Think Thursday - Naira Stability Boosts Imports, FG Bond Auction Slated, Global Markets Mixed on Earnings & Trade

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kickoff. Naira stability boosted vehicle imports, while the FG plans a ₦80billion bond auction amid strong sectoral performance led by Consumer Goods and Banking. Globally, S&P 500 and Nasdaq rose on tech earnings, US jobless claims hit a three-month low, and markets await key Fed and trade decisions.

Nigerian News & Market Update

1,350 vehicles arrive at PTML in two days (Naira stability):

Between July 19-21, 2025, 1,350 vehicles (1,000 new, 350 used) are arriving at Tincan Island Port. The stable naira, supported by CBN’s $4.1billion FX injections, boosted imports despite falling reserves and concerns over sustaining currency interventions. - Punch

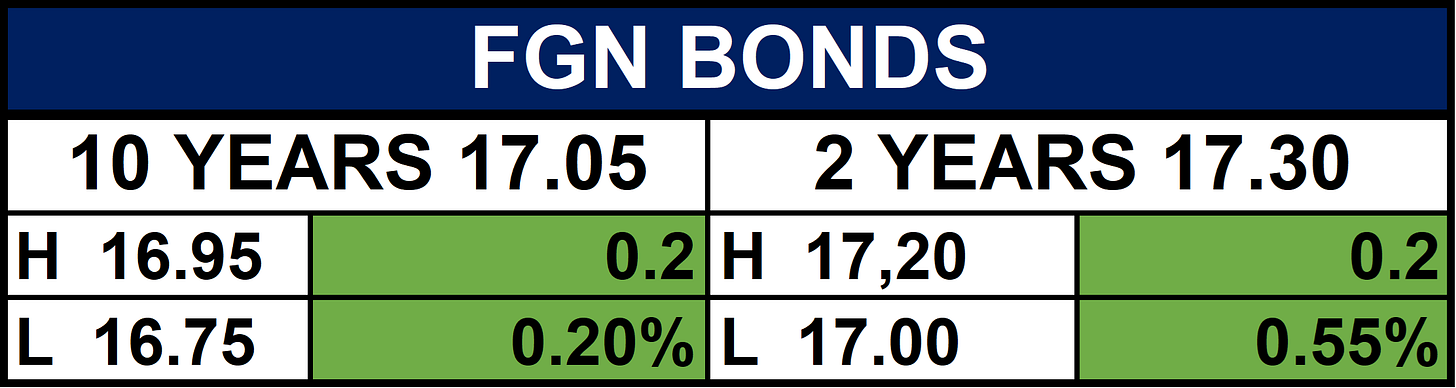

FG Offers ₦80bn In Bond Auction For July:

The Federal Government will auction ₦80 billion in bonds on July 28, 2025, comprising ₦20billion (19.30% APR 2029, 5 years) and ₦60billion (17.95% June 2032, 7 years). Minimum subscription is ₦5,000. This is less than June’s ₦100billion offer, where high demand saw limited allotments – only ₦1.05billion out of ₦41.7billion bids for the 2029 bond and ₦98.95billion out of ₦561.2billion bids for the 2032 bond. - Channels

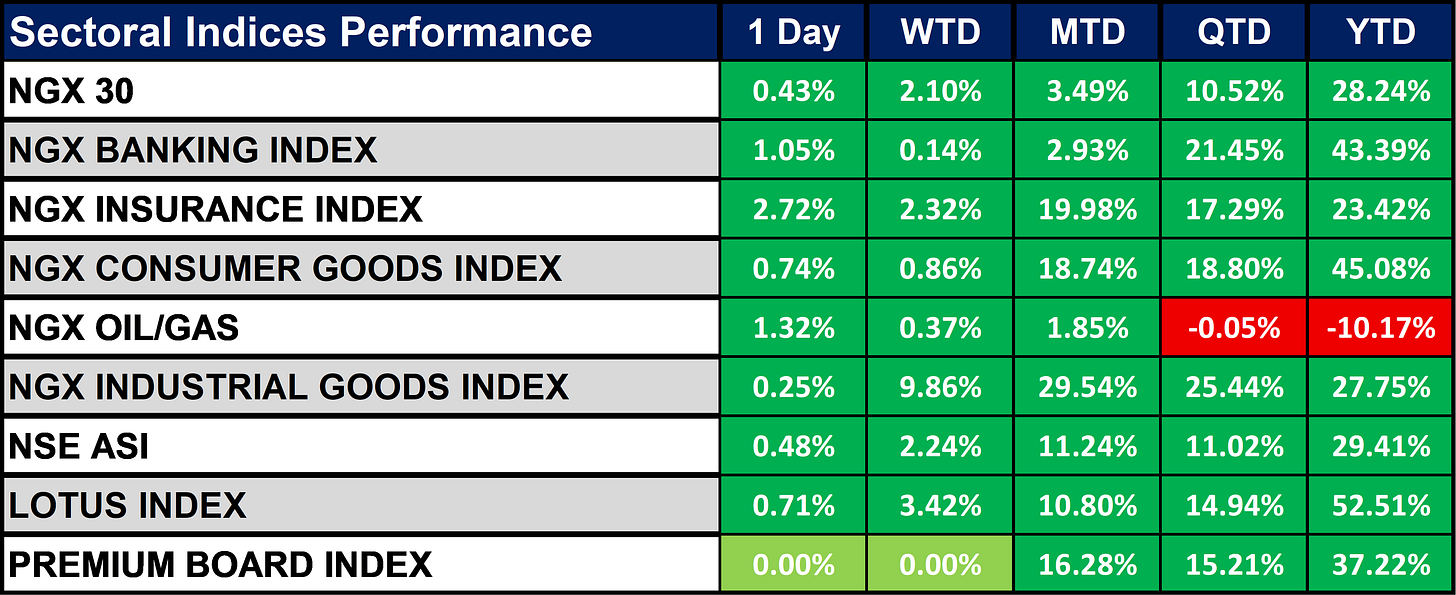

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian stock market is showing strong, broad-based momentum, with most sectors posting impressive gains. Consumer Goods (+45.08%), Banking (+43.39%), and Lotus Index (+52.51%) lead year-to-date (YTD) performance, driven by solid monthly and quarterly gains. Industrial Goods also shows resilience with a YTD return of +27.75%, backed by the strongest week-to-date (WTD) gain of +9.86%.

On the downside, Oil & Gas is the only laggard, down -10.17% YTD, despite a modest recent uptick

Fixed Income (FGN Bonds)

Global News & Market Update

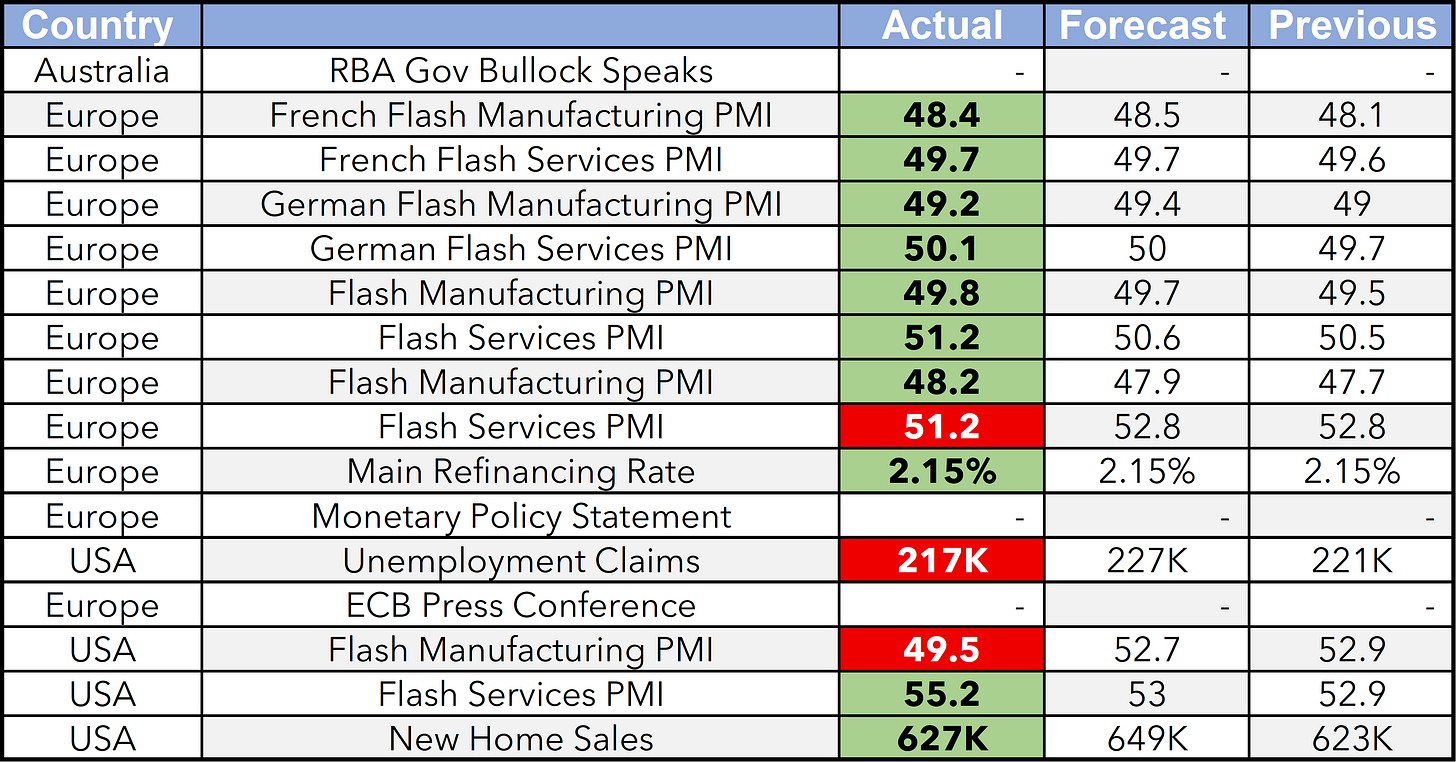

S&P 500, Nasdaq move higher after mixed earnings; Dow lags:

The S&P 500 and Nasdaq rose, boosted by Alphabet’s spending plans, while the Dow fell due to declines in UnitedHealth, IBM, and Honeywell. Tesla dropped 7.6% after warning of tough quarters ahead. Trade developments showed Trump cutting tariffs with Japan and the EU nearing a 15% tariff deal. Jobless claims fell to 217,000, signaling economic strength, while inflation concerns rose with higher business prices. Markets see a 62% chance of a Fed rate cut in September. - Reuters

US weekly jobless claims drop to three-month low:

New US jobless claims fell by 4,000 to 217,000 last week, the lowest since April, indicating a stable labour market despite slower hiring. Continuing claims rose slightly to 1.955 million, suggesting longer unemployment spells for some workers. Economists expect the Fed to keep rates unchanged next week, as stable jobs data gives no strong reason for a cut despite Trump’s pressure. Overall, layoffs remain low, but cautious hiring and reduced immigration are lowering the number of jobs needed to maintain the unemployment rate, which is expected to hold at 4.1% this month. - Reuters

Indices, Commodities & Currencies

The table below depicts that the markets showed a broadly positive trend, led by strong gains in equities and energy, with Japan’s Nikkei 225 up +5.25% and oil prices rising over 1%. Agricultural commodities like Soybean Oil (+19%) surged on supply concerns, while metals declined, reflecting reduced demand for safe-haven assets. Despite the upbeat momentum, a rise in the VIX (+4.53%) signals lingering market caution. Currency movements were mostly stable, with the USD slightly stronger and the GBP weaker.

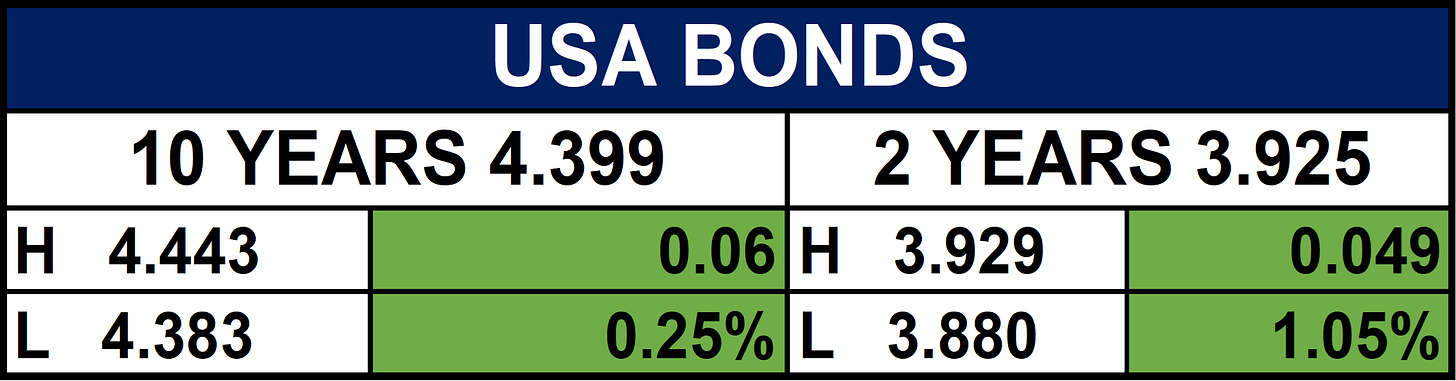

Fixed Income (USA Bonds)

Events

Conclusion

This week, Nigeria’s markets remained strong, driven by naira stability and sector gains, while bond auctions highlighted government funding needs. Globally, markets were cautiously optimistic, supported by tech gains but weighed by trade and inflation concerns.

Outlook: Investors may see short-term gains in consumer and banking stocks, steady global equities, and market movements shaped by upcoming Fed decisions on rates and inflation.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.