Money Monday- Strong Liquidity, Pension Reforms and Oil Strikes Define Nigeria’s Market; Global Trade and Energy Shifts Add Uncertainty

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market overview. The Nigerian market reflected mixed signals with liquidity surging past ₦4 trillion and yields easing as the CBN withheld auctions, while bond investors rallied on expectations of lower rates. Meanwhile, industrial action in the oil sector and new pension recapitalisation rules added uncertainty to the domestic outlook. Globally, central banks are balancing inflationary pressures with slowing growth, trade tensions continue to reshape supply chains, and energy markets softened on the back of expected supply increases.

Nigerian News & Market Update

OMO Bills Yield Drop as CBN Fails to Float Auction:

The Open Market Operations (OMO) bill yields dropped as CBN withheld auctions, fueling strong investor demand. System liquidity surged past ₦4 trillion, pushing rates lower. Further inflows may sustain pressure unless CBN intervenes. - dmarketforces

Nigerian Bonds Return Reduces Ahead of Reopen Offers:

FGN bonds rallied on strong demand and a 50bps CBN rate cut. Investors expect lower rates at the September ₦200billion auction. Caution persists as PFAs diversify under new rules. - dmarketforces

NNPC, NUPRC, NMDPRA shut as PENGASSAN begins strike:

The Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN)’s strike shut down key oil agencies over Dangote Refinery worker dismissals. It ordered a halt to crude and gas supplies, raising fears of fuel shortages. Government mediation is now crucial to avert a deeper crisis. - Punch

Pencom Sets December 2026 Deadline For PFAs To Recapitalise To ₦20billion:

PenCom raised PFAs’ capital to ₦20billion and PFCs’ to ₦25billion, with a 2026 compliance deadline. The requirements scale with assets to match risk exposure.

The move targets stronger stability and service delivery in the pension sector. - LeadershipFresh inflows lift banks’ cash reserves to ₦4.02trillion amid CBN policy easing:

Banks’ liquidity rose to ₦4.02trillion on inflows and CBN easing, pushing interbank rates lower. Analysts expect liquidity to stay strong with more inflows due. CBN may intervene to curb excess funds. - TheSun

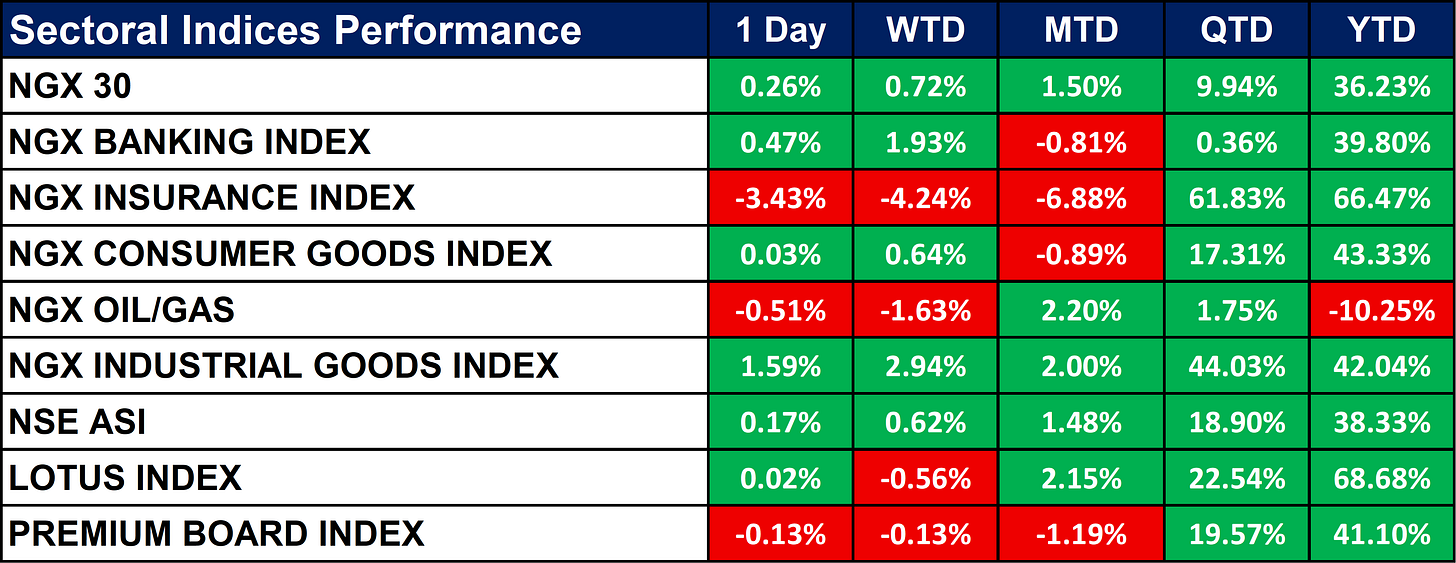

Nigeria Sectoral Indices Performance

The table below depicts that the NGX indices showed mixed performance: Industrial Goods (+1.59%) and Banking (+0.47%) gained, while Insurance (-3.43%) and Oil/Gas (-0.51%) declined. Quarter-to-date, Insurance (+61.83%) and Industrial Goods (+44.03%) led gains, while Oil/Gas fell (-10.25% YTD). Overall, NSE ASI is up +38.33% YTD, reflecting strong market growth despite sectoral divergences.

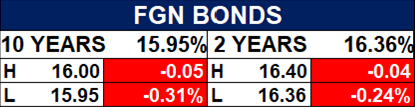

Fixed Income (FGN Bonds)

Global News & Market Update

Bank of Israel keeps rates on hold as Gaza war, inflation endure:

The Bank of Israel held rates at 4.5% amid Gaza conflict and sticky inflation.

Inflation eased to 2.9%, but growth slowed with a 4% Q2 contraction.

Rates are expected to drop gradually to 3.75% next year. - ReutersUS expands export blacklist in crackdown on Chinese workarounds:

The U.S. extended export curbs to subsidiaries 50% owned by listed firms, targeting companies like Huawei, DJI, and Hikvision. China condemned the move, warning of supply chain disruption. The rule tightens controls despite ongoing U.S.-China trade talks. - Reuters

UK consumer borrowing rises by most since October 2024:

UK consumer borrowing grew 7.1% in August, the fastest since October 2024.

Net borrowing rose to £1.69billion, while mortgage lending slowed. Spending may cool ahead of expected tax hikes in November’s budget. - ReutersUS tariffs threaten $3.1 billion of Singapore’s pharma exports, trade talks ongoing:

Pharma makes up 13% of Singapore’s $3.1billion exports to the U.S., now facing 100% tariffs. Officials say some firms may get exemptions as trade talks continue.

Tariffs also threaten semiconductors and electronics, 40% of U.S.-bound exports. - ReutersOil prices drop 2% on expected global supply growth:

Oil prices fell 2% as OPEC+ planned a November output hike and Kurdistan resumed exports. Brent slid to $68.87, WTI to $64.36. Resumed flows may add 230,000 bpd to supply. - Reuters

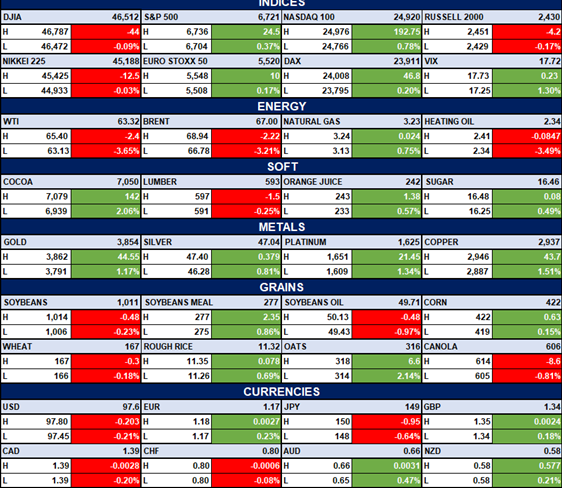

Indices, Commodities & Currencies

The table below shows mixed market performance across asset classes. Equities (S&P 500, NASDAQ 100, DAX) posted gains, while some like Nikkei 225 and Russell 2000 declined. Energy prices fell (Brent, WTI), metals and soft commodities mostly rose, and currencies traded mixed with the USD slightly weaker.

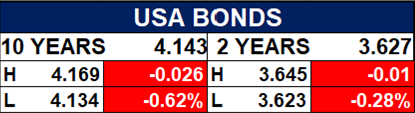

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigeria’s markets may stay liquid with downward pressure on yields if inflows persist and the CBN holds off intervention. However, the PENGASSAN strike poses a significant risk to energy supply and inflation if prolonged. Globally, caution prevails as geopolitical tensions, U.S. trade restrictions, and softening oil prices shape investor sentiment. Overall, we expect near-term volatility but see opportunities in resilient sectors such as industrials and insurance, while monitoring energy disruptions and monetary policy signals for direction.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.