Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

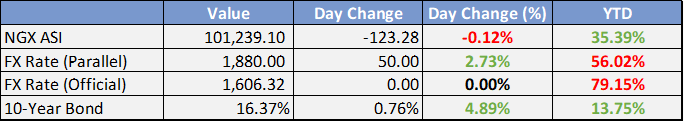

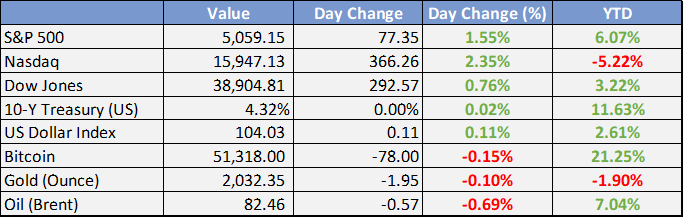

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Nigeria's GDP performance in the fourth quarter of 2023:

Overall GDP Growth: Nigeria's GDP increased by 3.46% year-on-year in Q4 2023, a slight decrease from the 3.52% growth in Q4 2022 but an improvement from the 2.54% growth in Q3 2023.

Sectoral Performance:

Services Sector: Led the GDP growth with a 3.98% increase, contributing 56.55% to the total GDP.

Agriculture Sector: Grew by 2.10%, marginally higher than the 2.05% growth in Q4 2022.

Industry Sector: Showed significant improvement with a 3.86% growth, recovering from a -0.94% decline in Q4 2022.

Contribution to GDP: Both the Industry and Services sectors increased their contributions to the overall GDP in Q4 2023 compared to the same period in 2022.

Annual GDP Growth: For the year 2023, Nigeria's GDP grew by 2.74%, slightly lower than the 3.10% growth rate in 2022.

Naira crash: NCC directs telcos to block Binance, other crypto platforms - Sun News

In a move to stem the free fall of the naira against the dollar, the Nigerian Communications Commission (NCC) has directed telecommunication firms to block access to the websites of Binance and other cryptocurrency companies.

An authoritative source in the industry confirmed this to Daily Sun stating that the telcos got a memo from the commission yesterday to that effect.

Banks sell $172m as CBN, EFCC battle currency speculators - Punch

The naira gained marginally against the United States dollar at the Nigerian Autonomous Foreign Exchange Market on Tuesday, closing at N1,542.58/$ from N1,551/$ recorded on Tuesday. The rate represents a 2.9 per cent appreciation from the N1,598.54 traded on Monday and a meagre 0.58 per cent against Tuesday’s rate.

IMF sees Naira depreciating by 35% to N2,081/$1 in official market - Vanguard

The International Monetary Fund (IMF) has warned that the exchange rate of the Naira may further depreciate by about 35 percent this year, adding that this could lead to inflation rate peaking at 44 per cent before the monetary policy tightening could bring the situation under control.

Global

AI Mania Resumes, With Nvidia Outlook Saving Broader Market - Bloomberg

On a day when virtually all trading felt like a prelude to Nvidia Corp.’s earnings report, the chip-making darling delivered a robust sales forecast that reinvigorated the artificial-intelligence mania behind last year’s stock-market rally. Its shares surged, spurring gains in index futures and rallies in global peers and suppliers.

Fed Minutes Show Unease Over Premature Cuts - WSJ

More Federal Reserve officials signaled concern at their meeting last month with cutting interest rates too soon and allowing price pressures to grow entrenched as opposed to the risks of holding rates too high for too long.

“Most participants noted the risks of moving too quickly to ease the stance of policy,” said the minutes of the Jan. 30-31 meeting, released Wednesday with a customary three-week delay.

Fed officials will dive into balance sheet debate at March FOMC - Reuters

The Federal Reserve’s internal debate over the fate of its balance sheet reduction effort is set to quicken at its March policy meeting, with policymakers first setting the stage for how they'll likely slow the drawdown, likely deferring a decision on when to stop the process altogether to a later date.

Market Commentary:

Currencies/Macro:

The US dollar remained relatively stable against the currencies of the G10 nations. The EUR/USD pair was nearly unchanged at 1.0815, and the GBP/USD stayed steady around 1.2630. The USD/JPY saw a slight increase to 150.20.

The minutes from the January Federal Open Market Committee (FOMC) meeting indicated that most officials were cautious about reducing interest rates too soon, expressing concerns that progress towards the Federal Reserve's 2% inflation goal might be jeopardized.

Richmond Fed President Barkin highlighted the persistently high inflation in services, suggesting a potential problem once the deflationary phase in goods prices ends, with shelter and services prices remaining elevated. Barkin also mentioned his preference for analyzing short-term price movements over year-over-year data.

In the Eurozone, consumer confidence for February was reported at -15.5, aligning with expectations but still indicating soft sentiment, as it has remained below -15 since the first quarter of 2022.

European Central Bank (ECB) member Wunsch, known for his hawkish views, stated it's premature to consider policy easing, suggesting that monetary policy might remain stricter for longer than the market anticipates. He also voiced concerns about wage pressures and the tight labor market.

The UK's Confederation of British Industry (CBI) trends survey for February showed an improvement, with total orders rising to -20, better than the expected -27 and an improvement from the previous -30. Selling prices increased to +17 from the prior +9, indicating a rise in price pressures.

Interest Rates:

The yield on the US 2-year treasury increased from a low of 4.58% to 4.66%, and the 10-year treasury yield climbed from 4.25% to 4.32%. The auction for 20-year bonds displayed a significant tail and a weak bid-to-cover ratio, indicating less demand than expected. Market expectations for the Federal Reserve's funds rate, which is at 5.375%, remain steady for the upcoming March meeting, but there is a 90% likelihood of a rate decrease by June.

In the credit markets, spreads showed minimal changes; the Main index tightened slightly by half a basis point to 56. However, the CDX index at 53 and US investment-grade credit spreads remained stable without significant movement. Primary market activity persisted, with four issuers in the US market, including significant deals from Cisco Systems and AstraZeneca, which contributed to a total of USD 19.4 billion being priced on the day. This activity brought the total volume for the week to USD 33.7 billion over two days.

Commodities:

Crude oil markets continued their upward trajectory, buoyed by a tight supply situation. The April West Texas Intermediate (WTI) contract rose by 1% to $77.83, and the April Brent contract increased by 0.75% to $82.96. Brent's prompt time spread, remaining near three-month highs and unaffected by expiration, indicates market tightness. Sparta Commodities observed that diesel shipments from India to Europe have dropped to their lowest level since 2022 due to Houthi attacks. Bloomberg highlighted China's increased procurement of crude from Russia's Far East, a source India has largely avoided due to sanctions worries. According to Kpler data cited by Bloomberg, China's intake of the Sokol blend in February has tripled compared to January. The fuels market also felt the impact of the 200kbpd TotalEnergies Donges refinery shutdown on Monday, further tightening supply due to ongoing refinery maintenance and closures.

Natural gas prices surged following Chesapeake Energy's announcement of delaying well production in reaction to this year's price collapse. The March Henry Hub contract has seen a 29% decline year-to-date but jumped 12% following the news. Chesapeake's CEO remarked on the market's current disinterest in additional gas supply. LNG prices in Asia have dropped to their lowest since 2021.

The metals market was influenced by speculation around US sanctions related to Navalny, potentially targeting Russia's metals industries. President Biden announced a forthcoming "major" sanctions package set to be revealed on Friday. Aluminium prices saw a significant spike of 3.4%, closing up 1.2% at $2,220, while nickel experienced a 3.7% high and closed up 2.8% at $16,800. In other industry news, Chile's state-owned miner Enami is expediting the shutdown of its copper smelter, originally scheduled to continue until April. First Quantum Minerals is seeking $20 billion from Panama in free trade arbitration following the country's shutdown of its flagship copper mine.

Iron ore markets appeared to stabilize around the $120 level after a sharp sell-off earlier in the week. The May Singapore Exchange (SGX) iron ore contract remained virtually unchanged at $119.75, while the 62% Mysteel index dropped an additional $2.15 to $120.05. Brokers pointed to poor steel mill margins and growing steel inventories as factors depressing production resumption rates.

Investment Tip of The Day

Minimize investment costs and fees by choosing low-cost index funds or ETFs for a significant portion of your portfolio. High fees can erode returns over time, so focusing on cost-effective investment vehicles can enhance your long-term wealth accumulation. This approach is especially valuable for long-term investors seeking to maximize their net returns.