Money Monday- Nigeria’s Economic Pulse: Non-Oil Export Growth, Market Momentum, and Global Headwinds

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick off. As we reach mid-Q3 2025, markets reflect a mix of optimism and caution. Nigeria shows strong signs of diversification, with rising non-oil exports and solid stock market gains. However, high interest rates and global geopolitical risks continue to challenge investor sentiment. This briefing highlights key local and global updates to watch in the weeks ahead.

Nigerian News & Market Update

Non-oil exports boom, hit $3.2billion in six months:

Nigeria’s non-oil exports reached $3.225 billion in H1 2025, up 19.59% from 2024, with volumes rising to 4.04 million tonnes. Growth was driven by strong demand for cocoa, sesame, cashew, and aluminium, African Continental Free Trade Area (AfCFTA) market access, and NEPC export support. Cocoa beans led exports (34.88% of value), followed by urea/fertilizer and cashew nuts. Top markets were the Netherlands, U.S., and India, and top exporters included Indorama, Starlink, and Dangote Fertilizer. Nigerian Export Promotion Council (NEPC) also supported over 3,000 farmers with seedlings and inputs, aiming for a record year. - Punch

Stock Market Records ₦2.84trillion Increase in One Week on Positive Momentum:

The Nigerian stock market gained ₦2.84 trillion last week, with the NGX All-Share Index up 3.18% to 145,754.91 points on strong interest in Insurance, Consumer Goods, and Industrial stocks after the new Insurance Act. Mutual Benefits Assurance, AIICO Insurance, and Royal Exchange led gains, while Livingtrust Mortgage Bank, Academy Press, and The Initiates Plc declined. Analysts expect mixed trading ahead, with profit-taking but continued focus on insurance and fundamentally strong sectors. - Thisday

Amid 27.50% Monetary Policy Rate (MPR), Economic Challenges, Prime Lending Rate Rise to 18.19%:

Nigeria’s average prime lending rate rose to 18.19% in June 2025 as the CBN kept its MPR at 27.50% to fight inflation. Wema Bank had the highest rate (32.50%), with Unity Bank (32%) and FCMB (31%) close behind. Analysts warn the high rates could squeeze SMEs, raise production costs, and slow business growth. - Thisday

Naira stable as external reserves hit eight-month high of $40.15billion:

Nigeria’s external reserves climbed to $40.15billion in August 2025, the highest in eight months, boosting the naira’s stability. The official rate closed at ₦1,533.56/$ and the parallel rate at ₦1,560/$, both stronger year-to-date. Reserve gains were driven by offshore inflows, reduced imports, and improved market confidence, with analysts projecting further increases and a year-end naira range of ₦1,490–₦1,520/$. - Businessday

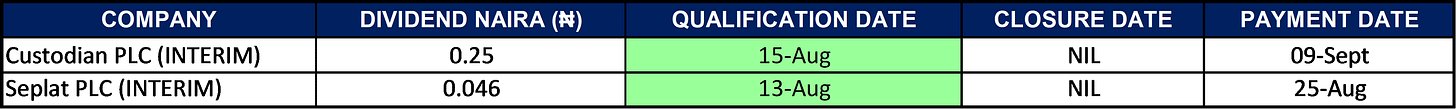

Dividends

Nigeria Sectoral Indices Performance

The table below depicts that the The NGX Insurance Index is the standout performer in 2025 so far. Most sectors are delivering strong quarterly and yearly gains, indicating broad market strength, except the Oil & Gas sector, which continues to underperform.

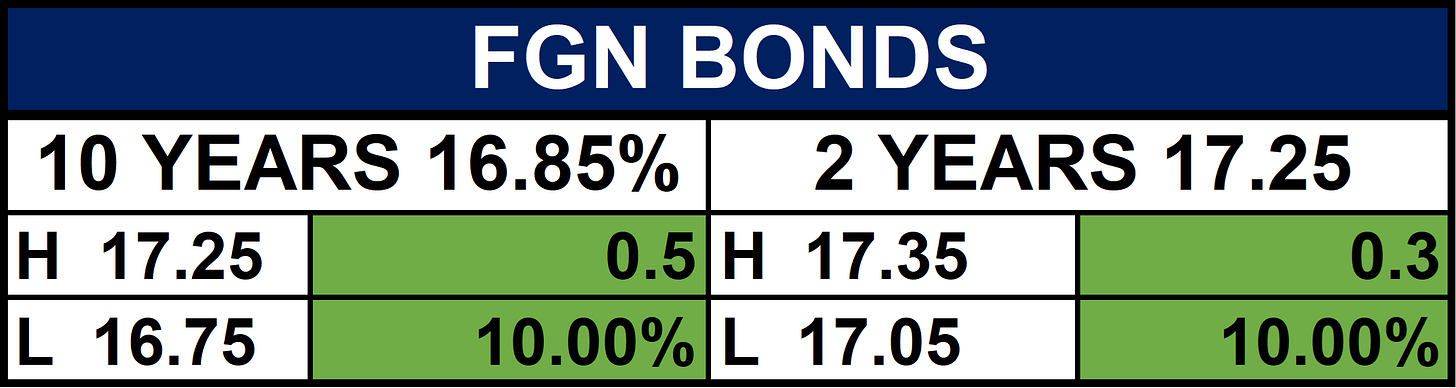

Fixed Income (FGN Bonds)

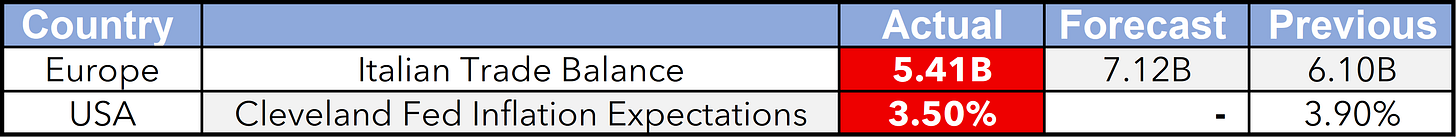

Global News & Market Update

Stock dip, US yields fall as markets brace for big week for trade, geopolitics:

Global stocks dipped slightly as investors awaited key events, including possible U.S. tariff extensions on China, a Trump–Putin meeting on Ukraine, and U.S. CPI data. The Dow fell 0.33%, while the Nasdaq edged up 0.11%. The STOXX 600 slipped 0.07%. Energy and materials lagged, while healthcare and consumer discretionary gained. Markets remain cautious, with a 90% chance still priced in for a Fed rate cut next month. Gold dropped 1.53%, and oil prices eased amid geopolitical uncertainty. - Reuters

India pushes ahead with US trade talks despite tariff hike to 50%:

Global markets fell slightly ahead of key U.S. inflation data and a planned Trump–Putin meeting on the Ukraine war. At the same time, U.S.–India tensions rose as the U.S. doubled tariffs on Indian exports over Russian oil purchases. Despite this, trade talks will continue later in August. India also condemned reported nuclear threats from Pakistan’s army chief. - Reuters

European stocks open higher:

European shares opened higher, with the Stoxx 600 and FTSE 100 both up 0.3%. As earnings season wraps up, Deutsche Bank reports a 10% drop in full-year profit estimates since late 2024, though more companies have raised than lowered their Q2 guidance. - CNBC

Nvidia and AMD to pay 15% of China chip sale revenues to US government:

Nvidia and AMD agreed to give 15% of their China chip sales revenue to the U.S. government to secure export licenses, in a first-of-its-kind deal under the Trump administration. The move has sparked criticism over national security concerns, as some fear the chips could aid China’s military AI capabilities. The deal comes amid broader U.S.–China trade talks and debate over easing export controls. - Financial Times

Indices, Commodities & Currencies

The table below shows that the Global markets were mostly cautious. U.S. equities held steady, Europe lagged, and energy & agricultural commodities saw broad gains. Cocoa and orange juice surged. The dollar strengthened, putting pressure on major currencies. Volatility rose slightly, hinting at investor uncertainty.

Fixed Income (USA Bonds)

Events

Conclusion

In conclusion, Nigeria’s non-oil exports rose to $3.2Billion, and the NGX gained ₦2.84Trillion, reflecting strong investor sentiment. The naira is stable, supported by rising reserves, but high interest rates may pressure SMEs. Globally, markets are cautious ahead of U.S.–China tariff decisions, the Trump–Putin meeting, and key inflation data. Investor may short-term volatility. Focus on value sectors like insurance and non-oil exports. Watch for CBN policy moves and global economic signals.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.