Think Thursday - Naira Strengthens Amid Rising Non-Oil Revenue as Global Markets React to Key Economic Data

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. As we head deeper into Q3 2025, both Nigerian and global markets are navigating key shifts from rising non-oil revenues and FX inflows at home to changing interest rate expectations and commodity volatility abroad. In Nigeria, encouraging reforms are driving gains in the ICT sector and fueling optimism across fiscal revenue streams, while global investors react to mixed U.S. data and ongoing geopolitical dynamics. This update brings you a concise breakdown of market-moving news, sectoral performance, global headlines, and investment signals to help you stay informed and ahead.

Nigerian News & Market Update

Non-oil revenue jumps 40% to ₦20.6trillion – Presidency:

Nigeria’s non-oil revenue rose by 40.5% to ₦20.59 trillion (Jan–Aug 2025), now making up 75% of government income. The increase is driven by reforms, digital systems, and better tax compliance. Customs contributed ₦3.68 trillion, and federal allocations to states have grown. However, more investment is still needed in education, healthcare, and infrastructure. - Punch

Naira gains as FX inflows rise 26% year-on-year:

The naira appreciated to ₦1,521.46/$ as FX inflows rose 26% year-on-year to $29 billion in Q1 2025, driven by CBN reforms and higher interest rates. However, FX outflows also grew to $13.8 billion, mainly due to debt payments. The naira has remained stable, trading between ₦1,500–₦1,600/$, and further stability is expected if current policies continue. - BusinessDay

Inside FG’s plan to list power assets on NGX:

The Nigerian government plans to list two DisCos and one GenCo on the Nigerian Exchange (NGX) to attract investment, improve transparency, and deepen public ownership. Only the most profitable and efficient power assets will be listed. The move is part of broader power sector reforms and aims to be completed before the 2027 elections. Key goals include enhancing governance, boosting capital access, and involving state governments in equity decisions. - BusinessDay

ICT Sector Expected to Overtake Oil in GDP Contribution by 2027, Says Minister:

Nigeria’s ICT sector is projected to contribute 21% to the Gross Domestic Product (GDP) by 2027, overtaking oil and gas. It currently contributes 16–18%, making it the country’s fastest-growing sector. Lagos State leads with over $6 billion in tech investments and hosts most of Nigeria’s top tech firms. The federal government is supporting growth through major initiatives like Project Bridge (fiber network), 3MTT (digital skills training), and a Digital Economy Bill. - Leadership

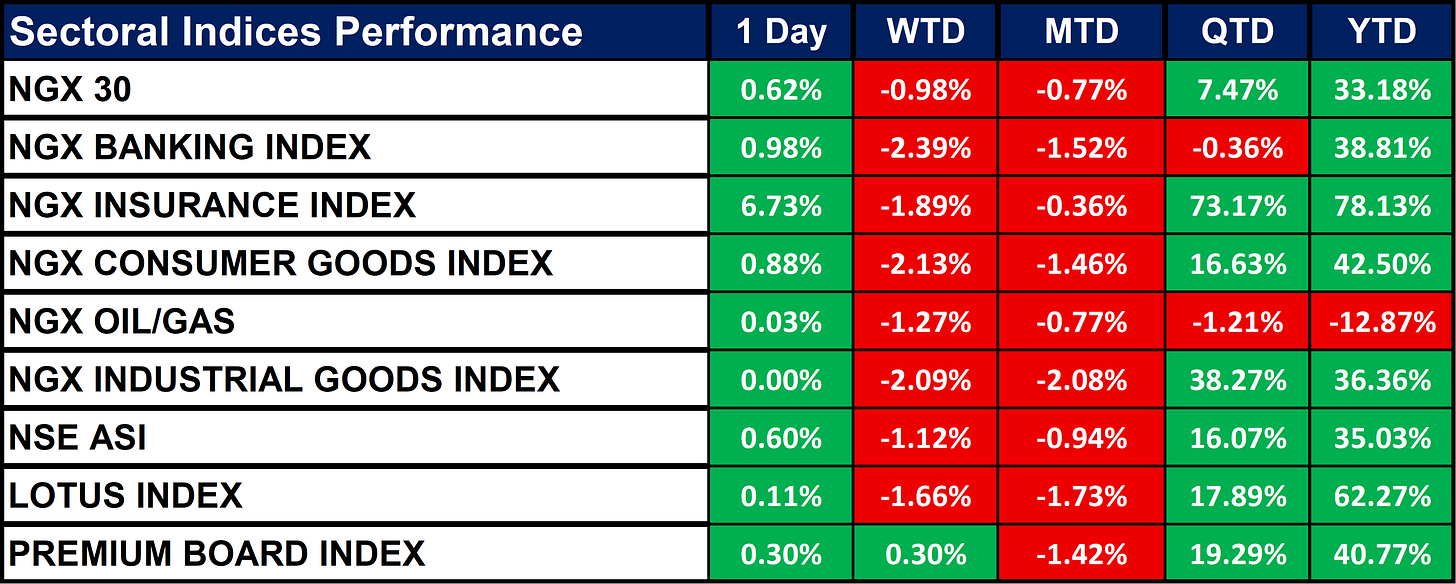

Nigeria Sectoral Indices Performance

The table below shows that the NGX sector indices showed positive 1-day performance, led by the Insurance Index (+6.73%). However, week-to-date (WTD) and month-to-date (MTD) returns are mostly negative across all sectors. On a quarter-to-date (QTD) and year-to-date (YTD) basis, most indices are strongly positive, especially Insurance (+78.13% YTD) and Industrial Goods (+38.27% QTD). The only major laggard is the Oil & Gas Index, down -12.87% YTD.

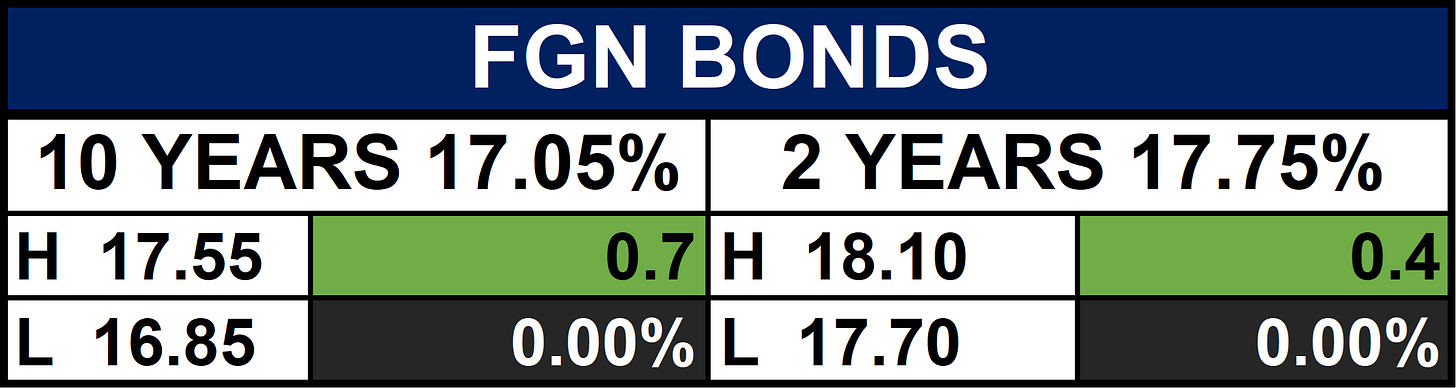

Fixed Income (FGN Bonds)

Global News & Market Update

10-year Treasury yield falls after weak private payrolls data:

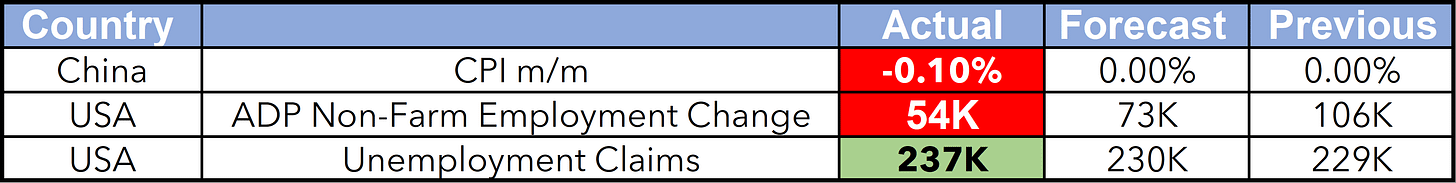

U.S. Treasury yields dipped slightly as weak labor data signaled an economic slowdown. Private payrolls rose by only 54,000 in August, and jobless claims increased to 237,000, boosting expectations of a Fed rate cut on September 17. Investors now await the official jobs report on Friday. - CNBC

Rising Coffee Prices: Causes and Future Outlook:

Coffee prices have risen sharply due to extreme weather in major producers like Brazil and Vietnam, causing poor harvests. In the U.S., prices hit a record $8.41 per pound, up 33% from last year. Tariffs, low inventories, and climate change are adding pressure. Prices may ease short-term but are expected to stay high long-term as demand grows and weather volatility continues. - CNBC

Zimbabwe to start blueberry exports to China after breakthrough agreement:

Zimbabwe can now export blueberries to China after signing a phytosanitary agreement during President Mnangagwa’s visit. Production is expected to grow from 8,000 to 12,000 metric tons by 2025. However, challenges like high interest rates, limited financing, and foreign currency rules may limit growth. Growers are seeking tax relief and input duty waivers to support the industry. - Reuters

Trump put pressure on European leaders over Russian oil purchases, White House official says:

U.S. President Donald Trump urged European leaders to stop buying Russian oil, saying it helps fund Russia’s war in Ukraine. Speaking during a “Coalition of the Willing” call led by French President Macron, Trump also called for more economic pressure on China for supporting Russia. He criticized European countries for lacking seriousness while continuing energy trade with Russia. The EU plans to phase out Russian oil and gas imports by 2028. Trump also expressed frustration over not yet ending the war, a promise he made upon taking office. - Reuters

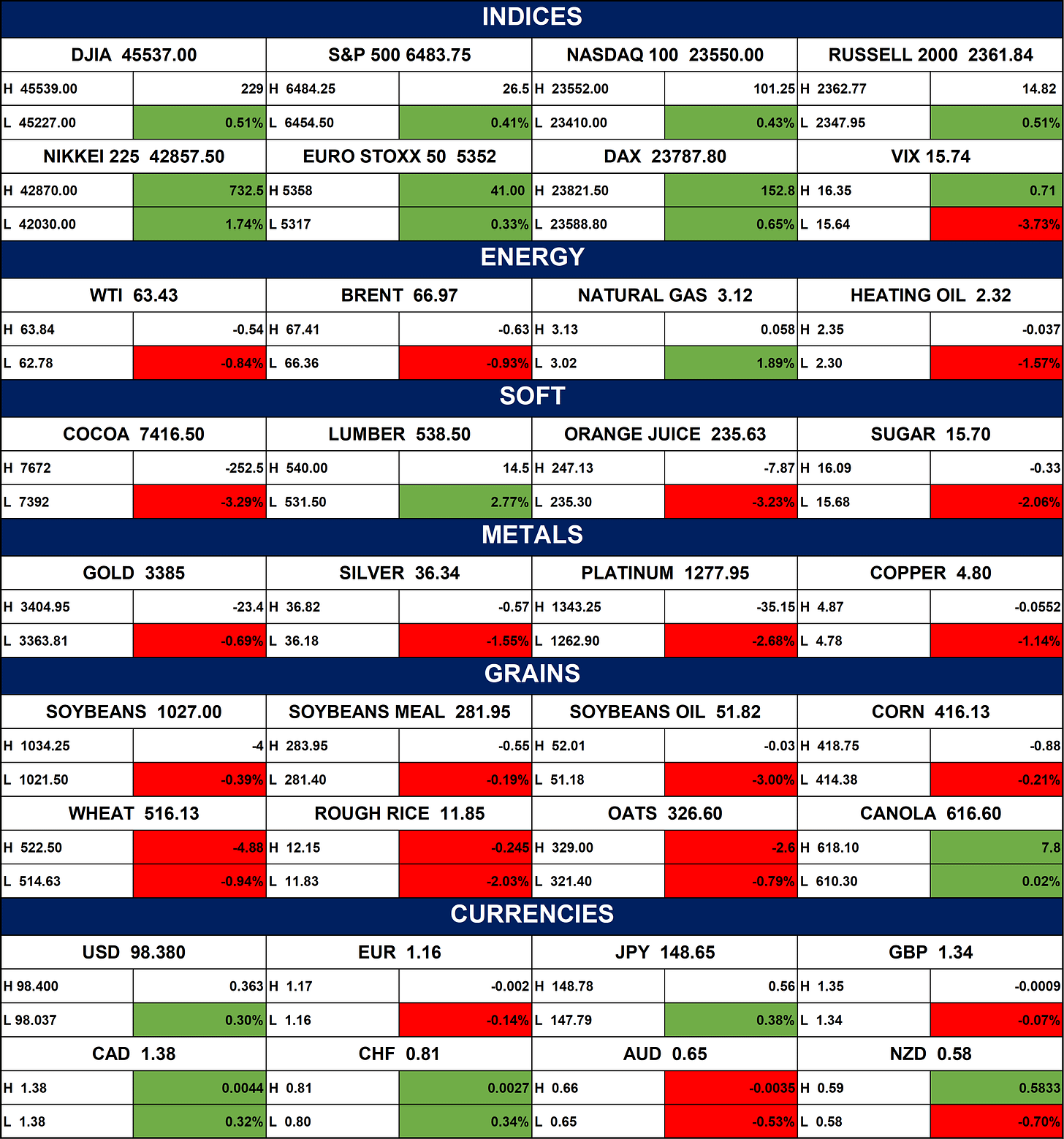

Indices, Commodities & Currencies

The table below depicts that the Global stock markets rose, led by the Nikkei 225. Volatility (VIX) dropped, indicating improved investor confidence. Most commodities fell, especially metals, energy, and agricultural products, though natural gas and lumber gained. In currencies, the USD and JPY strengthened, while the NZD weakened sharply (-0.70%), making it the biggest decliner, along with a drop in the EUR and AUD.

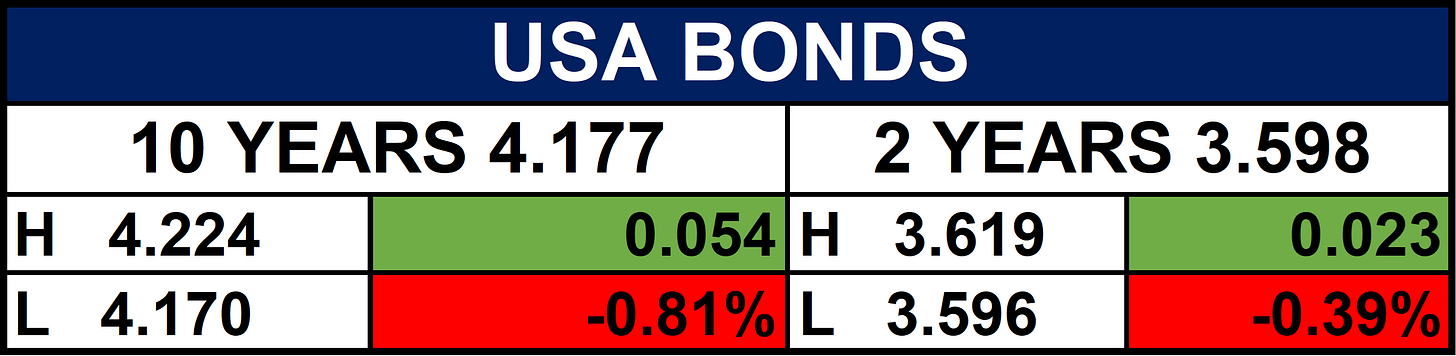

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian markets may see gains from ongoing reforms, rising FX inflows, and plans to list power assets on the NGX, with the ICT sector leading growth. Globally, markets are watching U.S. jobs data, interest rate decisions, and rising commodity prices, all of which could drive short-term volatility. Investors should monitor Nigeria’s digital economy and naira trends, as well as global central bank actions and commodity movements.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.