Money Monday- Rebasing, Reforms, and Resilience: Nigeria’s Markets Set the Tone for the Week

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kickoff. The Nigerian market opened mixed as the naira dipped slightly to ₦1,532.34/$, supported by stronger FX reserves and rising oil output (1.51mbpd(Million Barrels Per Day)). GDP rebasing showed 41.7% growth over 2014, with services and trade leading. The NGX gained 27.84% YtD(Year-to-Date), ranking among Africa’s best, driven by reforms and strong earnings. Globally, Goldman Sachs beat Q2 expectations, while the dollar strengthened (+1.6% in July) on robust US data.

Nigerian News & Market Update

Naira slips to 1,532.34/$ despite CBN intervention:

The naira closed slightly weaker at ₦1,532.34/$ despite early gains. CBN interventions and a $422million rise in reserves supported stability. Improved oil output (1.51mbpd(Million Barrels Per Day)) boosted dollar inflows. Analysts expect steady rates this week, with focus on the MPC(Monetary Policy Committee) decision to guide market direction. - Punch

Nigeria’s Gross Domestic Product Rebased To ₦205tn For 2019:

Nigeria rebased its GDP to 2019, showing a 41.7% increase over 2014. GDP reached ₦372.8trillion ($243billion) in 2024 with 3.38% growth that year. Top sectors were crop production, trade, real estate, telecoms, and oil & gas. The services sector led with 53%, and the informal sector contributed 42.5% of GDP. - Channels

At 27.84% YtD(Year-to-Date) Return, Nigeria Joins Top Six Best Performing Stock Market in Africa:

The NGX gained 27.84% YtD, driven by economic reforms, strong corporate earnings, and renewed investor confidence. Reforms like fuel subsidy removal, FX unification, and banking recapitalization boosted sentiment. Analysts expect steady performance in H2 2025, with banks’ capital raises likely moderating rapid price movements. - Thisday

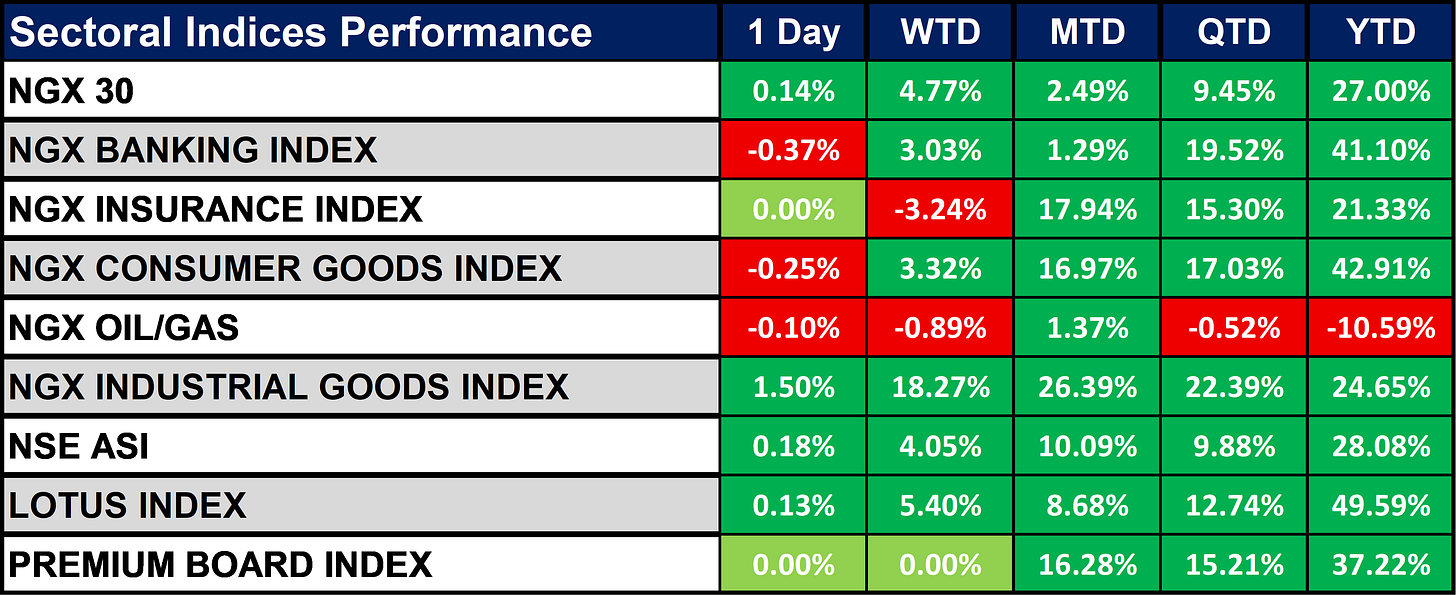

Nigeria Sectoral Indices Performance

The table below depicts that most NGX sectors closed positive YTD, led by Lotus Index (+49.6%), Consumer Goods (+42.9%), and Banking (+41.1%).

On the day, Industrial Goods gained most (+1.5%), while Oil & Gas remained the weakest sector YTD (-10.6%)

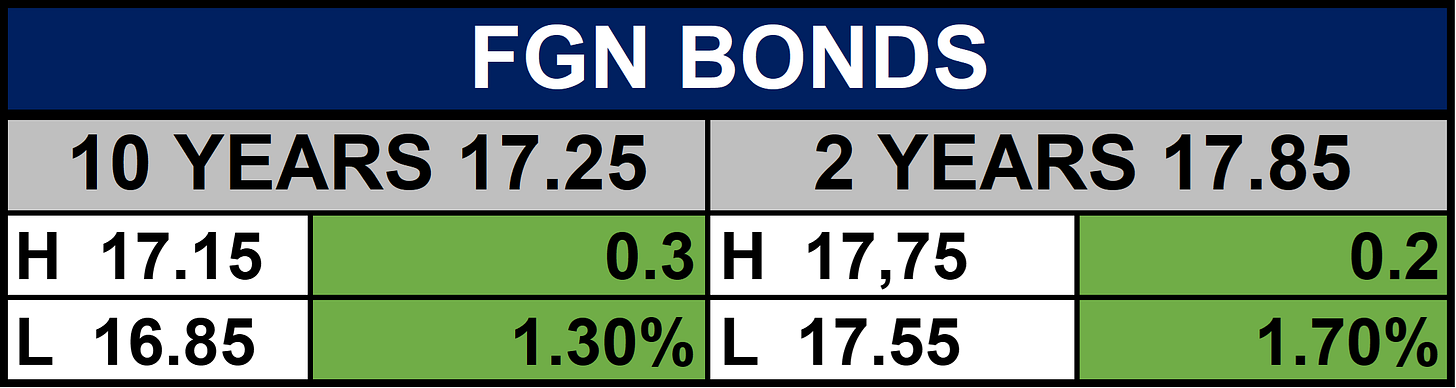

Fixed Income (FGN Bonds)

Dividends

Global News & Market Update

Goldman Sachs tops estimates as traders generate $840 million more revenue than expected:

Goldman Sachs reported Q2 profit up 22% to $3.72billion ($10.91/share), with revenue rising 15% to $14.58billion, beating estimates by $1.1billion, driven by strong trading operations which generated $840million above expectations. - CNBC

Dollar gets reprieve as US economy shrugs off tariffs:

The dollar rose 1.6% in July after a weak start to 2025, supported by strong jobs growth (147,000) and 2.7% inflation, reducing chances of Fed rate cuts. Risks from Trump’s Fed attacks and tariffs remain, while the euro weakened amid ECB (European Central Bank) concerns and US tariff threats. - Financial Times

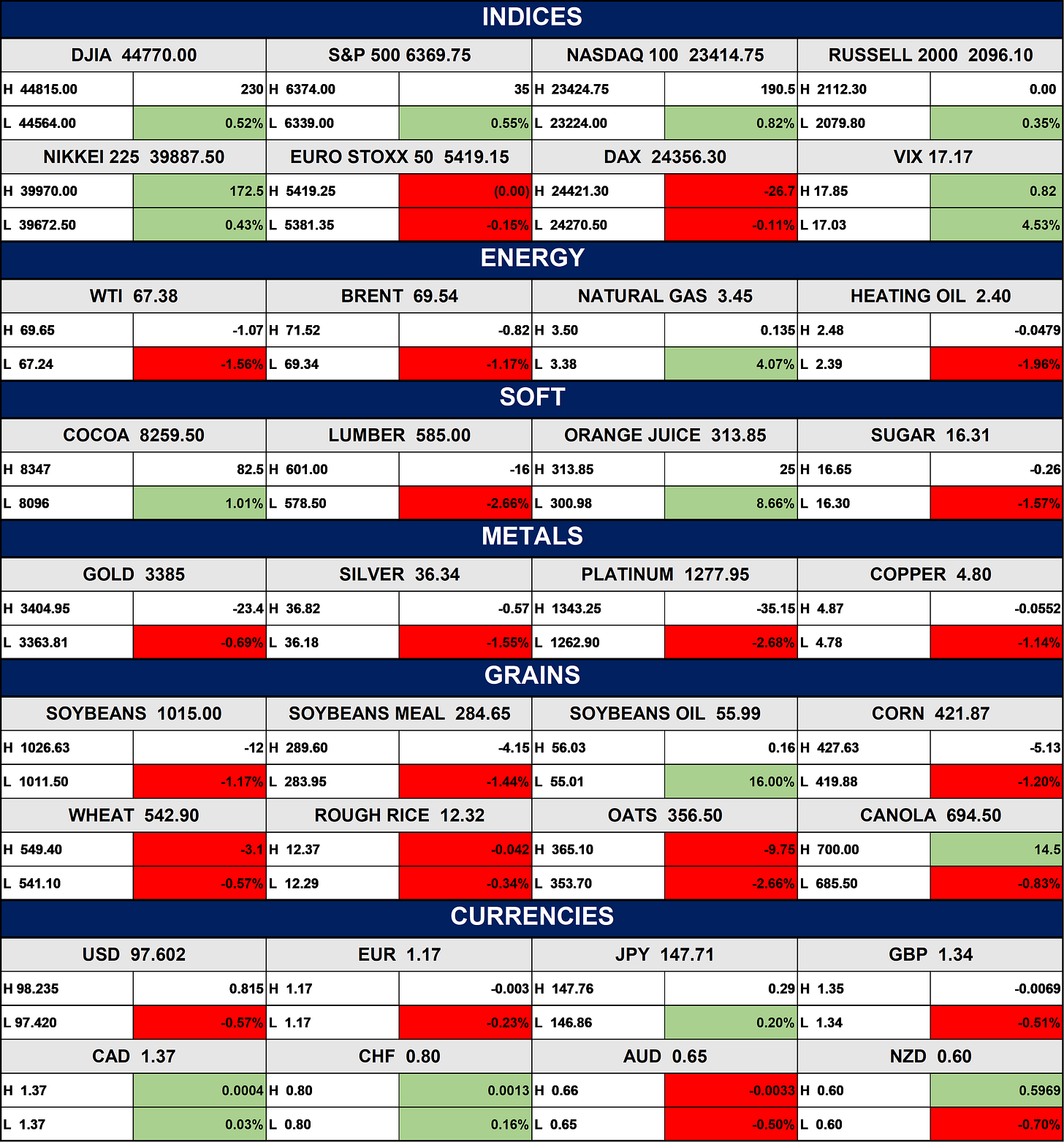

Indices, Commodities & Currencies

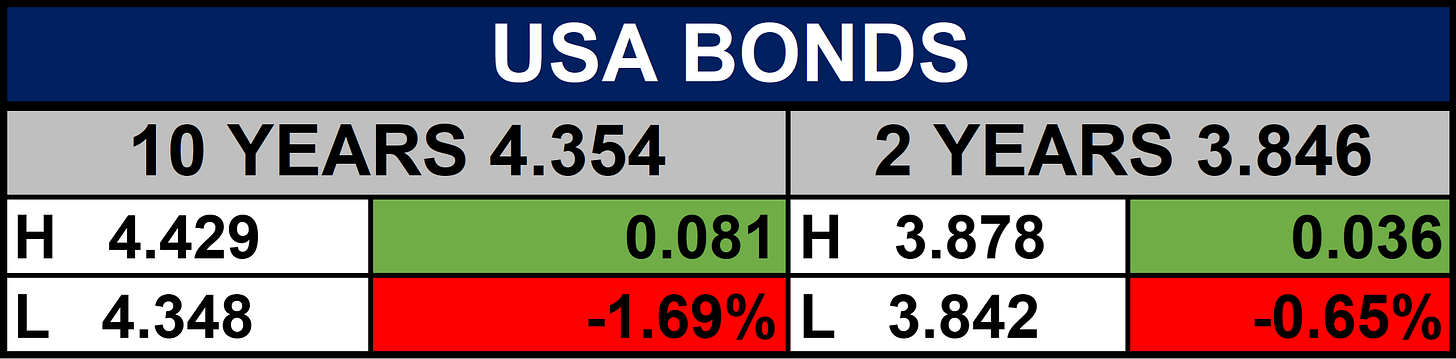

Fixed Income (USA Bonds)

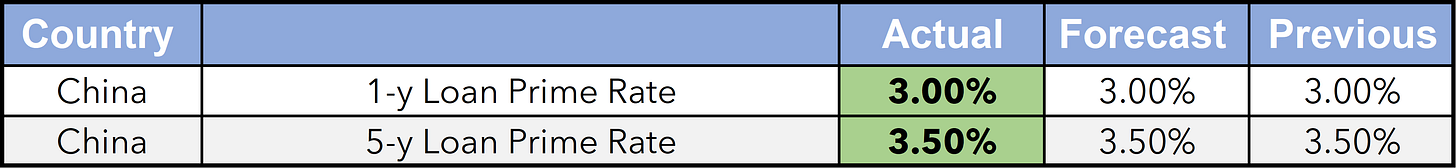

Events

Conclusion

As the week unfolds, markets may remain watchful of the MPC decision and banking recapitalisation impacts, though outcomes remain uncertain. Globally, US data and earnings could sway sentiment, but geopolitical and inflation risks linger. Investors might consider staying cautious yet strategic, focusing on strong sectors while remaining mindful of potential surprises in policy and currency markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.