Money Monday- Nigeria’s Market Gains Resilience Amid Global Shifts in Oil, Trade, and Inflation Outlook.

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick off. Nigeria’s financial markets entered the week on a cautiously optimistic note, with the naira nearing a five-month high, the NGX All Share Index sustaining robust YTD gains, and FX inflows showing resilience despite a recent dip. The domestic oil sector also drew attention as distributors backed Dangote’s CNG-powered truck plan, a move seen as transformational for efficiency and cost management. Globally, investors continue to weigh OPEC+’s modest output hike, record highs in gold, and shifting trade dynamics in China, Germany, and the U.S. as policy signals shape market sentiment.

Nigerian News & Market Update

Petrol distributors dissociate from NUPENG strike:

The Association of Distributors and Transporters of Petroleum Products (ADITOP) has distanced itself from the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG) strike, saying it supports Dangote Refinery’s CNG-powered truck distribution scheme. ADITOP’s president, Lawan Dan-Zaki, described the strike as unnecessary and insisted members would continue distributing petroleum products. He said Dangote’s plan would improve efficiency, cut costs, create jobs, and promote economic growth. - Punch

NGX restores trading rights to Universal Insurance:

The Nigerian Exchange (NGX) has lifted the suspension on Universal Insurance Plc after the company submitted its delayed 2024 audited and 2025 unaudited financial statements. Trading in the insurer’s shares resumed on September 3, 2025, following confirmation of compliance with NGX filing rules. - Punch

Naira Nears Five-Month High At 1,514/$:

The naira closed last week at ₦1,514.86/$ on the official market, its strongest level in five months, after starting September at ₦1,526.09/$. It also firmed slightly at the parallel market to ₦1,538/$. The rally was supported by a $15million CBN intervention and higher portfolio inflows. Analysts expect relative stability in the near term, though speculative demand, oil price swings, and the outcome of the Organization of the Petroleum Exporting Countries plus other allied oil-producing nations (OPEC+) meeting could limit further gains. - Channels

Nigeria’s FX Market Records $2.80billion Inflow Amid Strong Domestic Support:

FX inflows into Nigeria fell 26.9% month-on-month to $2.80billion in August (from $3.83billion in July), according to FMDQ data. Foreign inflows dropped sharply to a four-month low of $1.06billion (38%), mainly due to weaker participation from Foreign Portfolio Investments (FPIs) and Foreign Direct Investments (FDIs), while domestic inflows declined to $1.74billion (62%) as exporters and corporates slowed. However, inflows from individuals and the CBN rose strongly. Analysts expect overall FX inflows to stay firm in the near term, supported by improving sentiment and attractive naira yields for portfolio investors, likely exceeding the 2024 average of $2.51billion. - ThisDay

At 29.31%, Maximum Lending Rate Drops One-Year Low Amid Stable Monetary Fee:

The CBN kept interest rates at 27.50%, while Nigeria’s average maximum lending rate dropped to 29.31% in July 2025, its lowest in a year. Inflation eased to 21.88%, and the naira closed at ₦1,534/$. However, the prime lending rate rose to 18.54%, the highest this year. Analysts expect rates to stay high but stable as the CBN focuses on curbing inflation and supporting the naira. - ThisDay

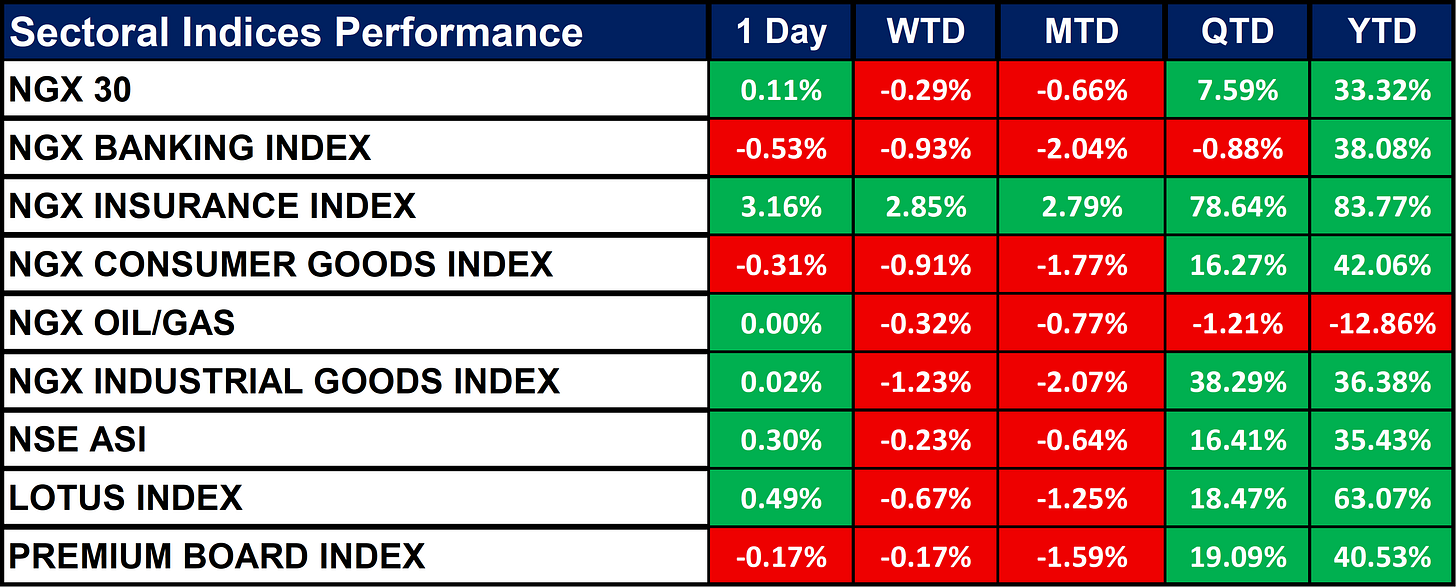

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sector indices showed mixed performance. The Insurance Index led gains with +3.16% (1-day) and remains the top performer YTD (+83.77%), while Oil/Gas stayed flat but is the only sector negative for the year (-12.86% YTD). The Banking and Consumer Goods indices recorded daily losses, though both are positive YTD. The NSE All Share Index rose 0.30% (1-day), sustaining a strong +35.43% YTD growth.

Fixed Income (FGN Bonds)

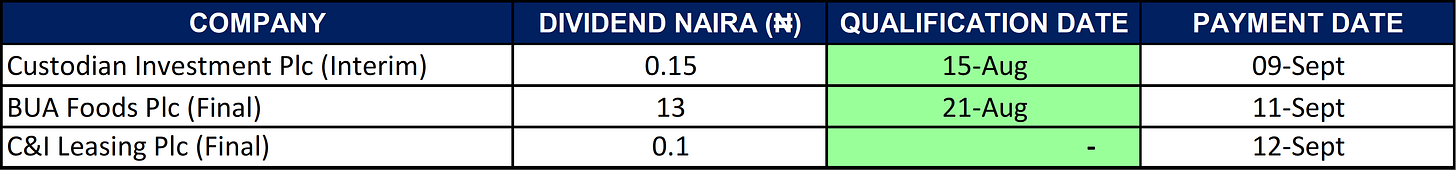

Dividends

Global News & Market Update

Treasury yields fall as investors look toward key inflation data:

U.S. Treasury yields fell on Monday ahead of key inflation data this week. The 10-year yield dropped to 4.06%, the 2-year to 3.49%, and the 30-year to 4.73%. Investors are awaiting August Consumer Price Index (CPI) and Producer Price Index (PPI) reports, which will guide expectations for Fed policy. Analysts say easing labor market data and slower hiring are helping push yields lower, with markets debating how persistent inflation pressures may affect future Fed rate cuts. - CNBC

Oil gains after OPEC+ output hike seen modest:

Oil prices rose over 1.5% on Monday after the Organization of the Petroleum Exporting Countries plus other allied oil-producing nations (OPEC+)’s planned October output hike of 137,000 bpd was seen as modest compared to earlier increases. Brent crude climbed to $66.63 and WTI to $62.89, recovering from last week’s losses. Analysts said much of the added supply is already in the market, limiting the impact. Support also came from fears of tighter supply if the U.S. imposes new sanctions on Russian oil, following Russia’s biggest air attack of the Ukraine war. Goldman Sachs kept its oil price forecast for 2025 unchanged but expects a slight surplus in 2026. - Reuters

Senegal raises 2025 forecast for Sangomar oil output:

Senegal has raised its 2025 oil output forecast for the Sangomar offshore field, operated by Woodside Energy, to 34.5 million barrels from 30.53 million. The field, which began production in June 2024, has already produced over 24 million barrels between January and August 2025, underscoring Senegal’s growing role as a new West African oil producer. - Reuters

Gold rallies to record high above $3,600/oz as Fed rate cut bets firm:

Gold surged to a record above $3,630/oz on weak U.S. jobs data, strengthening expectations of a Fed rate cut next week. Prices are up 38% in 2025, supported by central bank buying, lower yields, and global uncertainty. Analysts see momentum toward $3,700–$3,730, while silver, platinum, and palladium also gained. - Reuters

Turkey forecasts 28.5% inflation this year, single digits by 2027:

Turkey’s government projects inflation to fall from 28.5% in 2025 to single digits by 2027, while growth is expected to recover from 3.3% next year to 5% in 2028. The lira remains weak at record lows, but tight monetary policy and structural reforms aim to stabilize the economy, narrow deficits, and boost tourism and exports. - Reuters

China reviews trade law update as tariff barriers rise:

China is reviewing its first foreign trade law revision since 2004 to give legal backing for stronger countermeasures in trade conflicts. The draft allows trade bans, restrictions, export controls, and investigations against entities seen as threats to sovereignty, while also proposing a trade adjustment assistance system to stabilize supply chains. The move comes amid escalating global trade tensions, including U.S. tariffs, EU-China disputes over electric vehicles, and China’s new anti-dumping duties on EU pork. - Reuters

German exports unexpectedly fall, investor morale plunges:

Germany’s exports fell 0.6% in July, hit by weaker U.S. demand due to new tariffs, though exports to EU partners rose. Investor sentiment dropped sharply, reflecting economic concerns. Still, industrial production grew 1.3%, and analysts expect future support from rate cuts and government stimulus despite a narrower trade surplus. - Reuters

Indices, Commodities & Currencies

The table below shows that the Global markets were mostly positive, with the Nikkei 225 (+2.65%) and DAX (+0.88%) leading gains, while the Russell 2000 (-0.01%) dipped. Energy prices rose across the board (Brent +1.08%, WTI +1.00%, Gas +1.48%). Soft commodities were mixed Cocoa (-3.09%) and Lumber (-2.24%) fell, but Orange Juice (+3.16%) gained. Metals declined, led by Platinum (-2.68%). Grains were mixed, with Oats surging (+9.15%) and Corn up (+0.58%), while Rough Rice fell (-2.04%). In currencies, the USD weakened (-0.35%), while the Euro (+0.27%), JPY (+0.14%), and NZD (+0.58%) strengthened.

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian markets are expected to remain mixed in the short term, with insurance leading while oil & gas stays weak. The naira should stay relatively stable, though oil price swings pose risks. Globally, lower U.S. yields, possible Fed cuts, and record gold prices are pushing investors toward safe assets, while trade tensions and OPEC+ moves may fuel volatility. Overall, selective gains could emerge in Q4 2025, favoring resilient sectors, gold, and new oil producers like Senegal.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.