Money Monday-Nigeria’s Economic Reforms Gain Traction Amid Global Market Headwinds: Key Developments Shaping the Week

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market update, where we break down the most important developments shaping both Nigerian and global markets. Expect insights on Nigeria’s economic reforms, corporate actions, sectoral performance, and key shifts across commodities, currencies, and global indices. This edition highlights improving investor sentiment locally, alongside major global supply, trade, and commodity trends that could influence market direction.

Nigerian News & Market Update

Tantalizers inks multimillion-dollar deal for prawn exports:

Tantalizers Plc has signed a five-year multimillion-dollar offtake deal to export wild-caught prawns and shrimps to US-based Harvester Fisheries, marking a major step in its global expansion and Nigeria’s seafood export push. - Punch

Emadeb begins oil production at Ibom field:

Emadeb Petroleum E&P has achieved first oil from its Ibom Field after over $100m investment, marking a major milestone for indigenous producers and boosting Nigeria’s crude output drive. - Punch

FCMB Group to raise share capital:

FCMB Group has called an EGM to seek shareholder approval to increase its capital-raising limit to ₦370billin and expand its authorised share capital as part of its ongoing capital-boosting programme. - Punch

S&P upgrades Nigeria’s outlook to ‘positive’ in boost for investor confidence:

S&P Global revised Nigeria’s outlook to “positive,” citing improving macroeconomic conditions and sustained reforms, while affirming its “B-/B” credit rating. - Businessday

Banks Place Funds at SDF as Lending Appetite Tightens:

Nigerian banks are increasingly parking funds at the CBN’s SDF amid weaker lending appetite, rising loan defaults, and pressure on earnings as interest rates fall and asset quality deteriorates. - Dmarketforces

Dangote Cement Opens ₦100billion Commercial Papers for Subscription:Dangote Cement has launched a ₦100billion dual-series commercial paper issuance to fund working capital, offering yields of 17.5% and 19% under its ₦500bn programme. - Dmarketforces

Nigeria’s Headline Inflation Rate Crashes to 16.05% in October:

Nigeria’s inflation dropped sharply to 16.05% in October, driven by significant declines in food and core inflation despite slight month-on-month price increases. - Dmarketforces

CRC Credit Bureau Appoints Patrick Akhidenor As Non-Executive Director:

CRC Credit Bureau has appointed Patrick Ehidiame Akhidenor, First Bank’s Chief Risk Officer, as a Non-Executive Director following CBN approval. - Leadership

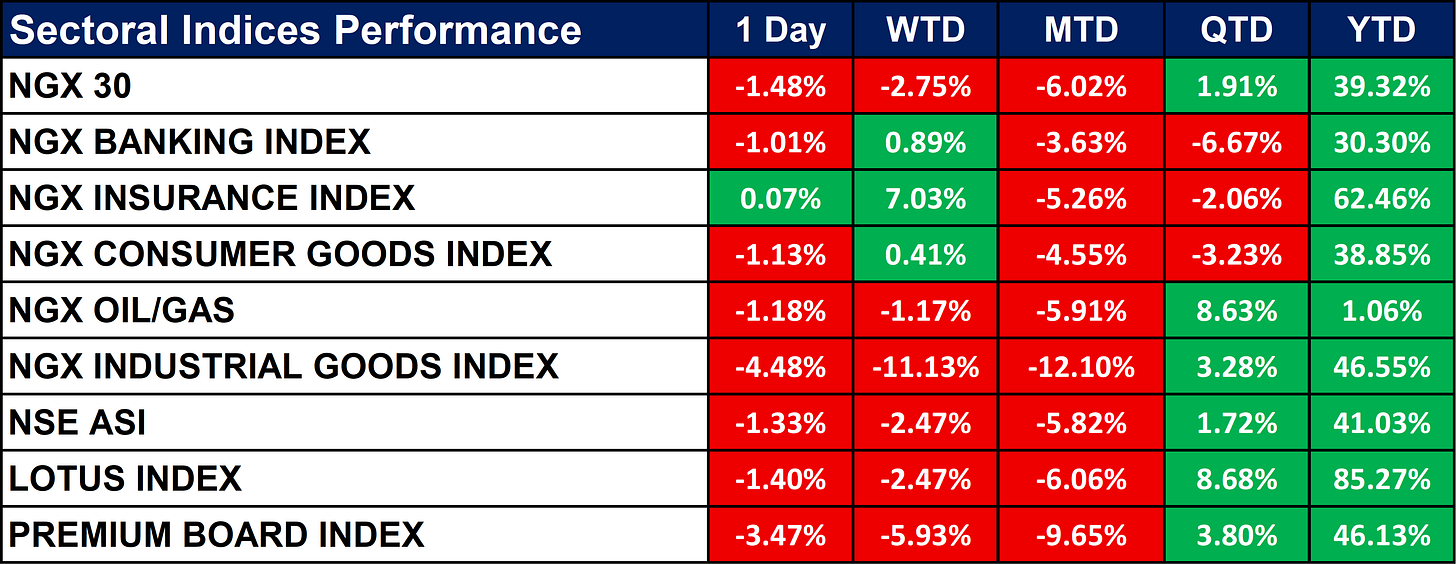

Nigeria Sectoral Indices Performance

The table below depicts that Most sector indices posted 1-day and month-to-date declines, with Industrial Goods and Premium Board showing the deepest losses.

Insurance was the standout performer, gaining across all short-term periods and leading YTD returns at over 62%. Quarter-to-date performance is broadly positive, with Oil/Gas, Lotus, NGX 30, NSE ASI, and Premium Board all showing notable gains.

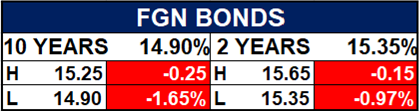

Fixed Income (FGN Bonds)

Corporate Action

Global News & Market Update

Deforestation in Brazil’s Cerrado region hurts potential soybean output, study finds:

Deforestation in Brazil’s Cerrado for soy farming worsens local climate, reducing potential yields by $9.4bn over 2008–2023 despite technological gains. - Reuters

India’s October trade deficit hits record high on surge in gold imports:

India’s merchandise trade deficit hit a record $41.68billion in October 2025 due to rising gold and crude imports and falling U.S. exports amid steep U.S. tariffs. - Reuters

Lithium surges in China after Ganfeng chairman predicts 2026 demand boom:

China’s lithium prices surged nearly 9% as Ganfeng Lithium forecasts 30–40% demand growth in 2026 amid supply constraints and rising energy storage demand. - Reuters

Hungary launches up to $272 million tax cut package for small businesses:

Hungary plans $272million in small business tax cuts financed by higher bank levies, alongside broader fiscal measures, ahead of next year’s election. - Reuters

Bank Indonesia to hold rates steady at 4.75% on November 19, cut next month: Reuters poll:

Bank Indonesia is expected to keep its key interest rate at 4.75% to support the rupiah and encourage lower lending rates, with further cuts likely next year. - Reuters

India ships first jet fuel cargo to US West Coast, traders say::

India exported its first-ever jet fuel shipment to the U.S. West Coast to help Chevron cover supply shortfalls after a refinery fire in California. - Reuters

Oil prices steady after loadings resume at Russian export hub:

Oil prices steadied as Russia’s Novorossiysk port resumed loadings after a Ukrainian attack, while supply risks and looming U.S. sanctions on Russian oil continue to influence the market. - Reuters

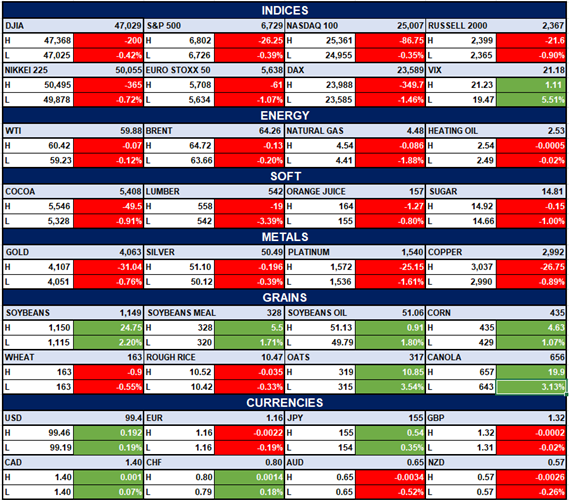

Indices, Commodities & Currencies

The table below depicts that the Global equity indices mostly traded lower, with the S&P 500, Nasdaq 100, Euro Stoxx 50, and DAX all posting declines.

In commodities, energy and metals were broadly weaker, while grains such as soybeans, corn, and canola showed notable intraday strength.

Major currencies were mixed, with the USD firming slightly while the EUR and JPY saw mild softness.

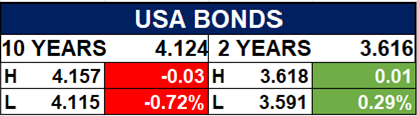

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigeria’s improving macro outlook, capital-raising activities, and easing inflation suggest potential stability, though weaker bank lending and sectoral volatility may create pockets of caution. Globally, rising commodity demand, shifting trade flows, and geopolitical supply disruptions could drive market swings in the near term. Investors should stay alert to policy moves, earnings updates, and global price pressures that may shape opportunities across equity and fixed-income markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.