Money Monday- Nigeria’s Real Estate and Market Gains Amid Global Trade Shifts and Geopolitical Tensions

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kickoff. This week’s highlights key developments in Nigeria’s economy, including the real estate sector's rise to become the third-largest GDP contributor, the CBN’s decision to hold policy rates amid inflation concerns, and a ₦3.2 trillion revenue boost in the cement industry. The Nigerian stock market also sustained its rally, gaining ₦1.81 trillion. Globally, markets reacted to geopolitical tensions, a new US-EU trade deal, and shifts in commodity and currency prices. The update offers insights into sector performance, monetary policy, and global trends.

Nigerian News & Market Update

Real estate sector surges to N41.3tn, boosts economy:

Nigeria’s real estate sector has become the third-largest contributor to the economy, valued at ₦41.3 trillion in 2024 after a recent GDP rebasing by the National Bureau of Statistics. The sector's value rose sharply from ₦10.5 trillion in 2023 to ₦30.7 trillion, due to improved data collection and valuation methods. Now surpassing industries like telecommunications and oil, real estate’s growth is driven by urbanization, better asset tracking, and formalization of property services. Stakeholders praised the development, noting the sector’s huge job creation potential and economic impact. They called for greater government support, highlighting real estate as a key driver of GDP growth, employment, and wealth creation in Nigeria’s non-oil economy. - Punch

FX, price stability in focus after MPC rate decision:

Ahead of its July 21–22 meeting, the Central Bank of Nigeria’s (CBN) Monetary Policy Committee (MPC) faced split expectations some analysts urged a rate cut to boost liquidity, while others advocated maintaining rates due to still-high inflation at 22.22%. Ultimately, the MPC retained all key policy parameters, including the Monetary Policy Rate at 27.5%, the Cash Reserve Ratio for Deposit Money Banks at 50%, and the Liquidity Ratio at 30%, aiming to sustain disinflation momentum. - Punch

Cement Producers Generate N3.2trn Revenue in H1 Amid Product Price Spike:

Nigeria’s three leading cement producers Dangote Cement, BUA Cement, and Lafarge Africa collectively reported ₦3.2 trillion in revenue in the first half of 2025, representing a 97.8% year-on-year increase from ₦1.6 trillion in H1 2024. The revenue boost is attributed to a significant rise in cement prices, driven by high demand from infrastructure and housing projects, increased energy costs, and raw material shortages. - Thisday

Stock Market Sustains Rally, Appreciate by N1.81trn in One-Week:

The Nigerian stock market gained ₦1.81 trillion last week, driven by strong H1 2025 corporate earnings and declining Treasury bill yields. The NGX All-Share Index rose 2.18% week-on-week to close at 134,452.93, with year-to-date returns at +30.6%. Most sector indices posted gains, with the Industrial Goods and Insurance sectors leading. Market breadth was positive, with 60 gainers versus 43 losers. Analysts expect continued bullish sentiment in the near term, supported by corporate earnings, falling fixed-income yields, and investor interest in fundamentally strong stocks offering dividend potential. - Thisday

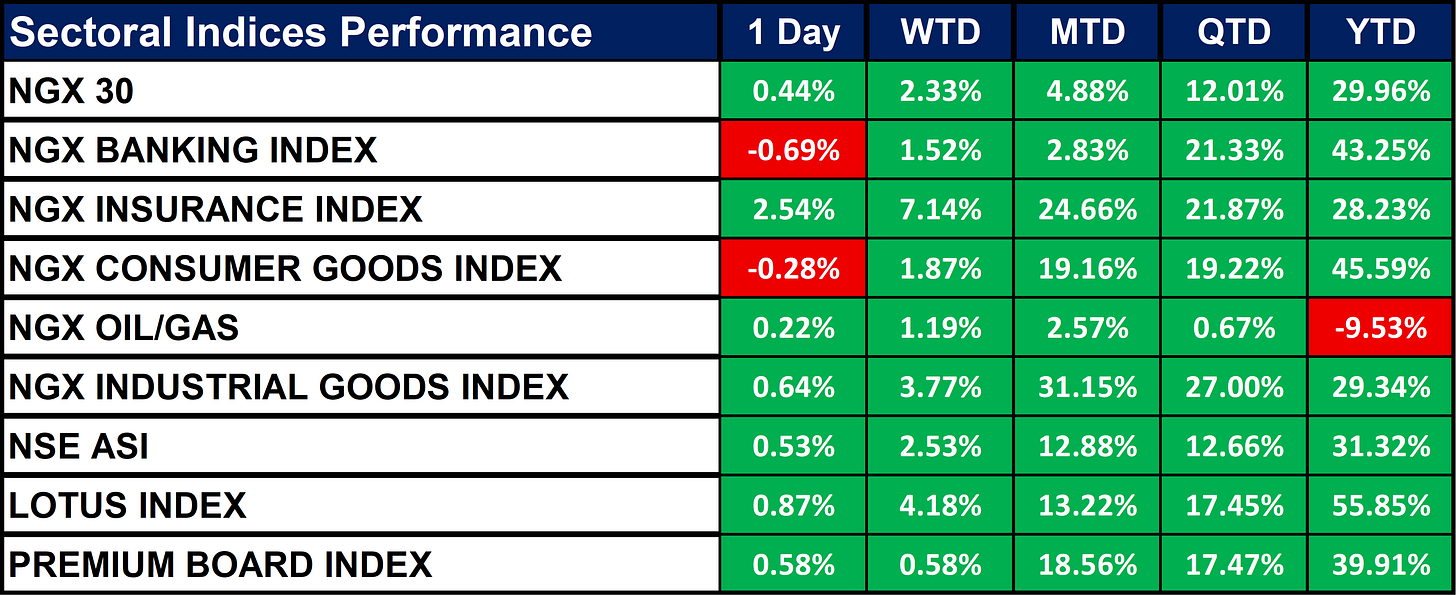

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectoral indices showed mostly positive performance, with the Insurance Index leading daily gains (+2.54%) and the Banking Index the top loser (-0.69%). Year-to-date, the Lotus (+55.85%), Consumer Goods (+45.59%), and Banking (+43.25%) indices lead, while the Oil/Gas Index is the only one in negative territory (-9.53%). Overall, market sentiment remains strong, particularly in insurance, banking, and industrial sectors.

Fixed Income (FGN Bonds)

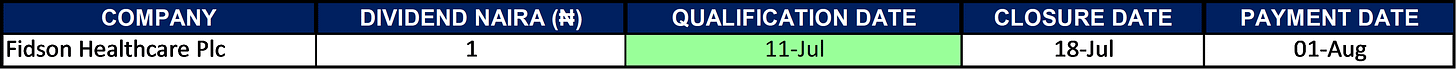

Dividends

Global News & Market Update

Oil rises 2% on US-EU trade deal, Trump's shorter deadline for Russia:

Oil prices rose 2% after the U.S. and EU signed a trade deal involving $750 billion in future U.S. energy purchases. President Trump also shortened Russia’s deadline to end the Ukraine war, increasing geopolitical tension. The market was further supported by hopes of a U.S.-China tariff truce, though gains were limited by a strong dollar and lower Indian oil demand. Meanwhile, OPEC+ emphasized compliance ahead of talks on increasing oil output. - Reuters

S&P 500, Nasdaq off records peaks as Wall St braces for high-stakes week:

U.S. stocks hit record highs but trimmed gains as investors shifted focus to upcoming mega cap earnings, a Fed meeting, and a looming tariff deadline. A new U.S.-EU trade deal eased trade war fears. Markets expect the Fed to hold rates steady, with inflation and jobs data in focus later this week. - Reuters

Indices, Commodities & Currencies

The table below shows that markets were mixed with tech and small-cap stocks up, while the Nikkei 225 dropped sharply. Volatility rose as the VIX jumped 4.5%, signaling investor caution. Energy and metals fell, but Natural Gas rose. Soybean Oil (+26%) and Orange Juice (+8.7%) surged on supply concerns. The USD strengthened across most currencies, reflecting a flight to safety.

Fixed Income (USA Bonds)

Conclusion

Nigeria's economy shows renewed strength, particularly in non-oil sectors like real estate and cement, signaling ongoing diversification. The CBN’s decision to hold rates reflects a cautious approach to managing inflation without disrupting market confidence. The stock market remains bullish, driven by strong earnings and lower yields. Looking ahead, market momentum may continue if Q3 earnings remain solid, while global volatility, CBN policy moves, and FX/oil trends will shape investor sentiment. Investors should stay alert to potential shifts in both local and international financial landscapes.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.