Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

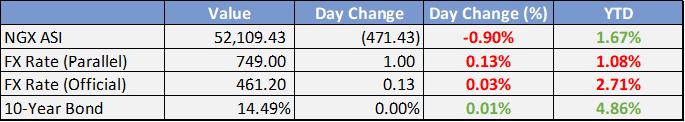

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

FG to generate $800m from Abuja, Kano airport concession- The Punch

Nigeria has approved the concession of two airports to Corporación America Airports, expected to generate $797.4 million. The Ministry of Aviation will be renamed the Ministry of Aviation and Aerospace to align with future aviation trends.FG eyes 1600MW with new power stations, transformers - The Punch

Nigeria has deployed facilities under the Presidential Power Initiative to increase electricity output by 1,600MW. The initiative, in partnership with Siemens, aims to raise grid power generation to 25,000MW.Federal Govt Inaugurates Blockchain Technology Committee - Leadership

Nigeria launched a National Policy on Blockchain Technology and established an Implementation & Steering Committee to drive its adoption, aiming to position the country as a global player in the blockchain ecosystem and advance its digital economy.

Global

Jamie Dimon and other top bank execs met with Senate Majority Leader Chuck Schumer yesterday to discuss the debt limit.

After the meeting, Dimon said the US “probably will not default”. That’s not very reassuring.

Separately, President Biden expressed confidence that an agreement could be reached ahead of the X-date before departing for the G7 summit in Japan.

The GOP has not been shy about bashing the president’s decision to travel at this time.

Meanwhile, the US Treasury’s cash balance has dwindled to ~$87 billion from ~$140 billion last week.

US commercial real estate (CRE) prices have fallen for the first time since 2011.

The drop was less than 1%, but it foreshadows additional headwinds for regional banks which hold significant amounts of CRE loans.

Additional declines in property values would add more pressure to an already vulnerable sector.

In Q4, banks held over 60% of the $3.6 trillion in outstanding CRE loans

US crude oil inventories increased by just over 5 million barrels last week.

Markets were expecting a 0.92 million draw.

Prices, however, rallied on optimism over a resolution of the debt limit crisis.

Meanwhile, the US government released another 2.4 million barrels from the Strategic Petroleum Reserves last week for the 7th straight weekly drain.

Earlier this week, the Biden administration expressed its intent to refill reserves by 3 million barrels.

Emerging markets are trading at a discount not seen since the late 1990s - Bloomberg

Emerging markets stocks are significantly cheaper than developed world equities, as shown by the price/book multiples of MSCI's World index and EM index. This valuation gap has not been observed since the late 1990s crises, presenting an attractive investment opportunity in emerging markets.

Ghana secures $3 billion IMF bailout for economic recovery – Tech Cabal

The International Monetary Fund (IMF) has granted Ghana a $3 billion bailout to aid its economic recovery from the debt crisis. This approval has boosted investor confidence, resulting in Ghana's currency, the cedi, becoming the world's top performer against the dollar.Ghana raises electricity tariffs by more than 18% - Business News Report

Ghana increases electricity tariff by 18.36% in Q2 2023 due to currency depreciation, inflation, and rising gas costs. The country's utilities regulator cites the need for higher rates to ensure uninterrupted power supply, as utility companies struggle financially. Ghana seeks IMF support amidst economic challenges, with approval of a $3 billion loan tranche expected.

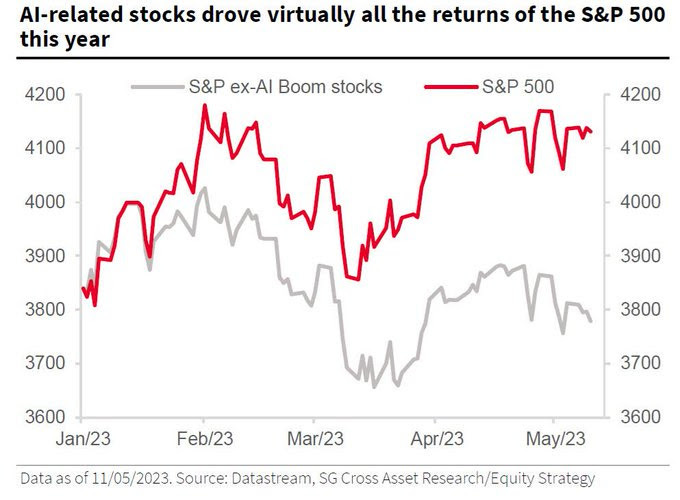

AI hype: The AI boom and hype is strong. So strong that without the AI-popular stocks, S&P 500 would be down 2% this year. Not +8%.

MOVE vs. VIX: Bond volatility (MOVE Index, blue) has eased from peak but has stayed in an elevated range, especially when compared to equity volatility (VIX Index, orange), which continues to trend lower.

Funding for US startups plunge 51% amid economic concerns- ZAYWA

US venture capital (VC) deals fell 51% YoY in the first four months of 2023, reaching $45.6 billion, as economic challenges led to a conservative approach by investors. Despite the decline, the US remained dominant in global VC funding, accounting for 36.9% of the total number of deals and 53.6% of the corresponding deal value.

Creditworthiness: US default risk perceptions so high that FAANG have lower CDS (credit default swaps) spreads.

Weekly Investment Watchlist

The Week Ahead:

Monday: US NY Empire manufacturing comes in at -31.8; est: -4.0.

Tuesday: Retail sales, industrial & manufacturing production, business inventories, NAHB housing market index

Wednesday: US housing starts for April comes in at 2.2% up to 1.4m; est -1.4%.

Thursday: Initial jobless claims, Philly Fed manufacturing, existing home sales, CB leading index

Friday: Powell speech

Investment Tip of The Day

Options can be a powerful tool for managing risk in your portfolio. For example, you can use put options to protect against downside risk in a particular stock or index, or you can use covered call options to generate income from a stock you already own.