Money Monday- Nigeria’s Reserves Strengthen as MPC Decision Looms; Global Oil Prices Slide on Oversupply Concerns

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market overview. We bring you a snapshot of the latest developments shaping Nigeria’s economy and the global markets. Domestically, rising reserves and FX interventions are stabilizing the naira, while sectoral indices remain mixed with Insurance and Lotus leading year-to-date gains. Key policy updates, from PenCom’s governance reforms to analysts’ divided views ahead of the MPC meeting, highlight ongoing regulatory and monetary shifts. On the global front, oil markets face renewed pressure from oversupply concerns, while geopolitical and trade moves—from U.S. support for Argentina to Turkey’s tariff rollback—underscore the complex interplay driving investor sentiment.

Nigerian News & Market Update

External reserves hit $42billion amidst rise in hydrocarbon revenue:

Nigeria’s foreign reserves rose to $42 billion, lifting investor confidence and supporting the naira, which strengthened below ₦1,500/$ in both official and parallel markets. - DailyTrust

Crude oil production drops to 1.43 million barrels in August:

Nigeria’s August oil output dropped 4.8% to 1.43 mbpd but stayed 5.5% higher year-on-year and met 96% of its OPEC quota. Forcados led production, followed by Bonny, Qua Iboe, and Escravos terminals.

Atiat unveils head office, expands into tech:

Atiat Limited unveiled its new Victoria Island headquarters and launched its “Atiat 3.0” strategy. The firm is expanding from automotive leasing into a full financial ecosystem covering finance, insurance, technology, and mobility.

This new hub serves as a base for innovation and West African expansion. – PunchPenCom bans majority shareholding in multiple PFOs:

PenCom now bans owning 5% or more in more than one pension fund operator to strengthen transparency and governance. Current holders have six months to sell excess shares or lose rights and face penalties. It also okayed controlled shared services and confirmed swift progress on the ₦758 billion pension bond to clear long-standing liabilities. - Punch

Rates Hit Floor in Money Market, Banking Liquidity Remains Surplus:

Banks had more than enough cash, keeping short-term rates stable near 26.5%.

Fresh funds from OMO maturities, bond coupons, and FAAC payments boosted market liquidity. Investors piled into treasury bills, making the auctions massively oversubscribed. - dmarketforcesCBN Injects $150m FX Intervention Sales to Fuel Naira Rally:

The CBN sold $150 million to banks to calm FX market volatility, helping the naira strengthen to about ₦1,488/$ as reserves rose to $42 billion. Analysts expect the currency to stay stable near term, backed by strong dollar inflows, improving investor confidence, and resilient market liquidity. - dmarketforces

Airtel Africa Enters $20.3million Shares Repurchase Deal with Barclays:

Airtel Africa has expanded its share buyback plan, arranging with Barclays to repurchase up to an additional $20.3 million in shares by March 31, 2026.

So far, it has spent $34.7 million buying back 14.2 million shares in the second tranche that began in May 2025. All repurchased shares will be cancelled to reduce the company’s share capital. - dmarketforcesMonetary Policy Committee Meeting- Analysts Divided Over Need For Rate Cut:

Analysts are split on whether the CBN should cut its 27.5% benchmark rate at this week’s MPC meeting, as inflation has eased to 20.12% and economic indicators show tentative stability. Some urge a cautious 50bps reduction to support growth, while others warn it’s too soon for monetary easing. - Leadership

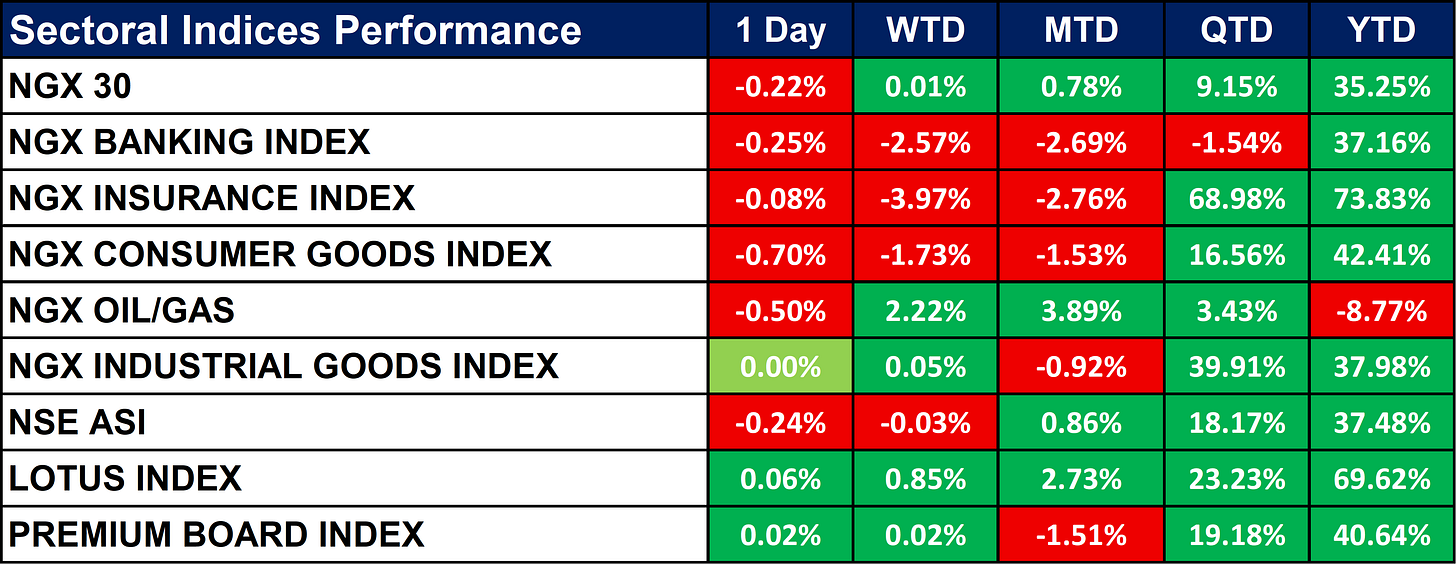

Nigeria Sectoral Indices Performance

The table below depicts that the NGX sectoral indices closed mixed, with most sectors posting slight daily losses. Insurance remains the strongest performer YTD (+73.83%), followed by Lotus (+69.62%) and Consumer Goods (+42.41%).

Oil/Gas is the only sector still negative YTD (-8.77%), despite recent short-term gains.

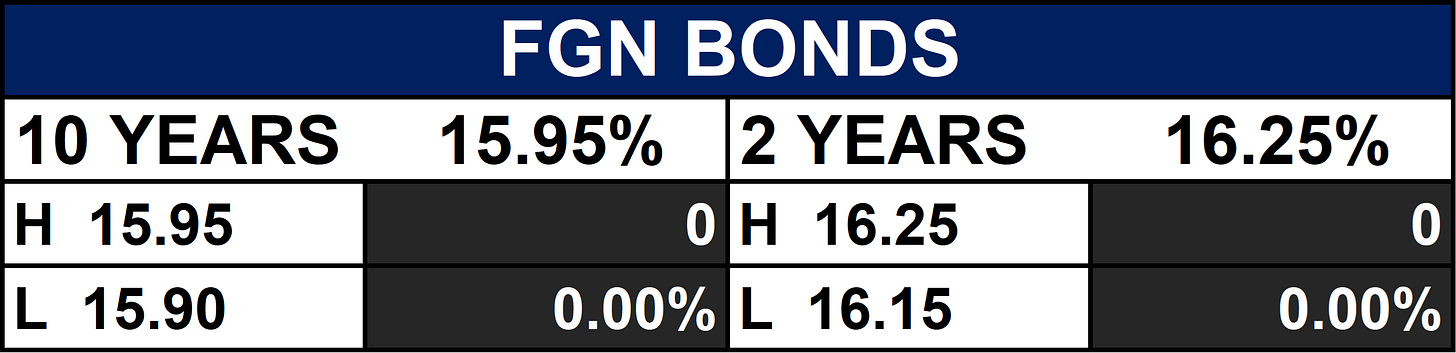

Fixed Income (FGN Bonds)

Global News & Market Update

Oil prices tick down as Iraq exports rise amid demand concerns:

Oil prices dropped on oversupply concerns despite tensions in the Middle East and Russia-Estonia airspace dispute. Iraq increased exports to about 3.4–3.45 million barrels a day and may restart Kurdish pipeline flows. Analysts see weaker demand ahead, warning Brent could slide into the $50 range. - Reuters

Ukrainian Railways plans freight tariff increase to tackle debt:

Ukrainian Railways faces huge war-related costs and shrinking cargo volumes.

It plans freight tariff hikes and spending cuts to avoid a $728 million state bailout in 2026. Rising energy, fuel, and wage expenses have made its old pricing model unsustainable. -ReutersUS ready to support Argentina with 'large and forceful' action, Treasury chief says:

The U.S. may back Argentina with currency swaps or debt purchases as Milei meets Trump in New York. Argentina’s central bank is burning reserves to defend the peso amid political turmoil. Talks aim to stabilize the economy and support Milei’s reforms. - Reuters

Turkey ends some tariffs on US imports ahead of Erdogan-Trump meeting:

Turkey scrapped 2018 retaliatory tariffs on U.S. goods as ties with Washington improve. President Erdogan will meet Trump in New York to discuss trade and military deals. Both sides aim to boost annual trade toward a $100 billion target despite past disputes. - Reuters

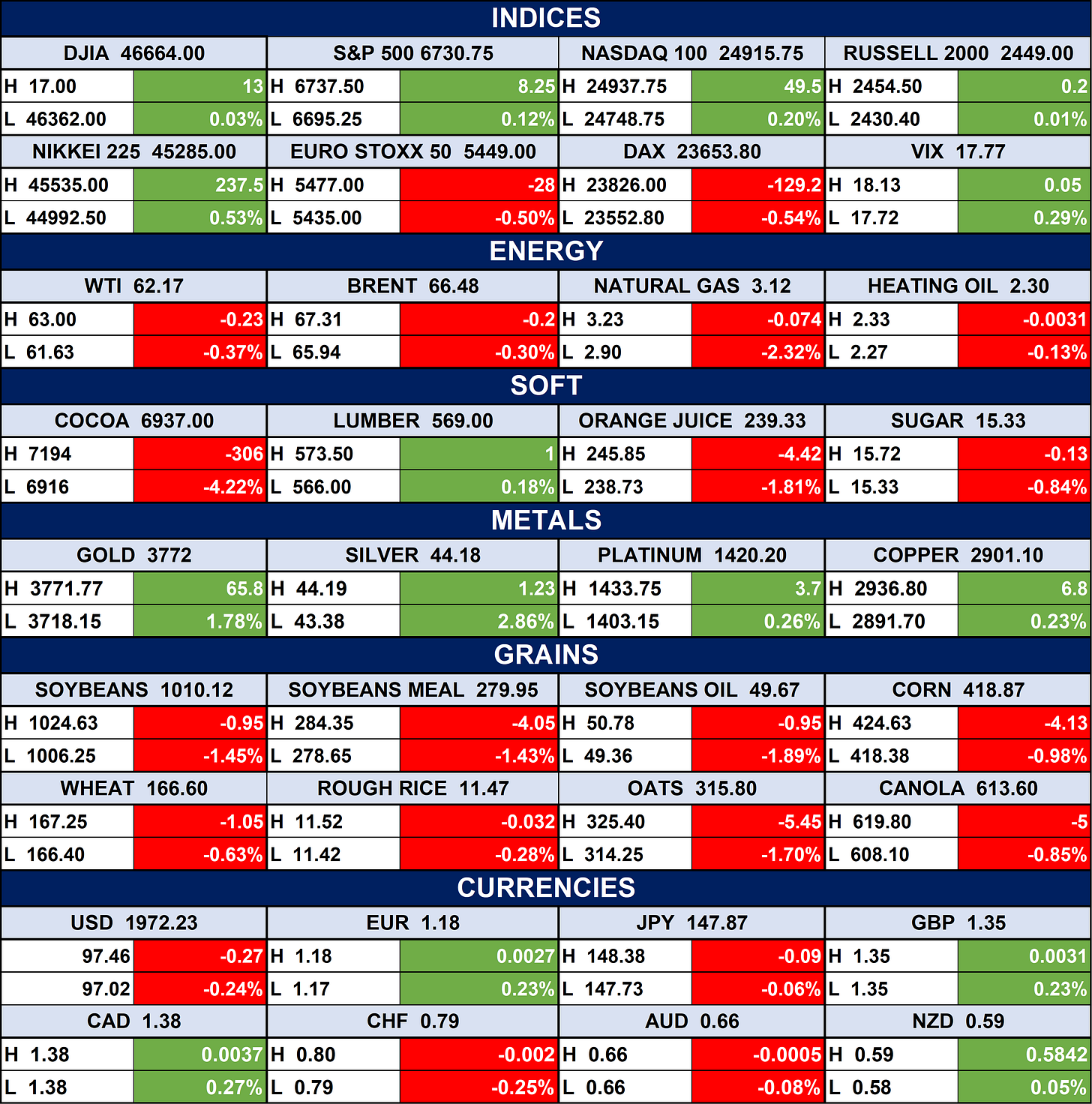

Indices, Commodities & Currencies

The table below shows that the Global stocks were mixed with U.S. indices edging up while European markets slipped. Gold and silver rose, but oil and most agricultural commodities fell. The dollar eased, while the euro, pound, and Canadian dollar gained slightly.

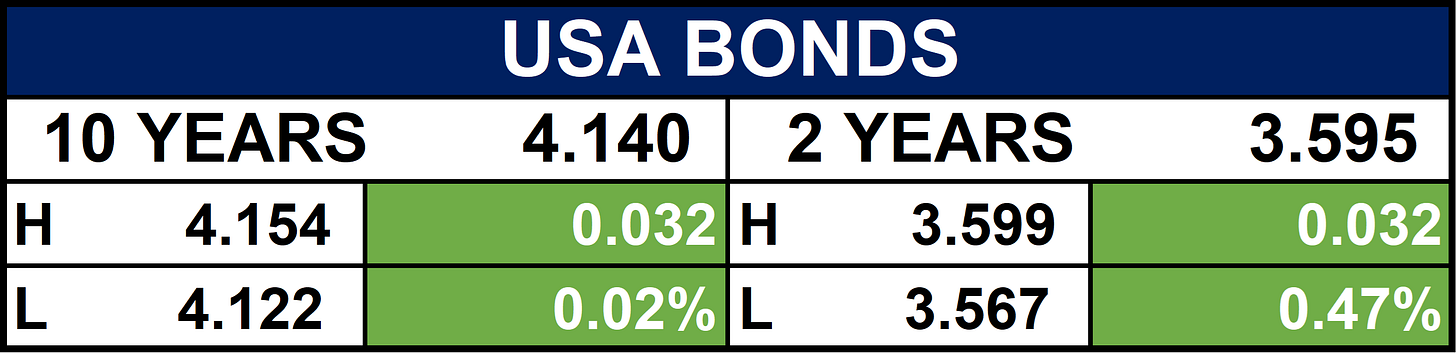

Fixed Income (USA Bonds)

Events

Conclusion

In conclusion, Nigeria’s financial landscape continues to balance encouraging signals such as stronger reserves, naira stability, and robust insurance and consumer sectors against structural challenges in oil output and monetary policy decisions. Globally, commodity markets remain volatile, with oil under pressure despite heightened geopolitical risks, while international trade and fiscal policy shifts in countries like Argentina and Turkey are shaping investor outlook. As always, staying alert to both domestic reforms and external shocks will be key for navigating the months ahead.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.