Think Thursday

Ranora Daily - Your daily source for reliable market analysis and news.

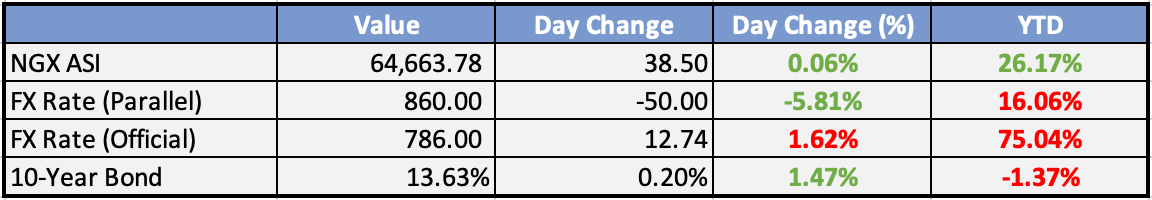

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

NNPCL secures $3bn loan to stabilise naira - Punch

The Nigerian National Petroleum Corporation Limited has secured a $3 billion crude repayment loan to support the naira and stabilise the foreign exchange market, a terse statement posted on the official account of the company on X (formerly known as Twitter) said on Wednesday.FBN shareholders seek peaceful resolution of boardroom tussle, endorse N17.9b dividend - The Guardian

Shareholders of FBN Holdings Plc, yesterday, called for a peaceful resolution of the lingering tussle over the control of the bank to ensure sustainable growth, even as they endorse a total dividend of N17.9 billion, culminating in 50 kobo due to every investor of the bank for the 2022 financial year.Naira rebounds, trades 850/dollar at parallel market – Punch

The naira rebounded against the United States dollar at the parallel market on Wednesday, closing at 850/dollar. This came about two days after the Central Bank of Nigeria announced its planned intervention in the foreign exchange market.

Global

Fed Saw ‘Significant’ Inflation Risk That May Merit More Hikes - Bloomberg

Federal Reserve officials at their policy meeting in July largely remained concerned that inflation would fail to recede and that further interest-rate increases would be needed. At the same time, cracks in that consensus were also becoming more apparent.

Coinbase wins approval to offer crypto futures trading in US - Reuters

Coinbase Global said on Wednesday it had secured approval to offer cryptocurrency futures to U.S. retail customers, scoring a major regulatory win even as it battles a lawsuit from the Securities and Exchange Commission (SEC).

Weekly Investment Watchlist

Market Commentary

Asia and Australia:

Asian equities traded lower again on Thursday. Japan was set to close near two-month lows, and Australia also dipped to lows not seen since early July. Hong Kong experienced a volatile day with gaps lower, recovery, and subsequent dip, while mainland bourses were also down.

China’s shadow banking giant, Zhongzhi, is facing a potential liquidity crisis, drawing attention due to news of the company planning a debt restructuring.

The yuan flirted with a 16-year low as the People’s Bank of China (PBOC) escalated efforts to slow its depreciation.

Japan’s exports turned to decline, and the trajectory of machinery orders remained soft. Exports to China fell by double digits for the second consecutive month.

Australian unemployment unexpectedly rose from 3.5% in June to 3.7% in July.

Europe, Middle East, Africa:

European equity markets were lower.

Norges Bank hiked its interest rate by 25 basis points to 4%, as expected, and signaled another hike in September. The bank indicated that the full impact of tightening is yet to be seen and that a somewhat higher policy rate is still needed to bring inflation to the target. The Norwegian krone (NOK) strengthened after the announcement.

ECB’s Kazaks stated that any additional rate hikes would be very small.

Analysts are eyeing a 6% Bank Rate for England after yesterday’s inflation data.

Russia decided not to tighten capital controls for now after an informal agreement with exporters to surrender more of their foreign revenues.

BAE Systems acquired Ball Corp’s aerospace arm for about $5.55 billion.

The Americas:

A study by the San Francisco Fed indicated that US households are on track to exhaust excess savings in the current quarter.

A bipartisan majority of Americans favor more tariffs on Chinese goods and stepped-up efforts to counter China’s military threats.

Cisco, one of the higher-profile tech companies, reported for the July quarter. Fiscal Q4 revenue growth of 16% YoY exceeded street expectations by more than 100 basis points, and margins beat estimates due to better pricing and mix, resulting in EPS 7.5% above consensus.

There is ongoing debate about the potential macro impact of the upcoming resumption of student loan payments. Target noted that the resumption of student loan repayments will put additional pressure on the already strained budgets of tens of millions of households.

The Week Ahead:

Monday:

Tuesday:

Industrial Production (China)

Retail Sales (US) MoM come in at +0.7%; est: +0.4%.

Wednesday:

Consumer Price Index (UK) comes in at 6.8%; est: 6.7%

Gross Domestic Product (EA)

Building Permits (US)

Industrial Production (US)

FOMC Minutes (US)

US July retail sales MoM come in at +0.7%; est: +0.4%.

Thursday:

Initial Jobless Claims (US)

Friday:

Retail Sales (UK)

Harmonized Index of Consumer Prices (EA)

Investment Tip of The Day

Research investment opportunities in emerging markets Explore investment opportunities in emerging markets to diversify your portfolio. These markets often offer potential growth prospects, but also carry higher risks. Conduct thorough research and consider consulting with a financial advisor before investing.