Money Monday-Nigeria’s Market Moves: Liquidity Boosts, Corporate Expansions, and Global Energy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Welcome to today’s market briefing, where we track key developments shaping Nigeria’s financial landscape and global energy markets. This edition highlights Nigeria’s evolving liquidity landscape, major corporate expansions in oil, gas, and agribusiness, alongside significant global energy and commodity moves. Investors can expect insights on sectoral performance, capital market reforms, and emerging opportunities from both domestic and international trends.

Nigerian News & Market Update

Jaiz Bank becomes global liquidity primary dealer:

Jaiz Bank becomes the first African financial institution to join IILM’s global network of primary dealers, enhancing its liquidity management and international Islamic finance presence. - TheNation

Shell Nigeria Gas Expands Operations To Ogun:

Shell Nigeria Gas is expanding its Ogun operations with a new supply deal to SG Industrial FZE, strengthening domestic gas utilisation and supporting Nigeria’s Decade of Gas agenda. - Channels

Chevron To Join Nigeria 2025 Oil License Bid:

Chevron will join Nigeria’s 2025 oil licensing round as part of plans to expand its assets and drilling operations in the country. - Channels

CBN to Open ₦750billion Ad hoc T-Bills Auction for Subscription:

The CBN is launching an unscheduled ₦750billion T-bill auction to meet government short-term funding needs and leverage rising market liquidity. - Dmarketforces

FG, SEC, NGX Group forge unified direction on Capital Gains Tax reform:

The Federal Government has set up a tax-policy committee to implement the new capital gains tax gradually and transparently, ensuring investor protection and market stability. - Businessday

Banks Cut Central Bank Deposit By ₦2.22trillion On Interest Rate Slash:

Banks sharply reduced their CBN SDF placements after the MPC slashed the deposit-rate corridor, making it less attractive to park idle liquidity with the apex bank. - Leadership

Ellah Lakes Extends ₦235billion Public Offer as Investor Demand Surges:

Ellah Lakes extends its ₦235billion public offer to December 19, 2025, due to strong investor demand, supporting its agribusiness expansion and food security initiatives. - DailyTimes

Ecobank Nigeria begins tender for $300million Senior Eurobond offer:

Ecobank Nigeria launches a $300million tender offer for its 2026 Senior Eurobonds to optimize its balance sheet and provide early redemption options to noteholders. - TheNation

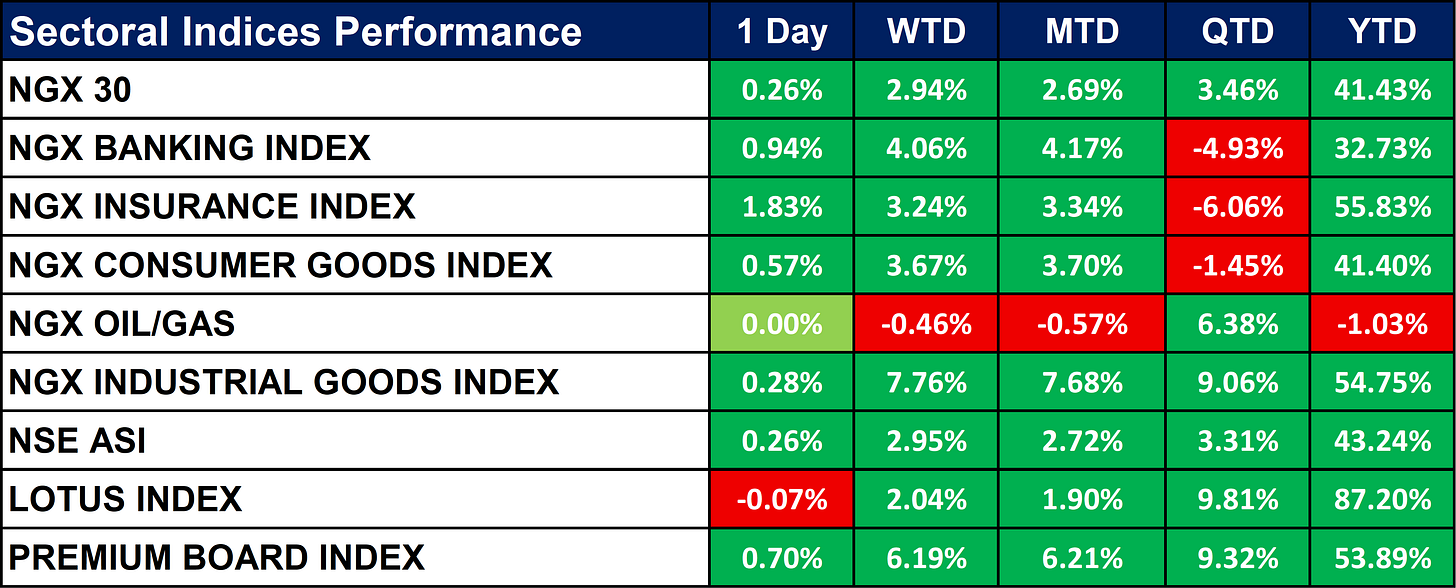

Nigeria Sectoral Indices Performance

The table below depicts that Most Nigerian equity indices closed higher on the day, with the NGX Insurance Index (+1.83%) and NGX Banking Index (+0.94%) leading gains. NGX Industrial Goods Index (+7.76% WTD) and Premium Board Index (+6.19% WTD) showed strong weekly performance, reflecting robust sectoral momentum.The NGX Oil/Gas Index remained flat on the day and slightly negative for the week and month, highlighting underperformance in the energy sector compared to broader market gains.

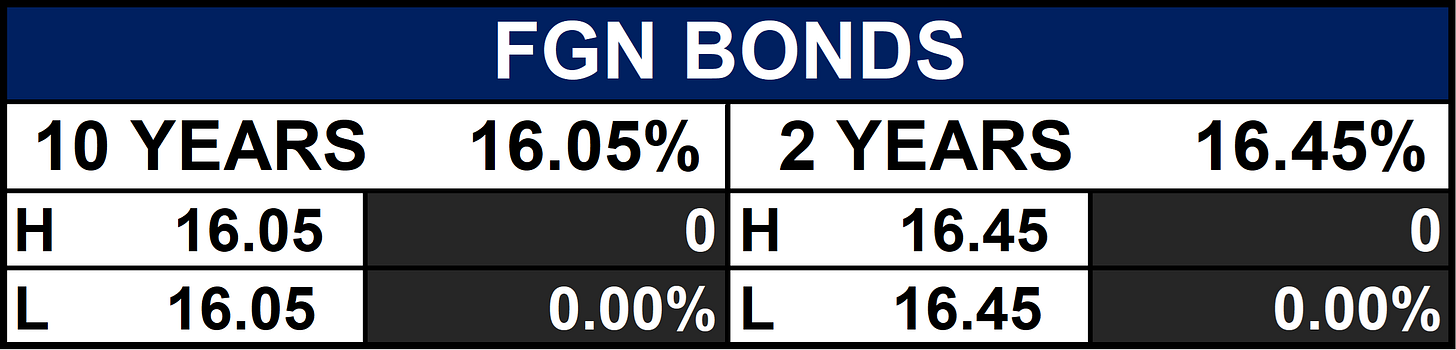

Fixed Income (FGN Bonds)

Corporate Action

Global News & Market Update

China refiner moves forward with expansion despite sanctions:

Chinese refiner Xinhai Chemical is pushing ahead with a $3.6billion petrochemicals expansion despite U.S. sanctions, using separate entities to continue importing Iranian oil. - Reuters

Indonesia to impose coal export tax of up to 5% next year:

Indonesia plans to impose a 1–5% coal export tax in 2026 to boost state revenues, potentially raising $1.2 billion. - Reuters

Indonesia fines dozens of palm oil, mining companies $2.3 billion for operating in forest areas:

Indonesia fines 71 palm oil and mining companies $2.3 billion for illegal operations in forest areas, seizing 3.7 million hectares of plantations. - Reuters

In latest UK oil and gas tie-up, Total merges North Sea assets with Repsol’s NEO NEXT:

TotalEnergies merges its UK North Sea assets with Repsol and HitecVision to form NEO NEXT+, consolidating production and benefiting from UK tax offsets. - Reuters

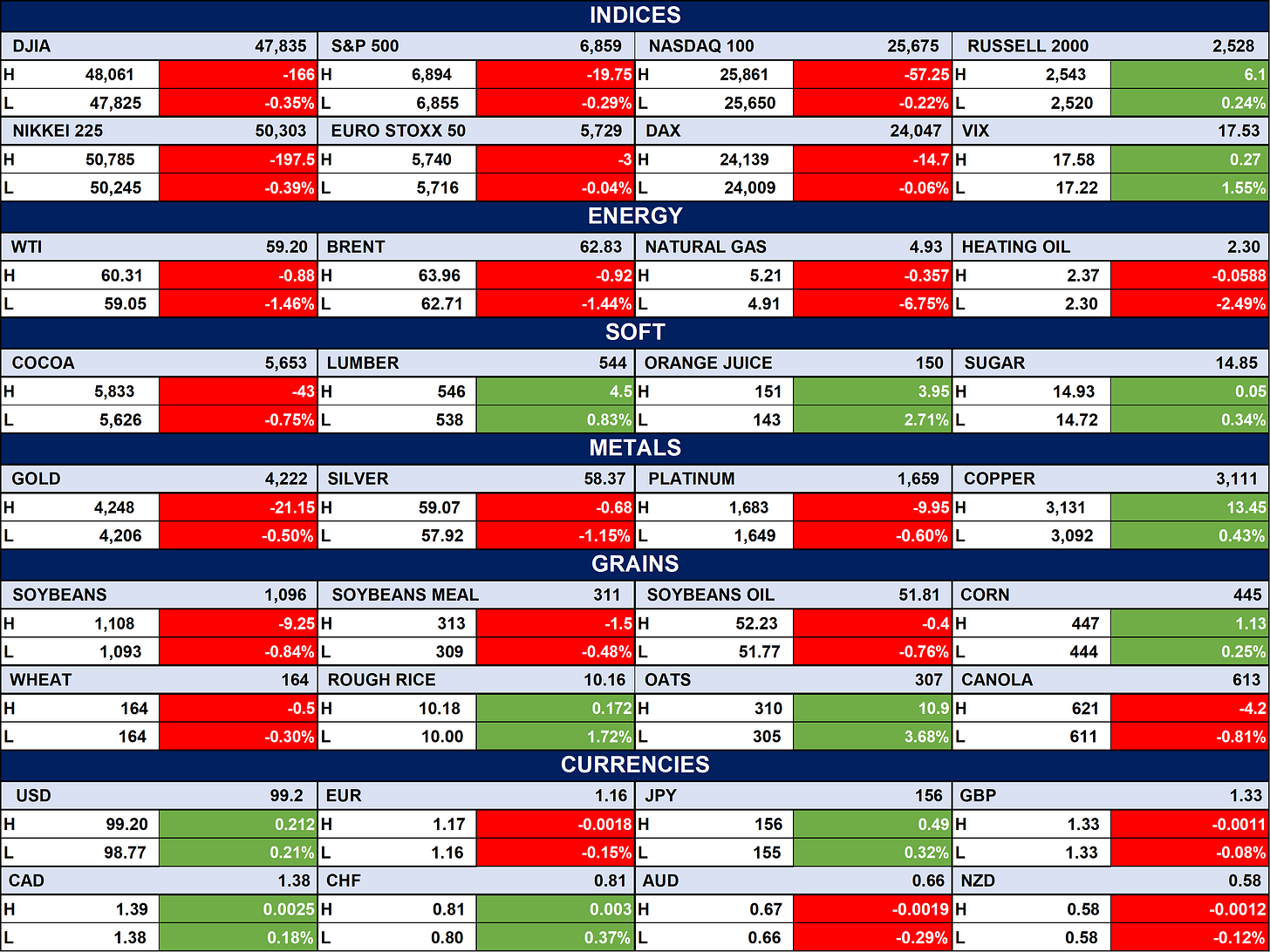

Indices, Commodities & Currencies

The table below depicts that the Global equity indices mostly pulled back, with the Dow, S&P 500, Nasdaq, Euro Stoxx 50 and Nikkei all closing lower, reflecting broad risk-off sentiment. Energy markets weakened, as WTI and Brent fell over 1%, while natural gas dropped sharply, signalling demand softness. Commodities were mixed, precious metals slipped, most agricultural grains declined, but soft commodities like orange juice and lumber gained; major currencies traded in tight ranges with slight strength in USD and CAD.

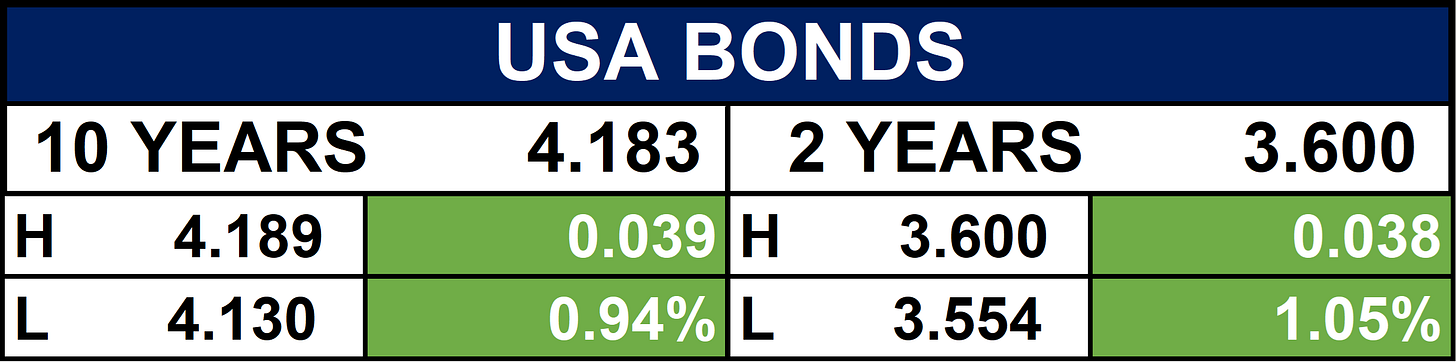

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigerian markets may see increased liquidity-driven activity following the CBN’s T-bill auction and banking adjustments, while strong corporate expansions signal potential sector growth. Globally, energy and commodity shifts, particularly in oil, gas, coal, and palm oil, could influence investment flows and market sentiment. Investors should monitor policy reforms, strategic asset acquisitions, and international market dynamics to position for potential opportunities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.