Money Monday- Nigeria Powers Ahead as Dangote, Aradel, and Chinese Investors Drive Energy Expansion Amid Global Market Optimism

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market Kick off. The Nigerian market opened the week on a mixed note, with major headlines led by Dangote’s $5billion refinery expansion drive, Aradel’s increased upstream investment, and $1.3billion Chinese inflows into Nigeria’s lithium sector. Globally, markets advanced amid easing U.S.-China trade tensions and new U.S. investments in AI and clean energy innovation.

Nigerian News & Market Update

Dangote to raise $5billion for refinery expansion – Afreximbank CEO:

Dangote is seeking an additional $5 billion from Afreximbank to expand his Lagos refinery, aiming to double output and halve fuel prices across West Africa. - Punch

Ezeibe inaugurated as 23rd president of NCRIB:

Ekeoma Ezeibe has been inaugurated as the 23rd and third female President of the Nigerian Council of Registered Insurance Brokers (NCRIB), pledging to deepen insurance penetration and industry collaboration. - Punch

Aradel Energy to acquire additional 40% stake in ND Western:

Aradel Holdings is acquiring an additional 40% stake in ND Western Limited, boosting its ownership and strengthening its position in Nigeria’s upstream oil and gas sector. - Punch

Dangote refinery begins construction for 1.4mbpd expansion:

Dangote Refinery has begun expanding its capacity from 650,000 to 1.4 million barrels per day, aiming to become the world’s largest refinery and boost Nigeria’s energy independence. - Punch

FG lists ₦260billion bonds for October auction:

The Federal Government, through the Debt Management Office (DMO), is offering ₦260 billion in bonds for October 2025, ₦130 billion each in five and seven-year reopenings backed by Nigeria’s full faith and credit. - Punch

Chinese firms invest $1.3billion in Nigeria’s lithium sector –Alake:

Chinese companies have invested $1.3 billion in Nigeria’s lithium processing sector, boosting economic diversification and solid minerals development under President Tinubu’s administration. - Thesun

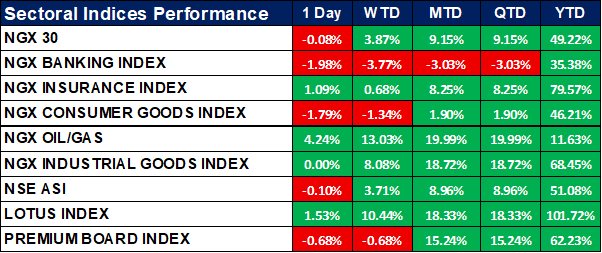

Nigeria Sectoral Indices Performance

The table below depicts that the NGX Oil/Gas index led gains today, rising 4.24%, while the Banking (-1.98%) and Consumer Goods (-1.79%) indices dragged the market.

Overall, the NSE ASI slipped 0.10% but remained up 3.71% week-to-date and 8.96% month-to-date. Year-to-date, the Insurance (+79.57%) and Lotus (+101.72%) indices remain the top performers, reflecting strong sector momentum.

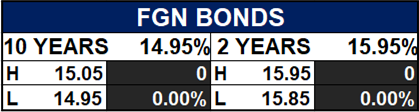

Fixed Income (FGN Bonds)

Corporate Action

Global News & Market Update

Rare earth miners fall as US-China truce to pause tariffs, export curbs:

Shares of rare earth mining companies fell after the U.S. and China agreed to pause tariffs and export curbs, easing trade tensions. - Reuters

US Department of Energy forms $1 billion supercomputer and AI partnership with AMD:

The U.S. has partnered with the Advanced Micro Devices, Inc. (AMD) in a $1 billion deal to build two supercomputers, Lux and Discovery, to advance fusion energy, cancer treatment, and national security research.- Reuters

Cameroon’s Biya re-elected at 92, opposition reports gunfire:

Cameroon’s 92-year-old President Paul Biya won a controversial eighth term with 53.66% of the vote, sparking opposition protests and clashes amid claims of election irregularities. - Reuters

UK to cut tax-free cash savings allowance in November budget:

Britain’s government plans to halve the annual cash ISA limit to £10,000 in the upcoming budget to encourage more investment in shares and boost local market participation. - Reuters

Britain announces $1.45 billion budget for offshore wind auction:

Britain has allocated £1.08 billion for its next offshore wind auction to accelerate renewable energy growth and meet its 2030 decarbonisation goals. - Reuters

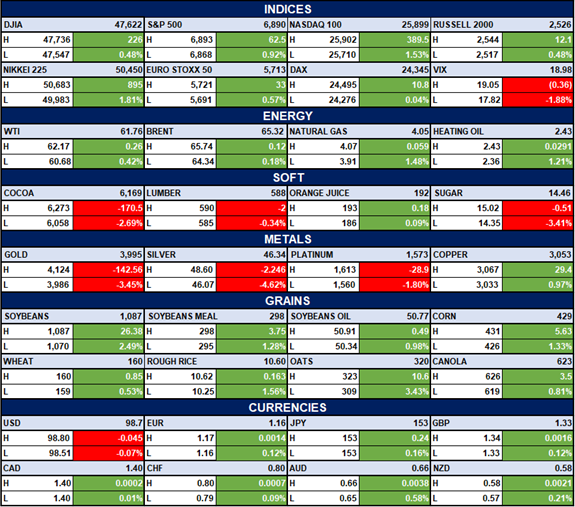

Indices, Commodities & Currencies

The table below depicts that the Global equities advanced, with the Dow Jones (+0.48%), Nasdaq 100 (+1.53%), and Nikkei 225 (+1.81%) all closing higher.

Energy prices edged up as WTI (+0.42%) and Brent (+0.18%) rose, while natural gas gained 1.48%. Metals declined sharply gold (-3.45%) and silver (-4.62%) led losses whereas grains like soybeans (+2.49%) and oats (+3.43%) posted strong gains.

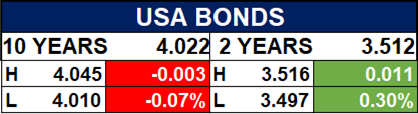

Fixed Income (USA Bonds)

Conclusion

Overall, Nigeria’s energy and mining sectors continue to attract strategic capital, supporting diversification and growth, while global markets benefit from improved trade sentiment and tech-driven optimism. Investors should stay alert to upcoming fiscal policies and energy reforms shaping both local and international market directions.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.

Thanks for writing this, it clarifies a lot. The ambition to halve fuel prices is really interesting, I hope it works out for pepole there. Always good to see AI investments too.