Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

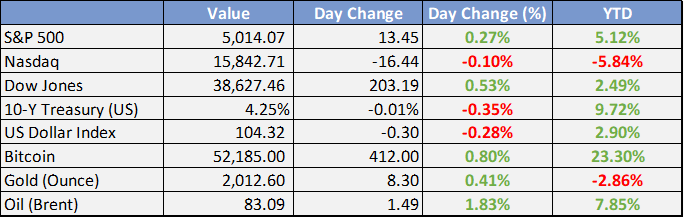

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

In January 2024, Nigeria experienced a significant increase in inflation rates. The headline inflation escalated to 29.90% year-on-year (YoY), up by 0.98% from the 28.92% recorded in December 2023. Month-on-month (MoM), the headline inflation also rose, reaching 2.64%, which is 0.35% higher than the 2.29% observed in December 2023.

Food inflation, a critical component of the overall inflation figure, saw a more pronounced rise, reaching 35.41% YoY in January 2024. This represents a 1.48% increase from the 33.93% recorded in the preceding month. On a MoM basis, food inflation escalated to 3.21%, up by 0.49% from 2.72% in December 2023.

Core inflation, which excludes volatile items such as food and energy, was also on the rise. It registered at 23.59% YoY in January 2024, marking a 0.53% increase from 23.06% in December 2023. Month-on-month, core inflation increased to 2.24%, a 0.42% rise from 1.82% recorded the month before.

These figures highlight the continuing inflationary pressures within the Nigerian economy, affecting both food prices and the broader basket of goods and services.

Tinubu, govs meet over food crisis as emirs, NBA lament hardship - Punch

Northern traditional rulers and the Nigerian Bar Association on Wednesday decried the hardship in the country precipitated by the fuel subsidy removal which had resulted in higher transport costs and food inflation. The traditional rulers and the NBA asked the Federal Government to quickly address the situation just as President Bola Tinubu will on Thursday (today) hold a closed-door meeting with state governors at the Aso Rock Villa, Abuja, to proffer solutions to the economic crisis in the country.

Investments Trapped, Broadband Penetration Nosedives As InfraCos Face New Hurdle - Leadership

The N17.5 million Infrastructure Companies (InfraCos) used in obtaining Open Access FIbre Infrastructure Network license from the Nigerian Communications Commission (NCC) may go down the drain, as they face new hurdle that could mar the rollout of fibre infrastructure to the six geopolitical regions of Nigeria, LEADERSHIP findings revealed.

FG distributes 42,000MT grains free, Ogun begins N5bn interventions - Punch

The Federal Government, on Wednesday, announced that it would distribute the 42,000 metric tonnes of grains approved by President Bola Tinubu to poor Nigerians at no cost. This came as Ogun State Governor Dapo Abiodun on Wednesday announced over N5bn intervention plans which he said would go a long way to help the residents of the state stay afloat the biting effects of the country’s struggling economy occasioned by the rising inflation and currency devaluation.

BUA Foods invests over $200m in sugar estate - Punch

The Managing Director of BUA Foods, Ayodele Abioye, has disclosed that the company has invested over $200m in its integrated sugar estate in Lafiagi, Kwara State. Abioye said this on Wednesday during a chat with journalists at the firm’s headquarters in Lagos. He revealed that the company was investing in the project comprising a sugar refinery, ethanol plant and other supporting infrastructure to reduce dependence on forex-impacted raw materials.

Global

Retail sales tumbled 0.8% in January, much more than expected - CNBC

Advance retail sales declined 0.8% for January, down from a 0.4% gain in December and worse than the estimate for a 0.3% drop.

Sales at building materials and garden stores were especially weak, sliding 4.1%. Miscellaneous store sales fell 3% and motor vehicle parts and retailers saw a 1.7% decrease.

Also, initial claims for unemployment insurance totaled 212,000 for the week ended Feb. 10, a decline of 8,000 from the previous week’s upwardly revised total and below the estimate for 220,000.

Warren Buffett’s Berkshire Hathaway Trims Its Massive Stake in Apple - WSJ

Warren Buffett’s Berkshire Hathaway; trimmed its flagship position in Apple; in the fourth quarter. Berkshire sold about 1% of its Apple shares in the final three months of 2023, leaving it with a 5.9% stake in the iPhone maker worth about $167 billion on Wednesday, according to Dow Jones Market Data.

Market Commentary:

Currencies/Macro:

The US dollar weakened against most G10 currencies following Tuesday's significant gains. The EUR/USD increased by 20 pips to 1.0730. The GBP/USD faced a decline from 1.2610 to 1.2540 due to unexpected UK CPI data, later stabilizing with a 0.25% decrease at 1.2560, marking sterling as the weakest among the G10 currencies. The USD/JPY saw a reduction of 25 pips to 150.55.

US producer price inflation for December was adjusted downwards to -0.2% from an initial -0.1%, with the core measure (excluding food and energy) revised to -0.1% from 0.0%. This revision positioned the annual rates at 1.0% for the overall index and 1.8% year-on-year for the core index.

Chicago Fed President Goolsbee, known for his dovish stance, expressed that slightly higher inflation figures over a few months would align with the Federal Reserve's goal of returning to a 2% inflation rate. He emphasized that rate decisions should be based on confidence in returning to the target rate, suggesting that the Fed's 2% target is linked to the personal consumption expenditures price index rather than the CPI, which can show significant variations.

UK inflation data for January was unexpectedly low, with the CPI decreasing by 0.6% month-on-month and increasing by 4.0% year-on-year, below the forecasted rates. The core inflation rate was reported at 5.1% year-on-year. Services inflation remained high at 6.5% year-on-year.

Bank of England Governor Bailey indicated that the current focus is on the duration of maintaining the present policy stance. He acknowledged signs of wage growth cooling and the need for further evidence, alongside indications of economic recovery and that the softer inflation data aligns with their expectations.

Eurozone industrial production for December outperformed expectations, registering a 2.6% month-on-month increase (against an expected -0.2%) and a 1.2% year-on-year growth, significantly surpassing the anticipated -4.0% year-on-year decline.

Interest Rates:

The yield on the US 2-year treasury dropped from 4.66% to 4.58%, and the 10-year treasury yield decreased from 4.32% to 4.26%. Market expectations for the Federal Reserve's funds rate, currently at 5.375%, remain steady for the upcoming March meeting, with a consensus on a 100% probability of a rate reduction by June.

In the wake of Tuesday's CPI-driven losses, credit markets saw a rebound, with the Main index tightening by half a basis point to 57.5 and the CDX index improving by a basis point to 54. Despite this recovery, cash spreads remained relatively stable as the market welcomed new issuances. In Europe, three issuers successfully priced approximately EUR 3.4 billion in corporate bonds, while the US market observed a resurgence in activity with five issuers, notably including Bristol Myers with a USD 13 billion jumbo deal, returning to the market after a day of inactivity.

Commodities:

Crude oil prices declined due to a larger-than-expected increase in U.S. inventories reported by the Energy Information Administration (EIA), with a substantial 12 million barrel rise last week. This led to a 1.5% drop in the March West Texas Intermediate (WTI) contract to $76.71 and a 1.4% decrease in the April Brent contract to $81.63. The surge in crude inventories was somewhat mitigated by a significant reduction in product inventories, including a 3.659 million barrel decrease in gasoline and a 1.916 million barrel drop in distillate stocks. Weak demand for fuel continued, with the four-week average of distillate demand hitting its lowest point since 2016 and gasoline demand at its lowest since 2021. Refinery utilization rates declined for the sixth consecutive week, reaching their lowest level since December 2022. U.S. crude production remained steady at a record 13.3 million barrels per day. In response to Houthi rebel attacks, Star Bulk Carriers Corp announced it would avoid sailing through the Red Sea. Russian crude shipments declined, impacted by U.S. sanctions on “Russia-friendly tankers,” leading to operational disruptions. Citi predicted a potential gasoline supply issue in Europe during the summer.

Asian natural gas prices hit an eight-month low due to low demand, while U.S. prices approached a three-and-a-half-year low, anticipating another bearish inventory report. The March Henry Hub contract has decreased by one-third in value this year.

In the metals market, copper prices fell again, dropping by 0.7% to $8,201, as the market adjusted expectations for Federal Reserve rate cuts in the first half of the year. Conversely, nickel rose by 0.4% to $16,320, and aluminum increased by 0.5% to $2,237, with nickel prices supported by operational shutdowns in New Caledonia and Australia. Norsk Hydro reported a significant profit drop due to reduced aluminum consumption, citing challenging market conditions but maintaining focus on improvement programs.

Iron ore saw slight gains in light trading during the Lunar New Year holidays, with the March SGX contract increasing by $1 to $129.15. BHP is anticipating a train drivers’ strike. BHP, Rio Tinto, and BlueScope Steel announced a collaboration on a feasibility study for Australia’s first pilot electric smelting furnace, aiming for a potential start in 2027, as part of efforts to produce “green iron.”

Investment Tip of The Day

Utilize a long-term investment strategy to capitalize on the power of compounding interest, which can significantly increase wealth over time. This approach encourages patience and persistence, focusing on steady growth rather than short-term gains. It's particularly effective for building substantial wealth for future needs, like retirement.