Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

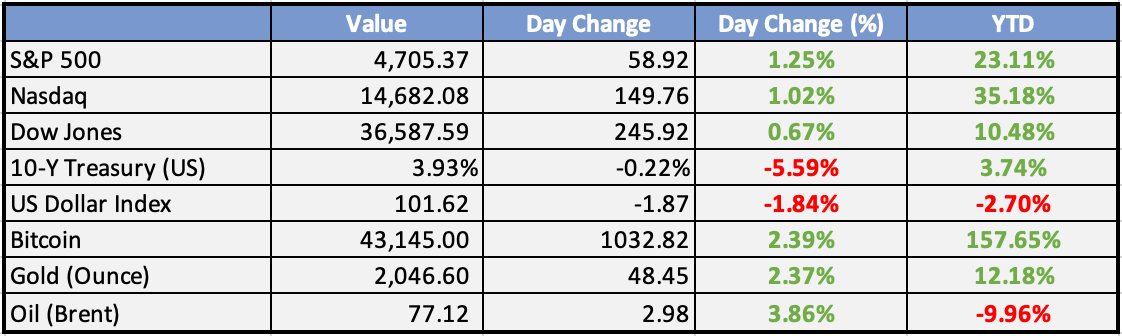

Market Data

Local

Global

x*Data as of 4pm WAT

Market News

Local

NNPCL not transparent on subsidy, dollar revenues – W’Bank - Punch

The Nigeria National Petroleum Corporation Limited is not transparent about the financial gains from fuel subsidy removal, the World Bank has disclosed.

NLC rejects TCN privatisation, demands policy reversal - Punch

The Nigeria Labour Congress has kicked against the proposed plans by the Federal Government to restructure the Transmission Company of Nigeria

Senate mulls scrapping of AMCON over poor financial performance - BusinessDay

The Senate Committee on Banking, Insurance, and Other Financial Institutions demanded the dissolution of the Asset Management Corporation of Nigeria (AMCON) over poor financial performance and its failure to recover N5 trillion in liabilities.

Global

Dow rallies more than 500 points to record, closes above 37,000 for the first time - CNBC

The Fed's signal of future rate cuts, fueled by easing inflation data, sent US markets soaring to record highs. The Dow broke 37,000 and the S&P 500 crossed 4,700 for the first time since 2022, fueled by hopes of a "soft landing" with lower borrowing costs. Bank stocks and housing-related companies led the rally.

California orders freeze on $68B budget deficit - Bloomberg

California's projected deficit ballooned to $68 billion, prompting Governor Newsom to freeze state spending. Agencies must cut back on non-essentials, with potential impacts on schools and tapping reserves. This follows a $14 billion deficit projection in October, and precedes a detailed budget proposal in January. The last spending freeze was in 2020 due to pandemic concerns.

Tesla recalls millions of vehicles amid probe of autopilot crashes - WSJ

Tesla's Autopilot system was found to be misused by drivers, leading to a recall of over 2 million vehicles. The NHTSA cited insufficient safety controls and a risk of crashes when drivers don't properly supervise. Tesla will offer a software update, but faces investigations from regulators concerned about misleading claims and risks.

Global Market Commentary

Overview

The FOMC announced the anticipated decision to maintain the status quo. However, the policy statement’s details and Chair Powell’s comments were interpreted as very dovish, triggering a decline in bond yields and the US dollar, coupled with a rebound in equities. Noteworthy events today encompas: Policy decisions by the ECB, BoE, and SNB, and US November retail sales.

Currencies/Macro:

The US dollar witnessed a substantial decline following the FOMC headlines and has continued to weaken since.

USD/JPY dropped from 145.15 to 143.00, while EUR bounced from 1.0785 to 1.0880.

GBP/USD, initially impacted by soft UK industrial production data, recovered to 1.2625, marking a net increase of 0.5%.

The FOMC decision was on hold, but the policy statement revealed dovish elements, including a downward revision to expected fed funds rate at end-2024 and lower inflation forecasts.

Interest Rates:

The US 2yr treasury yield slid ahead of FOMC, dropping -7bps to 4.67%, extending further during Powell’s press conference to 4.43%.

10yr yields fell from 4.15% to 4.02% on the Fed headlines, with Dec 2024 Fed pricing reflecting a more aggressive easing than depicted by the Fed today.

Commodities:

Oil markets experienced modest gains, influenced by EIA inventory data showing larger-than-expected crude draws and an OPEC Monthly forecasting a significant deficit next quarter.

Copper declined by 0.2% to $8,339, nickel fell by 0.73% to $16,400, and aluminium rose by 1.1% to $2,145.

Iron ore markets softened on disappointment after the CCP annual economic work conference in Beijing, resulting in a decline in the January SGX contract.

Day Ahead:

US:

RBA Assistant Governor Brad Jones (Financial Systems) is scheduled to speak at the Finance & Banking Conference at 2:00 pm.

US retail sales are anticipated to firm slightly in November, supported by Black Friday sales.

Eurozone:

Given the sharp downside surprise on Eurozone November CPI, the ECB is fully expected to keep its benchmark rates on hold today.

The Bank of England MPC decision will be focused on the statement and meeting minutes, with the policy expected to remain on hold at 5.25%.

The Swiss National Bank announces its quarterly monetary policy decision today, with a steady hand expected but market interest in commentary regarding FX intervention, given franc strength.

The Week Ahead:

Monday:

Tuesday:

Core CPI m/m (US)

Wednesday:

UK GDP fell by 0.3% in October

US Core PPI m/m was unchanged in November

US Federal Reserve held interest rates at 5.50% steady for a third meeting

Thursday:

UK Official Bank Rate maintained at 5.25%

EA Main Refinancing Rate remain unchanged at 4.50%

US retail sales rise by 0.3% in November

US Unemployment Claims fell to 202,000, a decrease of 19,000 from the previous week's revised level of 221,000

Friday:

Flash Manufacturing PMI (UK)

Flash Services PMI (UK)

Empire State Manufacturing Index (US)

Flash Manufacturing PMI (US)

Flash Services PMI (US)

Investment Tip of The Day

Assess Contingent Liability Exposure: Understand the contingent liabilities of companies in your portfolio, such as legal claims or warranty obligations. These liabilities can affect financial health and risk profiles.