Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

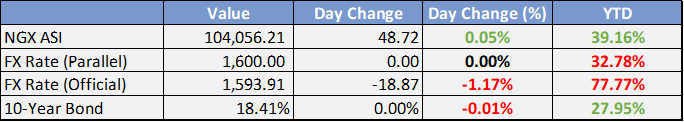

Local

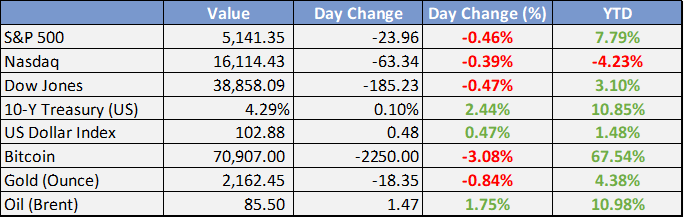

Global

*Data as of 4pm WAT

Market News

Local

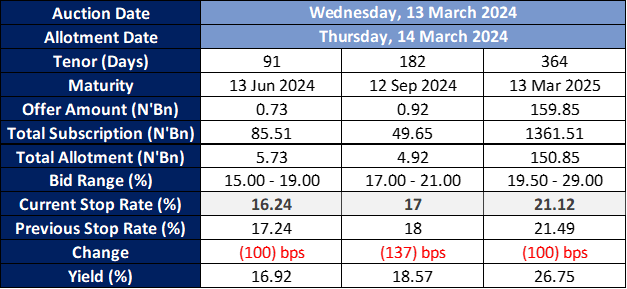

Kindly find below the result of yesterdays’s NTB auction:

SON unveils 80 new Nigerian industrial standards for CNG vehicles

Alake urges African nations to use proven mineral reserves as equity

Nigeria secures $1.3 bln funding for rail link to Niger Republic

Global

Market Commentary:

Currencies/Macro:

The US dollar experienced minimal overall changes against the majority of G10 currencies. The EUR/USD increased by 0.2% to 1.0950, while the GBP/USD fluctuated around 1.2800. The USD/JPY remained almost unchanged for the day, stabilizing at 147.80.

In the Eurozone, industrial production for January exhibited a significant decline of 3.2% month-over-month, which was more substantial than the expected 1.8% decrease. This downturn was notably influenced by a sharp reduction in Ireland, adjusting the overall figures for the region.

In the United Kingdom, the Gross Domestic Product (GDP) for January showed a 0.2% month-over-month increase, aligning with forecasts. This growth was primarily driven by the service sector and robust construction activity. However, industrial production in the UK experienced a slight decline of 0.2% month-over-month, contrary to expectations of remaining steady.

Interest Rates:

The US 2-year Treasury yield increased from 4.58% to 4.63%, and the 10-year yield climbed from 4.13% to 4.19%, with a robust 30-year auction momentarily halting the upward trend. Market expectations for the Federal Reserve's funds rate, currently at 5.375%, anticipate it remaining steady at the upcoming 21 March meeting, while there is a 65% likelihood of a rate cut by June.

In the credit market, indices continued their tightening trajectory, with Main improving by another basis point to 51 and the CDX slightly tightening to 48. U.S. investment-grade (IG) cash credit also saw positive movement, improving by 1-2 basis points. In Europe, 11 non-sovereign, supranational, and agency (ex-SSA) issuers accessed approximately EUR 8.5 billion in capital, featuring significant corporate actions such as Stellantis issuing EUR 1.25 billion across 6.5- and 12-year maturities and Aston Martin securing GBP 400 million for a 5-year non-call 2-year issuance. Noteworthy issuances also included Deutsche Telekom (EUR 750 million for 12 years) and Nestle (GBP 800 million for 5.12 years). In the US, four issuers priced USD 4 billion in total for the week, amounting to USD 31 billion, with financial institutions like Nordea and State Street among the leading entities, issuing USD 1 billion in 3-year securities with respective terms.

Commodities:

Brent crude oil reached four-month closing highs, influenced by several factors including attacks on Russian refineries, a significant crude drawdown as reported by the EIA, and escalating tensions in the Middle East, all contributing to a robust demand for oil. The April West Texas Intermediate (WTI) contract saw a 2.67% increase to $79.63, while the May Brent contract rose by 2.5% to $83.97. In response to drone attacks by Ukraine, a major fire erupted at Rosneft's largest refinery, necessitating the shutdown of key refining units. The Financial Times highlighted that these attacks had impacted around 10% of Russia's total oil refining capacity. Concurrently, Israeli military action targeted Hezbollah positions in Lebanon's Bekaa Valley. The EIA's report revealed a 1.5 million barrel reduction in crude inventories, marking the first decline in nearly two months, alongside a significant 5.66 million barrel drop in gasoline supplies. U.S. crude production decreased by 100,000 barrels to 13.1 million barrels per day. Following these developments, gasoline prices also surged, with the April New York contract increasing by 4% over the week. Additionally, the U.S. Department of Energy purchased 3.25 million barrels of domestic sour crude to replenish the Strategic Petroleum Reserve at an average cost of $77.43 per barrel, totaling 29.6 million barrels to date.

In the metals sector, copper prices soared to 11-month highs amid reports of planned production cuts by Chinese smelters, with the price escalating by 3% to $8,920. A meeting convened by the China Nonferrous Metals Industry Association discussed potential measures, including reductions in output by unprofitable smelters and increased reliance on copper scrap, although no definitive agreements were reached. Government representatives at the meeting indicated that capacity restrictions similar to those in the aluminum and steel industries might be considered for copper smelting.

Iron ore prices experienced another decline, influenced by Country Garden's missed domestic bond payment, exacerbating concerns about the sector. The April Singapore Exchange (SGX) iron ore contract decreased by $1.40 to $105.95, while the 62% Mysteel index dropped by $4.30 to $106.45, marking a 25% correction from the 18-month highs observed in January. Citi's recent analysis suggested that the "first line of cost defense" for iron ore is estimated at $90 to $95 per ton, below which some non-mainstream producers would face losses, with major producers potentially considering production cuts if prices fall to between $75 and $80. Rising inventories and tepid demand post-Lunar New Year, alongside persistent challenges in the residential construction sector, continue to dampen market sentiment.

Investment Tip of The Day

Maintain a well-structured record-keeping system for all your financial documents, including investments, taxes, and estate planning. Efficient record-keeping simplifies monitoring your financial progress, facilitates informed decision-making, and ensures you are prepared for tax season or any legal matters. It also aids in the strategic review and adjustment of your financial plan.