Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

CBN sacks Union, Polaris, Keystone banks’ boards - Punch

The Central Bank of Nigeria has dissolved the boards and managements of Union Bank of Nigeria, Keystone Bank and Polaris Bank over alleged corporate governance infractions and non-compliance with regulatory requirements.

FG plans N450bn power intervention fund - Punch

The Federal Government is set to spend N450bn on power interventions in 2024. This is according to the budget analysis of the Nigerian Bulk Electricity Trading Company. Under the firm’s capital expenditure, N450bn was budgeted for ‘FGN Power Intervention Fund.’

NNPC rakes in N2.5trn profit - TheSun

The Nigerian National Petroleum Company (NNPC) Limited says it recorded a profit of N2.548 trillion in 2022. The national oil company in its 2022 Financial Performance Report posted online described the profit as the highest since its inception in 1977.

CBN appoints new executive officials for Union, Keystone, Polaris Bank - Vanguard

The Central Bank of Nigeria has announced a new appointment of executive officers for Union Bank, Keystone Bank, and Polaris banks following the dissolution of the board of the banks on Wednesday.

Nigeria Partners Saudi On Mining Sector Development - Leadership

As the world transitions from fossil fuel to cleaner energy, Nigeria and the Kingdom of Saudi Arabia have resolved to strengthen the cooperation between both countries to enhance the development of solid minerals.

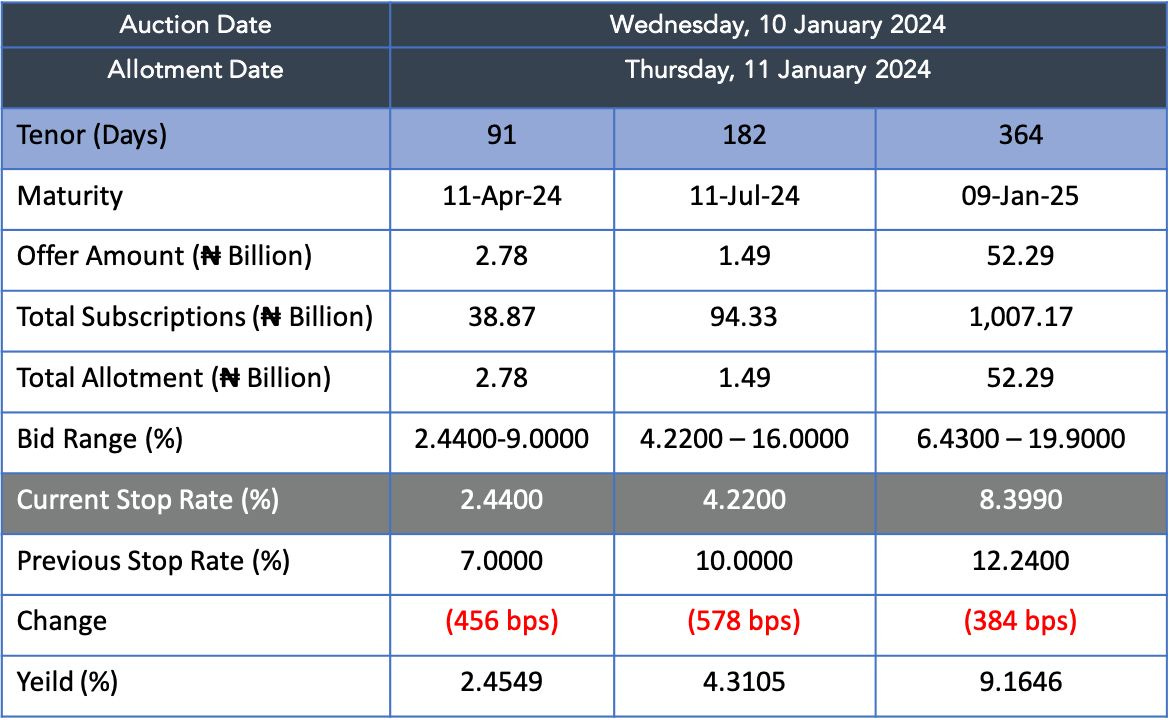

Results from Treasury Bill Auction

Global

Spot bitcoin ETFs to start trading in big boost to crypto industry - Reuters

Landmark moment for Bitcoin as 11 US spot ETFs get SEC approval and start trading, sparking potential market share wars, institutional inflows, and boosting crypto stocks. Expect intense competition with low fees driving investor interest in a gradually growing market.

Market Commentary:

Asia and Australia

Asia-Pacific region mostly higher on Thursday. Nikkei 225 surged 1.8%, and Hang Seng Index jumped 1.3%.

Indian shares posted modest gains amid positive global cues. Investors awaited earnings from TCS and Infosys and economic data for market direction.

Sensex ended up 0.09% at 71,721.18, while Nifty settled 0.13% higher at 21,647.20.

Automakers led gains; Hero MotoCorp and Bajaj Auto climbed. Axis Bank, BPCL, and Reliance Industries rose, while some stocks like Larsen & Toubro and Wipro fell.

Polycab India shares plunged 20% following reports of Income Tax Department raids.

Europe, the Middle East, and Africa:

European stocks rebounded after two sessions of losses. STOXX 600 rose 0.5% to 478.82.

German DAX added 0.6%, France's CAC 40 rose 0.5%, and the U.K.'s FTSE 100 was marginally higher.

VAT Group shares rose over 1% after reporting stronger-than-expected Q4 orders.

Marks & Spencer plunged 5% despite strong holiday sales growth due to an uncertain outlook.

The Americas:

U.S. futures indicate a slightly lower open after fluctuating. S&P 500 futures down by 0.1%.

The Labor Department reported a 0.3% increase in the consumer price index (CPI) for December, exceeding expectations.

Core CPI rose 0.3% in December, matching November's increase, with an annual rate of 3.4%.

Initial jobless claims slipped to 202,000, lower than expected.

Major U.S. indexes closed higher on Wednesday, with Nasdaq up for the fourth straight session. Nasdaq rose 0.8%, S&P 500 climbed 0.6%, and Dow rose 0.5%.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Thursday:

US Core CPI m/m increased to 0.3%

US Unemployment Claims came in at 202,000, a decrease of 1,000 from the previous week's revised level.

Friday:

GDP m/m (UK)

Core PPI m/m (US)

Investment Tip of The Day

Evaluate Third-Party Vendor Risks: Companies often rely on third-party vendors. Assess the risks associated with vendor relationships, including cybersecurity risks and the potential impact on operations.