Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

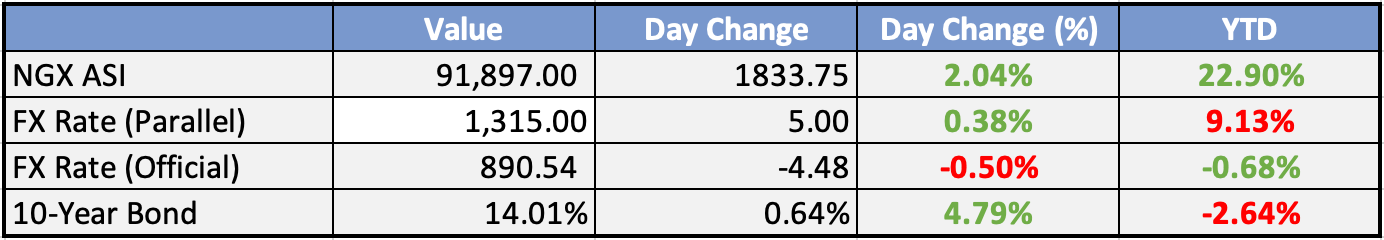

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Access Holdings to float new subsidiary - Punch

Access Holdings Company Plc has received regulatory approval to set up a consumer lending subsidiary, named Oxygen X Finance Company Limited.

This was revealed in a corporate notice filed with the Nigerian Exchange Limited on Wednesday.

FG seeks $1.5bn loans to shore up naira, boost budget - Punch

Nigeria is seeking $1.5bn aid from the World Bank to tackle the severe dollar shortage contributing to the decline of the naira.

Nigeria’s crude oil production rises to 1.4mbd (OPEC) - Punch

Nigeria’s crude oil production rose to 1.418mbpd in December 2023, a report by the Organisation of the Petroleum Exporting Countries has said.

CBN to tackle forex infractions with heavy sanctions - Punch

The Central Bank of Nigeria has uncovered infractions, gross abuses, and non-compliance with foreign exchange market regulations.

Tinubu approves N5bn grant for TETFund - The Sun

President Bola Tinubu has approved N5.1billion for the funding of 185 successful research proposals under the Tertiary Education Trust Fund (TETFund) National Research Fund (NRF) 2023 Grant Cycle.

Global

Oil inventories unexpectedly rise by 483,000 barrels last week - Yahoo Finance

US crude unexpectedly jumped last week, raising demand concerns due to weaker China growth. WTI oil dipped after API reported a 939,000-barrel stockpile increase vs. expected drawdown. Official data awaited with mixed expectations.

Apple to Face US Antitrust Lawsuit as Soon as March - Bloomberg

US Justice Department to sue Apple as early as March for alleged antitrust violations in iPhone/iPad hardware and software, focusing on restrictions hindering competition. This follows DOJ's ongoing probes since 2019 and Supreme Court's recent decision on Epic Games case. Apple may need to adjust App Store practices due to EU's new digital gatekeeper rules.

Market Commentary:

Overview:

The US dollar and bond yields rose, driven by stronger US economic data. Pound performed well on an upside surprise in UK CPI.

Currencies/Macro:

US dollar rebound continued against major currencies except sterling and euro. EUR/USD fell from 1.0875 to 1.0845 (one-month low) but returned to 1.0875/80. GBP/USD slipped to 1.2610, then rallied to 1.2685. USD/JPY rose from 147.20 to 148.52 (six-week high). AUD/USD extended decline to 0.6525 but trimmed losses to 0.6550 as US equities bounced. NZD/USD fell -0.5% to 0.6110. AUD/NZD changed little at 1.0725.

US retail sales in December rose 0.6%m/m (est. +0.4%m/m, prior +0.3%m/m). Industrial production rose 0.1%m/m (est. -0.1%m/m). Manufacturing rose 0.1%m/m. NAHB homebuilder confidence rose to 44 in January (est. 39, prior 37).

Fed’s Beige Book noted flat or slightly up economic activity, with interest rates and inflation weighing on activity. Increased uncertainty or pessimism about the outlook.

UK inflation data for December was stronger than expected. CPI rose 0.4%m/m and 4.0%y/y (est. +0.2% and 3.8%y/y). Core at 5.1%y/y (est. 4.9%y/y).

Eurozone CPI for December finalized unchanged at 2.9%y/y, with core at 3.4%y/y.

ECB officials pushed back on market pricing of rate cuts. Lagarde stated easing unlikely before mid-year, policy needs to remain restrictive. Knot said lower market pricing counterproductive.

Interest Rates:

US 2yr treasury yield rose from 4.22% to 4.36%, 10yr yield rose from 4.06% to 4.11%. Market expects Fed funds rate unchanged on February 1, 50% chance of cut in March.

Australian 3yr government bond yields rose from 3.75% to 3.87%, 10yr yield rose from 4.20% to 4.31%. Market expects RBA cash rate unchanged on February 6, 30% chance of cut by June. New Zealand rates markets expect OCR unchanged on February 28, 80% chance of rate cut in May.

Credit indices reflected risk-off move. Main 1.5bp wider to 62.5, CDX out a bp to 57. US cash spreads resilient. Primary activity continued in Europe and the US.

Commodities:

Crude markets stabilized with Middle East situation, US cold impact, and positive OPEC forecast for 2025 demand. Feb WTI at $72.72, March Brent at $78.07. OPEC forecasts global demand for crude to rise by 1.8mbpd. Non-OPEC supply set to rise by 1.3mbpd in 2024 and 2025, keeping markets in deficit.

Freezing temperatures offline 700kbpd in the US. Natural gas markets weak, February TTF contract down 6.6%.

Metals fell on weaker-than-expected Chinese data and higher rate expectations in the US. China home prices fell the most in almost 9 years. Copper down 1% at $8,283, aluminium fell 1.7% to $2,176.

Iron ore markets fell sharply on weaker Chinese data. February SGX contract fell $3.30 to $125.40, 62% Mysteel fell $2.55 to $126.70. Chinese steel production weakest in almost 6 years in December.

Day ahead:

Eurozone:

ECB president Lagarde speaks in Davos at 6:05pm Syd. The final estimate for Europe’s December CPI is due, with the preliminary reading 2.9%yr overall, 3.4%yr core.

UK December CPI likely to show sticky services inflation, with goods driving disinflation. Consensus for overall CPI is 3.8%yr, with the core rate 4.9%yr, services 6.1%yr.

US:

December retail sales anticipated to show further gains after solid Black Friday sales (market f/c: 0.4%mth).

Industrial production in December likely consistent with a subdued picture for manufacturing (market f/c: 0%mth). Import prices index should show declines (market f/c: -0.5%mth).

November business inventories should reflect an uncertain outlook limiting inventory accrual (market f/c: -0.1%mth).

The January NAHB housing market index is likely to indicate homebuilder sentiment is near historic lows.

The Federal Reserve's Beige Book provides an update on economic conditions across the country. Fed officials Barr, Bowman, and Williams are listed to speak.

The Week Ahead:

Monday:

Tuesday:

US Empire State Manufacturing Index fell twenty-nine points to -43.7

UK unemployment at 4.2% in quarter to December

Wednesday:

UK Consumer Prices Index (CPI) rose by 4.0% in the 12 months to December 2023, up from 3.9% in November

US core retail sales MoM came in at 0.4% vs 0.2% exp and 0.2% previously;

Thursday:

US Unemployment Claims came in at 187,000, a decrease of 16,000 from the previous week's revised level.

Friday:

Retail Sales m/m (UK)

Prelim UoM Consumer Sentiment (US)

Investment Tip of The Day

Monitor Securities Lending Practices: If your investments involve securities lending, understand the associated risks. Poorly managed securities lending programs can introduce additional counterparty and liquidity risks.