held steady as OPEC+ approved a small output increase for December but signaled a pause next year, with market sentiment weighed by surplus concerns and weak Asian factory data. - Reuters

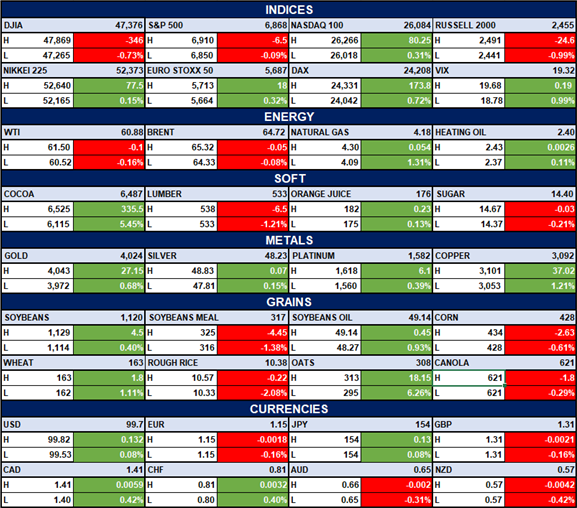

Indices, Commodities & Currencies

The table below depicts that the Global markets showed mixed performance: U.S. indices like the DJIA and S&P 500 fell slightly, while the NASDAQ 100 rose.

Energy commodities were mostly flat, with Natural Gas up 1.31%, while Brent and WTI edged lower. Cocoa led gains in softs, while Soybean Meal and Lumber declined. Currencies were mixed.

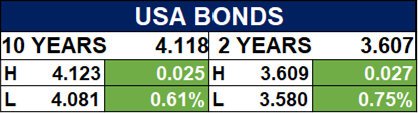

Fixed Income (USA Bonds)

Events

Conclusion

With OPEC+ signaling a production pause and inflation trends shifting across major markets, investors could expect near-term volatility in energy and currency markets. Locally, higher FGN Savings Bond rates and ongoing tech-driven corporate reforms may attract increased retail and institutional activity into defensive and growth sectors. Staying diversified across fixed income and strong YTD-performing equities remains a strategic approach as global macro signals continue to evolve.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.