Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

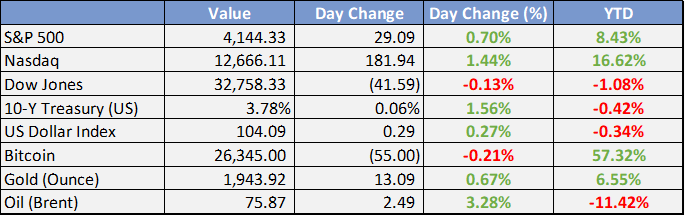

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Buhari writes Senate seeking approval to pay N226bn, $556.8m, £98.5m judgment debts owed by FG- Business News Report

President Buhari seeks Senate approval to pay a judgement debt of $566.75 million, £98.53 million, and N226.28 billion. The debt will be settled through the issuance of promissory notes, as approved by the Federal Executive Council. Relevant ministers are available for further information.

FG to stop deduction of $418m Paris Club debt from States accounts, to pay back amounts so far deducted—NGF - Business News Report

The Nigeria Governors Forum announces that the Federal Government will halt further deductions from state accounts to meet local government obligations and will reimburse the deducted funds. Abdulrahman Abdulrazaq is the new NGF Chairman, and Seyi Makinde is the Vice-Chairman.

National Assembly extends 2022 budget implementation by six months - Punch

The House of Representatives extends the implementation period of the capital component of the 2022 Appropriation Act by six months, based on President Buhari's request. The House also passes the budgets of the Niger Delta Development Commission for 2021, 2022, and 2023, with a total estimate of N2.29 trillion.

FG approves NIN, debit card merger - Punch

Commercial banks in Nigeria are now authorized to provide debit cards that double as National Identity Cards at no extra cost. The Federal Executive Council also approves an automated system to integrate National Identity Numbers (NINs) with SIM cards, simplifying the NIN-SIM linkage and SIM replacement processes.

Aviation Minister, Hadi Sirika, confirms Nigeria Air aircraft will arrive on Friday. - Nairametrics

The Aviation Minister confirmed that the Nigeria Air plane will land in the country in 2 days as part of processes to commence operations and unveiling of the delivery process. He noted that the only incomplete item is the aerotropolis, which is the airport city and is 60% complete.

Global

Fitch puts US rating on negative watch as debt deadline looms - Reuters

Fitch Ratings has placed the United States' "AAA" credit rating on watch for a possible downgrade, raising concerns in global markets as the debt ceiling deadline approaches. A downgrade could affect Treasury debt pricing, similar to the 2011 downgrade by S&P.

Ron DeSantis' presidential campaign launch melts down in Twitter glitches- NBC News

Florida Gov. Ron DeSantis' Twitter event announcing his 2024 presidential bid was repeatedly disrupted by server issues, causing the app to crash. DeSantis eventually spoke, outlining his conservative agenda, while facing potential competition from former President Donald Trump.

Half-Empty a Year Ago, Cruises Are Now Packed Like Sardines - WSJ

Those anticipating a similar experience of spacious cruises from last summer should be aware that crowds have returned to the seas, indicating a higher demand for cruise vacations.

Minutes from May’s FOMC meeting revealed a divide among officials regarding further interest-rate increases.

While some participants (hawks) signaled additional firming was likely necessary, several (doves) noted that further hikes may not be needed, provided the economy continues to progress as expected.

Yesterday, Fed Waller–in the some camp–expressed concern over the lack of progress in inflation and emphasized the need to “maintain flexibility”.

Markets still expect a pause (now called a “skip”) in June, but odds of a 25bps increase in July have risen to nearly 50% from 33% a week ago.

Stop me if you’ve heard this before: President Biden and Speaker Kevin McCarthy met yesterday, reached no deal, but expressed optimism.

According to JPMorgan economist, there’s a 25% (and rising) chance the US reaches the X-date without a deal.

In the last 24 hours, both Fitch Ratings and DBRS Morningstar warned about a potential credit rating downgrade for the US.

The cost to protect against a default—via credit default swaps—is at its highest since 2011 while yields on short-term T-bills maturing after the X-date remain elevated.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Bank of Korea's kept benchmark 7D repo rate unchanged at 3.5% for third consecutive meeting, as widely expected, also cut its FY23 GDP forecast.

China's economic growth will get a bigger boost if PBOC cuts RRR for banks rather than interest rates.

Singapore's economy grew by 0.4% y/y in Q1 versus flash estimate 0.1% but, export outlook cut.

Europe, Middle East, Africa

Q1 final GDP for Germany was (0.3%) vs 0.0% expected q/q, or (0.5%) vs (0.1%) expected y/y. - confirms a winter recession.

French business confidence fell back below its long-term average in May at 99 versus consensus 101 and prior 101

The Americas

McCarthy still optimistic of reaching debt ceiling deal in time to avert default but gaps remain on spending levels. Spending cuts will not bode well for GDP growth, since Government spending was the largest boost to Q1 GDP.

The May FOMC meeting minutes showed officials split on need for further hikes, as some stressed that the language in the policy statement should not be interpreted as signaling either that decreases in the target range are likely or further increases in the target range had been ruled out.

Yields on T-bills maturing in early June surge above 7% amid debt ceiling fears

Meta slashes business teams in final three-part-round of layoffs

The Week Ahead:

Monday: Fed talk - Bullard, Barkin, Bostic, Daly

Tuesday: US Manufacturing PMI comes in at 48.5; est: 50.2, US new homes sales come in at 683k; est: 663k.

Wednesday: FOMC minutes

Thursday: Initial jobless claims, GDP growth, pending home sales

Friday: Core PCE, personal income & spending, durable goods orders, Michigan consumer sentiment

Investment Tip of The Day

Regularly monitor the performance of your investments and assess whether they are meeting your expectations. If certain investments consistently underperform or no longer align with your goals, consider making adjustments.