Money Monday- Nigeria’s Bond Rally Deepens as UAC, Seplat Drive Corporate Momentum; Global Markets Steady Amid Trade Tensions and Oil Outlook Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market Kick off. This overview highlights UAC’s acquisition of CHI Limited, Seplat’s $3 billion expansion plan, and Nigeria’s bond rally amid strong liquidity. NGX indices closed broadly positive, led by Insurance and Industrial Goods. Globally, markets face renewed US-China trade tensions, easing inflation in India, and shifting oil dynamics as the Organization of the Petroleum Exporting Countries (OPEC) revises its outlook.

Nigerian News & Market Update

Stanbic IBTC leads UAC’s acquisition of CHI Limited:

UAC Nigeria acquired CHI Limited with Stanbic IBTC as lead arranger, expanding its FMCG reach and brand portfolio. Stanbic IBTC provided full financial and advisory support for the deal’s success. - Punch

Bond rally continues as yields dip 18.38%:

Nigeria’s bond market stayed bullish as yields fell to 18.38% on strong investor demand and improved liquidity. The DMO’s ₦100bn auction was oversubscribed, while Treasury bills and Eurobonds also saw yield declines amid positive sentiment. - Punch

Crude row deepens as refiners reject 11m-barrel local supply:

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) says 11 crude cargoes went unclaimed due to pricing and grade issues, though supply was available. Refiners argue shortages and infrastructure gaps hinder operations. They call for better support to ensure consistent local crude supply. - Punch

Citi Meets CBN ₦200billion Capital Requirement Ahead of Deadline:

Citibank Nigeria met the CBN’s ₦200billion capital requirement ahead of schedule, reinforcing confidence in Nigeria’s economy. The move strengthens its support for key sectors and expands digital and social finance initiatives. - dmarketforces

Seplat’s $3 Billion Investment Strategic Bet on Nigeria’s Energy Future:

Seplat Energy launched a $3billion five-year plan to boost oil and gas output, drill 120 wells, and develop three gas projects. The self-funded strategy targets $6bn cash flow by 2030, reinforcing Seplat’s leadership in Nigeria’s energy sector. - dmarketforces

Agricon dumps national grid for 1.5MW gas plant:

Agricon West Africa switched to a 1.5MW gas-powered plant from Clarke Energy, cutting energy costs by up to 65% and boosting rice production efficiency. The move supports Nigeria’s food security and showcases sustainable industrial growth. - Punch

Nigeria’s Total Public Debt Rises By 11.6% to ₦152.40 trillion:

Nigeria’s public debt rose 11.6% to ₦152.4tillion ($99.7billion) as of June 2025, driven by higher domestic and external borrowings. The federal government accounted for over 90% of the total, raising fiscal risk concerns. - dmarketforces

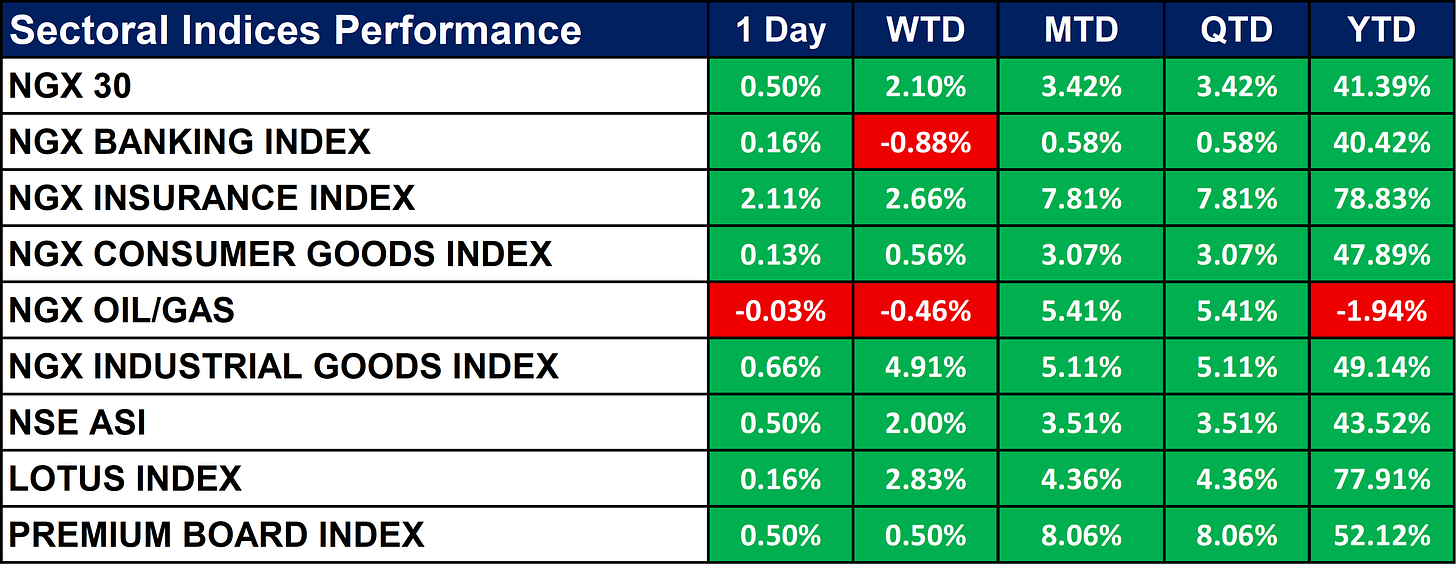

Nigeria Sectoral Indices Performance

The table below depicts that the NGX market closed broadly positive, led by gains in the Insurance (+2.11%) and Industrial Goods (+0.66%) indices. Year-to-date, the Insurance Index remains the top performer at +78.83%, followed by Lotus (+77.91%) and Consumer Goods (+47.89%). However, the Oil/Gas sector continued to lag, down -0.03% for the day and -1.94% year-to-date.

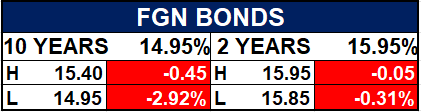

Fixed Income (FGN Bonds)

Global News & Market Update

Russia’s seaborne fuel exports sank 17% in September after drone attacks:

Russia’s oil product exports dropped 17% in September due to drone attacks on refineries, with Baltic and Black Sea shipments falling, while Arctic exports rose slightly. - Reuters

India’s retail inflation slows to eight-year low in September, leaving room for rate cut:

India’s retail inflation hit an eight-year low of 1.54% in September as food prices fell, prompting a likely Reserve Bank of India (RBI) rate cut in December. Core inflation eased slightly, and tax cuts support growth. The Reserve Bank of India (RBI) raised 2025 GDP forecast to 6.8%. - Reuters

China’s September imports of crude oil, soybeans rise:

China’s September imports rose for soybeans, crude, and iron ore but fell for coal, while exports grew 8.3% amid U.S. trade tensions. - Reuters

Equities rebound after Trump cools China rhetoric but gold at record highs:

Stocks rose after Trump eased trade war threats, gold hit record highs, and oil prices recovered, as investors stay cautious ahead of U.S. earnings. - Reuters

OPEC points to smaller 2026 oil supply deficit as OPEC+ pumps more:

OPEC projects world oil supply will roughly meet demand in 2026, revising down last month’s forecast of a supply shortfall. The Organization of the Petroleum Exporting Countries Plus (OPEC+) is boosting output, raising oversupply concerns and weighing on prices. The gap between Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency (IEA) forecasts narrows, though analysts still anticipate potential surplus next year. - Reuters

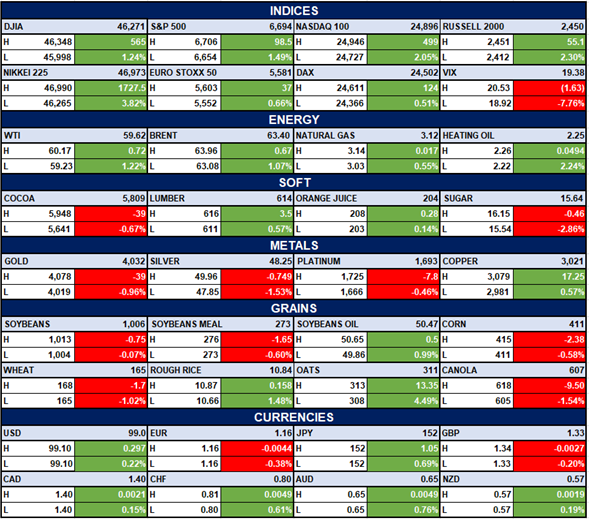

Indices, Commodities & Currencies

The table below depicts that the markets mostly rose, led by tech and energy sectors.

Metals declined, while energy and soft commodities gained.

USD edged up; EUR and GBP dipped slightly.

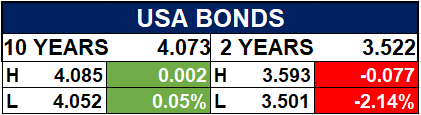

Fixed Income (USA Bonds)

Conclusion

Overall, Nigeria’s markets remain buoyant, supported by solid corporate actions, robust bond demand, and sectoral resilience despite fiscal pressures. Globally, investors are weighing geopolitical risks against improving economic indicators. As local and international markets adjust to policy and price shifts, strategic positioning and diversification remain crucial for sustained portfolio performance.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.