Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

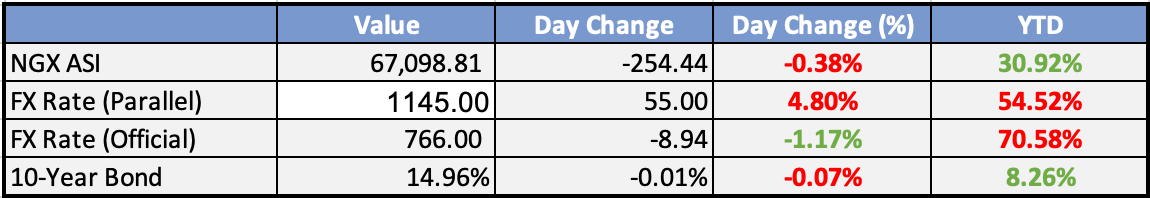

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

FG commits to mining sector devt - Nigeria Business News

President Bola Tinubu has expressed the Federal Government’s commitment to develop the mining sector by creating an enabling environment for players in the industry to thrive. The president said this at the opening of the 8th edition of Nigeria Mining Week in Abuja

FG subsidized electricity with N135.23bn in Q2, 2023 – NERC - Vanguard

During the second quarter of 2023, the Federal Government of Nigeria subsidized the electricity sector with approximately N135.23 billion. This subsidy was provided to address shortfalls between the cost of electricity generation and the revenue collected by distribution companies, ensuring stability in the power sector.

Naira hits new low, 1060/$ as MAN kicks at policy reversal - Vanguard

The crises festering in Nigeria’s currency exchange market doubled down yesterday with the local currency depreciating further across all segments of the market.

18% tax-to-GDP ratio: We won’t increase taxes, Adedeji assures companies - Businessday

Zacch Adedeji, the acting chairman of the Federal Inland Revenue Service (FIRS), has assured corporate organisations in the country that FIRS’s resolve to increase the country’s tax-to-GDP ratio to 18 percent from 10.86 will not lead to an increase in taxes.

Naira gains 6.77% despite liquidity drop at official market - Business Day

Naira strengthened against the dollar at the official market, gaining 6.77 percent despite declined liquidity in the market on Wednesday. At the close of trading on Wednesday the dollar was quoted at N790.68, which was weaker than N848.12 quoted on Tuesday at Investors’ andExporters(I&E) forex window, data from the FMDQ showed.

Global

U.S. weekly jobless claims total 198,000, fewer than expected - CNBC

Initial jobless claims for the week ended Oct. 14 were expected to total 210,000, according to a Dow Jones consensus estimate. Continuing claims totaled 1.734 million, up 29,000 from the previous week and higher than the FactSet estimate for 1.698 million.

Stock Market News, Oct. 18, 2023: S&P 500 Closes Lower, Treasury Yields Climb Above 4.9% - Wall Street Journal

Netflix shares rose in off-hours trading after the company said it's planning price increases. Long-term bond yields hit a fresh 16-year high, weighing on stocks already pressured by the conflict in Gaza and corporate earnings results. Read today's full markets roundup here.

Biden to seek 'unprecedented' Israel aid package; pledges $100 million for humanitarian relief in Gaza and West Bank - CNBC

Biden announced that his administration will commit $100 million to humanitarian assistance in Gaza and the West Bank. Biden, the first U.S. president to visit Israel during wartime, arrived in Tel Aviv hours after an explosion killed hundreds of people in a hospital in Gaza.

Weekly Investment Watchlist

Market Commentary:

Asia - Pacific

Asian equities closed with mixed results on Wednesday, lacking a clear direction. Notable movements included a slightly lower Hang Seng, underperformance in Shenzhen due to the US tech ban, and sharp declines in Taipei ahead of heavyweight earnings. Japan remained flat, and Southeast Asia had mixed results.

China released various macro data, most of which exceeded expectations. However, the imminent default of Chinese property developer Country Garden on bonds weighed down on property developer stocks, which reached their lowest levels since 2009.

China's GDP growth for the third quarter was 4.9% YoY, surpassing the 4.4% expected but still lower than the 6.3% recorded in July. The QoQ GDP growth was 1.3%, significantly higher than the previous quarter's 0.5%.

Industrial Production remained unchanged at +4.5%, while Retail Sales increased to +5.5% from +4.6% the previous month.

Europe, the Middle East, and Africa

European markets initially rose earlier in the day, led by the luxury sector due to China's positive retail sales data. However, they turned lower later, with the UK FTSE 100 declining after steady inflation data that exceeded consensus.

UK inflation in September surprised on the upside, reaching 6.7% YoY compared to a consensus of 6.6% and a previous reading of 6.7%. Core inflation also rose to 6.1% YoY, surpassing the consensus of 6.0% and the prior 6.2%.

ASML's Q3 results indicated that lower demand is impacting the industry, with weak net bookings compared to the previous quarter. The company also cut its FY 2024 guidance.

The Americas

News of Nvidia being banned from selling chips to China and possibly other countries significantly affected the stock and the broader tech sector, with shares initially down over 7%.

The NAHB Housing Market Index came in at 40, lower than the previously revised 44. Housing market data is starting to decline, likely due to higher mortgage rates.

US Retail Sales were a positive surprise, with the headline number rising 0.7% MoM versus an estimated 0.3%, and core retail sales (excluding autos) increasing by 0.6% MoM versus the expected 0.2%.

Canada's inflation statistics came in better than expected, with headline CPI rising 3.8% YoY in September, below the consensus of 3.9% but down from the hotter-than-expected 4.0% reading in August.

The Week Ahead:

Monday:

Empire State manufacturing index dropped -6.5 points to -4.6 in October

Tuesday:

US retail sales up 0.7% in September

Wednesday:

UK Consumer Price Index YoY is at 6.70%

Thursday:

Unemployment Claims (US)

Friday:

Retail Sales m/m (UK)

Investment Tip of The Day

Stay disciplined during market euphoria During periods of market euphoria, it's crucial to remain disciplined and avoid making irrational investment decisions. Stick to your long-term plan and avoid getting caught up in excessive optimism or fear of missing out.