Think Thursday - Mixed Market Signals Amid Falling Inflation, Insurance Rally, and Oil Sector Woes

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kickoff. Markets are showing mixed trends. In Nigeria, inflation is expected to ease, boosting sentiment, while the insurance sector leads with strong gains due to recent reforms. However, the oil/gas sector remains weak. Profit-taking has slightly pulled the market down. Globally, U.S. inflation surprised to the upside, raising concerns about interest rates. Europe showed economic weakness, while India and Angola adjusted energy strategies. Volatility is rising, and investors are advised to stay selective, focusing on strong sectors like insurance and industrials.

Nigerian News & Market Update

Harvest season, stable naira set to pull inflation down to 21.34% in July:

Nigeria’s inflation is projected to ease for the second month in July, with headline inflation expected to drop to 21.34% from 22.22% in June, driven by harvest season, stable naira, and lower logistics costs. Food prices for items like tomatoes, yams, and onions saw significant declines, while most staple and imported goods remained stable. Core inflation and food inflation are also expected to dip slightly. However, risks remain due to insecurity, oil price drops, and upcoming foreign exchange demand. - Businessday

Why insurance stocks are rallying and investors cashing in:

The Nigerian stock market rose 3.18% for the 11th week, driven by a 41% surge in the insurance sector after the Nigerian Insurance Industry Reform Acts. The new law boosts capital requirements, enforces compulsory insurance, and promotes digital adoption. Investors are bullish, expecting growth, innovation, and stronger regulation in the sector. - Nairametrics

Anxiety as oil stocks plunge 10 per cent YTD, erase previous gains:

The oil and gas sector has fallen 10% in 2025, making it the worst performer on the NGX, despite the overall market gaining nearly 50%. The drop is due to weak earnings, delayed dividends, oil price volatility, and high costs. Investors are calling for better security, cost management, and government support to revive the sector. - Guardian

Capitalisation dips by ₦121 billion, amid profit taking in 53 stocks:

The Nigerian stock market declined slightly, with the All-Share Index down 0.13% and market capitalization falling by ₦121 billion due to profit-taking in major stocks like Lafarge, Nigerian Breweries, and Zenith Bank. Despite the dip, market breadth was positive with 53 gainers and 21 losers, showing continued buying interest. Top gainers included FTN Cocoa, Learn Africa, and AXA Mansard, while Thomas Wyatt and UPDC led the losers. Trading volume rose by 5.06%, with Universal Insurance and Japaul Gold among the most actively traded stocks. - Guardian

Sell crude to Dangote in Naira to prevent fuel scarcity, NLC urges FG:

The Nigeria Labour Congress (NLC) has urged the federal government to sell crude oil to the Dangote Refinery in naira, not foreign currency, to help lower fuel prices and avoid petrol scarcity. The NLC argues that charging in dollars raises costs for a local refinery capable of meeting national demand. They praised the refinery as a vital national asset that can create jobs and boost industrial capacity. Dangote Industries plans to deploy 4,000 Compressed Natural Gas (CNG) powered trucks to cut logistics costs and support efficient fuel distribution. - DailyTimes

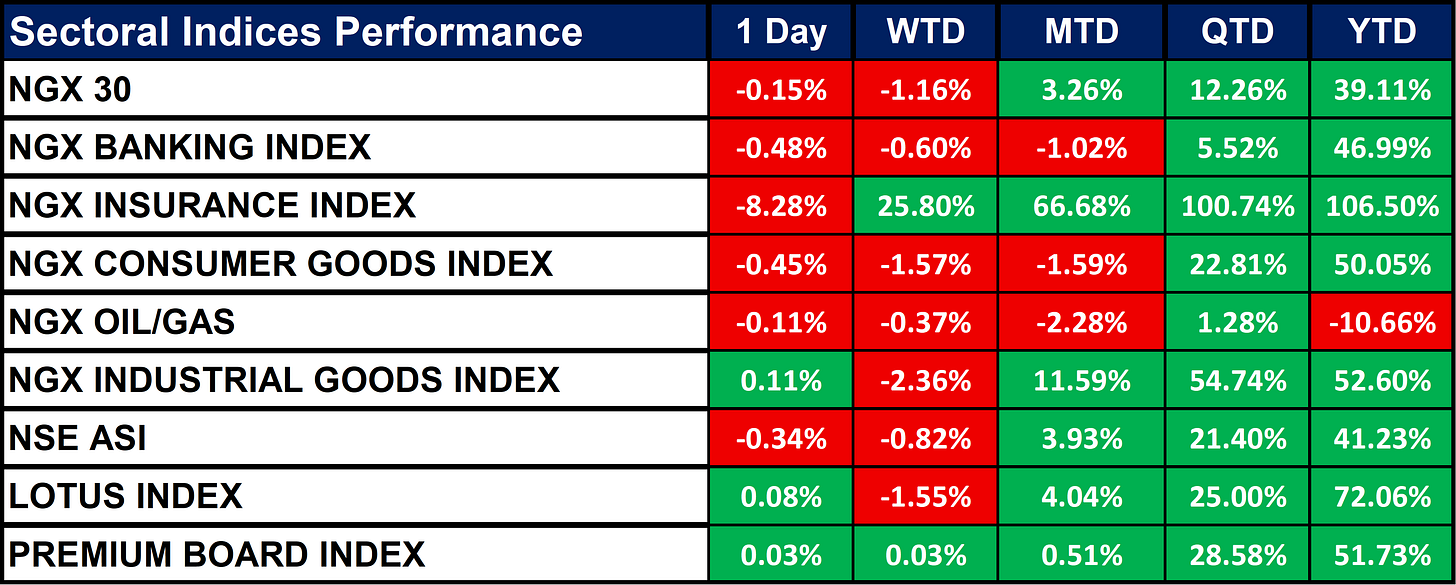

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices were mostly down for the day, led by a sharp drop in the Insurance Index (-8.28%). Despite this, the Insurance sector remains the top performer year-to-date (+106.50%). The Oil/Gas Index is the only sector with a negative YTD return (-10.66%). Overall, most indices show strong performance over the month, quarter, and year.

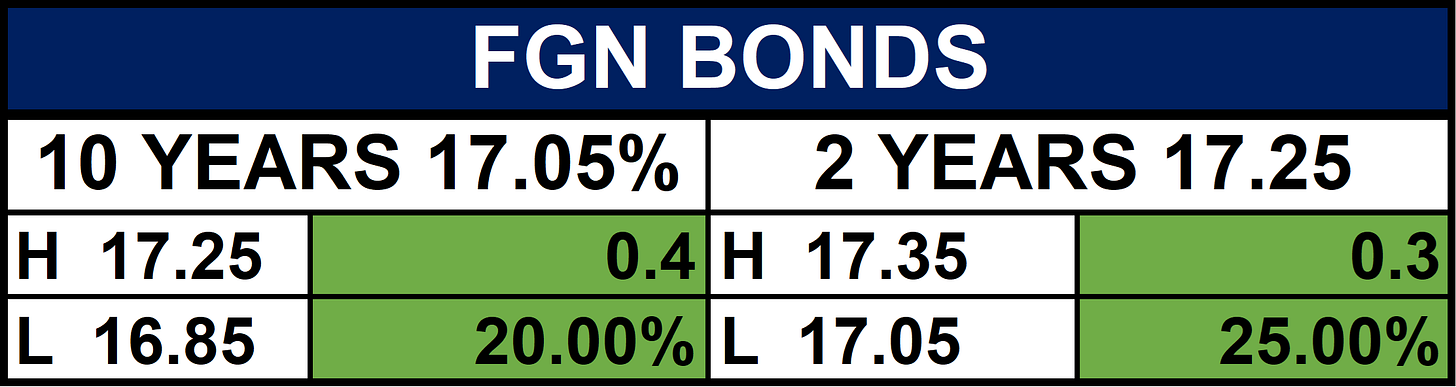

Fixed Income (FGN Bonds)

Global News & Market Update

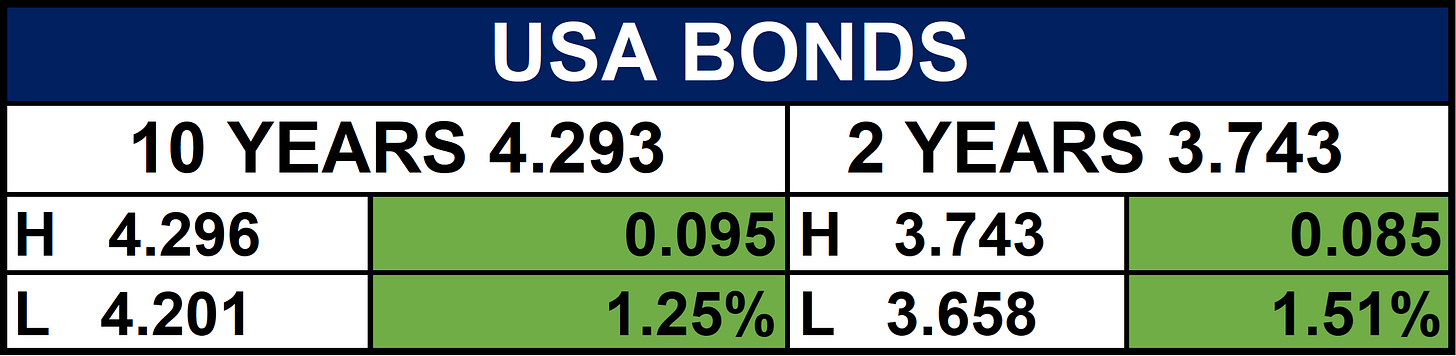

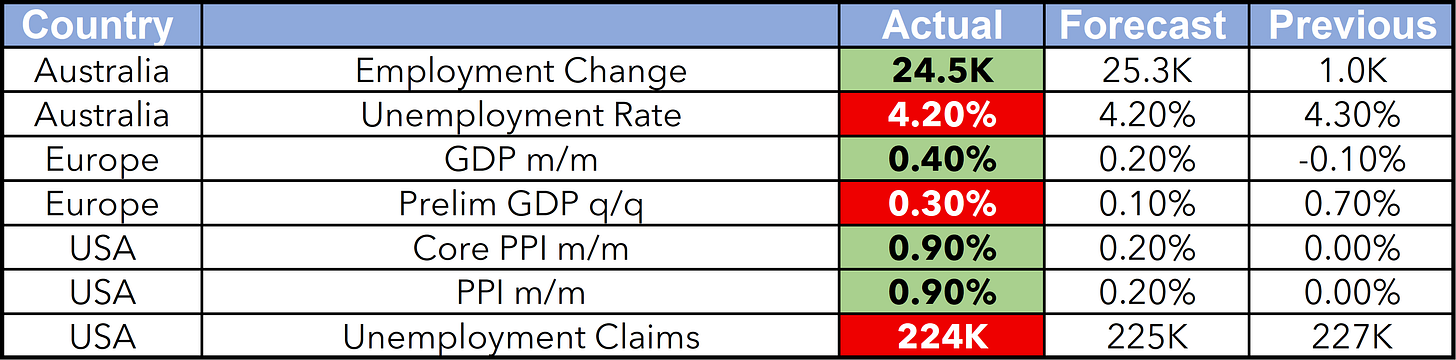

2-year Treasury yield rises after hot producer prices number:

U.S. Treasury yields rose slightly after July's Producer Price Index (PPI) showed a 0.9% increase, well above the expected 0.2%, signaling persistent wholesale inflation. The 2-year yield rose to 3.722%, and the 10-year to 4.265%. Despite the inflation surprise, markets still see a 93% chance of a Fed rate cut in September, though a larger 0.5% cut is now off the table. Attention is now on next week’s Jackson Hole symposium, where the Fed may signal future policy moves. - CNBC

Indian state refiners eye Russian oil as discounts widen, sources say:

Indian state refiners have resumed interest in Russian Urals crude as discounts widened to about $2.70 per barrel, making it more attractive than in July. Purchases were previously paused due to narrowing discounts. These refiners supply over 60% of India’s refining capacity and rely on delivered oil. They await the outcome of a Trump-Putin meeting that may affect sanctions and oil trade. While Bharat Petroleum Corporation Limited (BPCL) plans to keep Russian oil at up to 35% of its needs, refiners are also exploring spot purchases from Brazil, West Africa, and the U.S. Russian oil still makes up over a third of India’s imports. - Reuters

Euro zone industry shrinks more than feared in June but GDP holds up:

Euro zone industrial output fell 1.3% in June, more than expected, mainly due to drops in Germany and consumer goods. Despite this, Q2 GDP and employment grew slightly by 0.1%. Recent data challenges earlier optimism about economic resilience, though investors still expect modest growth supported by EU-U.S. trade deals and German spending plans. - Reuters

Angola seeks gas growth as oil output flatlines despite OPEC exit:

Azule Energy, after a successful gas discovery in Angola, is considering drilling a second well within two years. The Gajajeira-01 find holds over 1 trillion cubic feet of gas and 100 million barrels of condensate. Angola aims to boost gas output by 20% in five years to support exports and domestic demand as oil output stagnates. Gas exports rose 19.1% in Q2, mainly to India and Spain, but revenues still lag oil. Key projects like Chevron’s Sanha Lean and Azule’s New Gas Consortium are central to future growth, with Angola targeting $60 billion in oil and gas investments and 23 exploration wells by 2030. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Markets were mixed, with most major stock indices down and volatility rising (VIX +4.49%). Energy prices rose, led by WTI and Brent. Precious metals gained, while grains and soft commodities mostly declined—Cocoa dropped sharply (-3.41%). Currency movements were mixed, with the USD and NZD up, and the EUR and AUD down.

Fixed Income (USA Bonds)

Events

Conclusion

Nigeria’s outlook is cautiously optimistic, with easing inflation and naira stability boosting sentiment, especially in the insurance sector. Oil & gas remains weak amid FX risks and price volatility. Globally, U.S. inflation and Fed uncertainty may drive volatility. Focus on resilient sectors, safe-haven assets, and fundamentals-driven strategies.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.