Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

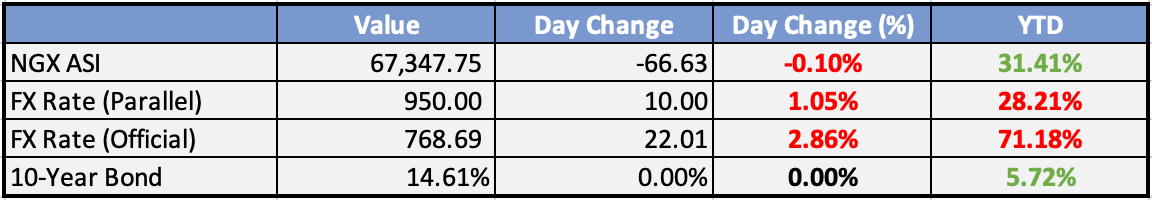

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Fidelity completes 100% acquisition of Union Bank UK - The Guardian

Fidelity Bank Nigeria has completed its 100% acquisition of Union Bank UK, marking a significant expansion of its international footprint. The deal, which received regulatory approval from the Central Bank of Nigeria and the UK Prudential Regulation Authority, strengthens Fidelity Bank's presence in the UK and enhances its capacity to serve its diverse clientele more effectively.

NUPRC lists 42 firms for gas flare commercialisation programme – The Sun Nigeria

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has identified 42 companies operating in Nigeria's oil and gas sector to participate in the Gas Flare Commercialization Programme. This initiative aims to reduce gas flaring and promote the utilization of associated gas in various industries, contributing to Nigeria's energy transition and environmental goals.

Ghanas Inflation down to 40.1 pct - GSS

According to data from the Ghana Statistical Services, the nation's headline inflation rate has decreased to 40.1%. Government statistician Samuel Kobina Annim noted that this marks the slowest rate of change in inflation in Ghana since October, with the figure pertaining to August.

Global

Former Starbucks CEO Howard Schultz steps down coffee chain’s board - CNBC

ormer Starbucks CEO Howard Schultz, 70, is resigning from the coffee chain's board, part of a planned transition. Schultz's third stint as CEO ended in March. His 11-month return included crafting a strategy to modernize cafes, improving relations with baristas, and launching Starbucks Oleato, a line of olive oil-infused beverages.

X Corp. agrees to try to settle lawsuits over mass layoffs - Bloomberg

X Corp has agreed to attempt a settlement in the lawsuits brought by thousands of former Twitter employees who claimed they were denied proper severance pay after being laid off when Musk acquired the social media platform. Shannon Liss-Riordan, representing the workers, stated in a memo that Twitter has agreed to engage in discussions after months of pressure.

Ukraine attacks Russian air defences in western Crimea, military says - Reuters

Ukraine launched a long-range overnight attack on Russian air defense systems near Yevpatoriya in Crimea. Russia reported shooting down 11 drones overnight over the region but made no mention of damage. Ukraine has been increasing its missile capabilities, as demonstrated in a recent attack on the Crimean port of Sevastopol.

Moody’s cuts China property sector’s outlook to negative - Reuters

Moody's has downgraded the outlook for China's property sector from stable to negative due to economic growth challenges that are expected to impact sales negatively, despite government support. The ratings agency anticipates a roughly 5% decrease in contracted sales over the next six to 12 months in China, with government measures aimed at boosting property purchases.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities delivered mostly positive performances. Japan’s Nikkei rose by 1.41%, Hong Kong’s Hang Seng increased by 0.21%, and China’s Shanghai Composite was up by 0.11%. Japan and Australia exhibited particularly strong gains. The Australian dollar and yen strengthened, while the U.S. dollar weakened.

In currency markets, the People’s Bank of China (PBOC) issued guidance to major banks, urging them to refrain from immediately squaring their foreign exchange positions to ease pressure on the yuan. This move appears to coincide with China’s Golden Week holidays, which typically bring seasonal demand for the dollar.

Fresh Chinese economic data for August is expected to show signs of improvement, potentially signaling that the worst of the year’s economic downturn has passed. Key indicators such as industrial output, retail sales, and fixed asset investment are forecasted to show growth. This follows positive credit, inflation, and car sales data released earlier in the week.

Japan reported that machinery orders fell roughly in line with expectations, signaling a slow start to the third quarter. Japanese investors also emerged as significant net buyers of foreign bonds, marking the largest purchase since March 2020.

Australian employment witnessed substantial growth of 64.9K jobs in August, surpassing the consensus estimate of a 25K increase. However, the majority of these gains were in part-time jobs, and the unemployment rate remained unchanged at 3.7%.

Chevron’s Australian liquefied natural gas (LNG) facilities could face disruptions due to escalating industrial actions by striking workers.

China’s Country Garden is facing a deadline to secure creditor approval for extending the repayment of its final onshore note.

Trade tensions are escalating between the European Union and China over subsidies provided to Chinese Electric Vehicles (EVs), with China warning of possible retaliatory actions.

Europe, Middle East, Africa:

European equity markets are generally on the rise, with significant indices like STOXX 600, FTSE 100, DAX, and CAC posting gains. The mining and oil/gas sectors are outperforming, while the autos sector is lagging.

The European Central Bank (ECB) faces a crucial rate decision amid market expectations of a 25-basis point rate hike. Inflation is anticipated to remain above 3% next year, but speculation abounds that the ECB may be nearing the end of its tightening cycle due to slowing economic activity.

The UK’s housing market is experiencing its weakest performance in 14 years, according to the Royal Institute of Chartered Surveyors (RICS). House prices and sales have declined significantly, with hedge funds such as Viking Global Investors shorting Lloyds Bank due to concerns about its mortgage business.

The EU luxury sector is encountering challenges due to a slowdown in China. Barclays analysts have downgraded the sector to “Neutral,” citing risks of disappointing sales growth and margin pressures.

The Americas:

S&P futures are up by 0.7%, signaling a potentially positive day for U.S. equities following a mixed performance on Wednesday. Notable sectors like big tech and autos stood out. Treasury bonds remain stable, while the dollar index shows minimal change. Key economic indicators, including retail sales, PPI, and initial claims, are on the day’s calendar, and the Federal Reserve is expected to maintain steady rates in the coming week.

Tensions are rising between the United Auto Workers (UAW) and automakers, with potential strikes looming. Noteworthy IPOs and acquisitions are making headlines, including ARM’s IPO at $51 per share, valuing the company at approximately $54.5 billion, and Apollo is among the bidders for IGT’s global gaming divisions, potentially worth $4-5 billion.

Small businesses are grappling with inflation and labor shortages. The NFIB Small Business Optimism Index declined to 91.3, marking its 20th consecutive month below the 49-year average of 98. Inflation is increasingly cited as a significant concern, with 40% of small businesses struggling to fill job openings.

Investor sentiment presents mixed signals. Bank of America’s latest Fund Manager Survey indicates a 17-month high in equity allocations but also reveals caution, with elevated cash levels. Goldman Sachs and Morgan Stanley offer differing views on market prospects, underscoring the current volatility and uncertainty characterizing the U.S. financial landscape.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

UK Manufacturing PMI was revised slightly higher to 43.0 in August 2023, up from the preliminary estimate of 42.5.

Industrial production in the Euro Area declined by 1.1% month-over-month in July 2023.

The consumer price index, rose 0.6% for the month and was up 3.7% from a year ago.

Thursday:

Employment Change s.a (AU)

Retail trade sales grew 0.6% in August compared to July, while increasing 1.6% year over year.

Friday:

Industrial Production (YoY) (CN)

NY Empire State Manufacturing Index (US)

Industrial Production (MoM) (US)

Michigan Consumer Sentiment Index (US)

Investment Tip of The Day

Employ Hedging Strategies: Explore hedging techniques like options contracts to offset potential losses. For example, using put options can protect your portfolio from downside risk in volatile markets.