Think Thursday - Naira Strengthens, Bonds Rally, and Global Markets Brace for Fed Rate Cut and OPEC Supply Surge

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s Market kick off. Nigeria’s markets opened strong, with the naira hitting its highest level since March and bond yields falling on expectations of disinflation and local borrowing. Regulatory reforms in the oil and gas sector are adding long-term stability. Globally, investors are focused on the U.S. Fed’s expected rate cuts, steady OPEC demand forecasts, and Saudi Arabia’s supply push to China, which could pressure oil prices. Equity markets are upbeat, but commodities and currencies remain volatile.

Nigerian News & Market Update

Naira rallies to 1,500/$ as reserves strengthen:

The naira appreciated to ₦1,500.91/$ at the official market, its strongest level since March, supported by rising foreign reserves of $41.59billion, stronger demand, and reduced speculation. Analysts attribute the rally to moderating inflation, higher oil output, and increased capital inflows. The outlook is positive, but risks remain from global oil prices, security challenges, and possible production disruptions. - Punch

Benchmark Yield on Nigerian Bonds Falls to 16.68%:

Nigerian government bonds gained in the secondary market as investors anticipate disinflation and new supply in September. Strong demand for short- and mid-term maturities pushed average yields down by 15bps to 16.68%, with the sharpest drops seen in bonds maturing in 2029 and 2032. Analysts link the rally to expectations of easing inflation and the government’s preference for local borrowing. - dmarketforces

DMO faults wrong insinuation on Nigeria’s debt service:

The DMO has clarified that Nigeria spent ₦67.99billion, not ₦611.71billion, servicing its first domestic U.S. dollar bond in March 2025. The ₦611.71billion figure referred to total FGN bond servicing. The $900m bond, issued in Sept. 2024 with a 9.75% yield and maturing in 2029, was oversubscribed and is listed on the NGX and FMDQ to fund infrastructure and attract dollar inflows. - TheNation

NUPRC secures $400m in decommissioning liabilities, tightens divestment rules:

The NUPRC has secured over $400m in decommissioning liabilities from recent oil and gas asset transfers, ensuring companies bear cleanup costs. Since April 2023, it has approved 94 decommissioning plans worth $4.42bn, alongside $9.2m pledged for environmental remediation and host community obligations. The move aligns with the Petroleum Industry Act to prevent future financial and environmental burdens. - DailyTimes

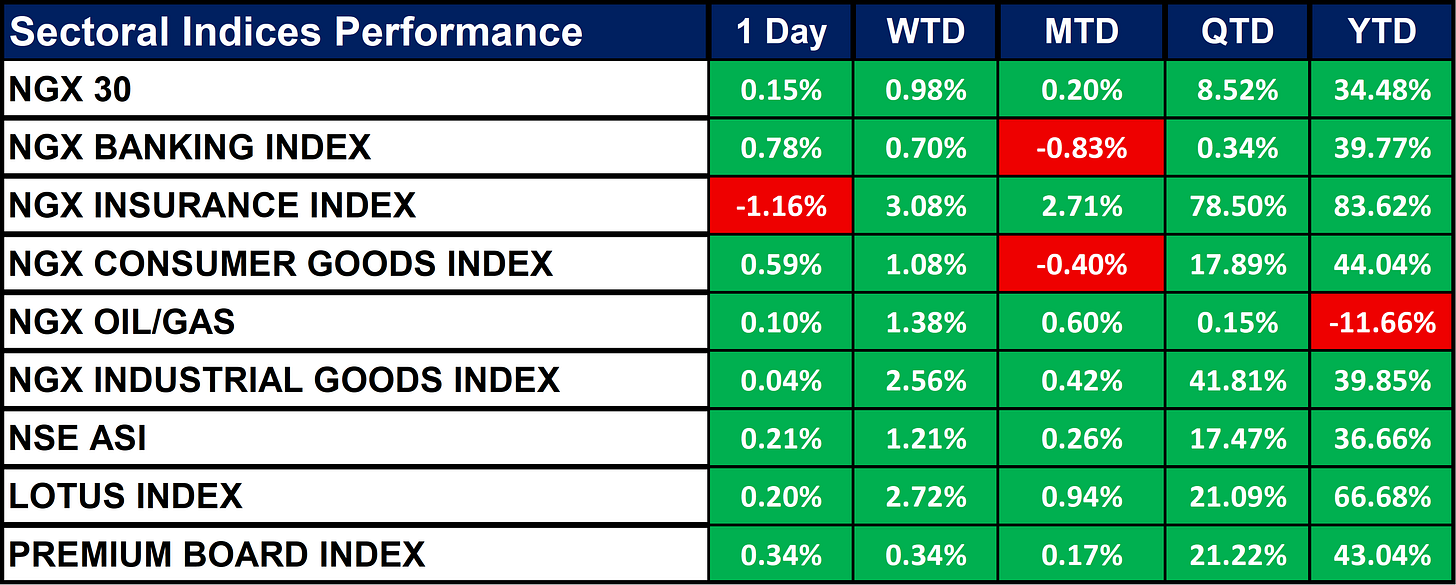

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian stock market is broadly strong, with the NSE ASI up 36.66% YTD. Sector performance is led by Insurance (+83.62% YTD), followed by strong gains in Consumer Goods, Banking, Industrial Goods, Lotus, and Premium Board indices (all above +39% YTD). However, the Oil & Gas index remains the weakest performer, down –11.66% YTD, despite short-term positive moves. Overall, the market shows resilience with Insurance driving growth while Oil & Gas lags.

Fixed Income (FGN Bonds)

Global News & Market Update

OPEC sticks to oil demand forecasts, says economy doing well:

The Organization of the Petroleum Exporting Countries (OPEC) kept its global oil demand growth forecasts unchanged for 2025 and 2026, citing continued solid economic growth. In its monthly report, OPEC noted that the world economy remains robust in the second half of 2025. It also reported that the Organization of the Petroleum Exporting Countries plus other major oil-producing nations (OPEC+) crude output rose by 509,000 bpd in August, reflecting earlier decisions to boost quotas as Saudi Arabia pushes to regain market share. - Reuters

US Fed looks set to resume rate cuts just as its peers are nearly done:

The U.S. Fed is set to cut rates next week, unlike most other major central banks that are pausing after earlier easing. The ECB held rates at 2% with lower inflation forecasts, while the Bank of Japan is the only one still considering a hike. Canada, New Zealand, Australia, and Norway face pressure for more cuts, but the UK and Switzerland are likely to hold steady. Overall, the Fed is the outlier, moving into a fresh easing cycle. - Reuters

Instant view: ECB holds rates steady at 2%, lowers inflation forecasts:

The European Central Bank (ECB) kept its interest rate at 2% and gave no guidance on future moves, even as inflation forecasts for 2027 were revised below its 2% target (headline at 1.9%, core at 1.8%). Markets reacted mildly, with the euro inching up and bond yields rising slightly. Analysts see the ECB cautious, with some expecting no more cuts this year while others point to possible easing in 2026 depending on risks. Overall, the ECB signaled patience, balancing lower long-term inflation with economic resilience and political uncertainties in the eurozone. - Reuters

US dollar eases after slightly hotter inflation, jobless claims uptick:

The U.S. dollar weakened after August inflation came in slightly hotter and jobless claims surged to a four-year high, strengthening expectations that the Fed will cut rates by 25 bps next week. CPI rose 0.4% in August and 2.9% year-on-year, while jobless claims hit 263,000, signaling labor market weakness. Markets see a 91% chance of a 25 bp cut and a small chance of a larger 50 bp move. The euro and sterling gained against the dollar, while the yen and Swiss franc also strengthened slightly. - Reuters

Saudi crude oil supply to China set to surge in October, trade sources say:

Saudi Arabia will boost crude exports to China in October to about 1.65 million barrels per day (51 million barrels total), up from 1.43 million bpd in September, after cutting prices to regain market share. Major Chinese refiners including Sinopec, Hengli, and Shenghong plan higher liftings. Aramco lowered its Arab Light crude price for Asia by $1 per barrel, following the recent Organization of the Petroleum Exporting Countries plus other major oil-producing nations (OPEC+) decision to raise output by 137,000 bpd in October, adding to a broader supply increase since April. - Reuters

Indices, Commodities & Currencies

The table below depicts that the Global stocks rallied, led by U.S. and Asian indices, while volatility eased. Commodities were mixed: grains gained strongly (soybean oil surged), but energy and metals fell. The U.S. dollar weakened against most major currencies.

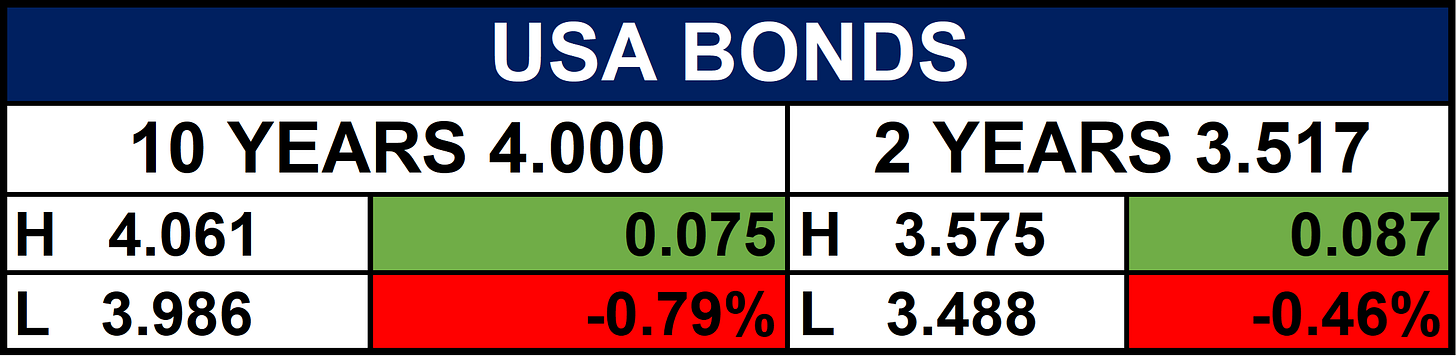

Fixed Income (USA Bonds)

Events

Conclusion

Nigeria’s outlook remains positive, supported by stronger reserves, easing inflation, and capital inflows, with bonds looking attractive if disinflation continues. However, oil volatility and security risks could slow momentum. Globally, markets will be shaped by the Fed’s upcoming rate cut and Saudi Arabia’s supply push, making cautious optimism the best stance for investors.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.