Think Thursday - Earnings Surge, Market Mixed: Nigeria’s Corporates Shine Amid Global Trade Watch

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kickoff. Nigerian companies posted strong H1 2025 results, with major firms like BUA Foods, Unilever, Transcorp, and Wema Bank recording sharp profit growth and declaring dividends. Globally, markets were mixed U.S. stocks rose on tech optimism, while energy prices dropped and commodity trends varied. The NGX showed broad strength, though oil & gas lagged. Overall, investor sentiment remains cautiously optimistic.

Nigerian News & Market Update

BUA Foods posts 101% profit growth, hits ₦276.1billion in H1 2025:

BUA Foods Plc posted strong H1 2025 results with profit before tax up 101% to ₦276.1billion and revenue rising 36% to ₦912.5billion, driven by significant growth across its product segments especially a 2923% surge in rice revenue. Gross and operating profits also rose sharply, while earnings per share nearly doubled. The company’s assets and equity grew, liabilities declined, and management credited the performance to its diversified model, efficiency, and expansion strategy. - Punch

Unilever Nigeria Grows Revenue by 54% in Six Months:

Unilever Nigeria Plc reported strong H1 2025 results, with revenue up 54% to ₦98.1billion and net profit rising 225% to ₦14.4billion, driven by improved cost efficiency and stable macroeconomic conditions. Operating profit surged 444% to ₦18.8billion. For the first time in over 20 years, the company declared an interim dividend of ₦0.50, totaling ₦2.87billion. Management credited the performance to focused execution of its growth strategy, investment in core brands, and a long-term commitment to the Nigerian market. - Thisday

Transcorp Reports ₦279.7billion Revenue in H1, to Pay ₦4.06billion interim dividend:

Transnational Corporation Plc reported a strong H1 2025 performance with revenue up 59% to ₦279.7billion and profit before tax rising 21% to ₦85.7billion. The company maintained a healthy gross profit margin of 47% despite economic challenges. It declared an interim dividend of 40 kobo per share, totaling ₦4.064billion. Management attributed the growth to its diversified operations across power and hospitality, strategic investments, and a resilient business model focused on delivering long-term stakeholder value. - Thisday

Wema Bank’s Profit Before Tax Jumps by 231% to ₦101.2billion in H1 2025.:

Wema Bank Plc delivered a strong H1 2025 performance, with Profit Before Tax surging 231% to ₦101.2billion and gross earnings rising 70% to ₦303.2billion. Interest income grew by 65%, while non-interest income jumped 91%. The bank's total assets increased to ₦3.96trillion, deposits grew to ₦2.60trillion, and loans rose 19% to ₦1.43trillion. Key profitability ratios like ROAE(Return on Average Equity) (60.4%) and ROAA(Return on Average Assets) (4.64%) improved, while the NPL (Non-performing Loan) ratio remained low at 3.17%, reflecting strong asset quality. The results underscore Wema Bank's resilience, digital leadership, and sustained growth momentum in its 80th year. - Thisday

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices showed broad gains, with Consumer Goods, Industrial Goods, and Lotus Index leading YTD performance. Despite a sharp 1-day drop in Insurance (-4.31%), it remains positive overall. Oil/Gas is the only sector in decline YTD (-8.58%). Market sentiment remains largely strong across most sectors.

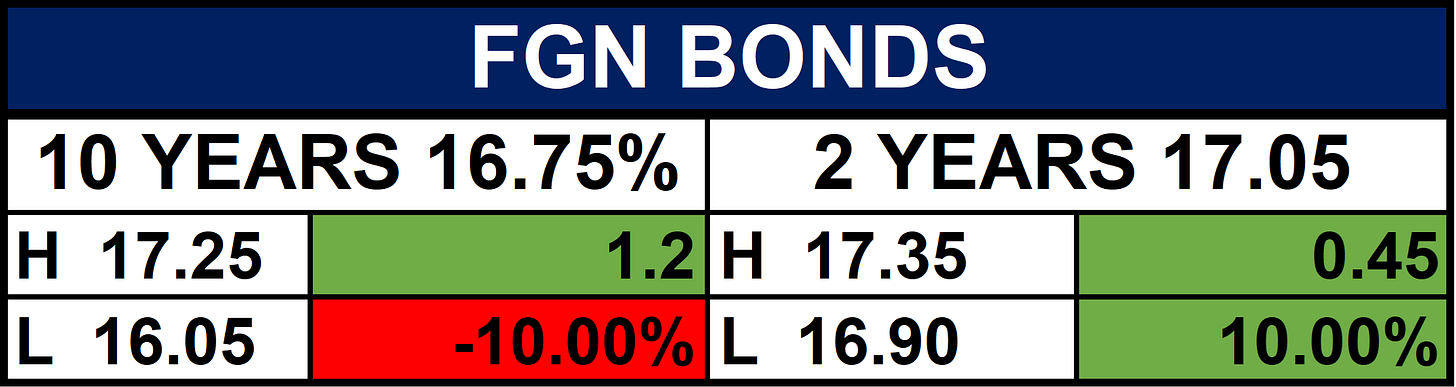

Fixed Income (FGN Bonds)

Global News & Market Update

Europe markets close higher as investors monitor ECB rate hold and U.S. trade talks:

European stocks (Stoxx 600) rose 0.24% on Thursday, extending gains as investors remained hopeful for a U.S.-EU trade deal ahead of the August 1 deadline. However, optimism softened, especially in the autos sector, amid uncertainty over potential 15% U.S. tariffs. The European Central Bank kept rates steady at 2%, with President Lagarde signaling a “wait and watch” approach due to ongoing economic uncertainty. - CNBC

Wall Street jumps as Microsoft enters $4 trillion club after results:

U.S. stocks hit record highs as Microsoft crossed the $4 trillion valuation mark after strong earnings, boosting confidence in AI-driven growth. Meta also surged 12% on a strong revenue forecast. Despite rising inflation and the Fed keeping rates unchanged, markets remained upbeat. The S&P 500, Nasdaq, and Dow are on track for their third straight monthly gains, supported by solid tech performance, economic resilience, and easing trade tensions. - Reuters

US inflation picks up in June; consumer spending rises moderately:

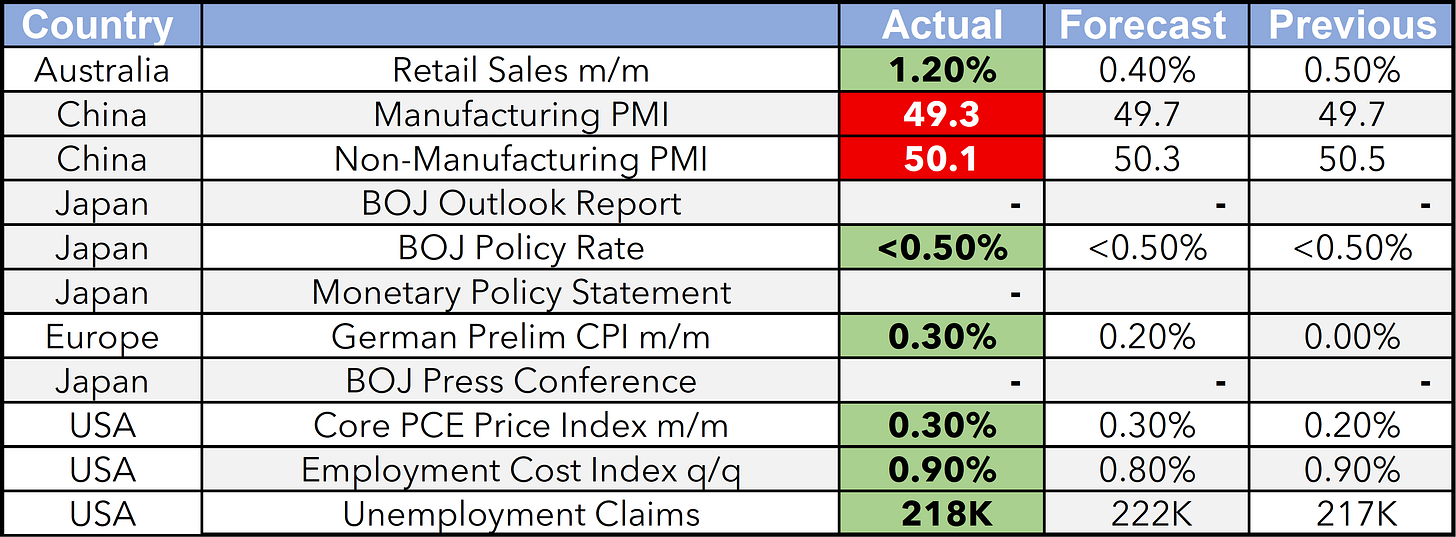

U.S. inflation rose in June, with the PCE index up 0.3% and annual inflation at 2.6%, driven by tariffs increasing import costs. Core inflation held at 2.8%. Consumer spending grew 0.3%, and GDP rebounded 3.0% in Q2 after a Q1 contraction. The Fed kept rates unchanged, noting that inflation may ease more slowly than expected. - Reuters

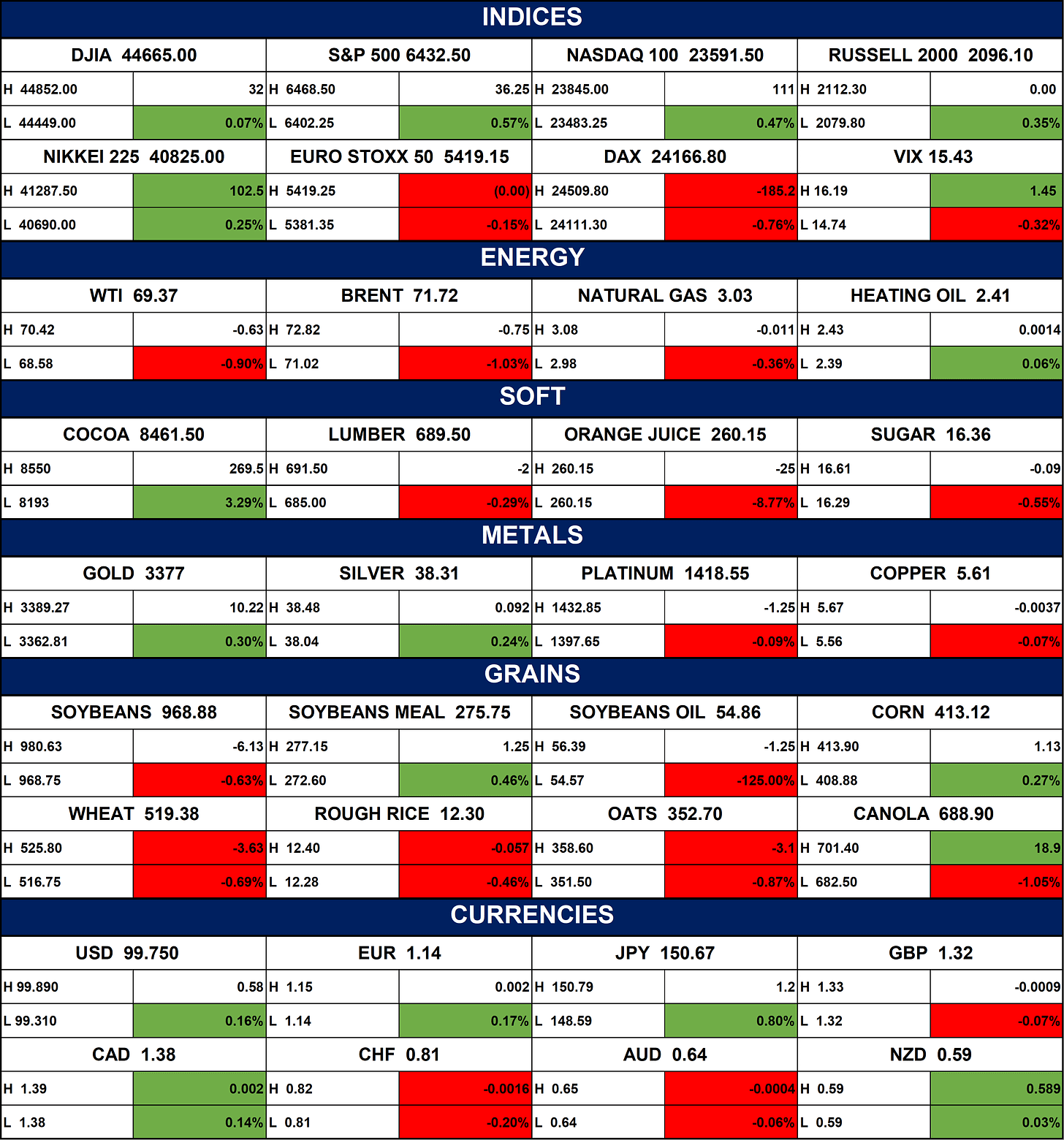

Indices, Commodities & Currencies

The table below depicts that the Markets were mixed across the board. U.S. and Asian indices posted modest gains, while European markets like the DAX declined. Energy prices fell, with WTI and Brent crude both down. Cocoa surged over 3%, but orange juice plunged nearly 9%. Precious metals saw slight gains, while grains mostly declined. In currencies, the U.S. dollar and Japanese yen strengthened, while the Swiss franc and British pound dipped slightly.

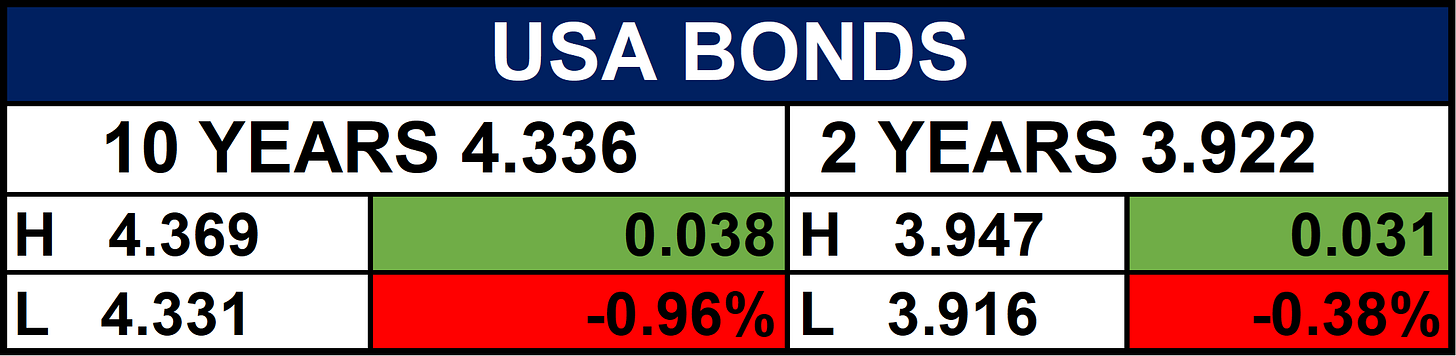

Fixed Income (USA Bonds)

Events

Conclusion

With Nigerian corporates showing impressive resilience and global equity markets buoyed by tech optimism, investor sentiment remains cautiously positive. However, uncertainties around inflation, energy prices, and global trade talks could shape short-term movements. In the coming days, markets may continue to ride on earnings momentum, though volatility could emerge as macro risks evolve. Investors should stay focused on fundamentals while keeping an eye on global economic cues and central bank signals.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.