Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

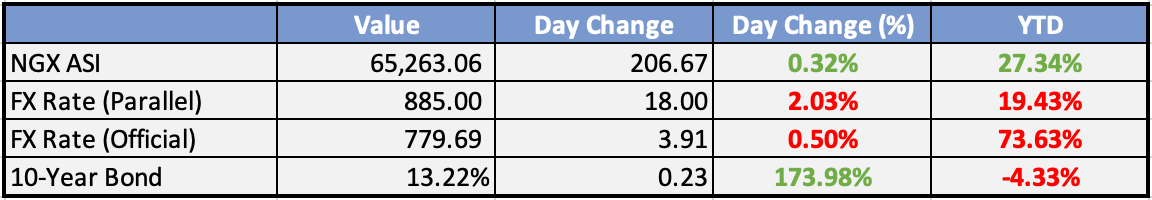

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Nigeria workers embark on protest - Business News Report

Organized labour led nationwide protests against the removal of a petrol subsidy and for a new minimum wage. Protests occurred in major cities, including Abuja, Kano, Oyo, Lagos, and Benin. Edo State Governor pledged to disburse N500 million monthly to poor households as a palliative.

Nigeria’s Mining Sector Fraught with Challenges, Despite Huge Potentials - This Day

A PwC report described the Nigerian mining sector as profitable and attractive to domestic and international investors, but it faces challenges due to lack of government support. The sector was once a significant contributor to Nigeria's GDP in the 1960s and 1970s.

FG to advance digitisation as NCC, BPSR sign MoU - The Guardian

The NCC and BPSR signed an MoU to digitize all Federal Government processes, aiming to enhance efficiency and productivity through digital transformation and collaboration with relevant stakeholders.

Global

Why the US Credit Rating Was Cut by Fitch and What It Means - Bloomberg

The US credit rating downgrade by Fitch is unlikely to have major negative consequences as the drop from AAA to AA+ is not substantial. The reasons for the downgrade were already known, and the US economy is performing well despite its unsustainable debt situation. However, if other credit-rating agencies follow suit, it may impact the stock and rates markets.

US Plans $103 Billion Debt Sale, as Issuance to Keep Rising - Bloomberg

The US Treasury increased quarterly bond sales for the first time in 2.5 years to finance budget deficits, which led to Fitch Ratings downgrading the government's credit rating. The Treasury will sell $103 billion of longer-term securities, reflecting rising borrowing needs amid deteriorating finances.

SoftBank’s Arm Targets $60 Billion-Plus Value for September IPO - Bloomberg

Arm Ltd., SoftBank Group's semiconductor unit, aims for an IPO valuation of $60 billion to $70 billion in September, amid growing interest in AI chips. The IPO targets to raise as much as $10 billion and is backed by potential anchor investors like Nvidia and Intel. SoftBank shares fell 3.7% following the news.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Asian equities showed a mixed performance on Thursday. Nikkei and Hang Seng extended their losses, while ASX and Kospi were also lower. Mainland China stocks, however, closed higher. Taiwan’s market was closed due to a typhoon.

The People’s Bank of China (PBOC) may cut commercial lenders’ reserve requirement ratio (RRR) as early as this month to boost lending and support economic recovery.

Caixin services activity in China expanded at a slightly faster pace in July, driven by an increase in the summer travel season.

Japan’s service sector activity in July expanded at a slightly slower pace as new business growth eased, while cost pressures remained high.

JGB yields are rising, reaching a nine-year high of 0.625% on Wednesday. However, the yen unexpectedly weakened due to remote prospects for an end to easing.

Toyota is planning to ramp up its push for electric cars in China through a research and development revamp.

Europe, Middle East, Africa

European equity markets were softer but improved from their worst levels. Tech, telecom, and autos were the biggest fallers, while banks and retail outperformed.

The Bank of England raised rates by 25 basis points, as expected, with the leeway provided by softer inflation numbers last month.

The July PMI for the Eurozone showed business activity contracting at an eight-month low of 48.6, lower than the flash reading of 48.9 and the previous month’s 49.9. The loss of momentum was due to ongoing weakness in manufacturing, while services sector activity also slowed.

UK services sector growth in July slowed to six-month lows as new order growth continued to ease.

The Bank of Japan (BOJ) kept its purchase offer amounts unchanged from the previous operation, raising questions about its exit from policy easing.

The Americas

Brazil surprised the market by cutting its Selic rate by 50 basis points, with the consensus expecting a 25 basis points cut. The current rate is now 13.25%. Further rate cuts are expected this year but not down to drastically low levels.

Fitch’s downgrade drew attention to Congress’s inability to control the more than $31 trillion in long-term debt.

Ackman is shorting 30-year Treasuries due to concerns about supply ramp-up, although this is not necessarily a widespread view.

Qualcomm, the latest chipmaker to report results, announced weaker than expected results. Management expects flat overall handset chip growth quarter-on-quarter for the September quarter (down 27% year-on-year) due to inventory corrections for both Android and iPhone.

The Week Ahead:

Monday:

Large Retailer Sales (Japan)

NBS Manufacturing PMI (China)

Chicago Purchasing Managers Index (US)

Tuesday:

Unemployment Rate (Japan)

Caixin Manufacturing PMI (China)

Unemployment Rate (EA)

S&P Global Manufacturing PMI (Canada)

ISM Manufacturing PMI (US)

Wednesday:

BOJ Monetary Policy Meeting Minutes (Japan)

ADP Employment Change (US)

U.S Added 324,000 Jobs in July Beating Estmate of +190,000 Jobs

Thursday:

US credit rating downgraded by Fitch Ratings from an AAA to AA+.

US Treasury boosts quarterly bond sales for the first time in 2.5 years in order to help finance budget deficits.

US ADP nonfarm payrolls for July come in at 324k; est: 190k.

Softbank (SFTBY) chip maker ARM is targeting a $60b IPO in September.

Friday:

Retail Sales (EA)

Average Hourly Earnings (US)

Ivey Purchasing Managers Index (Canada)

Investment Tip of The Day

Monitor key economic indicators such as employment data, consumer confidence, and manufacturing indices to gauge the health of the economy. Economic reports provide insights into business cycles, consumption patterns, and investment opportunities.