Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

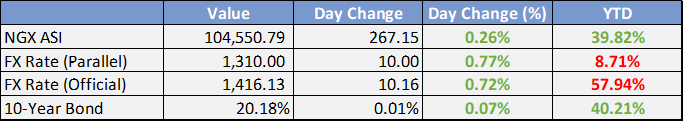

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Real GDP growth in the US for Q4 2023 decelerated to 3.4% from Q3's 4.9% due to a comprehensive data revision.

The slowdown was primarily caused by reduced private inventory investment and slower increases in government spending and residential fixed investment.

Consumer spending remained strong, indicating a positive economic outlook.

Inflation remained moderate at 1.9%, beneficial for consumers and businesses.

Downward revisions in some economic components signal potential risks and a need for cautious monitoring of future data.

Overall, while the US economy expanded in Q4 2023, the pace of growth has slowed, with strong consumer spending and corporate profits offset by potential near-term economic risks.

S&P affirms United States 'AA+/A-1+' sovereign ratings on economic resilience

Market Commentary:

Currencies/Macro:

The US dollar index increased by 0.1% today. The Euro dropped from 1.0839 to 1.0811 as expectations for a June ECB rate cut solidified, with such a move now nearly fully anticipated.

USD/JPY surged to 151.97, marking its highest point since 1990 during the Tokyo session, but later retreated to 151.03. The ongoing speculation about Bank of Japan intervention kept investors cautious. Following a meeting with officials from the Bank of Japan and the Financial Services Agency, Japan’s top foreign exchange official Kanda vowed to address the yen's excessive weakness appropriately.

The Chinese yuan faced continued pressure, with the onshore CNY approaching the People's Bank of China’s 2% daily fluctuation limit at 7.2365.

Sweden's Riksbank maintained its policy rate at 4.00%, as expected, but revised downwards its inflation and policy rate forecasts, hinting at a potential rate cut in May or June.

ECB's Cipollone from Italy, known for his dovish stance, suggested that the ECB could quickly ease monetary policy, even if wage inflation remains persistent: "An excessive focus on short-term wage developments might overlook the necessary wage recovery for the euro area’s fragile recovery to strengthen. If the data aligns with March projections, we should be ready to promptly reduce our restrictive monetary policy stance." Kazaks from Latvia echoed the need for caution due to high uncertainty, emphasizing the desire to prevent inflation resurgence but noted no objections to market expectations for a rate cut in June.

The Eurozone ESI economic confidence index improved to 96.3 from 95.5, showing a broad-based increase in consumer confidence, industrial sentiment, and services sentiment.

Interest Rates:

The US 2-year Treasury yield decreased from 4.60% to 4.56%, and the 10-year Treasury yield dropped from 4.24% to 4.18%. The market anticipates that the Federal Reserve's funds rate, currently at a midpoint of 5.375%, will remain unchanged at the upcoming meeting on May 2nd, with a 70% likelihood of a rate cut by June.

In the credit market, indices showed positive movement with Main tightening by half a basis point to 55, and CDX experiencing a significant late surge, improving by 2 basis points to 51.5, in alignment with the rally in US equities. US investment-grade cash remained stable to slightly tighter as issuance volumes decreased in anticipation of Easter and the end of the month.

Commodities:

Crude oil markets concluded the day with a marginal increase despite a report of rising U.S. stockpiles dampening the mood. The May West Texas Intermediate (WTI) contract edged up by 0.1% to $81.70, and the May Brent contract also saw a slight increase of 0.1% to $86.34. This slight uptick in WTI prices came after an initial drop of approximately 0.3% following the Energy Information Administration's announcement of a 3.1 million barrel increase in crude inventory. Additionally, gasoline inventories experienced a rise for the first time in seven weeks, by 1.298 million barrels, although distillate inventories decreased by 1.185 million barrels. This change in gasoline stocks was attributed to the sixth consecutive week of increased refinery crude runs. U.S. crude production remained steady at 13.1 million barrels per day, while exports saw a 14% reduction to 4.181 million barrels per day. JP Morgan has speculated that recent production cuts by Moscow could elevate Brent prices to $90 in April, with potential to reach the mid-$90s by May and approach $100 by September. Bloomberg highlighted the accumulation of Russian diesel on tankers off the west coast of Brazil and in other regions, indicating potential logistical challenges and market adjustments.

In the natural gas sector, the May Henry Hub contract declined by nearly 4% due to the forecast of warmer weather across the central and eastern United States. Conversely, coal markets witnessed a significant boost, with the May ARA contract increasing by 5.4% following infrastructure disruptions caused by the Baltimore Bridge collapse.

Metals trading remained steady in anticipation of the month, quarter, and fiscal year end for certain markets. Copper prices stayed level at $8,867 per metric ton, while nickel experienced a minor drop of 0.2% to $16,610 per metric ton, and zinc prices rose slightly by 0.2% to $2,447 per metric ton. Reports from the UK Telegraph suggest that China's significant accumulation of copper stockpiles has raised market concerns, especially given the global tightness in copper supply following reduced production forecasts from several mines late last year.

Investment Tip of The Day

Consider the integration of digital assets, such as cryptocurrencies or blockchain-based investments, into your portfolio, with a clear understanding of their risks and potential. This emerging asset class can offer diversification benefits and exposure to innovative financial technologies. However, due diligence and a cautious allocation are essential, given the volatility and evolving regulatory landscape associated with digital assets.