Money Monday- Nigerian Market Shows Resilience Amid Short-Term Volatility; Global Factors Signal Cautious Optimism

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick off. The Nigerian market is navigating a mix of short-term pressures and longer-term growth opportunities. NGXGROUP’s revenue surge, driven by recapitalisations and listings, reflects a strong underlying market foundation despite recent sector declines. Meanwhile, the naira’s modest strengthening, rising foreign reserves, and historic growth in non-oil exports underscore improving economic fundamentals. On the global stage, cautious investor sentiment prevails as the US dollar softens ahead of key jobs data, while geopolitical tensions and energy developments shape market dynamics. Together, these factors create a complex but potentially promising environment for investors both locally and internationally.

Nigerian News & Market Update

NGX revenue surges to ₦24billion on recapitalisation, listings:

NGXGROUP’s revenue grew to ₦24 billion in 2024, boosted by bank recapitalisations and major listings. Transaction and listing fees saw sharp increases, driving strong profit growth. The company invested in technology and improved efficiency, resulting in a 157% rise in profit before tax. Despite expected lower foreign exchange gains in 2025, NGXGROUP plans to expand listings, product offerings, and retail investor participation, aiming for steady long-term growth with a projected 12.9% revenue Compound Annual Growth Rate (CAGR). - Punch

Naira firms to 1,531.57/$ on FX liquidity, reserves boost:

The naira strengthened slightly to ₦1,531.57/USD on the official Nigerian Foreign Exchange Market, appreciating 0.23% week-on-week and 0.13% month-on-month. This marks a recovery from a weaker position at the end of July. External reserves also rose to $41.27 billion. Analysts attribute the naira’s gains to improved market liquidity, sustained dollar inflows, and Central Bank of Nigeria (CBN) interventions. The parallel market also saw modest appreciation, signaling increased trader confidence. Experts expect the naira to remain largely stable in the near term, supported by continued CBN support and steady FX inflows, though stronger dollar demand may limit further gains. - Punch

NGX Suspends Trading in 3 Insurance Firms over Default Filing:

The Nigerian Exchange Limited (NGX) has suspended trading in the shares of Regency Alliance Insurance Plc, International Energy Insurance Plc, and Universal Insurance Plc starting September 1, 2025. The suspension is due to these companies failing to submit their audited financial statements for the year ended December 31, 2024, as required by exchange rules. Trading will remain suspended until the companies comply by filing the outstanding reports. The Exchange has also notified the Securities and Exchange Commission (SEC) about the suspension. - dmarketforces

FG Offers Investors 16.541% Rates In September 2025 Savings Bonds:

The Federal Government of Nigeria, through the Debt Management Office (DMO), is offering FGN Savings Bonds for September 2025 with interest rates of 15.541% (2-year bond) and 16.541% (3-year bond) both increased from the previous month. The subscription window is open until September 5, with settlement on September 10. Interest is paid quarterly. Bonds are priced at ₦1,000 per unit, with a minimum investment of ₦5,000. The programme aims to promote financial inclusion and provide safe investment options for retail investors. The bonds are tax-exempt for qualified investors. - Channels

Nigeria’s internet usage peaks despite shrinking subscriptions:

Despite a decline in internet subscriptions, Nigeria’s data consumption hit a record 1.1 million terabytes in July 2025, according to the Nigerian Communications Commission (NCC). The surge is driven by more users migrating to 4G and 5G networks, even as total subscriptions dropped from 141.1 million to 138.7 million due to rising service costs. Airtel lost the most users, while MTN retained market dominance. Teledensity also declined. Operators face the challenge of meeting growing data demand amid a shrinking customer base and higher tariffs. In response, firms like Airtel are increasing investment in 5G infrastructure to support rising usage. - TheSun

Non-oil exports emerging as Nigeria’s new source of FX – National Orientation Agency of Nigeria (NOA):

Nigeria’s non-oil exports nearly matched oil earnings in the first half of 2025, generating $3.22 billion compared to $3.47 billion from crude oil. This marks a major shift in the economy, with non-oil sectors mainly agriculture and manufacturing growing steadily. The National Orientation Agency (NOA) called it a historic development, crediting recent reforms and export promotion efforts under the Tinubu administration. - BusinessDay

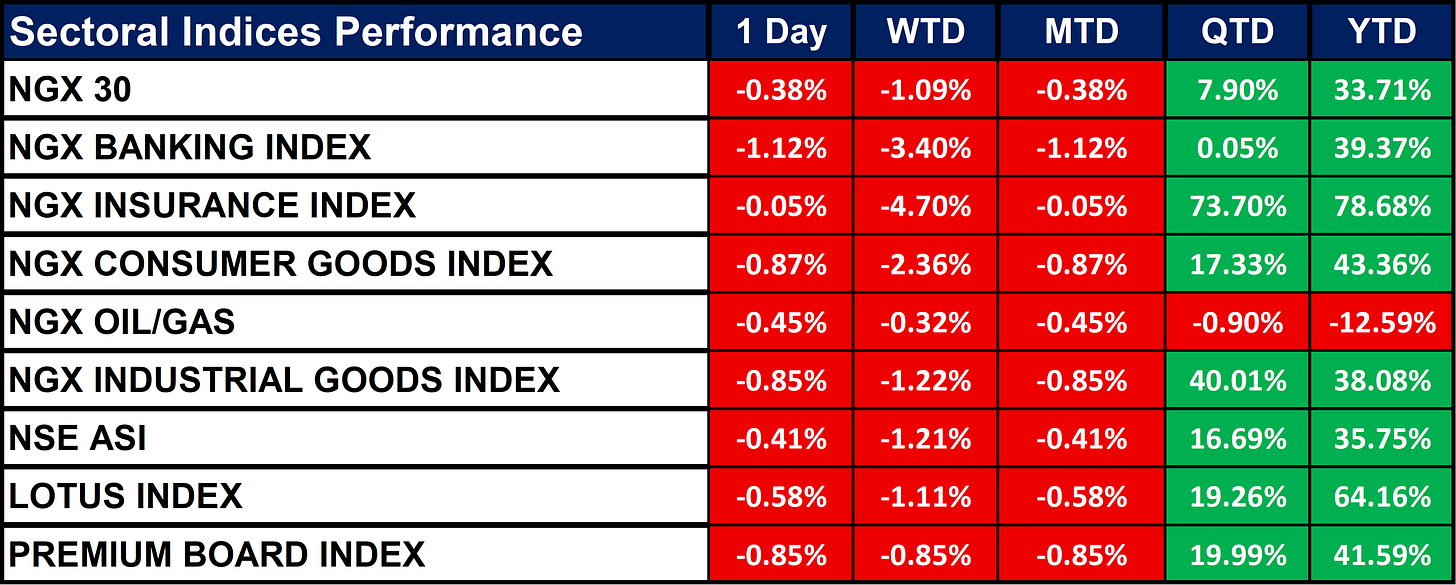

Nigeria Sectoral Indices Performance

The table below depicts that most sector indices experienced short-term declines, with all showing negative returns over 1 Day, Week-to-Date, and Month-to-Date periods for example, the NGX Banking Index fell by -1.12% in one day and -3.40% WTD. However, over longer periods, most sectors posted strong gains. The NGX Insurance Index led with impressive increases of +73.70% QTD and +78.68% YTD, followed by Industrial Goods and Consumer Goods sectors with solid double-digit gains. The only exception was the NGX Oil/Gas sector, which showed negative performance both quarterly (-0.90%) and yearly (-12.59%). Overall, despite recent short-term losses, the longer-term trend remains positive across most sectors.

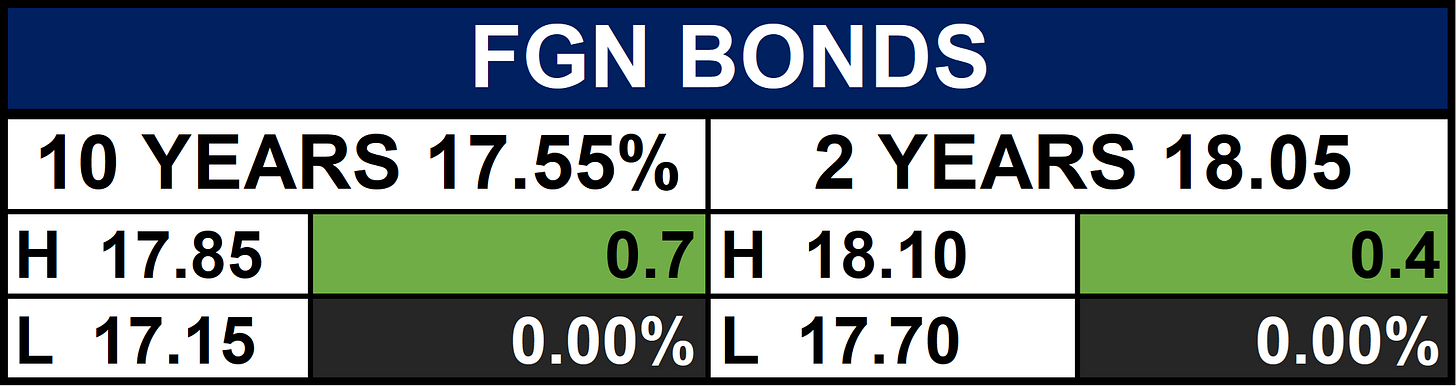

Fixed Income (FGN Bonds)

Dividends

Global News & Market Update

Dollar hits lowest since end-July ahead of US jobs data:

The US dollar dropped to a five-week low ahead of important US jobs data, with markets expecting potential Federal Reserve rate cuts. Concerns over weaker economic performance and political tensions, including Trump’s conflict with the Fed, pressured the dollar. Meanwhile, the euro and British pound gained slightly, and the Chinese yuan strengthened after policy signals. - Reuters

Angola plans first output at Cabinda oil refinery by year-end:

Angola’s new 30,000 barrels-per-day Cabinda oil refinery will start producing fuel by the end of 2025, aiming to reduce the country’s dependence on expensive fuel imports. The project is partly owned by investment firm Gemcorp and state oil company Sonangol. Plans to expand capacity and build larger refineries like Soyo and Lobito are ongoing but face funding and development challenges. - Reuters

China, Russia join Iran in rejecting European move to restore sanctions on Tehran:

China and Russia, along with Iran, have rejected a European push to reimpose UN sanctions on Iran using the "snapback mechanism" from the 2015 nuclear deal. They argue the European move is legally flawed and politically damaging. The sanctions had been lifted under the deal, which is set to expire in October 2025. Recent talks between Iran and European countries failed to produce progress toward a new agreement, amid tensions following U.S. withdrawal from the deal in 2018. - Reuters

Hong Kong retail sales up 1.8% in July, sentiment steady, government says:

Hong Kong's retail sales by value rose 1.8% in July 2025 from a year earlier, marking the third consecutive month of growth. Sales reached HK$29.7 billion ($3.8 billion), supported by increased visitor arrivals, especially from mainland China, which rose 11.8% year-on-year. Despite this, overall retail sales for the first seven months of 2025 fell 2.6% compared to 2024. Jewellery and watches saw strong sales growth, while clothing sales stabilized after previous declines. The government expects consumer sentiment to remain steady, boosted by tourism and major events. - Reuters

Hungarian section of new oil pipeline to Serbia to be finished by end-2027, minister says:

Hungary plans to complete its section of a new oil pipeline to Serbia by the end of 2027, which will supply Russian Urals crude oil. So far, Hungary has imported about 5 billion cubic meters of gas via the Turkstream pipeline through Serbia this year. Despite EU efforts to phase out Russian energy by 2027, Hungary and Slovakia continue to maintain energy ties with Russia. Recent conflicts between Russia and Ukraine have disrupted energy supplies in the region. - Reuters

India Q1 current account swings to $2.4 bln deficit on wider trade gap, RBI data shows:

India recorded a current account deficit (CAD) of $2.4 billion (0.2% of GDP) in April-June 2025, driven by a wider merchandise trade deficit of $68.5 billion. Despite this, strong exports to the U.S. and rising services exports helped cushion the deficit compared to last year. Remittances also increased to $33.2 billion. However, economists warn that if U.S. tariffs remain high, the CAD could widen to 1.3% of GDP. The balance of payments showed a surplus of $4.5 billion but may turn negative in the next quarter due to slower foreign investment and growing trade deficits, putting pressure on the rupee. - Reuters

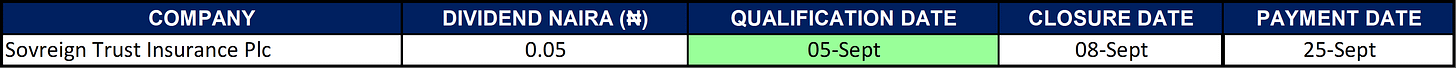

Indices, Commodities & Currencies

The table below shows that the global stock indices posted modest gains, reflecting cautious investor optimism, while a sharp 4.95% rise in the VIX signaled growing market uncertainty. Oil prices moved higher, but natural gas declined. Grain commodities outperformed, with oats and corn leading strong gains. In contrast, metals and soft commodities saw widespread declines. Currency markets remained stable, with the US dollar dipping slightly and other major currencies posting small gains.

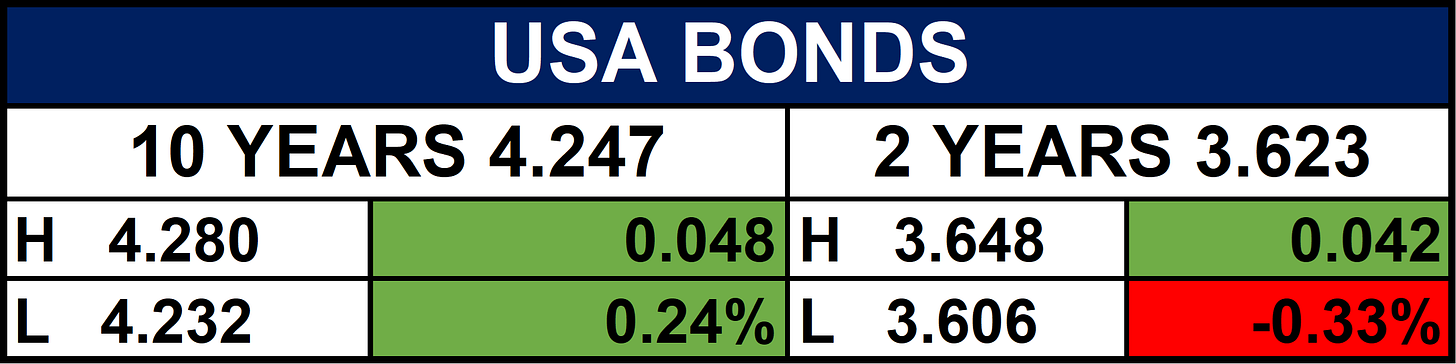

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Investors should expect short-term volatility driven by shifting economic indicators and regulatory actions, such as trading suspensions of Nigerian insurance firms. Despite this, strong quarterly and yearly gains in Nigerian sectors like insurance and industrial goods, alongside supportive government bond yields and improving foreign exchange stability, provide a solid foundation for growth. Globally, potential Federal Reserve policy changes and ongoing geopolitical tensions may impact capital flows and investor risk appetite. Therefore, a cautious but optimistic approach focusing on diversified exposure to high-performing sectors while closely monitoring currency trends and global economic signals is advised.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.