Money Monday-Nigeria’s Inflation Eases, Markets Rally Ahead of Fed Decision

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market overview. The Nigerian market started the week on a strong footing, with broad-based gains across key sectors despite mixed performances in Insurance and Premium Board stocks. Locally, investors are digesting policy updates on fuel distribution, inflation, and Eurobond yields, while globally, markets remain cautious as attention turns to the U.S. Federal Reserve’s crucial rate decision later this week.

Nigerian News & Market Update

Dangote deploys 1,000 fuel distribution trucks, IPMAN rallies marketers

Dangote Refinery has begun direct fuel distribution with over 1,000 CNG-powered trucks, cutting petrol prices to ₦820/litre at the gantry and ₦841–₦851 at the pump in key states. The scheme, expected to expand nationwide as more trucks arrive, aims to save Nigeria ₦1.8trillion annually, lower inflation, support MSMEs, and create jobs, though some marketers (DAPPMAN) see it as anti-competitive while IPMAN supports it. - Punch

Excess Liquidity Worth over ₦2trillion Keeps Market Rates in Check:

Nigeria’s money market stayed liquid at ₦2.09trillion, keeping rates below 27%, supported by OMO, Treasury bill, and Remita inflows despite the Cash Reserve Ratio (CRR) debits. The Overnight Policy Rate (OPR) held at 26.50% and overnight rate at 26.96%. This week, liquidity will rise further with about ₦378billion in maturities, while the CBN plans to auction ₦290billion in T-bills and could resume OMO sales to absorb excess funds. - dmarketforces

Nigeria’s Headline Inflation Rate Falls to 20.12% in August:

Nigeria’s headline inflation fell to 20.12% in August 2025, down from 21.88% in July, marking a significant slowdown. Month-on-month inflation also eased to 0.74% from 1.99%. Food inflation dropped to 21.87% y/y (1.65% m/m), driven by lower prices of staples like rice, maize, millet, and semolina. Core inflation declined to 20.33% y/y, though it inched up month-on-month to 1.43% from 0.97% in July. - dmarketforces

Nigeria Eurobonds Yield Tracks Below 8% on Bargain Hunting:

Nigeria’s Eurobond yields fell to 7.86% as foreign investors increased buying, driven by expectations of U.S. Fed rate cuts and demand for higher-yielding emerging market assets. Strong interest in longer maturities and weaker U.S. economic data boosted sentiment, with markets pricing a likely 25bps cut in September and more easing later in the year. - dmarketforces

United Bank for Africa Increases Financial Inclusion Drive:

UBA has launched the Super Savers Season 5 promo to boost savings culture and financial inclusion, offering over ₦150million in prizes to 1,500 winners across different account types, including Kiddies, Teens, and NextGen. The bank is also expanding access through digital onboarding, prepaid cards, mobile banking, AI chatbot Leo, cross-border UBA Connect, and agent banking, all aimed at reaching the unbanked, empowering communities, and driving financial independence across Africa. - Thisday

DMO Allots ₦3.05billion FGN Savings Bond In September:

The Debt Management Office (DMO) raised ₦3.05billion from the September 2025 FGN Savings Bonds, lower than August’s ₦3.3billion. The 2-year bond (due 2027) raised ₦631.8million at 15.541%, while the 3-year bond (due 2028) attracted higher demand, raising ₦2.42billion at 16.541%. A total of 2,039 investors subscribed, with quarterly coupon payments scheduled. The bonds remain tax-exempt for pension funds and qualify under investment laws. - Channels

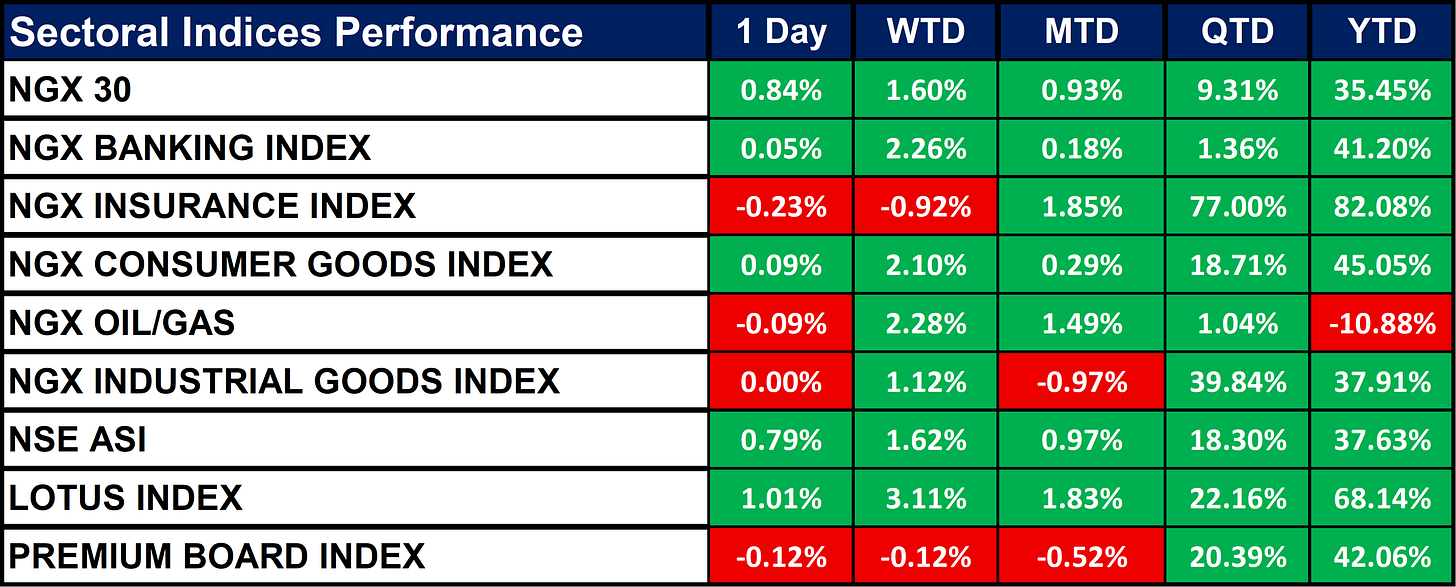

Nigeria Sectoral Indices Performance

The table below depicts that the NGX started the week strong on Monday, with broad gains across major indices. Banking (+2.26%), Consumer Goods (+2.10%), Oil/Gas (+2.28%), and Lotus (+3.11%) drove the rally, while Insurance (–0.92%) and Premium Board (–0.12%) declined. Year-to-date, the market remains robust with the ASI up +37.63%, led by Insurance (+82.08%) and Lotus (+68.14%), though Oil/Gas (–10.88%) continues to underperform.

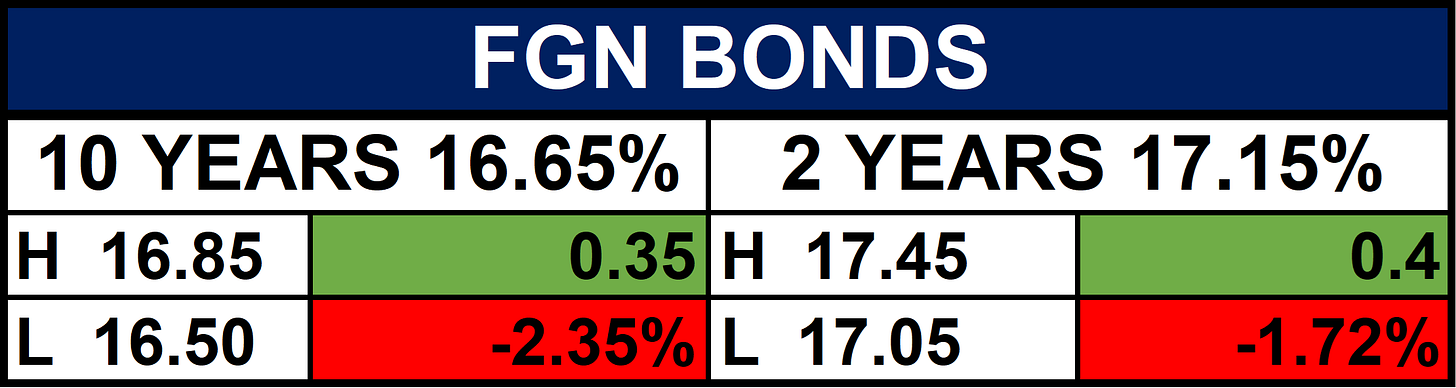

Fixed Income (FGN Bonds)

Global News & Market Update

Oil rises as investors assess attacks on Russian energy facilities:

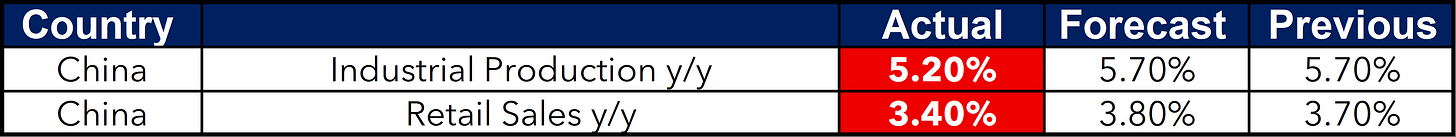

Oil prices rose modestly as Ukrainian drone attacks on Russian refineries and U.S. pressure for tougher sanctions on Russian crude fueled supply concerns. Gains were supported by strong Chinese refinery demand and falling U.S. crude inventories, though weak Chinese data limited upside. Markets await the Fed’s September rate decision, which could influence fuel demand. - Reuters

Gold hovers near record high as dollar softens ahead of Fed meeting:

Gold prices climbed near record highs around $3,661/oz, supported by a weaker U.S. dollar and lower Treasury yields as investors await the Fed’s policy meeting, where a 25bps rate cut is widely expected. Some anticipate a larger cut, with further easing possible this year. Bullion benefits from the low-rate environment, with short-term targets seen at $3,700–$3,743. Silver, platinum, and palladium saw mixed moves, while political pressure and U.S. inflation/jobs data keep focus on the Fed’s decision. - Reuters

India and US to hold trade talks, raising hopes for reset:

India and the U.S. will hold trade talks in New Delhi on Tuesday, aiming to ease tensions after President Trump imposed 25% punitive tariffs on Indian goods over Russian oil purchases. India’s exports to the U.S. dropped in August, with the broader trade deficit narrowing. While earlier negotiations stalled, both sides now signal optimism for a deal. The talks come as India deepens engagement with China and Russia, adding geopolitical weight to the discussions. - Reuters

Mexico launches 5-billion-euro bond issue to partially fund Pemex bond buyback:

Mexico issued a €5 billion ($5.88billion) three-tranche bond covering 4-, 8-, and 12-year maturities to help finance a $9.9billion Pemex bond buyback. Proceeds will support government funding and provide capital to state oil firm Pemex to repay and repurchase outstanding debt. - Reuters

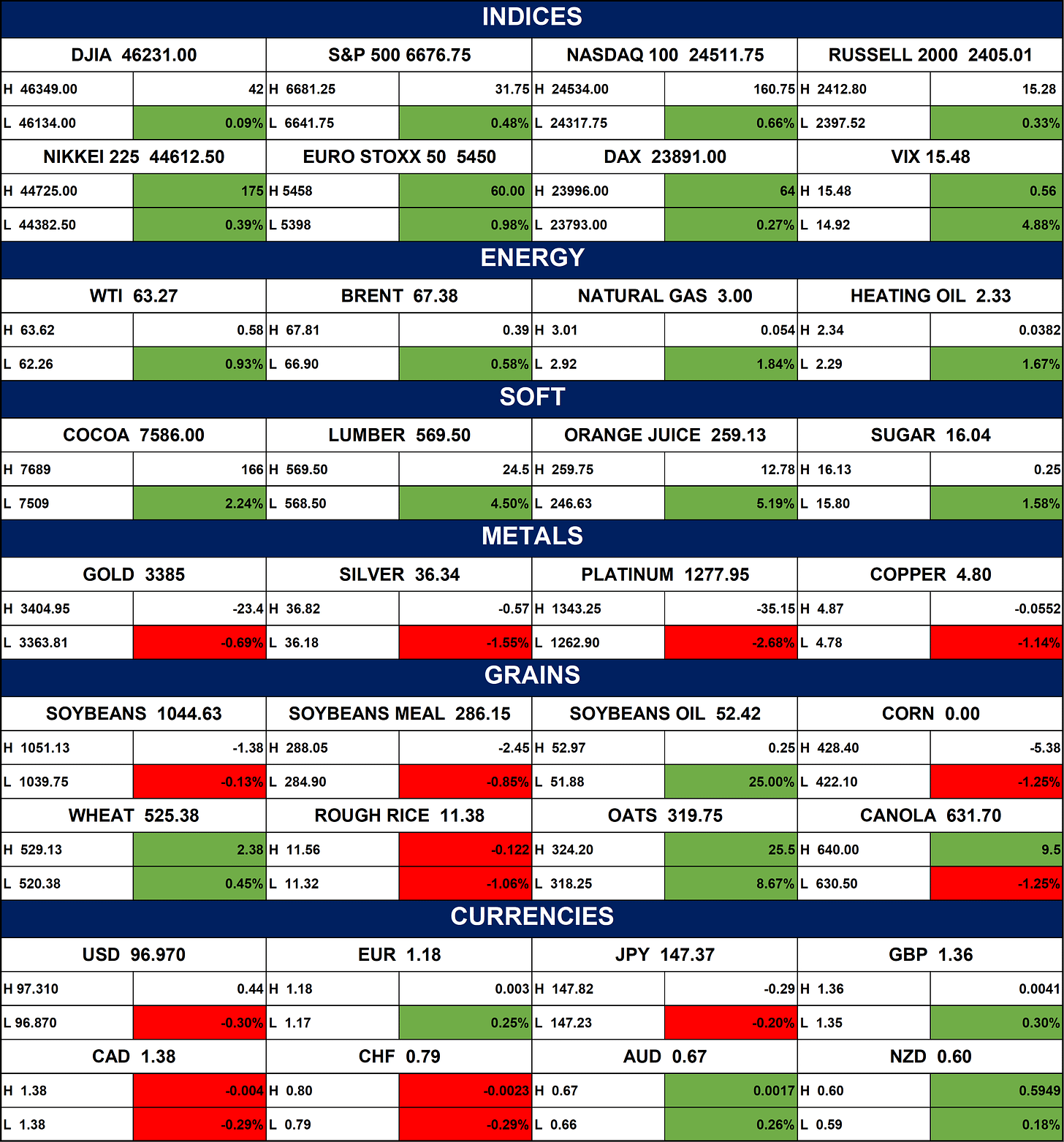

Indices, Commodities & Currencies

The table below shows that the Global stocks gained across major indices, oil and energy prices rose, and soft commodities like cocoa, lumber, and orange juice saw strong rallies. Metals declined, with gold, silver, platinum, and copper all down. Grains were mixed oats surged, while corn and canola fell. The U.S. dollar weakened slightly, while the euro and New Zealand dollar strengthened.

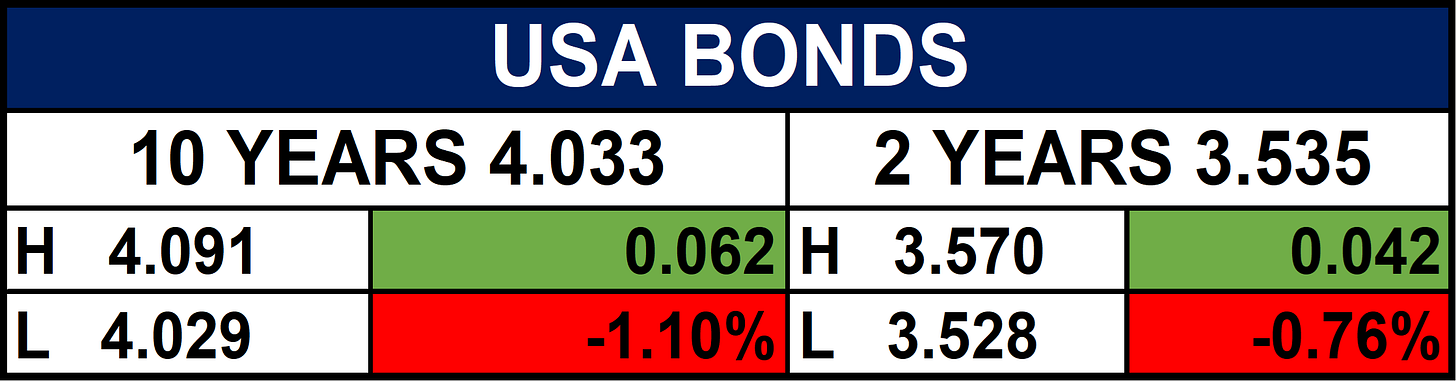

Fixed Income (USA Bonds)

Events

Conclusion

Nigeria’s easing inflation (20.12% in August) could lift equities, especially in banking and consumer goods, though excess liquidity may prompt CBN OMO mop-ups, pressuring fixed income. Globally, the Fed’s rate cut will shape capital flows, supporting Eurobonds and inflows into Nigeria. Higher oil prices aid fiscal revenues, while gold near records highlights investor caution

Bottom line: While opportunities may exist in equities and Eurobonds, lingering risks from liquidity mop-ups, oil price volatility, and global policy shifts mean investors should stay selective and manage positions cautiously.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.