Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

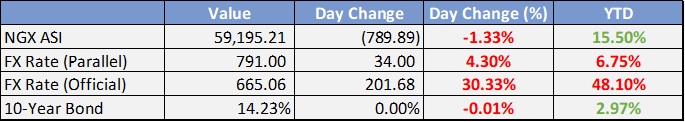

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Private sector, economists back CBN as naira falls to 664/$ - Punch

The Central Bank of Nigeria removes rate cap on the naira, allowing for a free float of the currency. This move aims to unify exchange rates and improve the foreign exchange market, receiving positive responses from the private sector and economists.OPEC projects Nigeria’s economy recovery in coming months - Punch

OPEC expects Nigeria's economy to recover in the coming months based on the strong recovery of its Purchasing Manager Index (PMI) in April. Despite challenges such as low business activity and purchasing power, the PMI indicates a potential near-term recovery.Tinubu projects 500,000 jobs with Data Protection Law - Punch

President Bola Tinubu has signed the Data Protection Bill into law, which aims to create jobs in the digital economy and protect privacy rights for Nigerians in both online and offline transactions.REA, Oando sign MoU to boost renewable energy access in Nigeria – The Guardian

The Rural Electrification Agency (REA) has partnered with Oando Clean Energy (OCEL) to deploy sustainable renewable energy in Nigeria, focusing on rural communities. The collaboration aims to provide solar power solutions to approximately 92 million Nigerians without electricity.

Global

US Federal Reserve Pauses Rate Hikes, Anticipates Future Increases - WSJ

Federal Reserve keeps rates unchanged but suggests future hikes may be necessary as inflation persists. GDP growth projections revised higher, unemployment rate expected to rise slightly, and inflation projections adjusted.

US May PPI (Price Producer Index) came in at 1.1% YoY; est 1.5%.

U.S. producer prices fell more than expected in May as energy and food costs declined.

Annual increase in producer inflation was the smallest in nearly 2-1/2 years.

Lower producer prices suggest relief for consumers and easing inflation pressures.

Goods prices dropped due to lower energy prices, while food prices also fell.

Inflation is subsiding as supply chain issues ease and demand for goods slows down.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Hang Seng led China markets higher as consumer and property stocks outperformed on hope of fresh stimulus, mainland markets led by cyclicals as overseas net fund inflow surged to highest since February.

In Thursday's MLF operation, PBOC cut the 1-year rate 10 bp to 2.65%, matching expectations, while rolling over CNY237B vs CNY200B in maturing loans.

China activity data confirms softening momentum. Industrial production rose 3.5% y/y in May, in line with expectations, following 5.6% in the previous month.

Australia employment rebounds strongly, jobless rate unexpectedly declines. Headline employment rose 75.9K m/m in May, above consensus 17.5K, rebounding from 4.3K decline in the previous month.

Europe, Middle East, Africa

UK Long-dated Gilts remain under pressure, with 10-year down for third session, leaving yield close to 4.5%.

Despite benign inflation dynamics, Pantheon Macroeconomics suggest there is risk of deeper Eurozone downturn.

The BoE will hold an external-led review into its economic forecasts after facing criticism for failing to anticipate the rise and persistence of inflation.

The Americas

Bond traders raise continue to bet Fed will steer US economy into recession

CAVA Group (NYSE) prices 14.44 mln share IPO at $22.00 per share, above the revised expected range of $19.00-20.00Alphabet introduces new AI shopping feature

The second largest homebuilder, Lennar, reported last night. They delivered a huge beat. Lennar’s Q2 EPS $2.94 vs $2.32 FactSet Consensus; revenues $8 bln vs $7.21 bln FactSet Consensus. Announced deliveries of 17,074 above its guidance; sharply raises FY23 deliveries guidance. Up 2.8% in the pre-market. With housing market inventory remaining tight, orders are starting to pick up.

The Week Ahead:

Tuesday: May CPI inflation: 4.0%

Wednesday: US May PPI (Price Producer Index) came in at 1.1% YoY; est 1.5%.; MBA mortgage applications; US Fed FOMC meeting

Thursday: US initial weekly jobless claims; Retail sales data; Philadelphia Business outlook

Friday: OPEX expirations; New York Fed services business activity; University of Michigan sentiment and inflation expectations

Investment Tip of The Day

Evaluate the impact of interest rates: Changes in interest rates can have significant implications for various investments, including bonds and real estate. Stay informed about interest rate movements and assess their potential impact on your investment strategy.