Money Monday-Nigeria’s Corporate Expansion Meets Global Policy Watch: Capital Raises, Energy Deals and Macro Signals Shape Market Outlook

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market update, where Nigerian corporates dominate headlines with capital raises, exchange listings, and major energy investments that signal confidence in long-term growth. Banking recapitalisation progress, consumer expansion, and oil & gas scale-ups remain key domestic themes. Globally, investors will track central bank policy signals, energy sector restructuring, and commodity trade shifts shaping risk sentiment.

Nigerian News & Market Update

Champion Breweries raises ₦42billion for bullet acquisition:

Champion Breweries is raising ₦42billion through a public share offer to acquire the Bullet brand portfolio, expanding into ready-to-drink and energy beverages across Africa. - Punch

FCMB clears ₦200billion licence hurdle ahead of recapitalisation:

FCMB secured a national banking licence after a major capital raise, positioning itself for future international licence eligibility under Nigeria’s banking recapitalisation programme. - Punch

Dangote Refinery, EIL Sign $350M Contract For 1.4MBPD Upgrade:

Dangote Group signed a $350 million contract with EIL to expand its refinery to 1.4 million barrels per day and boost petrochemical production, aiming to become the world’s largest single-location refinery. - Channels

Zichis Agro Allied Industries Plans Listing Of 1.1bn Shares On Nigerian Exchange:

Zichis Agro Allied Industries will list 1.086 billion shares on the NGX Growth Board at N1.81 per share to enhance liquidity and access long-term capital. - Leadership

Morison Industries Lists 266.838m Shares On NGX After Private Placement:

Morison Industries listed 266.838 million new shares on the NGX after a private placement to boost capital, liquidity, and support growth in the healthcare sector. - Leadership

Heirs energies production hits 50,000bpd:

Heirs Energies has doubled oil and gas production to support Nigeria’s energy security and acquired a 20% stake in Seplat Energy, becoming its largest shareholder. - Guardian

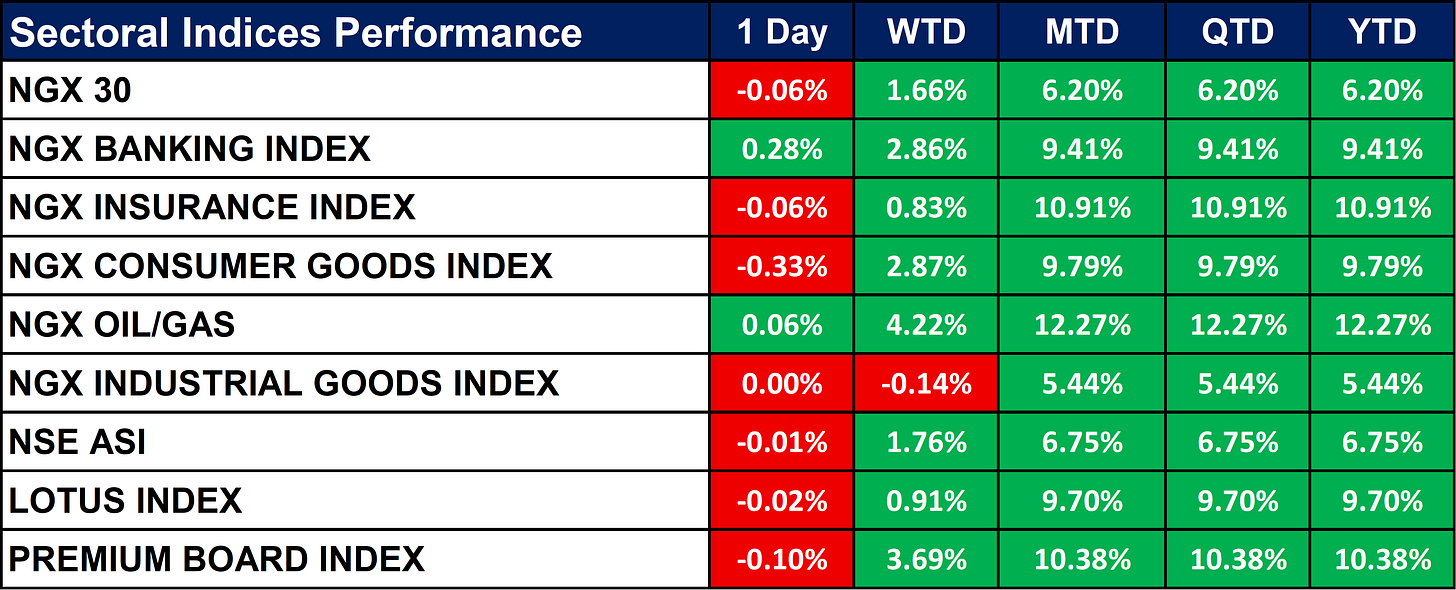

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectoral performance was mixed on the day, with marginal declines across most indices, while Banking (+0.28%) and Oil & Gas (+0.06%) closed slightly positive. Week-to-date and month-to-date returns remain firmly positive, led by Oil & Gas, Banking, Consumer Goods, and the Premium Board, reflecting sustained buying interest. Year-to-date performance is broadly strong across sectors, with Oil & Gas and Insurance emerging as top outperformers on the NGX.

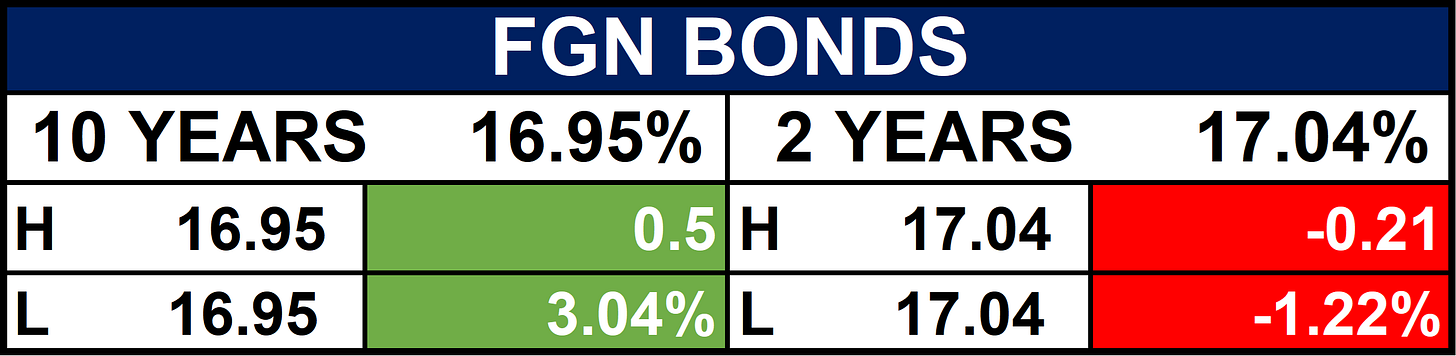

Fixed Income (FGN Bonds)

Global News & Market Update

Chinese importer buys Canadian canola, denting Australian export hopes:

A Chinese importer has resumed buying Canadian canola as China moves to ease punitive tariffs, boosting Canadian farmers while dimming export prospects for Australia. - Reuters

Kenya launches IPO of state oil pipeline firm, seeking $825 million:

Kenya has launched an IPO to sell a 65% stake in its state-owned pipeline company, aiming to raise $825 million in East Africa’s largest local-currency public offering. - Reuters

Shell seeks to exit Syria’s al-Omar oilfield:

Shell has asked to exit Syria’s al-Omar oilfield and transfer its stake to state operators as Syria regains control, while other US firms eye renewed investment. - Reuters

China set to keep rates steady for eighth month, some traders wager on Q1 easing:

China is expected to hold benchmark lending rates steady again in January, though markets are increasingly betting on a policy rate cut in the first quarter to support weak domestic demand. - Reuters

Berlin to take minority stake in power grid TenneT Germany:

Germany has approved plans to buy a 25.1% minority stake in TenneT’s German power grid business, strengthening state control over critical energy infrastructure. - Reuters

Inflation in Canada accelerates to 2.4% in December, but key measures ease:

Canada’s inflation rose to 2.4% in December due to base effects, but easing core measures reinforced expectations that the Bank of Canada will keep interest rates on hold. - Reuters

Bank Indonesia to hold rates again as rupiah currency remains weak:

Bank Indonesia is expected to keep interest rates unchanged at 4.75% to support the weak rupiah, despite expectations of modest rate cuts later in 2026 as growth and inflation remain subdued. - Reuters

Philippines makes first natural gas discovery in more than a decade:

The Philippines has made its first natural gas discovery in over a decade near the Malampaya field, potentially boosting domestic energy supply and reducing reliance on coal and LNG imports. - Reuters

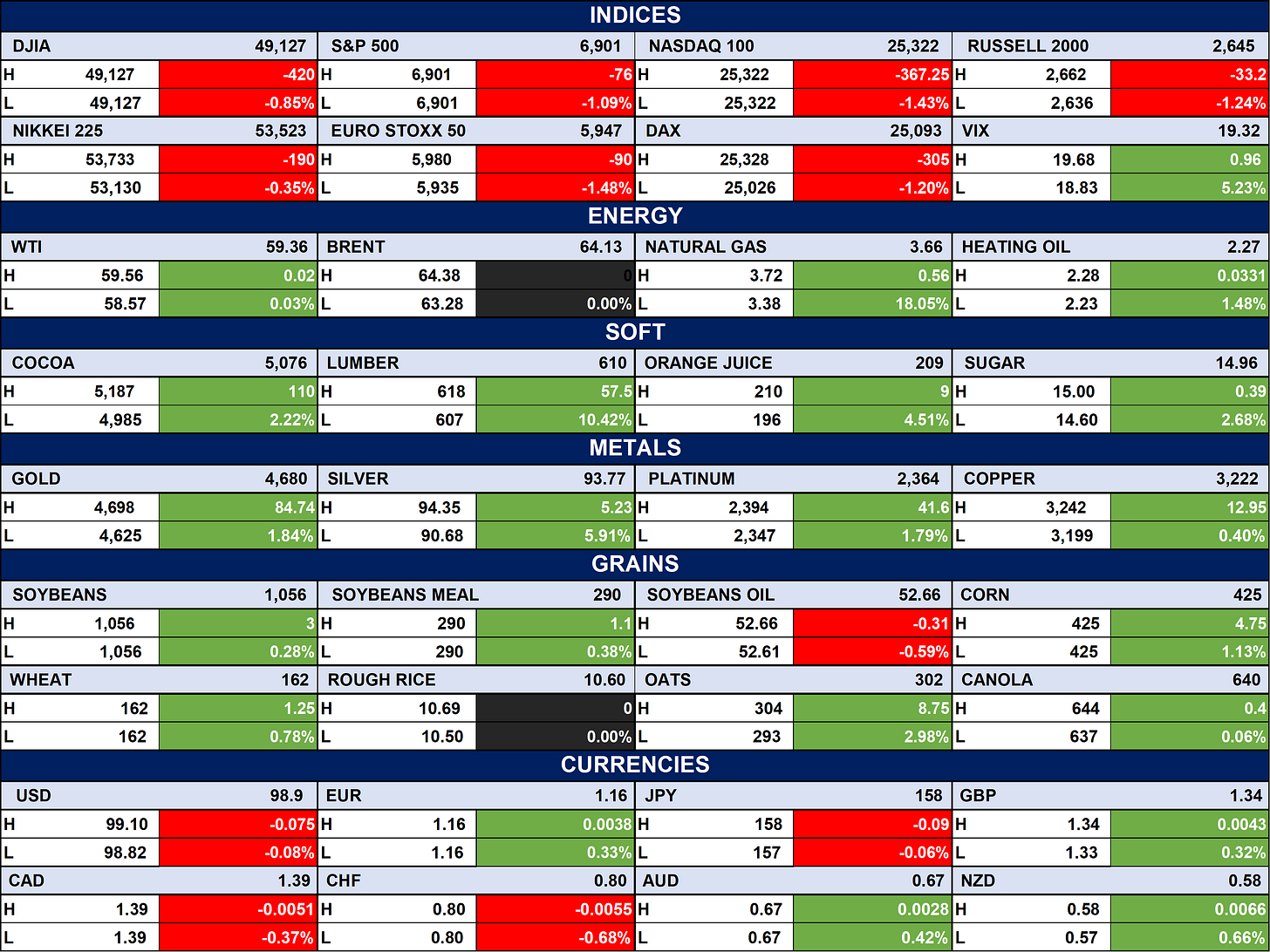

Indices, Commodities & Currencies

The table below depicts that the Global equities traded broadly lower, with US and European indices in the red and volatility (VIX) edging higher, reflecting cautious risk sentiment. Commodities were mixed but largely supportive, as energy prices firmed, soft commodities and metals posted gains, while grains were mostly stable with limited downside. In FX markets, the dollar was marginally weaker against major peers, while commodity-linked and select emerging currencies showed modest resilience.

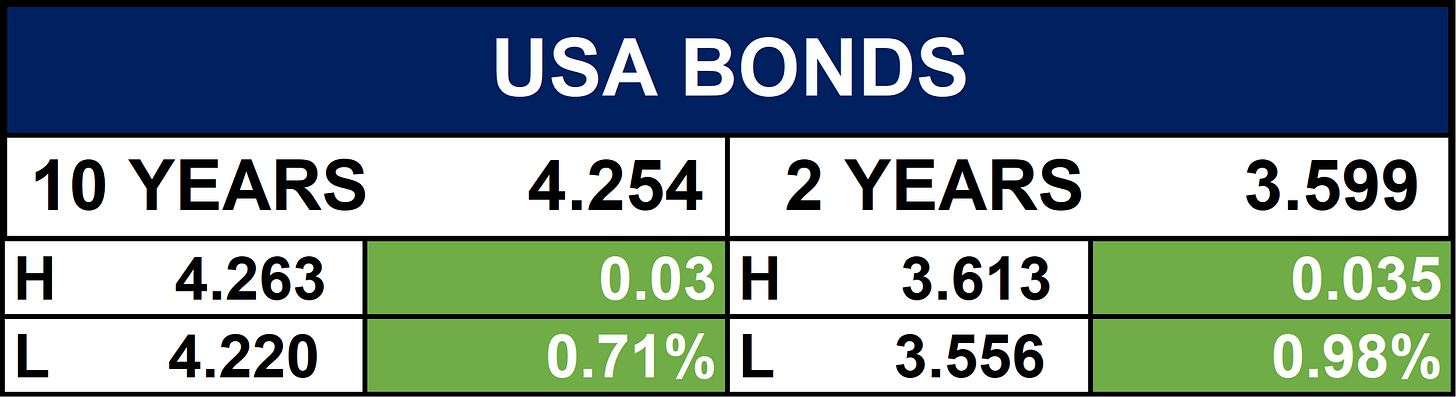

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian markets may see increased activity around equities and sector rotations as fresh capital flows into banking, energy, and consumer names, while new listings support liquidity. Globally, steady but cautious monetary policy stances and energy realignments could keep volatility selective rather than broad-based. Investors could expect markets to remain headline-driven, with opportunities tied to balance-sheet strength, reform momentum, and macro policy clarity.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.