Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Netherlands partners Nigeria to accelerate green, digital economy, EU channels 200m Euros to project - Business News Report

Netherlands pledges support for Nigeria's green economy transition, emphasizing circular economy benefits, while the EU commits 200 million Euros for green projects, aiming to achieve Nigeria's Net-Zero emissions target by 2060.

Nigeria records N927bn trade surplus in Q1 2023 - Business News Report

Nigeria's trade surplus reaches N927.16 billion in Q1 2023, with total exports at N6.49 trillion and imports at N5.56 trillion, according to the National Bureau of Statistics (NBS).

Tinubu discusses poverty, insecurity with EU President, meets NGF - The Guardian

President Bola Tinubu urged the European Union to support Nigeria and Africa in enhancing security and economic development to alleviate poverty. Tinubu emphasized the need for partnership in addressing poverty and security challenges, specifically mentioning Lake Chad and coastal areas.

SEC and SON Collaborate to Standardize Commodities - Punch

The SEC partners with the Standards Organization of Nigeria to develop export standards for commodities, aiming to grow the economy, create jobs, and increase foreign exchange. This collaboration will facilitate product exports and enhance Nigeria's economy.

Nigeria's Oil Production Drops Below 1 Million Barrels per Day - Punch

Nigeria's Crude Oil Production Falls Below 1 Million Barrels per Day, Affecting Budget and Revenues, Despite Varying Figures Reported by OPEC and NNPC.

Petrol Marketers Struggle to Secure N10bn for New Fuel Orders - Punch

Depot Owners Struggle to Meet Financial Requirement as Nigerian National Petroleum Company Implements New Fuel Lifting Cost, Leading to Potential Shutdowns. Filling stations in Lagos State are reportedly not selling products as depot owners face challenges in raising funds of N5bn-N10bn for new orders.

NIBSS Reduces Fees for Electronic Transfers - Punch

NIBSS reduces transaction processing fee for Instant Payments from N5 to N3.75k, effective July 1, 2023, to promote financial inclusion and innovation, as stated in a letter to payment solution providers.

NNPCL to Reduce Fuel Imports starting August - Punch

The Nigerian National Petroleum Company (NNPCL) plans to decrease fuel imports when the Dangote Refinery begins operations in late July or early August. The refinery aims to meet Nigeria's fuel demands and eliminate substandard petroleum products.

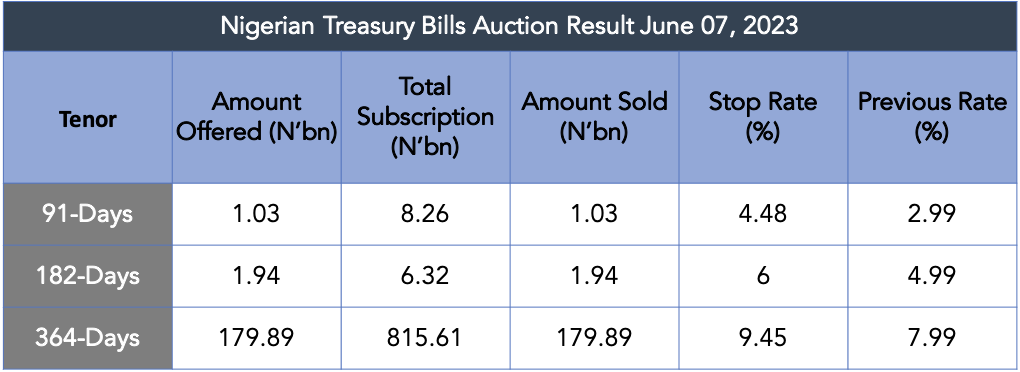

NTB Auction Stop Rates Rise as Inflation Expectations Worsens.

NTB auction stop rates increased across all tenors as investors sought higher yields to counter rising inflation caused by subsidies. Strong subscription and higher rates are expected to revive market sentiment.

Global

Binance traders have pulled out $800m worth of crypto from the platform after the recent SEC lawsuit - Financial Times

Withdrawals exceeding $800 million were made from Binance following the US securities regulator's lawsuit against the exchange. Traders displayed caution amid US authorities' efforts to crack down on illicit cryptocurrency activities, with significant outflows into stable coins like USDT, USDC, and BUSD. The SEC accuses Binance of securities law violations.

Bank of Canada raises rates to highest level in 22 years, breaking four-month pause - WSJ

Bank of Canada ends rate pause, raises rates to 4.75% - highest in 22 years - on strong consumer spending and inflation concerns, signaling potential for further increases in July.

Canadian wildfires shroud US East Coast in smoke - Reuters

US East Coast engulfed in Canadian wildfire smoke, causing school closures, flight delays, and health warnings. New York's skyline obscured, air quality alerts issued, and outdoor activities canceled. President Biden urges caution.

The Organization for Economic Cooperation and Development (OECD) published its updated global Economic Outlook yesterday.

Like the World Bank, the OECD sees limited growth for this year and next, predicting global growth of 2.7% in 2023 (up from 2.6% in March) and 2.9% in 2024 (unchanged).

Excluding the pandemic, this year’s growth is expected to be the slowest since the global financial crisis.

The organization warned that stubborn inflation remains a major headwind for central banks, whose subsequent rate hikes could stunt growth further.

The VIX1D - Wall Street's New Fear Gauge Shows Unexpected Stability - Bloomberg

Wall Street's recently introduced fear gauge, the Cboe One-Day Volatility Index, is consistently opening lower since its creation, puzzling traders who expect more volatility. The gauge's behavior raises questions about its effectiveness as a sentiment indicator in the options market.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

China rate-cut expectations grow as signs of weak recovery mount

Reserve Bank of India’s MPC voted unanimously to keep repo rate unchanged at 6.5% for second successive meeting and kept its "withdrawal of accommodation" message.

Bank of Korea warns on easing monetary policy too early and putting pressure on the Won.

Japanese companies with a March reporting season are projecting dividends totaling JPY15.2T this year, which would be the third straight record.

Japan Q1 GDP upgrade bigger than expected, driven by private inventories. Q1 GDP growth was revised up to 2.7% q/q annualized from first preliminary estimate of 1.6%.

Taiwan exports sink again, marking ninth consecutive months of weakness and outlook remains bleak

Europe, Middle East, Africa

EU governments sell €27B debt, busiest week since 2020

Eurozone's Q1 GDP -0.1% qtr/qtr (expected 0.0%; last -0.1%); 1.0% yr/yr (expected 1.2%; last 1.8%).

Eurozone Q1 Employment Change 0.6% qtr/qtr, as expected (last 0.3%); 1.6% yr/yr (expected 1.7%; last 1.5%)

UK labor market shows signs of cooling. Starting salaries slipped to a 25-month low, although salary levels for new hires still running at a relatively sharp pace.

The Americas

Apple cuts Vision Pro sales target to 150K units vs previously discussed 1M units

US Treasury’s $1tn borrowing drive set to put banks under strain. Analysts fear scale of new issuance following debt ceiling fight will push up yields and suck cash out of deposits.

The Week Ahead:

Monday: US May ISM Services index comes in at 50.3; est 51.8.

Tuesday: IBD/TIPP economic optimism, API crude oil stock change

Wednesday: US trade deficit, EIA stocks change, consumer credit change

Thursday: Initial jobless claims, wholesale inventories

Friday: WASDE report

Investment Tip of The Day

Stay educated and informed: Continue educating yourself about investing and personal finance. Read books, attend webinars or seminars, and follow reputable financial news sources to enhance your knowledge and make well-informed investment decisions.