Money Monday- Nigeria’s Economic Reforms Gain Traction as Global Markets Brace for Policy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick off. As Nigeria navigates key economic reforms, investor sentiment remains largely optimistic. The equity market continues to show strength, with strong sectoral performance particularly in Insurance and Industrial Goods despite global headwinds. Local industries are adjusting to forex challenges, inflation is easing, and key sectors like Telecoms and Oil & Gas are showing signs of strategic progress. Globally, cautious sentiment prevails as markets await signals from central banks and geopolitical developments.

Nigerian News & Market Update

Nigeria’s factories go local to survive currency turmoil:

Nigerian manufacturers are shifting to local raw materials due to naira devaluation and forex scarcity following currency reforms. This has helped reduce costs (e.g., CAP saved 60% on inputs) and improve resilience. While challenges like poor infrastructure and limited supplier capacity remain, business confidence is rising as the naira stabilizes and reforms take hold. - Punch

Nigeria sustains oil production above Organization of the Petroleum Exporting Countries (OPEC) quota:

Nigeria’s crude oil production rose to 1.507 million barrels per day (bpd) in July, surpassing its OPEC quota for the second straight month. This increase reflects the government's efforts under the "Project One Million Barrels" initiative, which includes reactivating dormant fields and improving regulatory efficiency. Current production is now averaging between 1.7–1.83 mbpd, with a goal of reaching 2.5 mbpd by 2026. - Punch

Telecoms operators see biggest growth post-COVID as investments surge – Association of Licensed Telecommunications Operators of Nigeria (ALTON):

Nigeria’s telecom sector is experiencing its strongest growth since the pandemic, with increased investments, network expansions, and security upgrades. The industry is adapting to new technologies and benefiting from stable regulatory leadership. The rebranding of 9Mobile to T2 boosts investor confidence. However, restrictions like Right of Way fees by some states could slow progress. Tax reforms are expected to ease the heavy tax burden on operators starting 2026. Overall, the sector is positioned for strong growth and economic impact. - TheSun

Nigeria’s Inflation Rate Falls To 21.8% — National Bureau of Statistics (NBS):

Nigeria’s headline inflation rate dropped to 21.8% in July 2025 from 22.22% in June, marking the fourth consecutive monthly decline, according to the National Bureau of Statistics (NBS). Core inflation eased to 21.33% year-on-year, while food inflation was 22.74%. Despite these improvements, many Nigerians remain critical of President Bola Tinubu’s economic reforms due to rising living costs. However, WTO Director-General Ngozi Okonjo-Iweala praised the administration for stabilizing the economy and emphasized the need for growth and social safety nets to support those affected by the reforms. - Channels

Senate, Securities and Exchange Commission (SEC) To Host Summit On Municipal Bonds, Sukuk For Infrastructure Development:

The Nigerian Senate and SEC will hold a summit on Sept 29-30, 2025, to promote municipal bonds and Sukuk as new ways to fund local government infrastructure. The goal is to reduce reliance on federal funds and boost local fiscal independence through sustainable capital market solutions. - Leadership

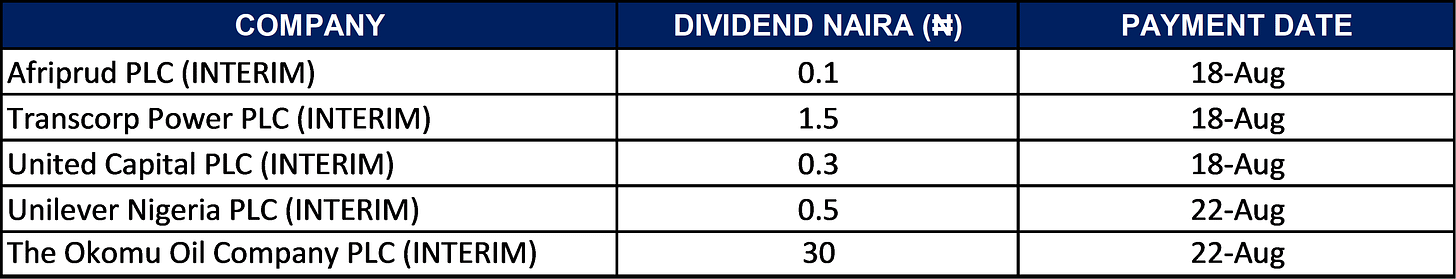

Dividends

Nigeria Sectoral Indices Performance

The table below depicts that the The Nigerian equities market remains strong, up +40.61% YTD. Insurance is the top-performing sector across all timeframes, driven by strong investor interest. Industrial Goods also show solid mid-to-long-term gains. Meanwhile, Banking and Consumer Goods face short-term pressure but remain positive YTD. Oil & Gas continues to underperform and is the only sector negative YTD.

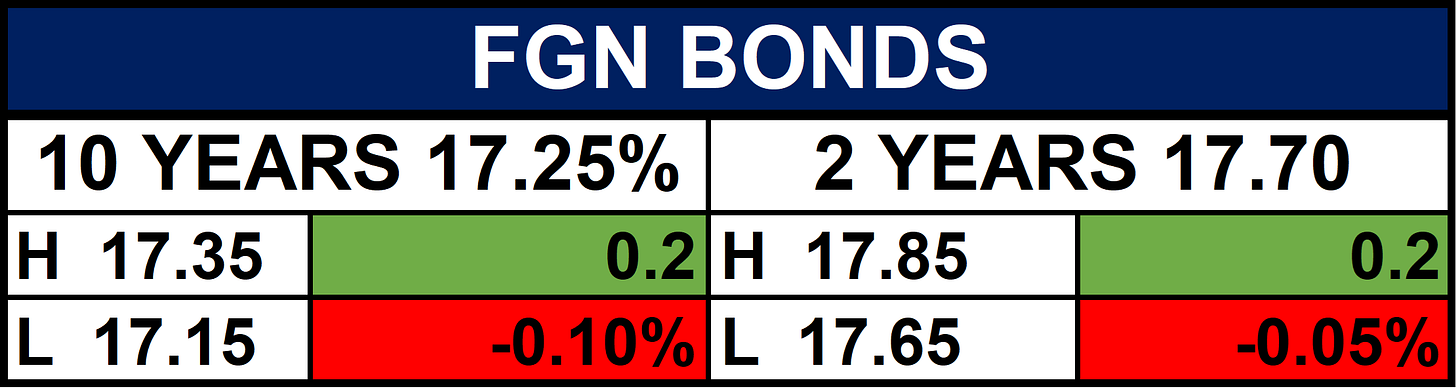

Fixed Income (FGN Bonds)

Global News & Market Update

Dollar gains before Ukraine peace talks, Fed policy in focus:

The U.S. dollar rose on Monday as markets focused on upcoming Ukraine peace talks led by President Trump and anticipated comments from Fed Chair Jerome Powell at the Jackson Hole symposium. Traders have scaled back expectations of a September interest rate cut after hotter-than-expected U.S. producer inflation data. Powell is expected to remain cautious, especially amid signs of labor market weakness. The euro slipped to $1.1673, while the dollar gained against the yen, reaching 47.85. - Reuters

Oil prices stable ahead of Trump-Zelenskiy meeting:

Oil prices were mostly steady as investors awaited talks between U.S. President Trump and Ukrainian President Zelenskyy following an inconclusive U.S.-Russia summit. Brent crude was around $65.94 per barrel, and WTI at $62.87. Markets are watching for potential impacts on oil supply depending on progress toward peace or tighter sanctions. Trump’s alignment with Moscow on peace terms and U.S. warnings about India’s Russian oil purchases added market uncertainty. Investors also anticipate insights on U.S. interest rates from the upcoming Federal Reserve meeting. - Reuters

European shares flat as investors await Ukraine talks:

European markets were flat as investors focused on peace talks between Ukraine, European leaders, and U.S. President Trump. Hopes for a deal boosted sentiment, while attention also turned to the upcoming U.S. Fed meeting. Renewable and defense stocks gained, Novo Nordisk rose on FDA news, but Commerzbank and eurozone banks declined. - Reuters

India's unemployment rate eases to 5.2% in July:

India's unemployment rate fell to 5.2% in July, mainly due to increased rural hiring. Urban joblessness rose slightly, while overall labor participation improved. The government plans to cut GST to boost local jobs amid U.S. trade tensions. S&P also upgraded India’s credit rating, citing strong growth and fiscal stability. - Reuters

Indices, Commodities & Currencies

The table below shows that the Global markets were mixed: U.S. large caps slipped while small caps and Japan’s Nikkei rose; Europe was uneven. Oil gained, but metals and soft commodities fell. Grains were mixed, with soybean oil spiking. The U.S. dollar strengthened broadly, weighing on major currencies except NZD. Overall, sentiment was cautious.

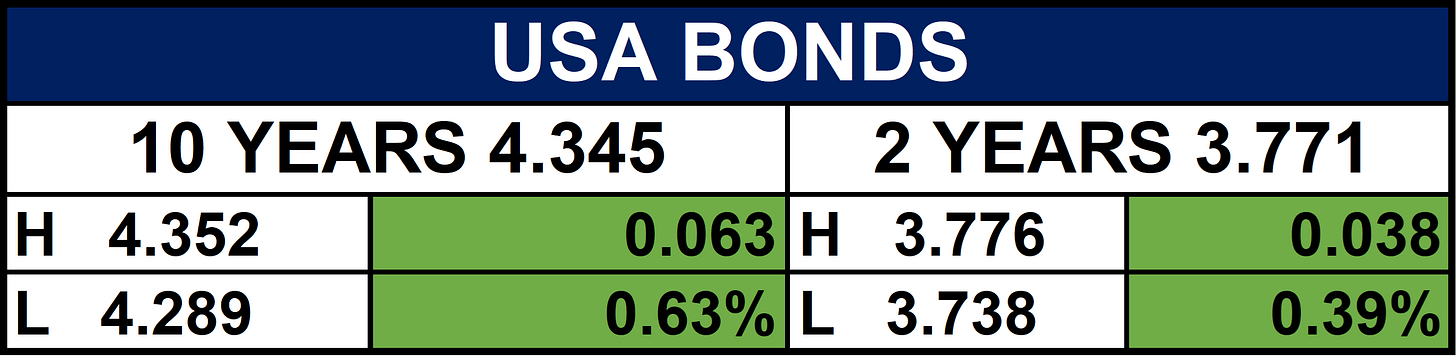

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigeria’s stabilizing inflation, rising oil output, and sector resilience especially in Insurance and Telecoms could support continued equity gains. However, short-term risks remain from global uncertainties, including U.S. Fed decisions, Ukraine peace talks, and currency fluctuations. Investors should expect sector rotation to continue, with defensive sectors like Insurance, Industrials, and Telecoms likely to remain in focus.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.