Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

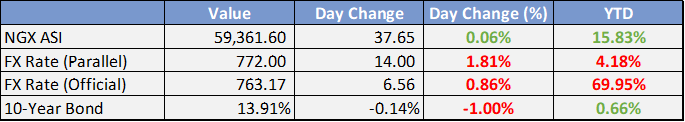

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

FG Pledges More Dollar Supply To Stabilise Naira – Daily Trust

The Nigerian government plans to inject foreign exchange to support the naira's value while market forces stabilize, following recent exchange rate unification and a surge in the black market.FG, lawyers meet over PIA implementation – Punch

The Nigerian government engages with legal advisors of the oil sector to discuss the smooth implementation of fuel subsidy removal and the Petroleum Industry Act 2021, aiming to provide clarity on diverse interpretations and ensure seamless operationalization of the objectives.Shippers Council imposes annual fee on port operators – Punch

The Nigerian Shippers Council introduces annual registration for terminal operators and port service providers to address the issue of anonymous shippers and importers. Registration fees range from N10,000 to N50,000, and the process is being transitioned to an automated platform.International airlines price tickets at N770/$1 up from N663/$1 - Naira Metrics

International airlines are set to increase ticket prices from N663.1 to N770.1 due to the rising cost of aviation fuel and other operational expenses. The price adjustment aims to sustain profitability and maintain service quality amid challenging market conditions.

Labour fumes as RMFAC hikes politicians’ salaries - Punch

Labour expresses dissatisfaction as the Revenue Mobilization Allocation and Fiscal Commission (RMAFC) raises the salaries of politicians. The move sparks outrage as workers' salaries remain stagnant, leading to concerns about income inequality and the prioritization of political elites over the general population.

Global

President Joe Biden called Xi Jinping a “dictator” at an event yesterday.

Biden implied Xi was unaware that the US shot down an alleged Chinese spy balloon in February because he didn’t know it was there.

Xi wasn’t happy about that, calling the comments a “provocation”.

This comes just one day after US Secretary of State Blinken’s trip to China to ease tensions with the country.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Bank Indonesia (BI) kept its 7D reverse repo rate unchanged at 5.75% for the fifth consecutive month.

China's Economic Daily commented recent yuan depreciation, attributing it zto the "result of market mechanism" and said it is highly probable yuan will appreciate against the dollar in H2.

China has begun a fresh round of nationwide inspections to assess the size of local government debt, coming as a sign that authorities are preparing to take concrete steps to tackle a key financial risk.

BOJ's Noguchi says guidance tweak still indicates a strong commitment to easing.

Record Number of European Firms Report Declining China Revenue in 2022.

Europe, Middle East, Africa

ECB Executive Board member Schnabel, a known hawk, said German inflation is being driven by profits and wages.

Ukraine energy minister Galushchenko warned that Russia could shut one of the last arteries carrying gas to Europe by the end of next year.

UK PM Sunak's hope for a pre-election tax cut is fading after national debt breached 100% of GDP for the first time since 1961 in data published Wednesday.

The Americas

Total US short interest surpasses $1T even as paper losses on positions top $100B, according to Bloomberg.

The number of active home listings hit a record low in May, according to Redfin

Investment Tip of The Day

Consider long-term trends. Identify long-term trends that could shape the future economy and investment landscape. Examples include demographic shifts, technological advancements, and changing consumer preferences. Position your portfolio to benefit from these trends.