Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

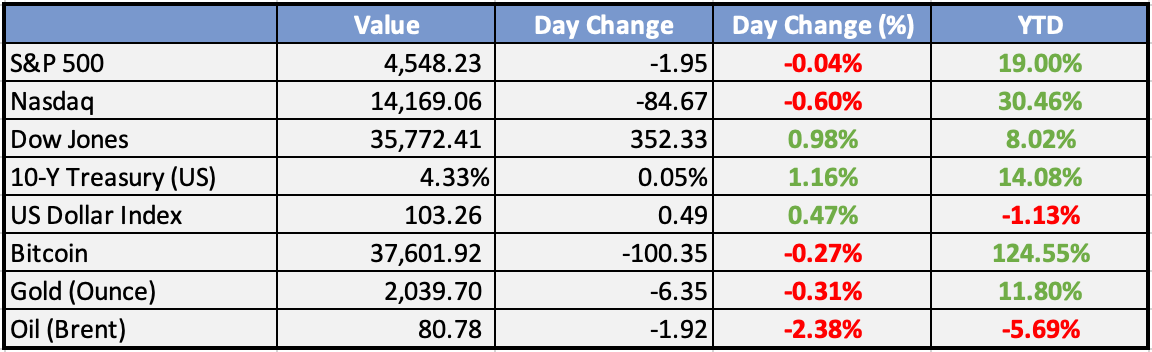

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Nigerian govt woos foreign mining investors with lower production cost - Premium Times

The minister quoted recent reports by audit firm KPMG which reported that mining’s contribution to Nigeria’s GDP rose from 0.3 per cent to 0.85 per cent last year, indicating 0.63 per cent year-on-year growth.

FG plans support for farmers, projects 31million MT grains - Punch

The production of 31 million metric tonnes of grains in 2024 is going to combat food inflation, create jobs and reduce poverty, the Federal Government stated on Wednesday.

Shortage of raw materials limiting local manufacturing capacity –MAN - The Sun

To this end, MAN has urged the Federal Government to encourage investment in the manufacturing industry, especially in sectors involved in ‘backward integration’, through introduction of incentives for local producers.

Supreme Court approves indefinite use of old, new naira notes - The Sun

A seven-member panel of the court led by Justice Inyang Okoro, said the notes should remain in circulation, pending when the Federal Government, after due consultation with relevant stakeholders, takes a decision on the matter.

Global

Microsoft secures non-voting board seat at OpenAI - CNBC

Microsoft will have a non-voting board seat at OpenAI, the company announced on Wednesday. This move comes after a turbulent month that saw the company's controlling non-profit board fire and then re-hire CEO Sam Altman. OpenAI's outlook has been intertwined with Microsoft since the software giant invested $13 billion into OpenAI.

GM plans $10B stock buyback in bid to assuage investors - WSJ

General Motors is increasing its cash return to shareholders by $10 billion, its largest stock buyback in recent memory. The company will fund it in part by freeing up capital previously earmarked for development of EVs and autonomous vehicles. GM is also reducing its spending on Cruise, its San Francisco-based driverless-car business, by nearly $2 billion.

Oil Holds Two-Day Advance Ahead of High-Stakes OPEC+ Meeting - Bloomberg

Oil prices rose for a third day as traders anticipated an OPEC+ meeting that will determine output policy for next year. Saudi Arabia is pushing for deeper output cuts to prevent a surplus in 2024, while some members, including Angola and Nigeria, are resisting. Analysts expect OPEC+ to reach a deal that will allow for discussions on output levels.

Daily Market Commentary

Overview

Despite US Treasury yields reaching multi-month lows, the US dollar staged a recovery, causing the AUD to slip to 0.6615. Notable events in today’s data calendar include Australia’s capex and building approvals, China’s manufacturing and services PMIs, Eurozone CPI, and US personal income and spending.

Currencies/Macro:

US dollar rebounds in NY trade, ending higher for the day.

EUR/USD slips to 1.0970; GBP/USD remains unchanged at 1.2690; USD/JPY slightly lower at 147.30.

AUD reached a four-month high of 0.6676 before falling to 0.6615.

NZD retraces from the RBNZ-induced peak to 0.6150; AUD/NZD slides to 1.0723, then trims losses to 1.0755.

US Q3 GDP revised higher to 5.2%q/q annualized; notable components include personal consumption, government consumption, and investment changes.

German CPI in November falls -0.4%m/m, annual pace at 3.2%y/y.

Interest Rates:

US 2yr treasury yield falls to 4.61% (lowest since July), then bounces to 4.65%; 10yr yield ranges between 4.25% and 4.32%.

Markets anticipate an unchanged Fed funds rate on December 14, with a 40% chance of a rate cut in March 2024.

Australian 3yr government bond yields extend decline; no hike expected at the next meeting, 40% chance in February 2024.

New Zealand rates markets project unchanged OCR on February 28, no further rate hikes, and a 50% chance of a rate cut by July 2024.

Commodities:

Crude markets hit 3-week highs on Fed pivot hopes and OPEC+ considering new oil production cuts.

January WTI contract rises to $77.95; January Brent contract increases to $83.22.

EIA reports crude stocks rising for the sixth consecutive week; crude inventory, gasoline, and distillate changes noted.

European diesel shipping rates from the US Gulf Coast to Europe double in the last 3 weeks.

LNG prices in Europe slump; temperatures in the UK impact withdrawals.

Metals experience a pullback; copper down 0.3% to $8,445; nickel case won by LME; Norsk Hydro ramps up aluminum recycling.

Iron ore prices stabilized after China’s NDRC interventions.

Day Ahead:

Australia's business investment update is expected to show a decline in private business capex in Q3.

Australia October dwelling approvals anticipated to oscillate around weak levels.

NZ November ANZ business confidence is expected to show a sustained lift.

Japan’s industrial production trend deceleration is driven by slowing foreign demand.

China’s official November PMIs forecasted to highlight a slight improvement in conditions across manufacturing and services.

Eurozone November CPI expected to experience further deceleration.

US personal income and spending show signs of cooling growth; PCE deflator influenced by October’s soft CPI print.

November Chicago PMI expected to highlight a downbeat business mood; initial jobless claims to tick up but remain low.

The Week Ahead:

Monday:

Tuesday:

US CB Consumer Confidence increased in November to 102.0

Wednesday:

US GDP q/q expanded an annualized 5.2% in Q3 2023, higher than 4.9% in the preliminary estimate

Thursday:

Core PCE Price Index m/m (US)

Unemployment Claims (US)

Friday:

ISM Manufacturing PMI (US)

Investment Tip of The Day

Review Country-Specific Risks: When investing internationally, consider country-specific risks such as political instability, regulatory changes, and economic conditions unique to each nation.