Money Monday-Nigeria Tightens Fiscal Oversight and Boosts Market Reforms as Global Risk Sentiment Strengthens

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market update, where we spotlight the major developments shaping Nigeria’s economy, capital markets, and global risk sentiment. In this edition, we break down critical domestic fiscal audits, rising fuel imports, corporate expansion plans, and regulatory shifts affecting equities settlement and debt markets. We also track key global policy moves from central bank decisions to commodity-market disruptions setting the tone for near-term market positioning.

Nigerian News & Market Update

FG’s Audit Uncovers Over ₦60billion Financial Irregularities In NNPC:

The Auditor-General’s 2022 report uncovers over ₦60billion in undocumented, irregular, and improperly approved NNPC transactions, citing systemic internal control failures and calling for recoveries, sanctions, and CEO accountability. - Channels

Nigeria’s petrol shipments surge after suspending import duty:

About 194 million litres of petrol are arriving in Nigeria as importers rush in new cargoes following the government’s suspension of the 15% fuel import duty until 2026. - Businessday

Dangote unveils $700million expansion plan to boost sugar production:

Dangote is investing over $700 million to boost local sugar production and reduce Nigeria’s reliance on sugar imports, strengthening its backward-integration and industrial expansion strategy. - Vanguard

SEC begins T+2 settlement cycle in capital market on Friday:

Nigeria’s SEC will shift equities settlement from T+3 to T+2 on November 28, 2025, accelerating fund access and improving market efficiency. - Vanguard

GENCOs reject FG’s offer to forfeit 50% of ₦5trillion debt:

Nigeria’s power generation companies have rejected the government’s proposal to accept only 50% of the over ₦5 trillion owed to them, insisting on full debt repayment and warning the haircut would worsen the sector’s financial crisis. - Vanguard

Nigeria targets ₦460billion as DMO reopens local bond issuance:

Nigeria’s Debt Management Office (DMO) will seek ₦460billion in new bond issuance doubling last month’s offer as strong local demand supports the government’s expanded domestic borrowing plan. - Dailytimes

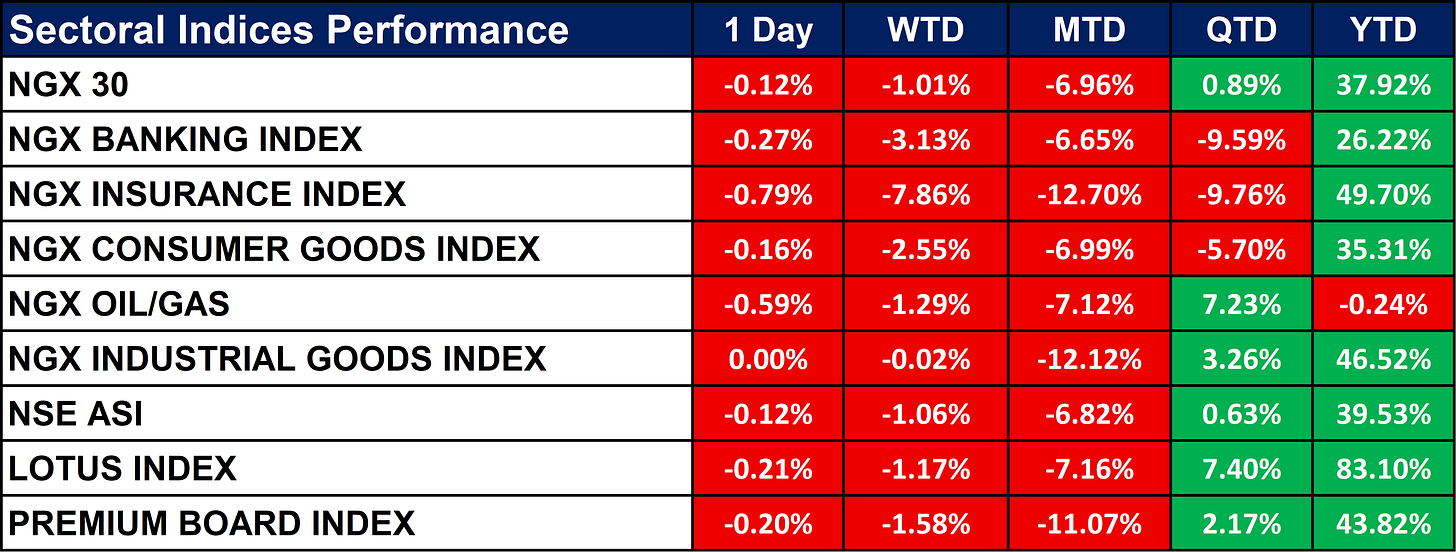

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectors were broadly negative across 1-Day, WTD, and MTD, with Banking, Insurance, and Consumer Goods recording the steepest declines. Despite short-term weakness, most sectors remain strongly positive YTD, led by Insurance (+49.70%), Lotus Islamic Index (+83.10%), and Industrial Goods (+46.52%). Oil & Gas is the only sector with negative YTD performance (-0.24%), while NGX 30 and NSE ASI maintain solid double-digit gains for the year.

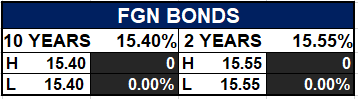

Fixed Income (FGN Bonds)

Corporate Action

Global News & Market Update

India’s sugar export quota at risk as mills avoid low-priced global market:

Indian sugar mills are unlikely to meet their full 1.5 million-ton export quota as low global prices make exports unprofitable, potentially supporting global sugar prices. - Reuters

Bank of Israel cuts rates for first time since January 2024 as inflation eases after Gaza truce:

The Bank of Israel cut its benchmark rate to 4.25% amid easing inflation and reduced geopolitical risk following the Gaza ceasefire. - Reuters

India’s finished steel imports in April-October down 34%, govt data shows:

India’s finished steel imports fell 34% year-on-year in April–October amid weak domestic demand and pressured prices, even as exports rose over 25%. - Reuters

Hungary’s second largest bank MBH to sell 7% stake in public offer:

Hungary’s MBH Bank will sell a 7% stake through a public offering starting Tuesday to broaden its investor base and boost trading activity. - Reuters

Brazil cenbank to offer $2 billion in dollar auctions with repurchase deal on Monday:

The Brazilian central bank will offer up to $2 billion in two dollar auctions with repurchase agreements on Monday to roll over contracts maturing in January. This move aims to maintain currency market liquidity and ease pressure on the Brazilian real. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global equity indices are broadly higher, with strong gains across the S&P 500, Nasdaq 100, Nikkei 225, and Euro Stoxx 50, reflecting positive risk sentiment. Commodities show mixed performance: energy (WTI, Brent) and most metals are up, while softs like lumber and orange juice decline; grains trade mostly flat to mildly higher. Major currencies remain stable, with slight strengthening in USD, EUR, CAD, and CHF, while JPY and GBP show minimal movement.

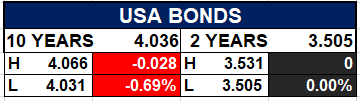

Fixed Income (USA Bonds)

Conclusion

Looking ahead, investors should monitor how Nigeria’s tightening fiscal oversight, renewed domestic borrowing, and energy-sector tensions could influence liquidity and sector performance. Globally, easing inflation in advanced markets and shifting commodity dynamics may support risk assets, though currency volatility and geopolitical events remain potential headwinds. Overall, a selectively bullish stance tilting toward resilient sectors and stable fixed-income instruments may prove advantageous in the coming weeks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.